South Dakota Auto Expense Travel Report

Description

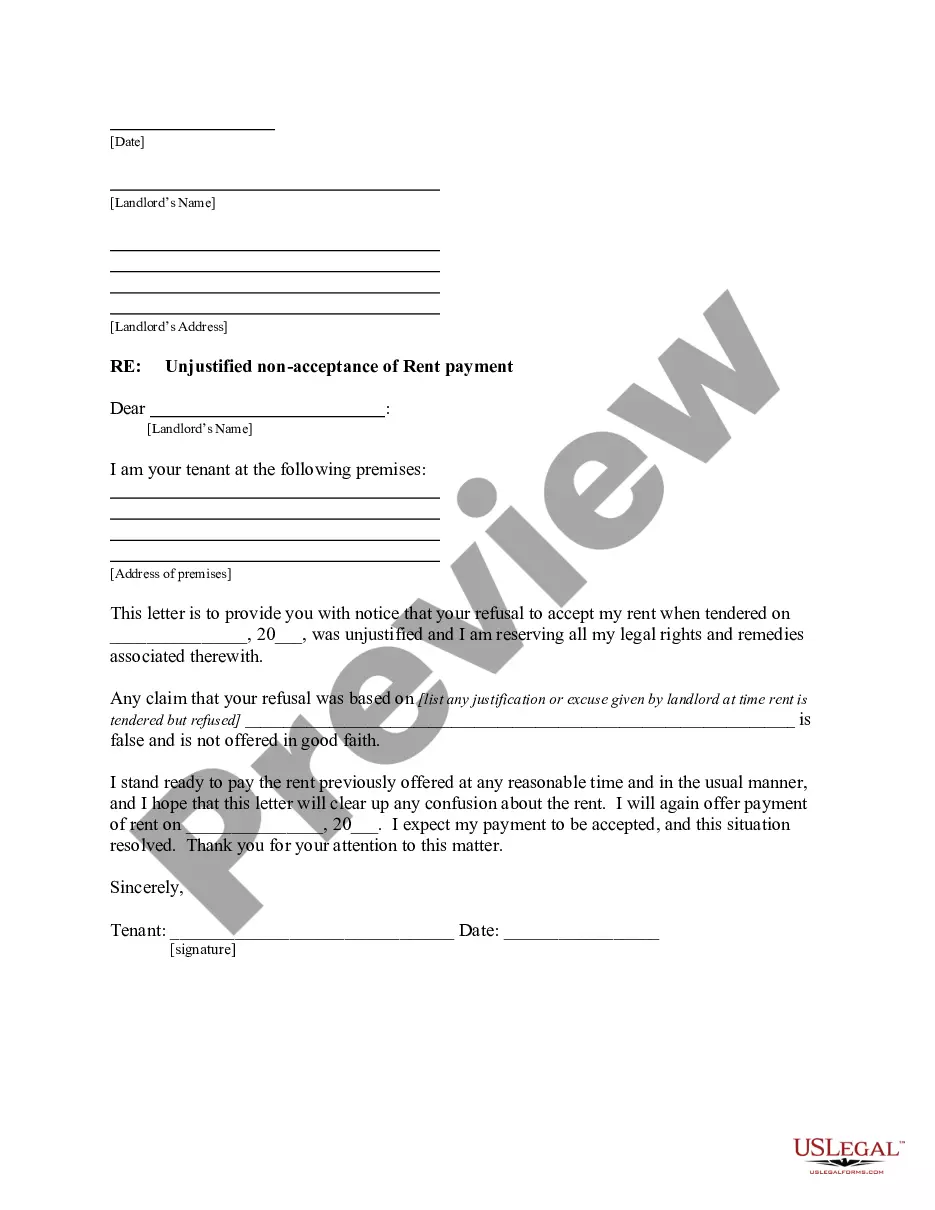

How to fill out Auto Expense Travel Report?

Locating the appropriate genuine document template may prove to be challenging. Naturally, there are countless templates accessible online, but how can you identify the specific type you need? Utilize the US Legal Forms website.

The service offers thousands of templates, including the South Dakota Auto Expense Travel Report, suitable for business and personal purposes. All forms are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Obtain button to find the South Dakota Auto Expense Travel Report. Use your account to browse the legitimate forms you have previously acquired. Go to the My documents section of your account to retrieve another copy of the document you need.

Choose the file format and download the legitimate document template to your device. Complete, edit, print, and sign the obtained South Dakota Auto Expense Travel Report. US Legal Forms is the largest library of legal documents where you can find numerous paper templates. Utilize the service to download properly crafted files that adhere to state requirements.

- First, make sure you have selected the correct template for your city/region.

- You can view the form by clicking the Preview button and read the form description to confirm that it is right for you.

- If the form does not suit your needs, utilize the Search box to find the appropriate document.

- Once you are confident that the form is suitable, click the Purchase now button to acquire the template.

- Select the pricing plan you desire and enter the necessary information.

- Create your account and pay for the order using your PayPal account or credit card.

Form popularity

FAQ

Mileage reimbursement in South Dakota follows the IRS standard mileage rate, which is adjusted periodically. This reimbursement helps individuals and companies recover costs incurred while traveling for work-related purposes. To ensure you receive the correct amount, include detailed records and use the South Dakota Auto Expense Travel Report as your guide during the reimbursement process.

The state mileage rate for South Dakota typically aligns with the IRS standard mileage rate. This standard is intended to provide fair reimbursement for business-related travel. When documenting your travels in a South Dakota Auto Expense Travel Report, use the current state mileage rate to claim deductions accurately and avoid issues during audits.

In South Dakota, the legal rate for mileage reimbursement is based on the IRS standard mileage rate. This rate is updated annually and is meant to cover the costs of operating a vehicle, including fuel, maintenance, and depreciation. When filling out your South Dakota Auto Expense Travel Report, make sure to apply this rate so you receive appropriate compensation for your travels.

The per diem rate in South Dakota varies based on the location and time of year. The General Services Administration (GSA) sets these rates, which help individuals and businesses manage travel expenses efficiently. Understanding the per diem rate is essential for completing your South Dakota Auto Expense Travel Report accurately. It ensures you claim the right amount for meals, lodging, and incidental expenses.

The state of South Dakota mileage reimbursement rate varies and is typically updated annually. This rate compensates employees for the use of personal vehicles for work-related travel, which can be documented in a South Dakota Auto Expense Travel Report. For the most accurate and up-to-date information, referring to official state resources or using comprehensive platforms like USLegalForms is advisable.

To fill in an expense report, begin by categorizing your expenses and entering them in the designated fields. For a South Dakota Auto Expense Travel Report, ensure that you list mileage costs alongside other expenses like lodging and meals. Utilizing platforms like USLegalForms can assist you in formatting your report accurately and ensuring compliance with state regulations.

To fill out a travel expense report, start by documenting each expense related to your trip, including dates, locations, and specific costs. For a South Dakota Auto Expense Travel Report, ensure you calculate mileage properly and attach relevant receipts. Providing clear and detailed information on the report streamlines the approval and reimbursement process.

An example of an expense report might include a South Dakota Auto Expense Travel Report detailing costs such as mileage, lodging, meals, and other travel-related expenses. It usually lists each expense alongside supporting documentation, such as receipts. This type of report helps both employees and employers track and reimburse legitimate travel expenses effectively.

To prove travel expenses for taxes in the context of a South Dakota Auto Expense Travel Report, you should keep thorough records, including receipts and travel itineraries. Additionally, documentation should show the date, purpose, and destination of your travel. By organizing this information, you can simplify your tax filing process and demonstrate the legitimacy of your expenses.

A travel expense report is a document that outlines the costs associated with business travel. This includes transportation, lodging, meals, and other expenses incurred while traveling for work. In the context of the South Dakota Auto Expense Travel Report, it specifically tracks vehicle-related expenses, ensuring you have a complete overview of travel costs. Using tools like US Legal Forms can simplify the process, making it easier for you to generate accurate and compliant reports.