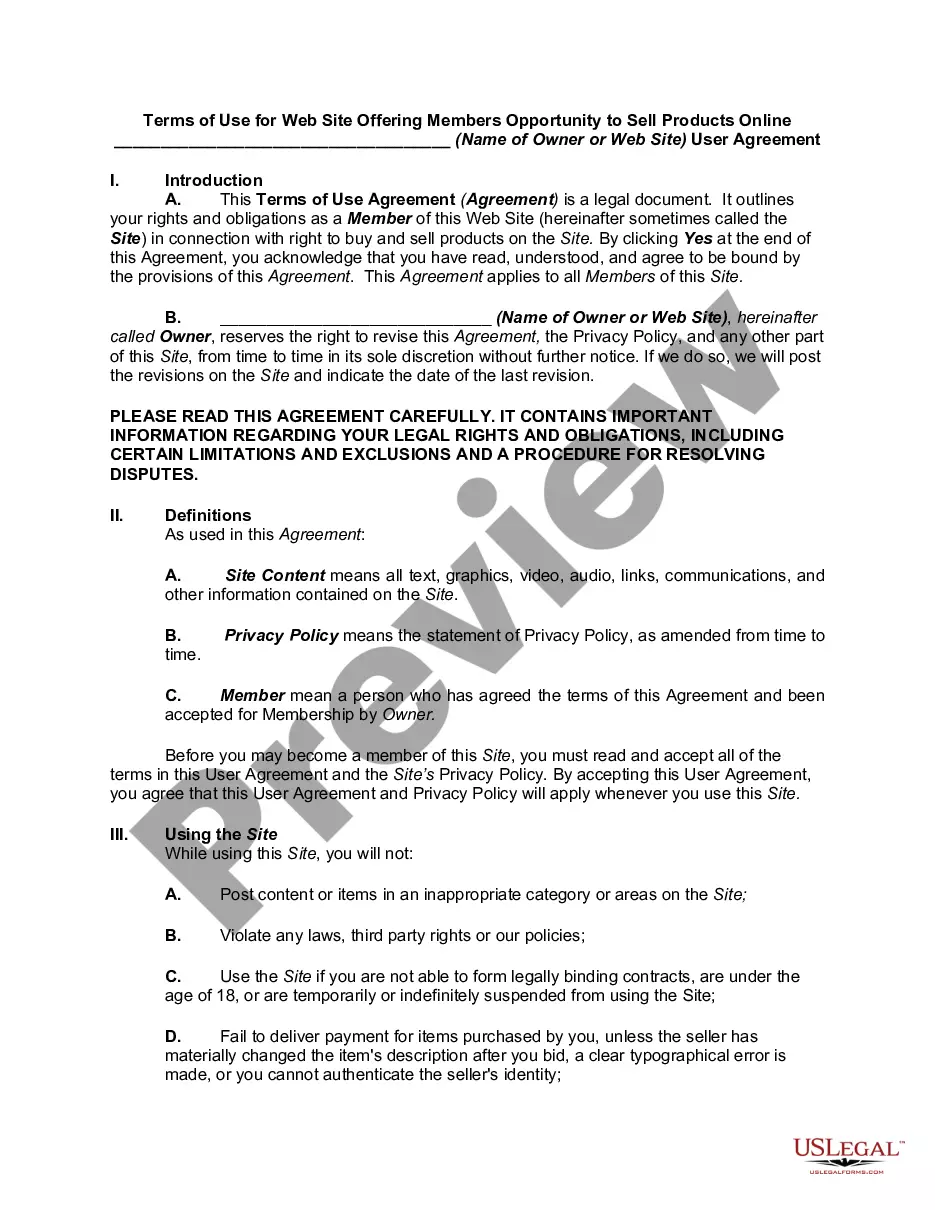

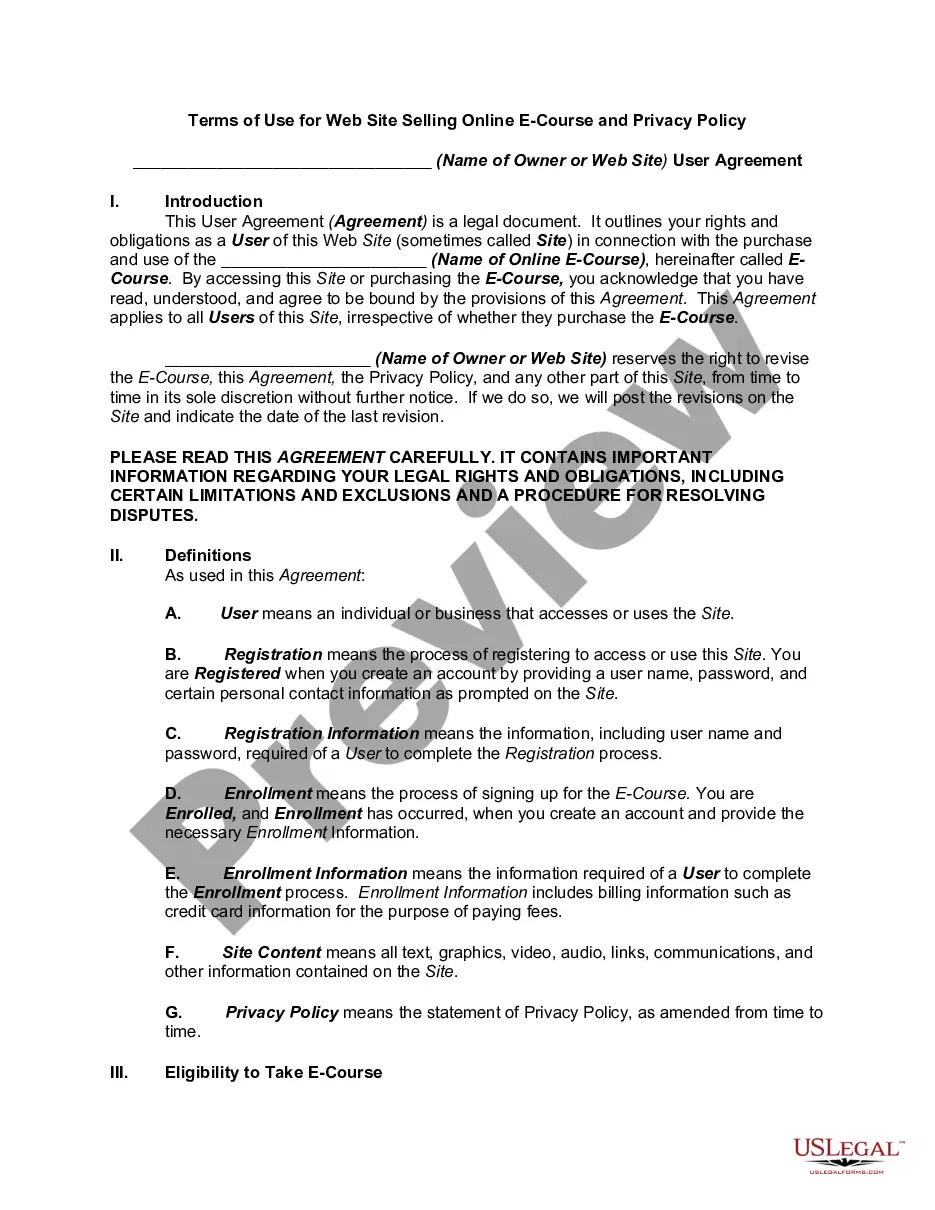

This is a form for a user agreement for an online auction and shopping website in which people and businesses buy and sell goods and services worldwide.

South Dakota Website Subscription User Agreement for Online Auction and Shopping Website

Description

How to fill out Website Subscription User Agreement For Online Auction And Shopping Website?

US Legal Forms - one of the largest collections of legal documents in the United States - provides an extensive array of legal form templates available for download or printing.

Using the website, you can discover thousands of forms for commercial and personal uses, organized by categories, states, or keywords. You can find the latest forms such as the South Dakota Website Subscription User Agreement for Online Auction and Shopping Website in just minutes.

If you already have an account, Log In to download the South Dakota Website Subscription User Agreement for Online Auction and Shopping Website from the US Legal Forms library. The Download button will appear on every form you view. You can access all your previously downloaded forms in the My documents section of your profile.

Select the format and download the form to your device.

Make modifications. Fill out, edit, print, and sign the downloaded South Dakota Website Subscription User Agreement for Online Auction and Shopping Website.

- If you're using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your location/region. Click the Preview button to review the form's content.

- Read the form summary to confirm that you have selected the appropriate form.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Get now button. Then, select the pricing plan you desire and provide your details to create an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Form popularity

FAQ

Yes, a business license is typically required to legally sell goods online in South Dakota. This requirement ensures that your business complies with local regulations, which are outlined under the South Dakota Website Subscription User Agreement for Online Auction and Shopping Website. It's essential to secure the proper licenses to operate your online store smoothly and legally.

As of now, the statewide sales tax rate in South Dakota is 4.5%. However, local governments can impose additional taxes, leading to varying rates across different areas. If you are selling products online, understanding these rates is crucial to staying compliant with the South Dakota Website Subscription User Agreement for Online Auction and Shopping Website.

No, a sales tax license and an Employer Identification Number (EIN) are different. A sales tax license allows you to collect sales tax from your customers, while an EIN identifies your business for tax purposes. If you're planning to operate under the South Dakota Website Subscription User Agreement for Online Auction and Shopping Website, you may need both to ensure full compliance with state regulations.

To obtain a sales tax license in South Dakota, you must first complete the application through the South Dakota Department of Revenue website. You will need to provide details about your business, including its nature and location. Once your application is reviewed and approved, you will receive your sales tax license, which is essential if you plan to operate under the South Dakota Website Subscription User Agreement for Online Auction and Shopping Website.

Yes, some services in South Dakota are subject to sales tax, while others are exempt. Generally, tangible goods are taxed, while professional services, such as legal and medical, are not. The South Dakota Website Subscription User Agreement for Online Auction and Shopping Website serves as a valuable resource to clarify which services are taxable and which are exempt, making it easier for users to manage their transactions.

South Dakota has a state sales tax rate that applies to most goods sold and services rendered. Currently, the standard state sales tax rate is 4.5%, but local jurisdictions may impose additional taxes. The South Dakota Website Subscription User Agreement for Online Auction and Shopping Website provides useful insights into how these rates apply to transactions, assisting users in understanding their payments.

In South Dakota, several services are exempt from sales tax, including professional services like legal advice, accounting, and medical services. These exemptions can positively impact businesses and individuals alike. By referencing the South Dakota Website Subscription User Agreement for Online Auction and Shopping Website, users can familiarize themselves with these exemptions and ensure compliance.

Tax exemption for services depends on the nature of the service in South Dakota. Some services, like legal and medical services, are exempt, while others may be taxable. The South Dakota Website Subscription User Agreement for Online Auction and Shopping Website explains these nuances in detail, helping users navigate their tax obligations effectively.

In South Dakota, certain items are exempt from sales tax. These typically include groceries, prescription drugs, and certain medical equipment. Additionally, items sold for resale are not taxed based on the South Dakota Website Subscription User Agreement for Online Auction and Shopping Website, which outlines these exemptions clearly. If you are unsure whether an item is taxable, the agreement provides guidance.

In South Dakota, many services are considered taxable, while some are exempt based on specific criteria. When you enter into an agreement like the South Dakota Website Subscription User Agreement for Online Auction and Shopping Website, understanding the taxability of your service offerings is vital. Always refer to the state's tax guidelines or seek advice from a tax expert to ensure you meet your legal obligations.