South Dakota Release of Purchase Contract - Residential

Description

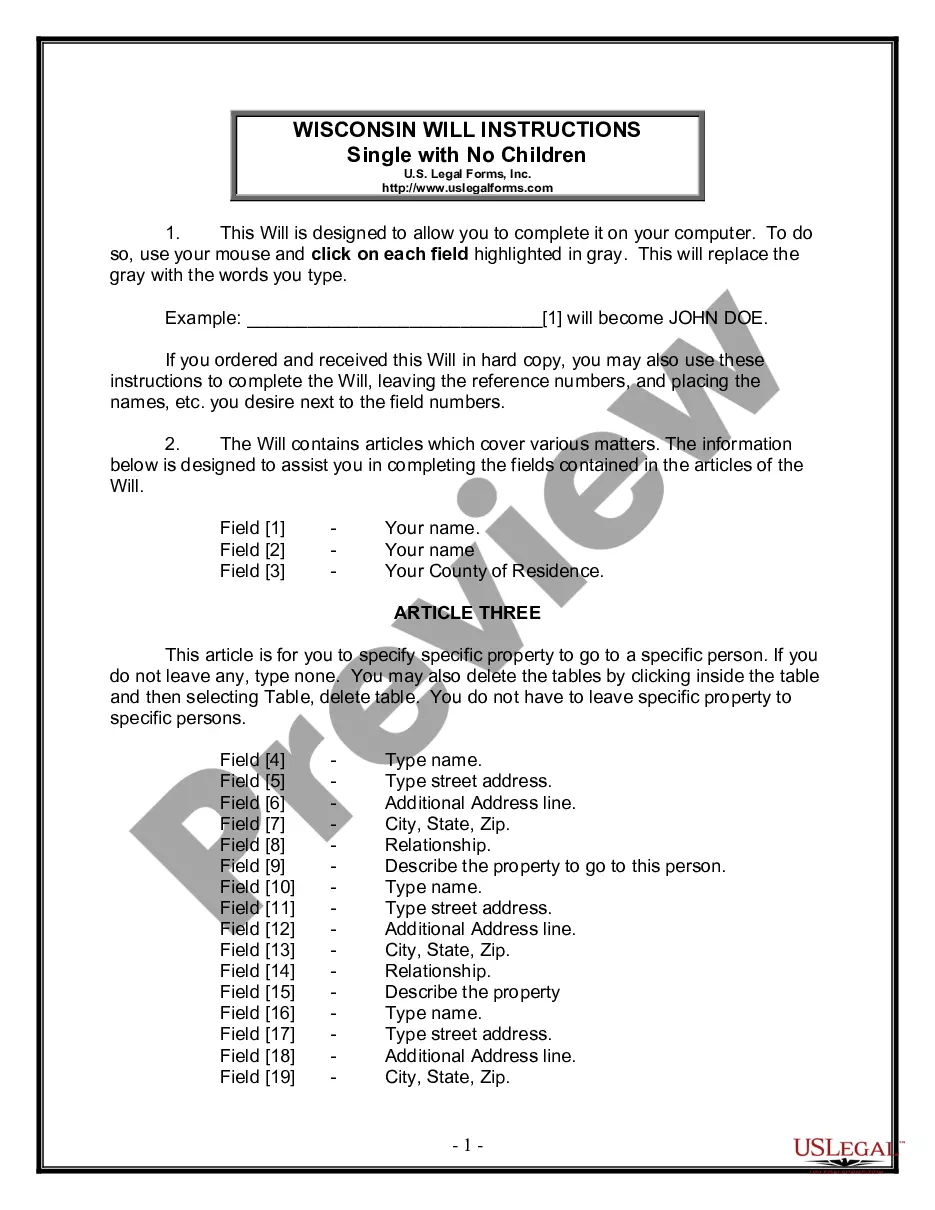

How to fill out Release Of Purchase Contract - Residential?

US Legal Forms - one of the largest compilations of legal documents in the United States - provides an extensive variety of legal template formats that you can download or print. By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the most recent versions of forms such as the South Dakota Release of Purchase Contract - Residential in mere moments. If you already have a membership, Log In and retrieve the South Dakota Release of Purchase Contract - Residential from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

If you are looking to use US Legal Forms for the first time, here are some simple steps to get started: Verify that you have selected the correct form for your location/region. Click the Preview button to review the form's content. Consult the form summary to ensure you have chosen the proper document. If the form does not suit your needs, utilize the Search bar at the top of the screen to find one that does. If you are satisfied with the document, confirm your choice by clicking the Acquire now button. Then, select your preferred pricing plan and provide your credentials to register for an account.

- Complete the payment. Use your credit card or PayPal account to finalize the transaction.

- Select the format and download the document to your device.

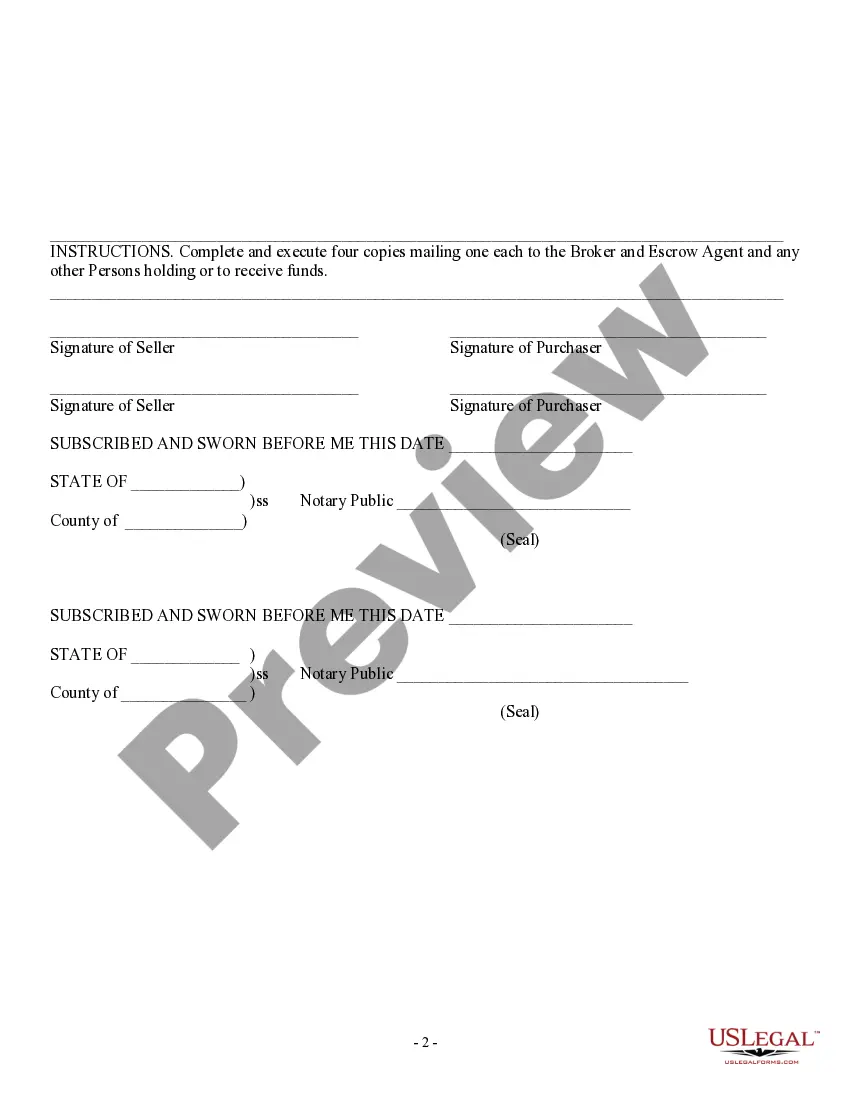

- Edit. Fill out, modify, print, and sign the downloaded South Dakota Release of Purchase Contract - Residential.

- Every template added to your account has no expiration date and belongs to you forever. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need.

- Access the South Dakota Release of Purchase Contract - Residential with US Legal Forms, the most extensive collection of legal document templates.

- Utilize a multitude of professional and state-specific templates that fulfill your business or personal requirements and needs.

Form popularity

FAQ

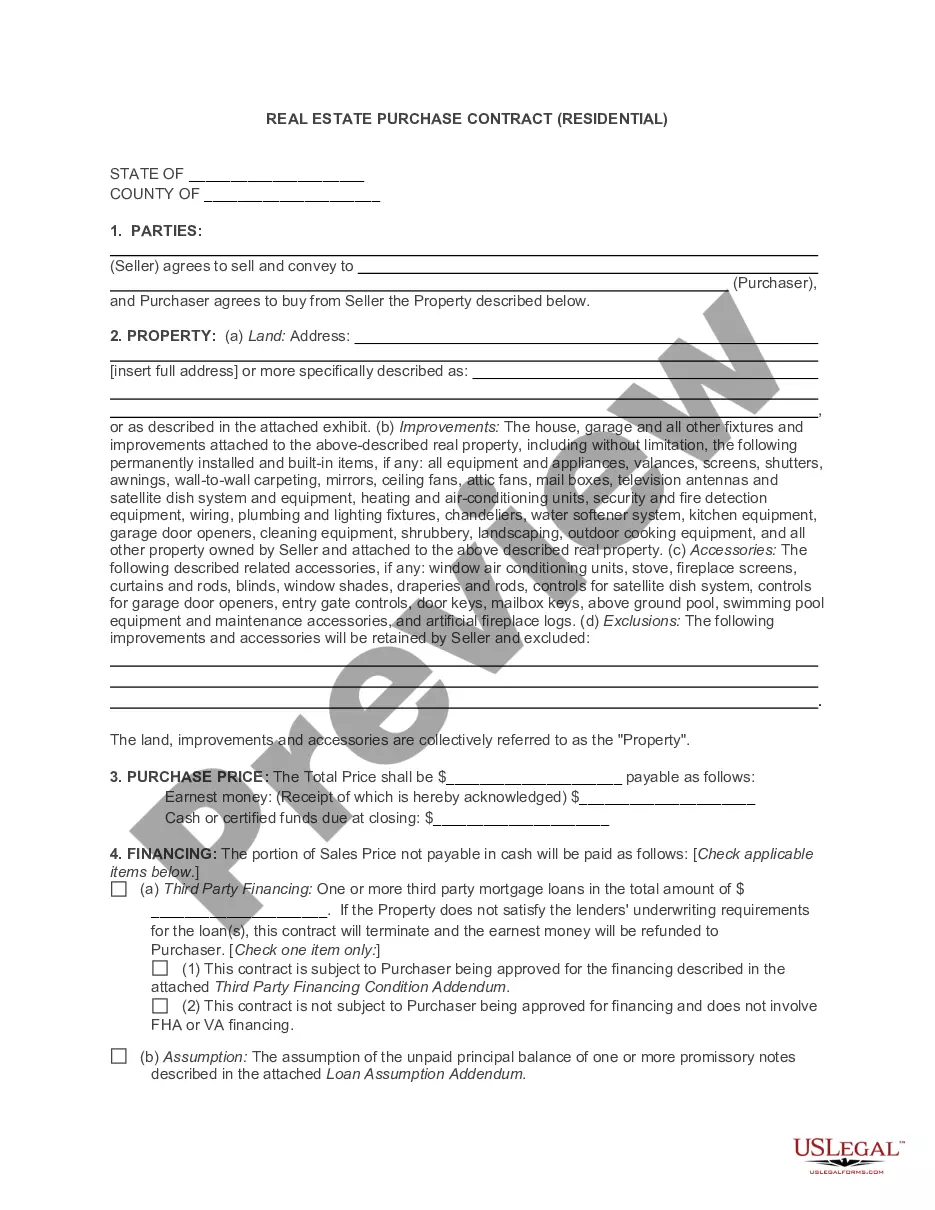

The words "and Joint Escrow Instructions" reflect that the form includes an instruction to the escrow holder by both the buyer and the seller (see paragraph 28) and includes space for the escrow holder to sign for receipt of the document (see page 8 of the contract).

If you're backing out of an offer without a contingency, you risk losing your earnest money. Since you put that money down based on the promise you'll follow through with the contract, backing out for any reason that's not outlined in the agreement means the seller is legally permitted to keep your money.

Despite having a home purchase agreement, earnest money, and contingencies in place, both buyers and sellers can back out of purchasing or selling a home.

Subparagraph E states that the balance of the purchase price (which must be filled in) will be deposited in escrow prior to closing. Subparagraph F shows the total purchase price.

In short: Yes, buyers can typically back out of buying a house before closing. However, once both parties have signed the purchase agreement, backing out becomes more complex, particularly if your goal is to avoid losing your earnest money deposit.

With a home inspection contingency in place, you can walk away from the deal, especially if the seller refuses to fix the problem or offer credits to offset the closing costs. The financing contingency is another important safeguard. It gives you an out if your lender doesn't pull through with a loan approval.

A contract for deed is a contract where the seller remains the legal owner of the property and the buyer makes monthly payments to the seller to buy the house. The seller remains the legal owner of the property until the contract is paid.

So the answer to "Can a seller back out on a deal?" is simple: Yes; but without fault on the buyer's part, that breach of contract is going to cost the seller dearly.

Purchase agreements usually include contingencies or situations in which you can back out of the contract without penalty. As long as you're pulling out of the purchase due to one of the contingencies listed on the purchase agreement, you're golden. If not, you may lose money.