South Dakota Private Annuity Agreement

Description

How to fill out Private Annuity Agreement?

If you need to complete, obtain, or create legal document templates, utilize US Legal Forms, the most significant collection of legal forms, which can be found online.

Take advantage of the site's simple and efficient search to locate the documents you need.

Different templates for businesses and personal uses are organized by categories and states, or keywords.

Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Step 4. Once you have found the form you require, select the Get now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

- Use US Legal Forms to locate the South Dakota Private Annuity Agreement with just a few clicks.

- If you are currently a US Legal Forms customer, sign in to your account and click on the Acquire button to find the South Dakota Private Annuity Agreement.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form’s content. Remember to read the description.

Form popularity

FAQ

Do I Need to Have My Will Notarized? No, in South Dakota, you do not need to notarize your will to make it legal. However, South Dakota allows you to make your will "self-proving" and you'll need to go to a notary if you want to do that.

The earnings on your fixed annuities are tax-deferred, so you don't pay taxes on them until you start receiving payments. Your money is private to everyone who might be looking, even the IRS. As mentioned in the previous paragraph, fixed annuities are safe from lawsuits by creditors or anyone else.

States such as Florida and Texas have laws that prevent creditors from seizing any money that is held inside an annuity or cash value life insurance policy.

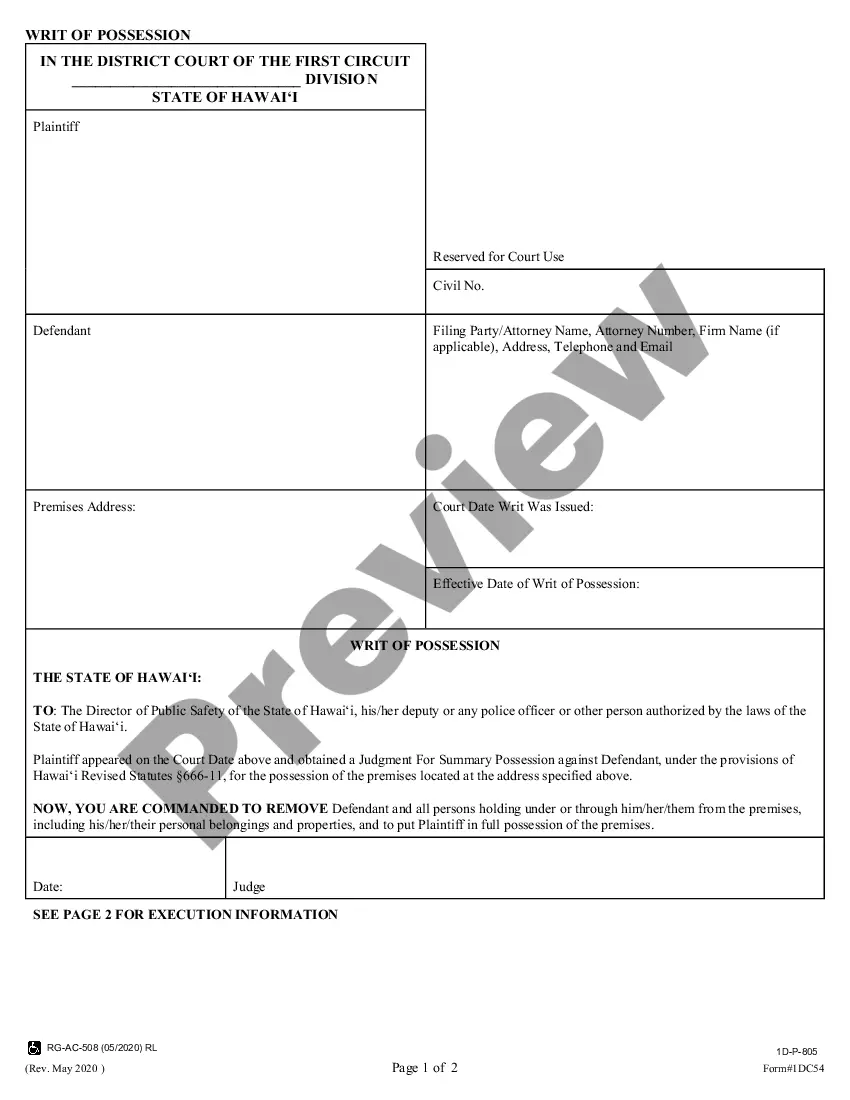

A private annuity is a special agreement in which an individual (annuitant) transfers property to an obligor. The obligor agrees to make payments to the annuitant according to an agreed-upon schedule in exchange for the property transfer.

Annuities and Life InsuranceSome protect the cash surrender values of life insurance policies and the proceeds of annuity contracts from attachment, garnishment, or legal process in favor of creditors. Others protect only the beneficiary's interest to the extent reasonably necessary for support.

Generally speaking, an annuity is not garnishable. There are certain kinds of income which are exempt from being seized by creditors to pay a judgment owing, and the income received from an annuity would be one of them.