Montana Commercial Space Simple Lease

Description

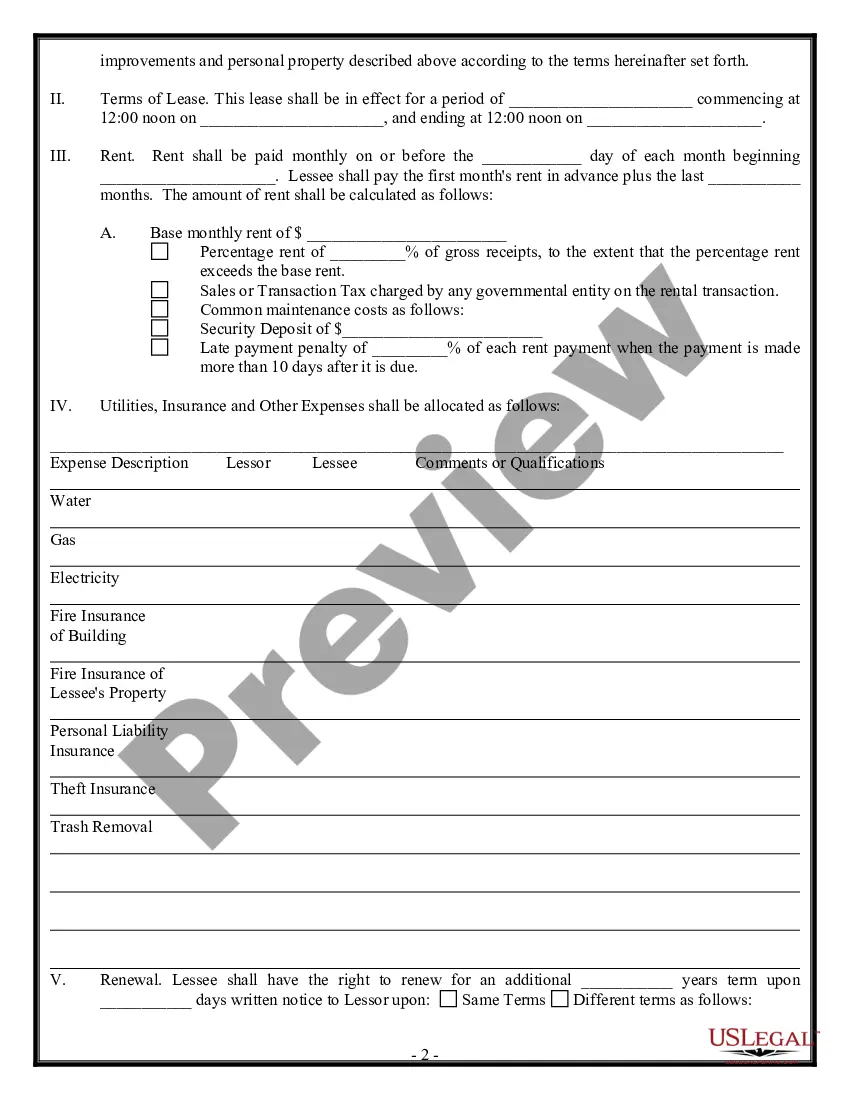

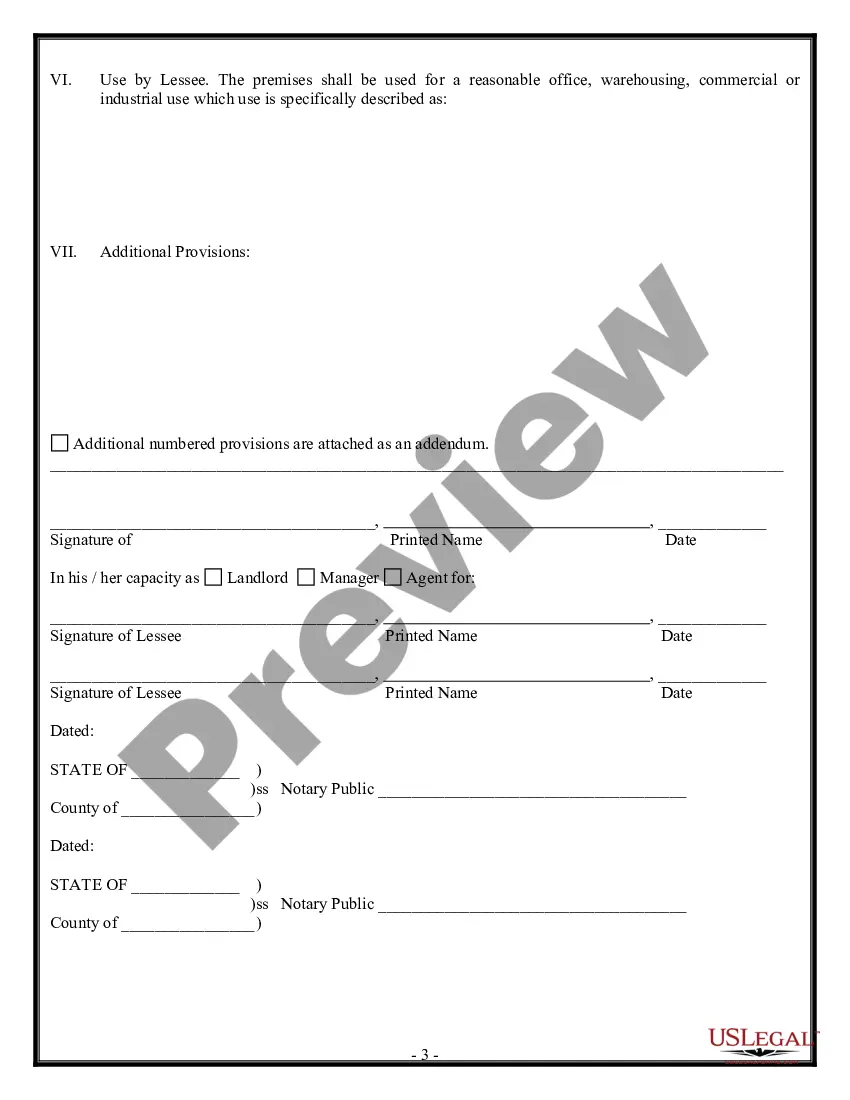

How to fill out Commercial Space Simple Lease?

Are you currently in a situation where you require documents for both business or personal purposes nearly every day.

There are many legal document templates accessible online, but finding reliable versions is not easy.

US Legal Forms offers thousands of template forms, including the Montana Commercial Space Simple Lease, designed to comply with state and federal regulations.

Once you acquire the right form, click Buy now.

Choose the pricing plan you prefer, complete the necessary information to set up your account, and purchase your order using PayPal or Visa or Mastercard.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After that, you will be able to download the Montana Commercial Space Simple Lease template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and make sure it is for the correct state/county.

- Utilize the Review button to examine the form.

- Read the description to ensure you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that suits your needs.

Form popularity

FAQ

The three main types of commercial leases include gross leases, net leases, and modified gross leases. In a gross lease, the landlord covers most expenses, while in a net lease, tenants take on some additional costs like taxes or maintenance. Understanding these types helps you choose the right structure for your Montana Commercial Space Simple Lease.

An example of a letter of intent to rent might include opening with a statement of interest, followed by specific terms such as the lease amount and duration. For instance, you might say you intend to lease the property at a set monthly rent, along with your conditions. This structured approach can facilitate your negotiations for a Montana Commercial Space Simple Lease.

Leasing a commercial space typically requires documentation such as proof of identity, financial statements, and sometimes, a business plan. Prepare to present your credit history and any references that demonstrate your reliability as a tenant. All these elements play a significant role in negotiating your Montana Commercial Space Simple Lease.

Yes, you can write your own lease agreement, especially for a Montana Commercial Space Simple Lease, but it is wise to ensure that it complies with local laws. Using templates can guide you in including all necessary clauses, such as maintenance responsibilities and termination terms. If you prefer a straightforward option, consider using platforms like US Legal Forms for customized assistance.

Writing a letter of intent for a commercial lease involves several steps. Begin with a clear introduction, followed by the core terms such as rent, duration, and any specific conditions. This document serves as a preliminary agreement for your Montana Commercial Space Simple Lease, clarifying intentions before a formal contract.

A commercial Letter of Intent (LOI) typically appears as a formal document that outlines the primary terms of the lease agreement. It includes the names of the parties, property details, rental amount, and lease duration. This simplified framework helps both parties understand their intentions in entering into a Montana Commercial Space Simple Lease.

To write a simple letter of intent for a Montana Commercial Space Simple Lease, start by clearly stating your intention to lease the commercial space. Include essential details like the names of the parties involved, the property address, and the proposed lease terms. Ensure that you express any conditions that need to be met before signing a formal lease agreement.

Leasing a commercial space typically involves several requirements, including proof of income, credit history, and sometimes a business plan. Additionally, landlords often seek personal or business guarantees to secure the lease. By using platforms like uslegalforms, you can easily navigate the requirements for a Montana Commercial Space Simple Lease, ensuring you have the necessary documentation and agreements in place.

Getting approved for a commercial lease can be challenging, but it primarily depends on your financial situation and the specific requirements of the landlord. Factors such as credit score, business history, and rental references play a crucial role. When you opt for a Montana Commercial Space Simple Lease, you may find that the clarity in terms can simplify the approval process and make it more accessible.

While different landlords have varying requirements, a credit score of 650 or higher is often considered favorable for securing a commercial lease. This score reflects your creditworthiness and ability to meet payment obligations. Landlords look for reliability, especially when entering into agreements like the Montana Commercial Space Simple Lease, which may involve significant financial commitments.