South Dakota Invoice Template for Postman

Description

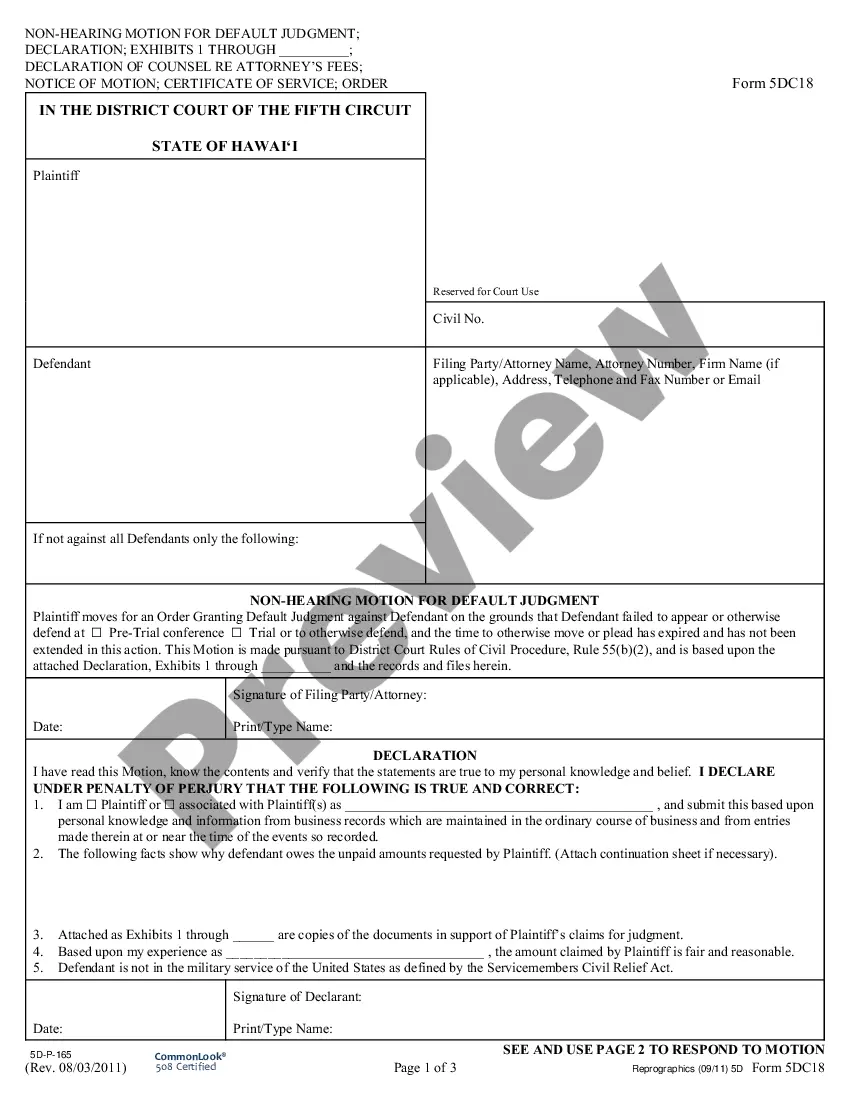

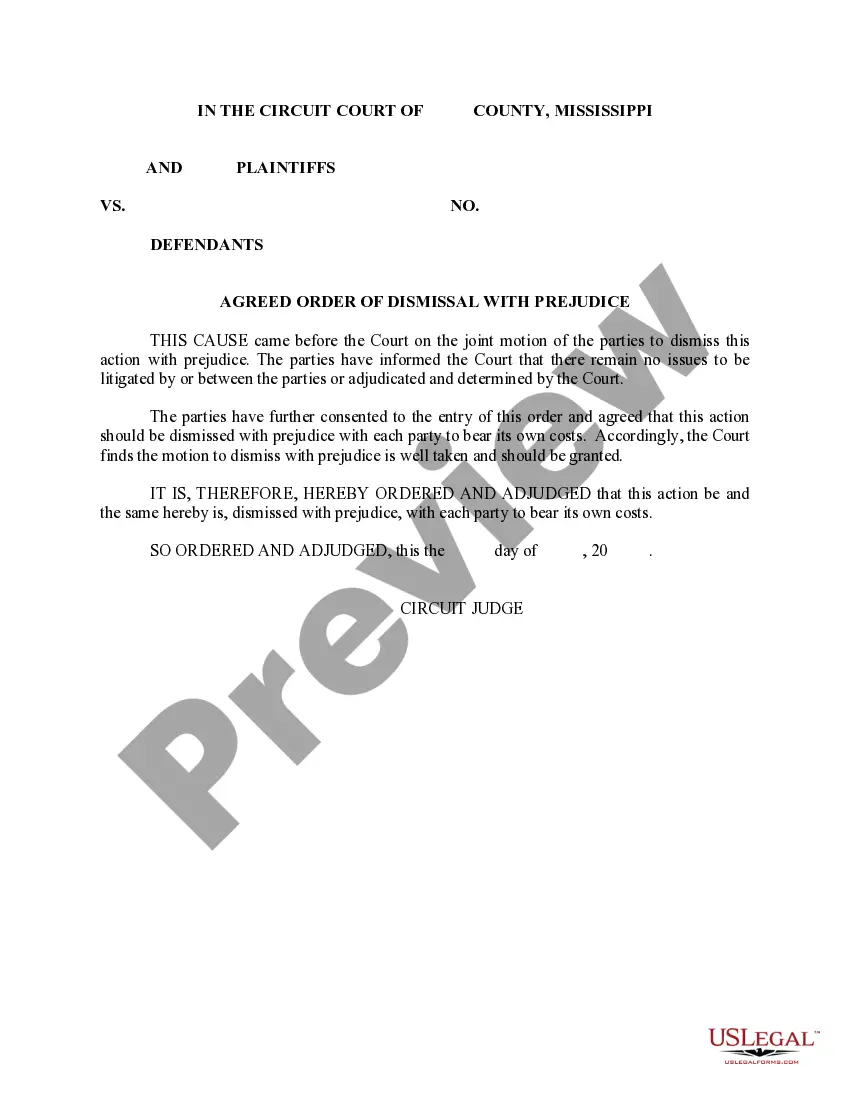

How to fill out Invoice Template For Postman?

If you need to finish, retrieve, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's simple and user-friendly search to locate the documents you require.

Numerous templates for business and personal purposes are categorized by types and regions, or keywords.

Step 5. Complete the payment process. You can use a credit card or PayPal account to finalize the transaction.

Step 6. Select the format of the legal form and download it to your device. Step 7. Fill out, edit, and print or sign the South Dakota Invoice Template for Postman.

- Use US Legal Forms to quickly find the South Dakota Invoice Template for Postman.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to obtain the South Dakota Invoice Template for Postman.

- You can also access forms you previously retrieved from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview feature to review the form's content. Don't forget to read the details.

- Step 3. If you are not satisfied with the document, utilize the Search box at the top of the screen to find additional variations of the legal form template.

- Step 4. Once you have found the form you desire, select the Get now button. Choose the payment plan you prefer and provide your details to register for the account.

Form popularity

FAQ

In South Dakota, most goods and services sold are subject to sales tax. This includes tangible personal property, certain services, and digital goods. However, essential items such as groceries and prescription drugs may be exempt. Utilizing the South Dakota Invoice Template for Postman can help you identify and distinguish taxable sales when issuing invoices.

To report sales tax, you should prepare your sales records and log all taxable sales transactions. Then, access the South Dakota Department of Revenue's online reporting system to submit your sales tax report. Be sure to double-check your calculations before finalizing the report. By utilizing the South Dakota Invoice Template for Postman, you can keep track of your invoices effectively, making reporting straightforward.

Filing sales tax in South Dakota requires you to gather all your taxable sales information for the reporting period. You can file online through the South Dakota Department of Revenue’s website by entering your sales figures and calculating the owed tax. Make sure to do this before the deadline to avoid penalties. An organized invoice system, like the South Dakota Invoice Template for Postman, can assist you in collecting accurate sales data.

To register for sales tax in South Dakota, you must visit the South Dakota Department of Revenue's website. You need to complete the online application for a sales tax license. Once registered, you will receive a sales tax license, allowing you to collect sales tax on your sales. Consider using the South Dakota Invoice Template for Postman to streamline your invoicing process after registration.

To change your Postman plan, access your account settings and select the billing section. Here, you can choose a different plan that suits your needs. Additionally, integrating the South Dakota Invoice Template for Postman from US Legal Forms can provide a reliable way to manage your invoicing processes.

To cancel your Postman plan, log into your account and navigate to the billing settings. Follow the cancellation prompts carefully to finalize the process. If you're looking for efficient documentation solutions, consider using the South Dakota Invoice Template for Postman from US Legal Forms for any future needs.

To check your Postman plan, log into your account and head to your workspace settings. There, you will find the details of your current plan and its features. In addition, you can explore US Legal Forms for the South Dakota Invoice Template for Postman to complement your project’s financial documentation.

Updating your Postman workspace is simple. Click on the workspace you want to update and navigate to the workspace settings. From there, you can modify details and configurations, which can help in effectively managing your South Dakota Invoice Template for Postman.

To change the Postman version, first, check for updates within the app. Go to the 'Settings' menu, and click on 'Update.' If you need a specific version, visit the official Postman website to download and install it, ensuring that your South Dakota Invoice Template for Postman remains compatible with the latest features.

To change your Postman account, start by logging into your current account. Navigate to your profile settings, where you can update your email address, password, and other necessary details. If you need further assistance, consider utilizing the South Dakota Invoice Template for Postman available on US Legal Forms, which can streamline your documentation process.