South Dakota Private Annuity Agreement with Payments to Last for Life of Annuitant

Description

How to fill out Private Annuity Agreement With Payments To Last For Life Of Annuitant?

You might spend hours on the Web looking for the legal document format that satisfies the state and federal requirements you require.

US Legal Forms offers thousands of legal templates that have been reviewed by professionals.

You can effortlessly download or print the South Dakota Private Annuity Agreement with Payments to End for the Life of Annuitant from my service.

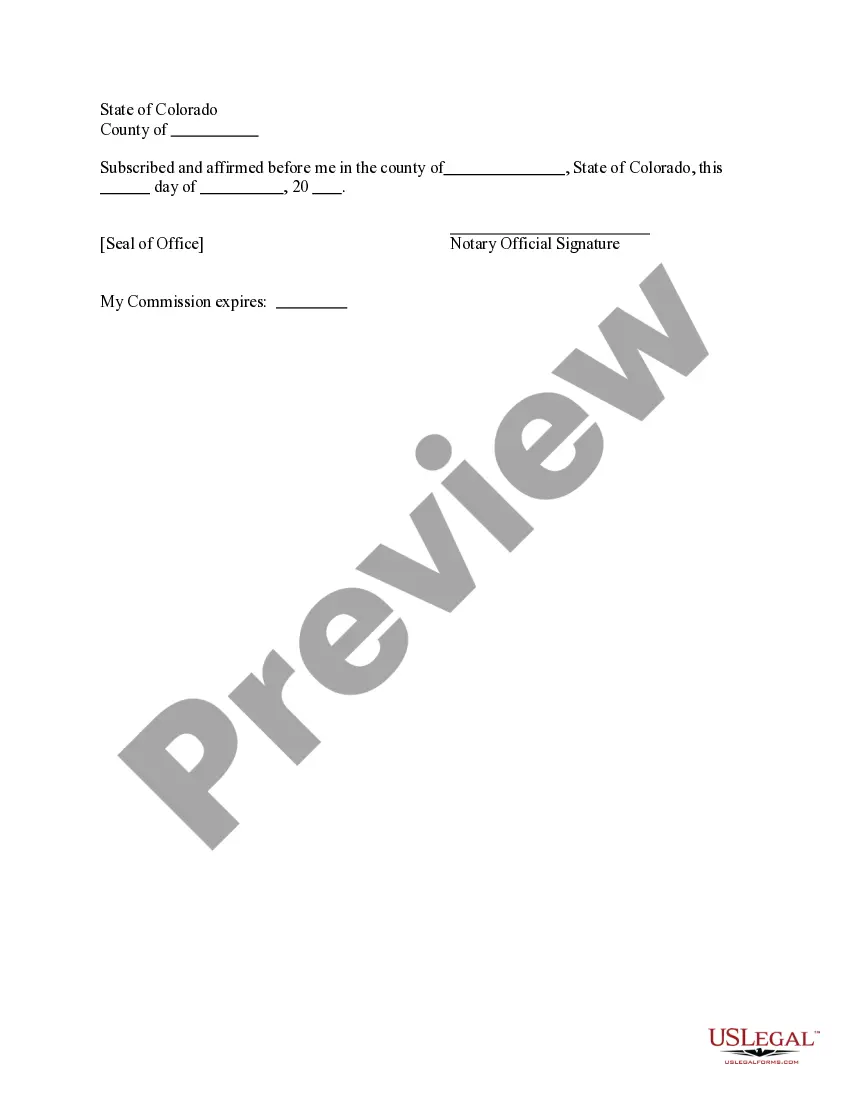

First and foremost, ensure that you have chosen the correct document format for the region/area that you selected. Review the form description to confirm that you have selected the right template. If available, utilize the Preview button to view the document format as well.

- If you possess a US Legal Forms account, you can Log In and then select the Download button.

- Subsequently, you can complete, modify, print, or sign the South Dakota Private Annuity Agreement with Payments to End for the Life of Annuitant.

- Every legal document format you purchase is yours indefinitely.

- To obtain another copy of a purchased form, navigate to the My documents section and click the corresponding button.

- If you are utilizing the US Legal Forms website for the first time, follow these straightforward instructions.

Form popularity

FAQ

If the annuitant is alive, the payments continue as specified in the South Dakota Private Annuity Agreement with Payments to Last for Life of Annuitant. This means that, as long as the annuitant remains living, they receive regular payments guaranteed by the terms of the agreement. This arrangement provides financial security and peace of mind, ensuring that the annuitant has a reliable income stream for their lifetime. Utilizing services like uslegalforms can help you set up and understand these agreements effectively.

Upon the death of the annuitant in a South Dakota Private Annuity Agreement with Payments to Last for Life of Annuitant, the taxation of the annuity can be complex. Generally, the value of the remaining payments may be included in the estate, possibly leading to estate taxes. It is vital for beneficiaries to seek advice to navigate these tax implications properly.

Yes, in the context of a South Dakota Private Annuity Agreement with Payments to Last for Life of Annuitant, the annuitant's life expectancy plays a crucial role in determining payment amounts. Payments are often calculated based on statistical life expectancy tables, ensuring that the annuitant receives appropriate income throughout their lifetime. This feature supports financial stability, especially in retirement.

For a South Dakota Private Annuity Agreement with Payments to Last for Life of Annuitant, taxation occurs based on a portion of each payment being considered taxable income. The Internal Revenue Service allows for a calculation method to determine how much is taxable versus nontaxable. Understanding this distribution is essential for financial planning, and a consultation with an expert can clarify your specific tax situation.

When the annuitant passes away, the tax implications of a South Dakota Private Annuity Agreement with Payments to Last for Life of Annuitant can vary. Typically, any remaining payments due may become part of the annuitant's estate and could be subject to estate taxes. Beneficiaries often do not face immediate tax liabilities; however, they should consult with a tax professional to fully understand their obligations.

The single-life annuity is the type of annuity that stops payment when the annuitant dies. As part of the South Dakota Private Annuity Agreement with Payments to Last for Life of Annuitant, this option provides a reliable income stream while you are alive, but it does not extend beyond your lifetime. Choosing this arrangement should include discussions regarding potential future needs and whether additional options could better suit your estate planning goals.

life annuity is a settlement option where payments stop at the annuitant's death. Under a South Dakota Private Annuity Agreement with Payments to Last for Life of Annuitant, this structure guarantees payments only during the lifetime of the annuitant. If you choose this option, it's crucial to consider your longterm financial needs, as no further payments will be made to beneficiaries.

When the annuitant dies under a South Dakota Private Annuity Agreement with Payments to Last for Life of Annuitant, the specific arrangements depend on the terms outlined in the agreement. Typically, if the agreement includes a beneficiary clause, the payments may continue to that designated individual. However, if it is a single-life annuity, the payments would cease upon the annuitant's death, emphasizing the importance of understanding the terms before entering into such agreements.

The South Dakota Private Annuity Agreement with Payments to Last for Life of Annuitant is designed specifically to provide lifetime payments to you as the annuitant. This option ensures that you receive a guaranteed income stream for the rest of your life, offering financial security and peace of mind. With this type of agreement, you can plan your finances knowing that these payments will not cease regardless of how long you live.

A straight life annuity stops making payments when the annuitant dies, making it a straightforward option for individuals not concerned about leaving an inheritance. This type of agreement is often part of a South Dakota Private Annuity Agreement with Payments to Last for Life of Annuitant, ensuring that you receive regular income during your lifetime without future obligations. This simplicity can be appealing for those who prioritize their own financial security.