South Dakota Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust

Description

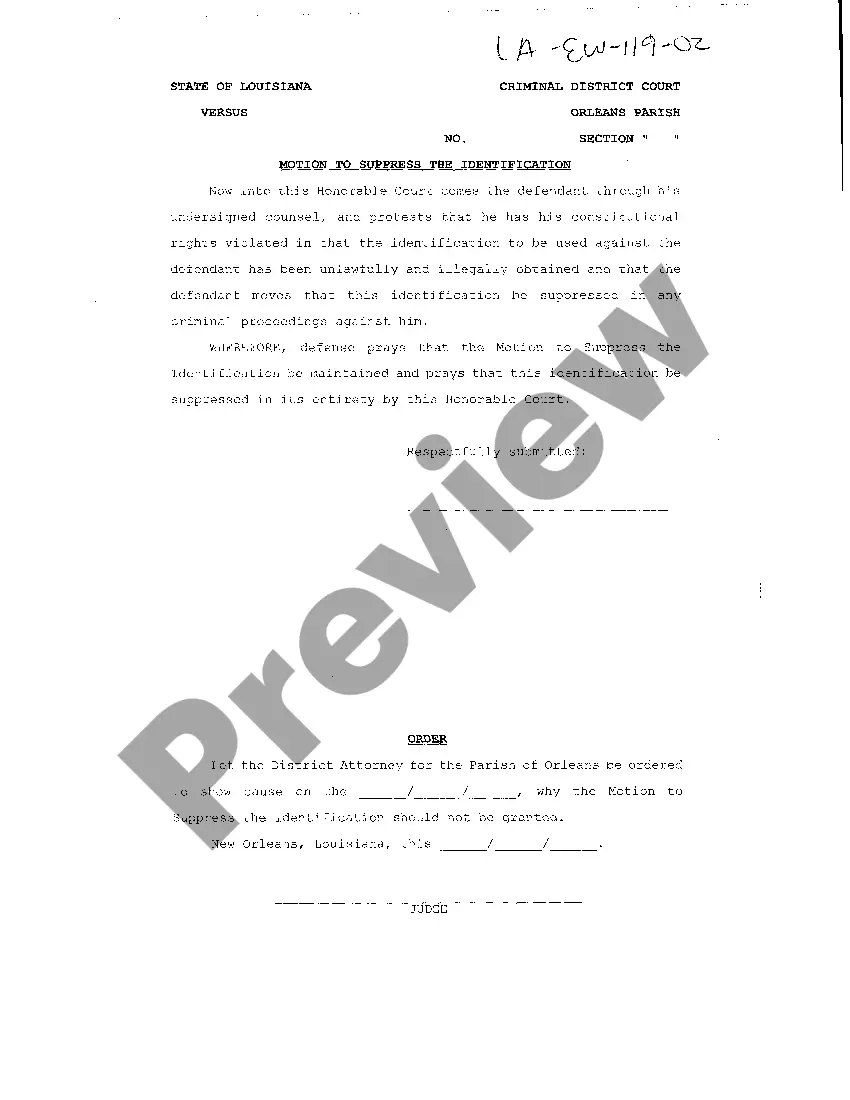

How to fill out Amendment Of Inter Vivos Trust Agreement For Withdrawal Of Property From Trust?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal form templates that you can download or create.

By utilizing the site, you will find a multitude of forms for business and personal use, organized by categories, states, or keywords. You can locate the latest versions of forms like the South Dakota Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust in just minutes.

If you already have a monthly subscription, Log In to download the South Dakota Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust from your US Legal Forms library. The Download button appears on every form you view.

If you are satisfied with the form, confirm your choice by clicking the Get now button. Then, select the pricing plan you prefer and provide your details to create an account.

Complete the transaction. Use your credit card or PayPal account to finalize the transaction. Choose the format and download the form to your device. Make changes. Fill out, edit, print, and sign the downloaded South Dakota Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust.

All forms added to your account do not have an expiration date and belong to you permanently. Therefore, to download or print another copy, simply go to the My documents section and click on the form you need. Access the South Dakota Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs.

- You can access all previously downloaded forms from the My documents section of your account.

- If you're using US Legal Forms for the first time, here are easy instructions to get you started.

- Ensure you have selected the correct form for your city/county.

- Click on the Review button to verify the form's content.

- Read the form description to ensure you have chosen the right form.

- If the form does not meet your requirements, use the Search field at the top of the page to find one that does.

Form popularity

FAQ

Yes, you can amend your trust by yourself, but it is crucial to adhere to South Dakota's legal requirements. Preparing your amendments properly enables you to maintain control over your assets. However, consider utilizing resources like US Legal Forms to ensure your South Dakota Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust is legally sound and avoids potential pitfalls.

To write a codicil to a trust, start by identifying the specific trust you are modifying. Clearly state that this document serves as a codicil to the South Dakota Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust. Outline the specific changes or additions you wish to make, and ensure it is signed and dated, preferably in the presence of witnesses.

Writing a trust amendment involves a few key steps. First, clearly state that the document is an amendment to your existing trust. Specify the changes you want to make, referencing the South Dakota Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust to guide you. Finally, you should sign the amendment and consider having it notarized for added validity.

Handwritten changes to a trust, often called holographic amendments, can be legal in South Dakota. However, it is essential to ensure these changes align with the formal requirements of the South Dakota Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust. To avoid future disputes, you might want to document the changes clearly and consider having them witnessed.

When the grantor of an inter vivos trust dies, the trust usually becomes irrevocable and the assets are managed according to the terms set forth in the trust agreement. Beneficiaries may then receive distributions as specified in the trust, often bypassing probate. Understanding the implications of the South Dakota Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust can aid in effective management and distribution of assets after the grantor's passing.

Moving property from one trust to another involves a few key steps, starting with assessing the terms of both trusts. It often requires legal documentation to effectuate the transfer, such as trust agreements or transfer deeds. By leveraging the South Dakota Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust, you can streamline this transition while ensuring compliance with state law.

Yes, a trust can be rolled into another trust, a process that is often handled by the trustee. This method allows for the consolidation of assets and can simplify management. When utilizing the South Dakota Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust, you can ensure that this process adheres to legal requirements, making it an efficient solution for trust consolidation.

Generally, transferring assets into a trust is not a taxable event in South Dakota, as long as the transferor remains the trust's beneficiary. However, it is essential to consult a tax advisor, as tax implications can vary based on specific circumstances. When considering the South Dakota Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust, understanding these details can help prevent unexpected tax consequences.

The decanting statute in South Dakota allows a trustee to transfer assets from one trust to another, effectively altering the terms of the trust. This process is beneficial for adapting to changing circumstances or addressing the needs of beneficiaries. In addition, the South Dakota Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust can support trustees in managing these transitions seamlessly, ensuring compliance with state regulations.

To transfer property from one trust to another, you typically need to follow a formal process. First, review the terms of both trusts to ensure compliance. Next, execute the necessary documents, such as a deed or assignment, to facilitate the transfer. Utilizing the South Dakota Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust can simplify this process, ensuring that all legal requirements are met.