A limited partnership is a modified partnership. It has characteristics of both a corporation and a general partnership. In a limited partnership, certain members contribute capital, but do not have liability for the debts of the partnership beyond the amount of their investment. These members are known as limited partners. The partners who manage the business and who are personally liable for the debts of the business are the general partners. Limited partners have the right to share in the profits of the business and, if the partnership is dissolved, will be entitled to a percentage of the assets of the partnership. A limited partner may lose his limited liability status if he participates in the control of the business.

South Dakota Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership

Description

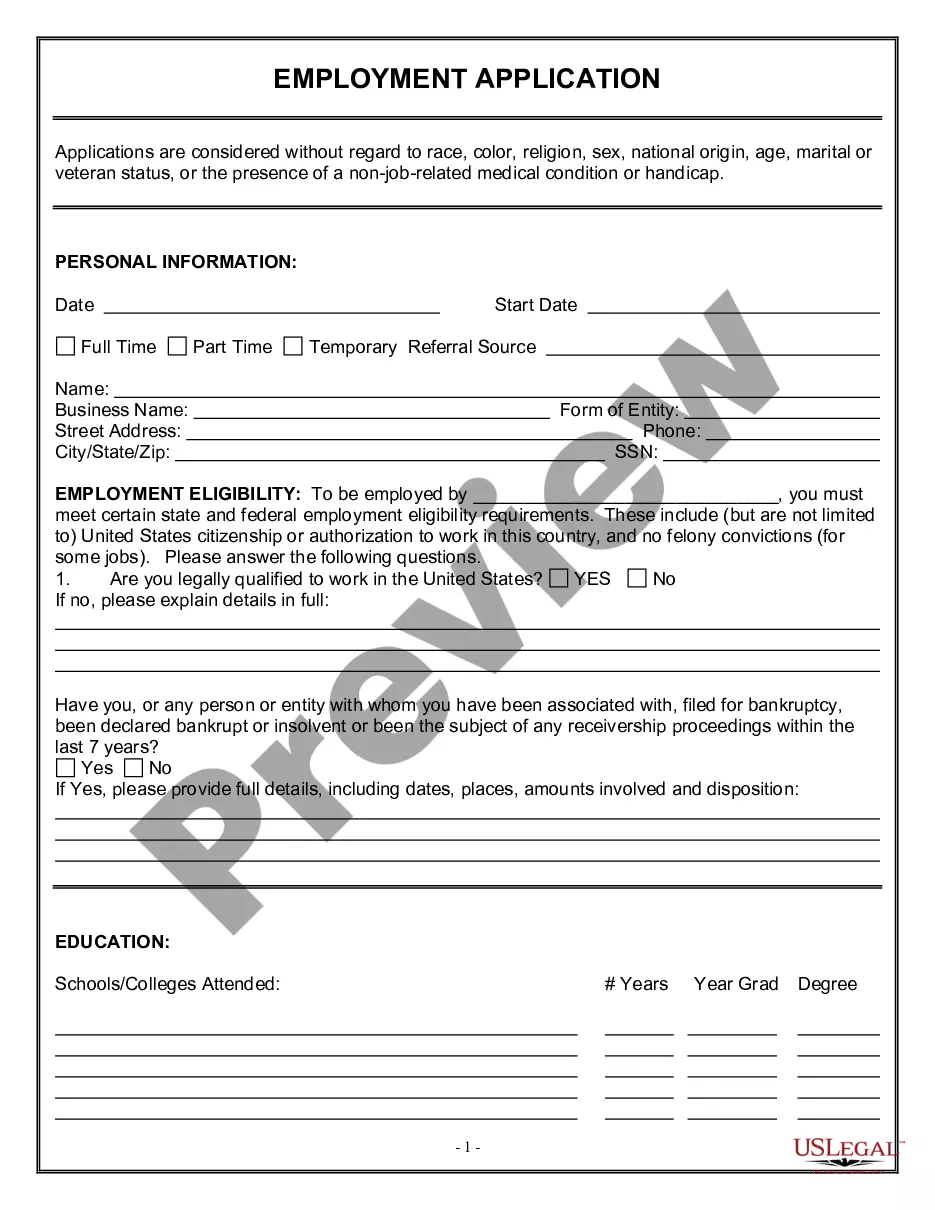

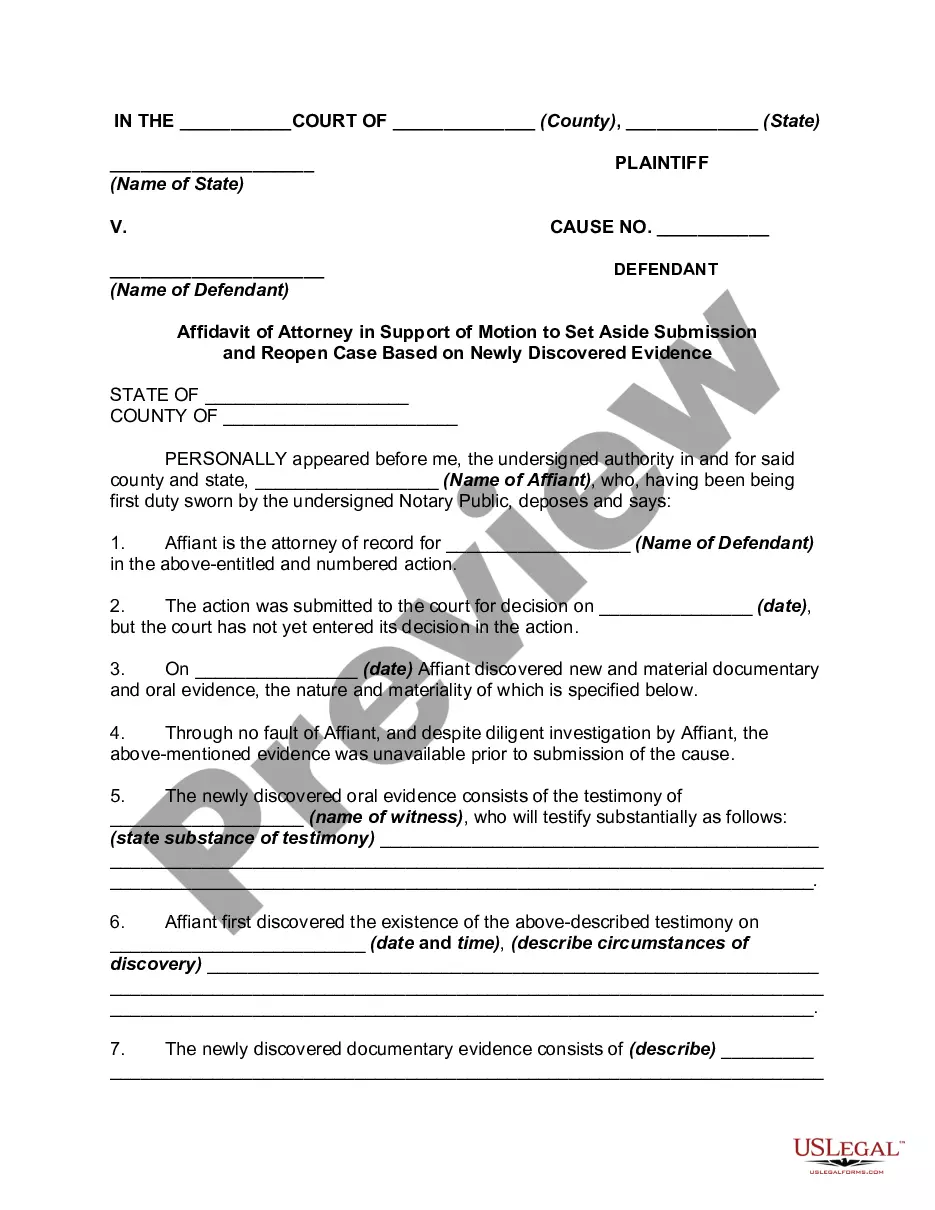

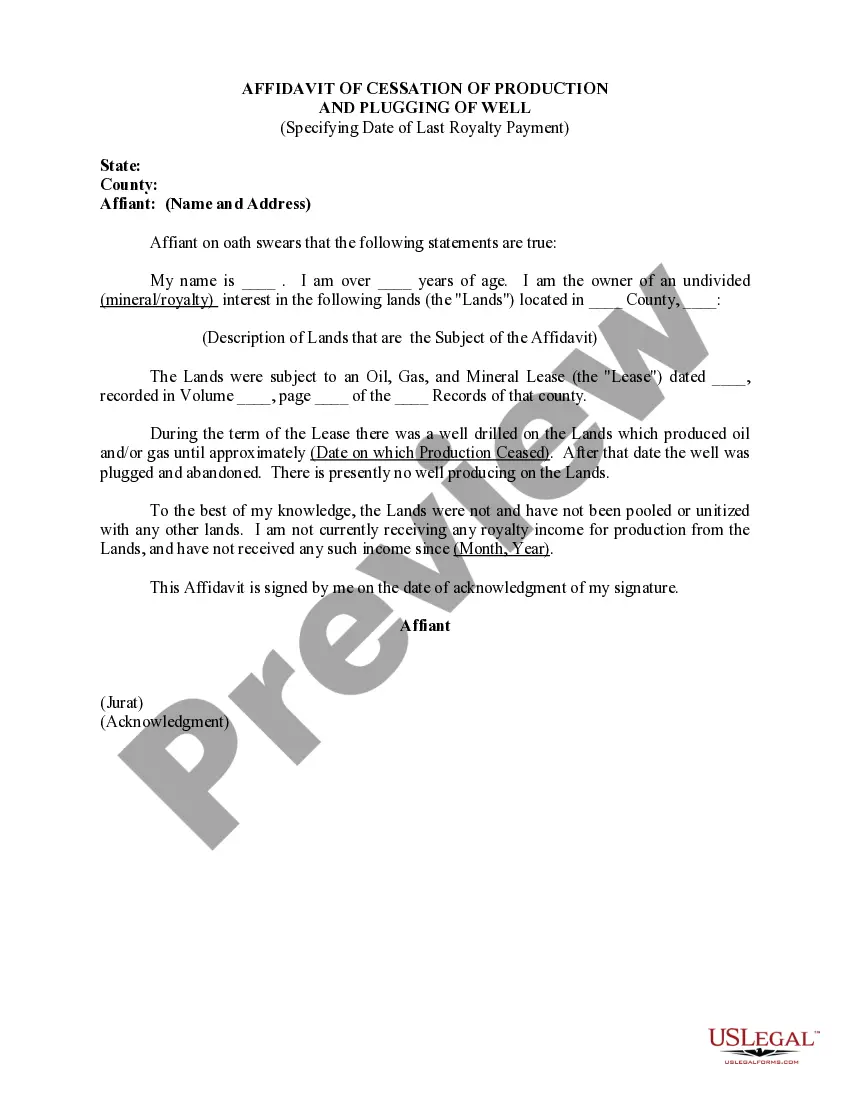

How to fill out Guaranty Of Payment By Limited Partners Of Notes Made By General Partner On Behalf Of Limited Partnership?

US Legal Forms - one of the most prominent collections of legal documents in the United States - offers a range of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal needs, categorized by types, states, or keywords. You can find the latest versions of documents like the South Dakota Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership in just seconds.

If you already have a monthly subscription, Log In and download the South Dakota Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership from the US Legal Forms library. The Download option will appear on each document you view. You can access all previously downloaded forms in the My documents section of your profile.

Process the payment. Use your Visa or Mastercard or PayPal account to complete the transaction.

Choose the format and download the document to your device. Make edits. Fill out, modify, print, and sign the downloaded South Dakota Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership.

Every template you add to your account has no expiration date and is yours indefinitely. So, if you wish to download or print another copy, simply go to the My documents section and click on the form you need.

Access the South Dakota Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership with US Legal Forms, one of the largest collections of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you want to use US Legal Forms for the first time, here are simple instructions to get you started.

- Make sure you have chosen the correct form for your area/state.

- Select the Review option to check the form's details.

- Read the form summary to ensure you have selected the right document.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking on the Buy now button.

- Then, select the pricing plan you wish and enter your information to create an account.

Form popularity

FAQ

No, general partners are liable for business debts beyond their capital contributions. This means their personal assets could be at risk to satisfy partnership debts. It is crucial for general partners to understand their extensive responsibilities, especially concerning arrangements like the South Dakota Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership, which provide a framework for understanding liability.

Yes, a general partner is indeed liable for the debts and obligations of a limited partnership. This liability arises because the general partner manages the partnership and has authority for its actions. In contrast, limited partners are not personally liable beyond their investment. The South Dakota Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership outlines these distinctions clearly.

General limited partners share a unique position where their liability is generally limited to the amount of their capital contributions. They are not responsible for the debts of the partnership beyond what they invest. This limitation provides a safeguard for their personal assets, particularly under arrangements like the South Dakota Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership. They can enjoy participation in profits while minimizing personal risk.

General partners are liable for the debts and obligations of the partnership. This includes business loans, contracts, and claims from creditors. Their personal assets may be at risk in the event the partnership faces bankruptcy or legal issues. Understanding the implications of the South Dakota Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership is essential for managing these risks.

While there is no legal requirement for a general partner to contribute capital, many choose to do so to show commitment. A capital contribution can strengthen the partnership's financial position and provide security to creditors. Moreover, under the South Dakota Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership, those contributions can help delineate the financial responsibilities among partners.

In a general partnership, partners typically have unlimited liability, which means they can be held personally responsible for the debts and obligations of the business. This liability extends to all partners, making it crucial to understand the risks involved. The South Dakota Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership provides some protections, distinguishing limited partners from general partners in terms of liability.

A general partner manages the day-to-day operations and decisions of a limited partnership. Unlike limited partners, general partners have the authority to bind the partnership legally and enter into contracts. They actively participate in the management and strategic direction of the business. With the South Dakota Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership, general partners carry additional responsibilities.

Dissolving an LLC in South Dakota involves a few key steps. Start by obtaining agreement from the members to dissolve the LLC. Then, file Articles of Dissolution with the Secretary of State and address any outstanding liabilities. For a seamless experience, you can explore uslegalforms for detailed templates and support throughout your dissolution journey.

To dissolve an LLC in South Dakota, you must file Articles of Dissolution with the Secretary of State. You should also settle any outstanding debts and distribute remaining assets among members. Lastly, file your final tax return to officially close your business. If you need assistance, uslegalforms can provide the necessary documents and guidance for this process.

Yes, South Dakota recognizes domestic partnerships. These partnerships allow couples to receive several legal benefits, including the ability to make health care decisions for each other. It is important to formally register your domestic partnership to enjoy these benefits. Always consult with legal resources, like uslegalforms, to ensure compliance with state laws.