Montana Commercial Lease Agreement for Land

Description

How to fill out Commercial Lease Agreement For Land?

Are you currently inside a placement the place you will need papers for either organization or personal functions virtually every day? There are tons of authorized record layouts available on the net, but finding versions you can rely is not effortless. US Legal Forms provides a huge number of kind layouts, much like the Montana Commercial Lease Agreement for Land, that happen to be created in order to meet federal and state demands.

Should you be currently informed about US Legal Forms website and get a free account, merely log in. Next, it is possible to obtain the Montana Commercial Lease Agreement for Land template.

If you do not have an accounts and wish to begin to use US Legal Forms, follow these steps:

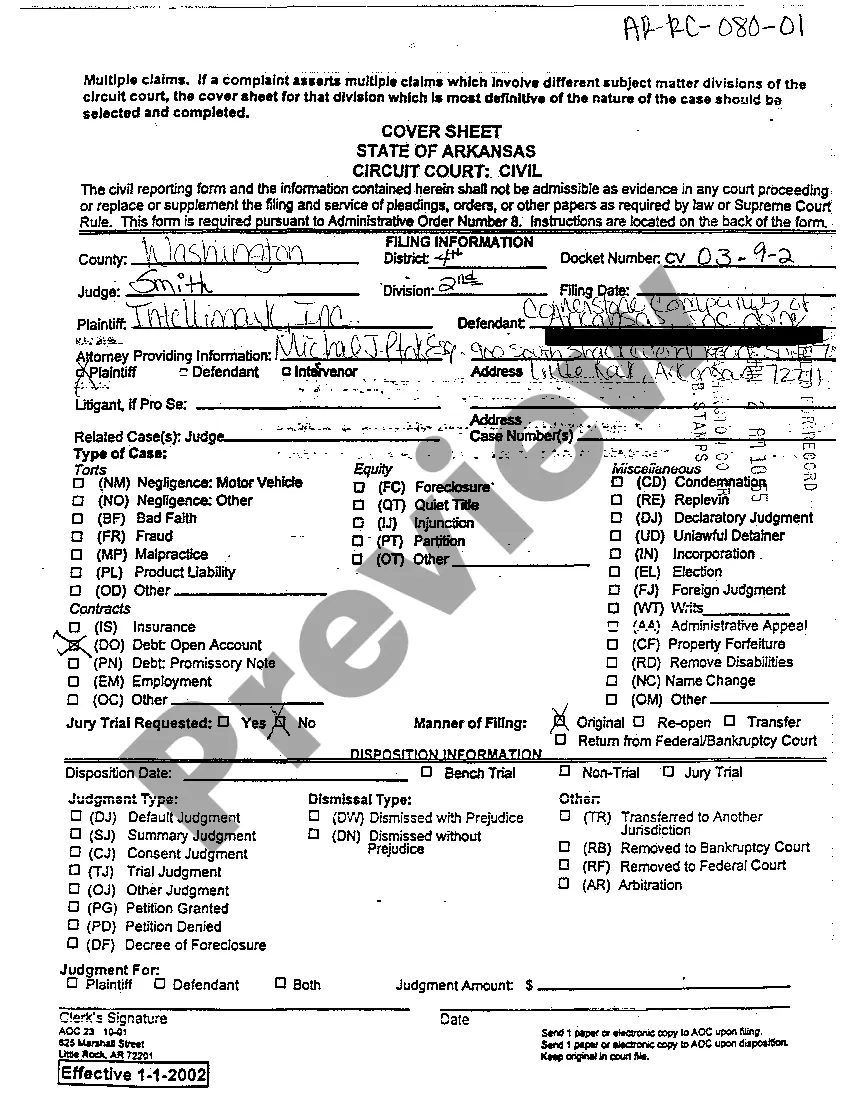

- Find the kind you need and ensure it is for the correct area/state.

- Make use of the Preview switch to check the shape.

- Read the outline to ensure that you have selected the right kind.

- In case the kind is not what you`re seeking, make use of the Look for discipline to find the kind that meets your needs and demands.

- When you obtain the correct kind, simply click Acquire now.

- Pick the rates program you desire, complete the required details to generate your money, and buy the transaction making use of your PayPal or bank card.

- Decide on a convenient file format and obtain your copy.

Find all of the record layouts you may have bought in the My Forms food selection. You can get a additional copy of Montana Commercial Lease Agreement for Land at any time, if necessary. Just click on the necessary kind to obtain or printing the record template.

Use US Legal Forms, the most considerable assortment of authorized kinds, to save time as well as avoid blunders. The service provides skillfully created authorized record layouts that you can use for an array of functions. Produce a free account on US Legal Forms and begin producing your way of life a little easier.

Form popularity

FAQ

Leases for more than seven years must be registered with the Land Registry, and it's usually the tenant's responsibility to complete that registration. If they fail to do so within two months of completion, it is not a valid legal lease and only takes effect as an agreement for a lease (a contract).

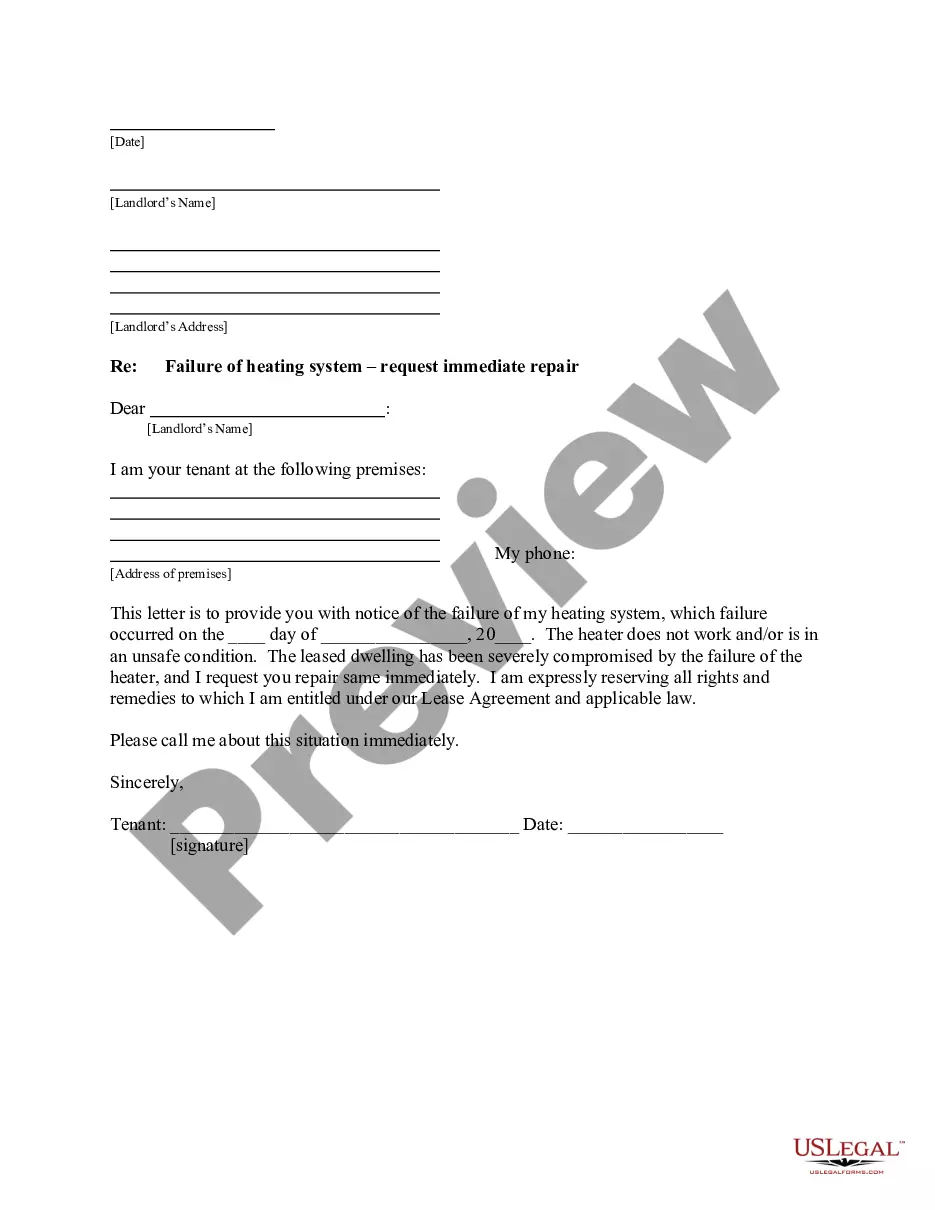

A written lease agreement must contain:The names and addresses of both parties;The description of the property;The rental amount and reasonable escalation;The frequency of rental payments, i.e. monthly;The amount of the deposit;The lease period;The notice period for termination of contract;More items...

Triple Net Lease Arguably the favorite among commercial landlords, the triple net lease, or NNN lease makes the tenant responsible for the majority of costs, including the base rent, property taxes, insurance, utilities and maintenance.

Commercial leases are typically three to five years. That guarantees enough rental income for the landlords to recoup their investment. Leases are often negotiable, but for a commercial lease, landlords frequently allow customization of the space for the sake of the renting business.

A Triple Net Lease (NNN Lease) is the most common type of lease in commercial buildings. In a NNN lease, the rent does not include operating expenses. Operating expenses include utilities, maintenance, property taxes, insurance and property management.

Commercial leases are legally binding contracts between landlords and commercial tenants. They give tenants the right to use the premises in a particular way for a set period for an agreed rent. Your lease will establish your rights and responsibilities as a tenant, as well as those of your landlord.

A lease is automatically void when it is against the law, such as a lease for an illegal purpose. In other circumstances, like fraud or duress, a lease can be declared void at the request of one party but not the other.

This lease structure makes the tenant responsible for the majority of costs. Specifically, the tenant pays the base rent, property but also taxes, insurance, utilities, and maintenance. This even includes standard property repairs associated with the commercial space being occupied.

Lease Deed Commercial The rental agreement or lease deed is designed for leasing or renting commercial property. The rental agreement is a legal document which lays out the prescribed terms and conditions under which the rented property is leased out that is to be followed between the land lord and the tenant.

And, how the most common retail leases are structured: Single net lease. A single net lease, or net lease, is an arrangement where the tenant pay for utilities and property taxes.