This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

South Dakota Installment Promissory Note with Acceleration Clause and Collection Fees

Description

How to fill out Installment Promissory Note With Acceleration Clause And Collection Fees?

Are you presently in a scenario where you need documents for potential corporate or personal uses almost every time? There are numerous legal document templates available online, but finding ones you can trust is challenging.

US Legal Forms provides thousands of form templates, such as the South Dakota Installment Promissory Note with Acceleration Clause and Collection Fees, that are designed to comply with state and federal regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. Then, you can download the South Dakota Installment Promissory Note with Acceleration Clause and Collection Fees template.

- Identify the form you need and verify it is for the correct city/state.

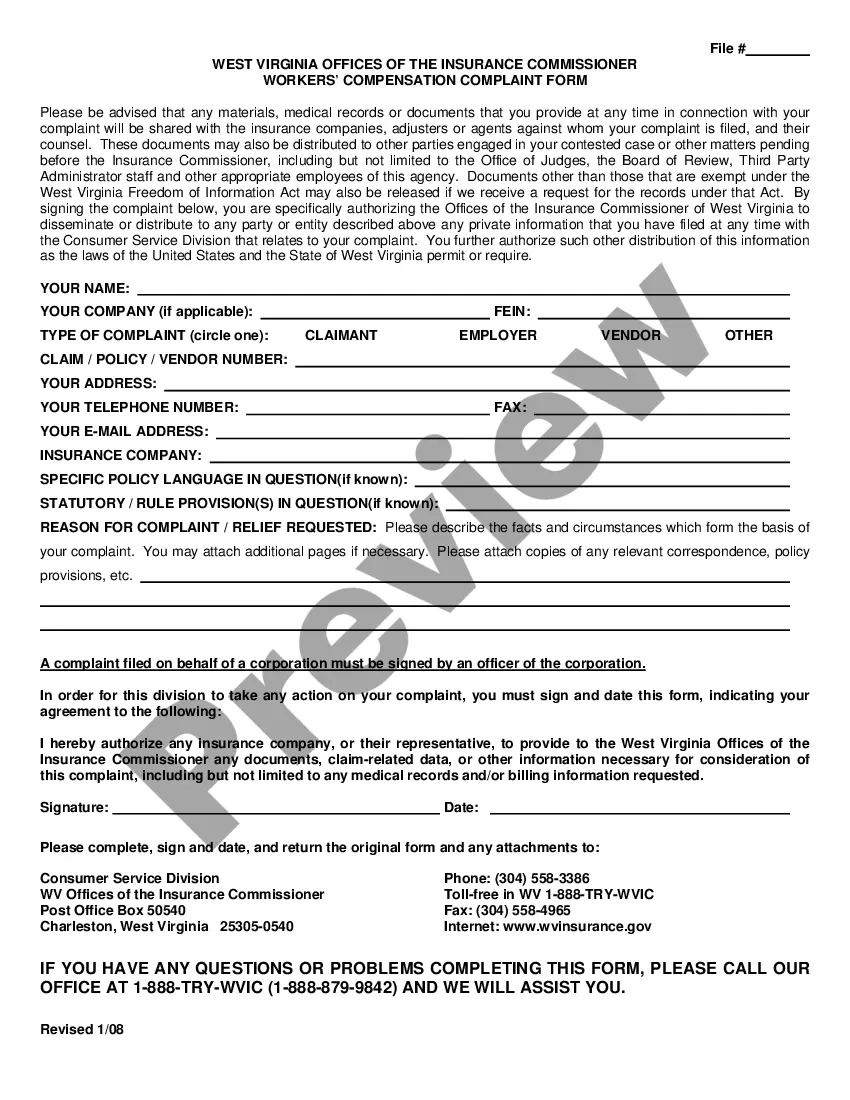

- Use the Review option to assess the document.

- Check the description to confirm that you have chosen the appropriate form.

- If the form is not what you are looking for, use the Search field to find the form that meets your requirements.

- Once you find the correct form, click Purchase now.

- Select the pricing plan you desire, fill in the required information to create your account, and pay for the order using your PayPal or Visa or Mastercard.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

When dealing with a South Dakota Installment Promissory Note with Acceleration Clause and Collection Fees, you generally have six years to collect on the note. This timeframe begins from the date of default, which is when the borrower fails to make a payment as agreed. Additionally, the terms outlined in the promissory note can provide specific conditions that may affect this timeline. If you need assistance with your promissory note, consider using the U.S. Legal Forms platform to ensure compliance and facilitate the collection process effectively.

Promissory notes can vary widely, including demand notes, installment notes, and secured notes, each designed for specific borrowing circumstances. For example, an installment note is commonly used for loans repaid in partial payments over time, like those seen in a South Dakota Installment Promissory Note with Acceleration Clause and Collection Fees. Understanding these distinctions can help ensure you choose the right option for your financial needs.

The main difference lies in their structure and repayment plans. An installment note includes regular, scheduled payments, while a standard promissory note may not specify such terms. When considering a South Dakota Installment Promissory Note with Acceleration Clause and Collection Fees, the clarity of installment payments helps both lenders and borrowers understand their financial commitments more easily.

A promissory note for debt payable in equal installments divides the total amount owed into smaller, manageable payments due at regular intervals. This arrangement allows borrowers to plan their finances better while fulfilling their obligations. When structured as a South Dakota Installment Promissory Note with Acceleration Clause and Collection Fees, it further enforces payment discipline and outlines potential fees for late payments.

You can accelerate a South Dakota Installment Promissory Note with Acceleration Clause and Collection Fees by declaring the entire balance due upon a specific event, like missed payments. The terms of the note should clearly outline the events that trigger acceleration. To proceed smoothly, consider using resources from uslegalforms to draft or review your note, ensuring it complies with legal standards and protects your interests.

To collect on a South Dakota Installment Promissory Note with Acceleration Clause and Collection Fees, you must first send a formal demand for payment to the borrower, outlining the due amount. If this does not yield results, you may need to explore legal avenues, including mediation or litigation, depending on the situation. Utilizing uslegalforms can simplify this process, providing you with the necessary documentation and guidance to ensure effective collection.

Yes, a promissory note can go to collections if the borrower fails to comply with the repayment terms. In cases of default, the lender may enlist a collections agency to recover the owed funds. A well-drafted South Dakota Installment Promissory Note with Acceleration Clause and Collection Fees not only outlines the payment schedule but also provides mechanisms for recovery, ensuring that lenders have necessary options for pursuing outstanding debts.

To legally enforce a promissory note, the lender must first document the terms of the agreement, including any acceleration clauses and collection fees. If the borrower fails to make payments, the lender can initiate legal action to recover the owed amount. Utilizing resources like USLegalForms can help you create a robust South Dakota Installment Promissory Note with Acceleration Clause and Collection Fees that meets legal standards and simplifies the enforcement process.