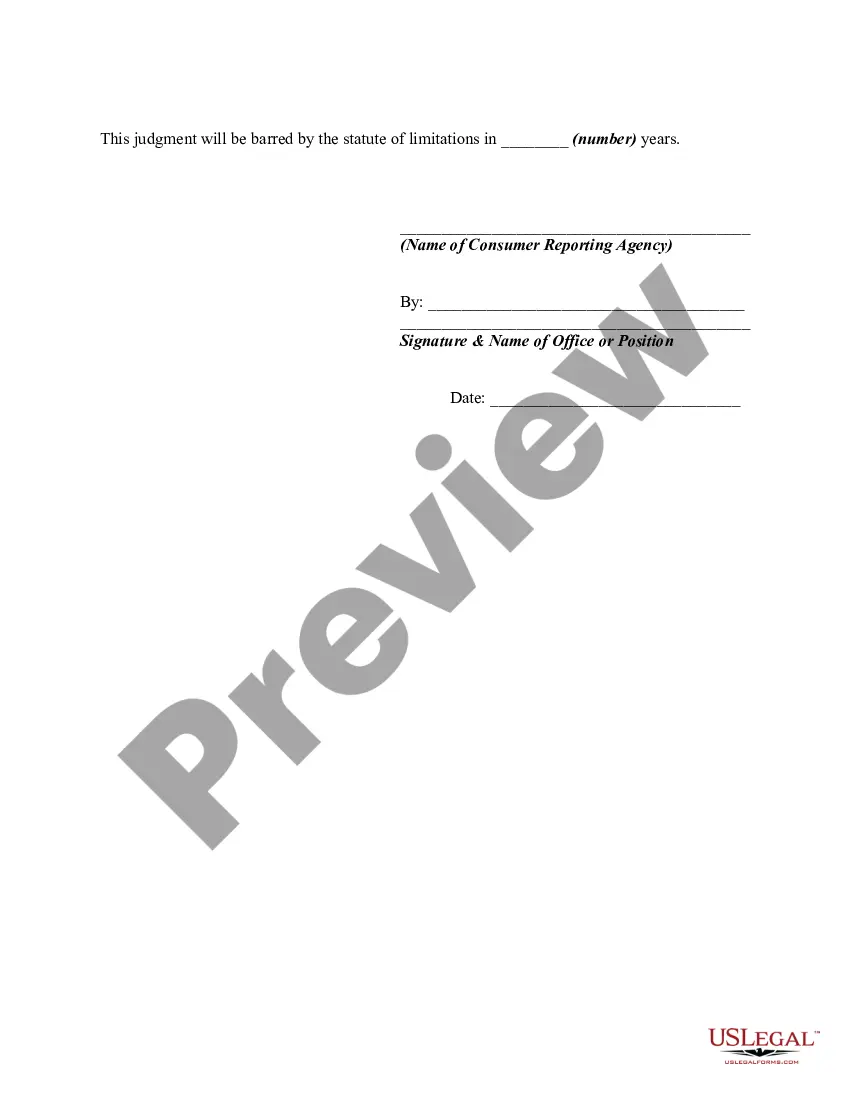

No particular language is necessary for this type of report so long as the report clearly conveys the necessary information.

South Dakota Report to Creditor by Collection Agency Regarding Judgment Against Debtor

Description

How to fill out Report To Creditor By Collection Agency Regarding Judgment Against Debtor?

Are you in a placement where you need files for possibly enterprise or specific uses virtually every day time? There are tons of lawful file layouts available on the Internet, but getting types you can rely on is not easy. US Legal Forms provides thousands of kind layouts, just like the South Dakota Report to Creditor by Collection Agency Regarding Judgment Against Debtor, that are published to meet state and federal requirements.

In case you are already informed about US Legal Forms site and possess your account, basically log in. After that, you are able to down load the South Dakota Report to Creditor by Collection Agency Regarding Judgment Against Debtor format.

Unless you come with an account and wish to begin to use US Legal Forms, adopt these measures:

- Discover the kind you need and ensure it is for your right metropolis/region.

- Use the Review key to check the shape.

- Read the description to ensure that you have selected the appropriate kind.

- When the kind is not what you are looking for, use the Search field to discover the kind that meets your requirements and requirements.

- Whenever you obtain the right kind, simply click Get now.

- Pick the rates program you desire, fill out the required information to produce your bank account, and pay for your order using your PayPal or Visa or Mastercard.

- Decide on a handy document structure and down load your duplicate.

Get every one of the file layouts you have purchased in the My Forms food list. You can aquire a more duplicate of South Dakota Report to Creditor by Collection Agency Regarding Judgment Against Debtor whenever, if required. Just select the necessary kind to down load or produce the file format.

Use US Legal Forms, probably the most comprehensive selection of lawful kinds, to save efforts and prevent errors. The services provides skillfully made lawful file layouts which you can use for a range of uses. Make your account on US Legal Forms and begin creating your way of life easier.

Form popularity

FAQ

For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts. If your home is repossessed and you still owe money on your mortgage, the time limit is 6 years for the interest on the mortgage and 12 years on the main amount.

Can a Debt Collector Collect After 10 Years? In most cases, the statute of limitations for a debt will have passed after 10 years. This means a debt collector may still attempt to pursue it (and you technically do still owe it), but they can't typically take legal action against you.

Statute of limitations on debt for all states StateWrittenOralArkansas6 years3California4 years2Colorado6 years6Connecticut6 years346 more rows ?

Debt collectors have a certain number of years they can sue you and win to collect a debt. It's called the statute of limitations and it usually begins when you fail to make a payment on a debt. In South Dakota, the statute of limitations is six years.

The original creditor can't continue to report a balance due if it has sold the account to a collections agency. However, it can report a charge off, which remains on your credit report for seven years, even if you pay off the debt?with the original creditor or via a collections agency.

A debt collector may not contact you at inconvenient times or places, such as before 8 in the morning or after 9 at night, unless you agree to it. And collectors may not contact you at work if they;re told (orally or in writing) that you're not allowed to get calls there.

Does the 7-year period repeat? In short, no. The 7-year rule means that each negative remark remains on your report for 7 years (possibly more depending on the remark). However, after that period has ended, a remark will fall off of your report.

Credit Reporting However, debt collectors cannot report false information about your debt. If you dispute a debt in writing with a debt collector, that debt collector must tell any credit reporting company that it has reported your debt to that you dispute the debt.