A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. A guaranty agreement is a type of contract. Thus, questions relating to such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law. A conditional guaranty contemplates, as a condition to liability on the part of the guarantor, the happening of some contingent event. A guaranty of the payment of a debt is distinguished from a guaranty of the collection of the debt, the former being absolute and the latter conditional.

South Dakota Conditional Guaranty of Payment of Obligation

Description

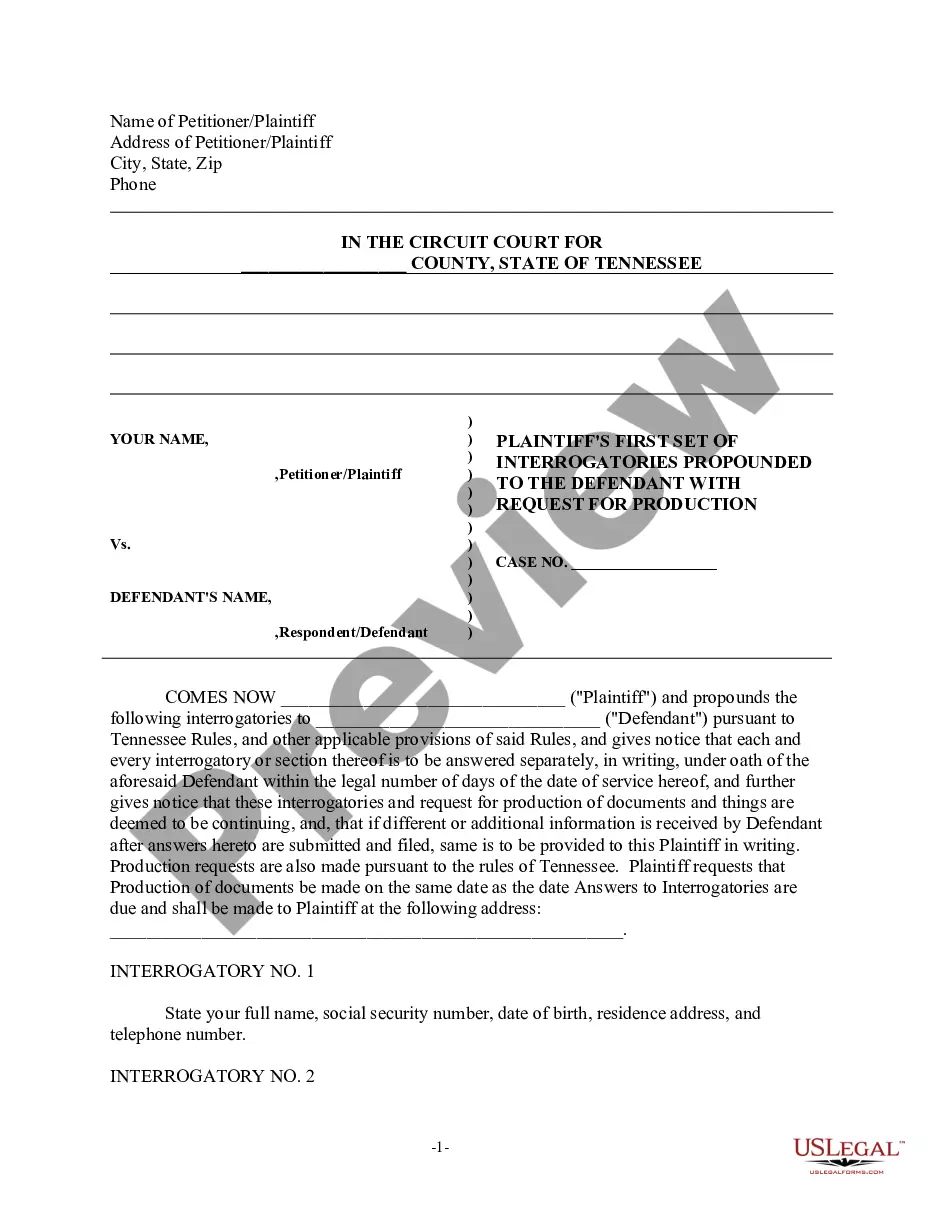

How to fill out Conditional Guaranty Of Payment Of Obligation?

You can spend hours online searching for the legal document template that meets the federal and state requirements you need.

US Legal Forms offers a multitude of legal documents that have been reviewed by experts.

You can download or print the South Dakota Conditional Guaranty of Payment of Obligation from my service.

First, ensure you have selected the correct document template for the region/city of your choice. Review the form outline to confirm that you have chosen the correct form. If available, utilize the Preview button to view the document template as well.

- If you have a US Legal Forms account, you can Log In and click on the Obtain button.

- Then, you can complete, modify, print, or sign the South Dakota Conditional Guaranty of Payment of Obligation.

- Every legal document template you buy is yours permanently.

- To obtain another copy of any purchased form, go to the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple guidelines below.

Form popularity

FAQ

Removing yourself from a personal guarantee, like a South Dakota Conditional Guaranty of Payment of Obligation, typically requires formal steps. Start by checking your agreement for any provisions regarding removal or termination. You may need to negotiate with the creditor, proving your request is valid and justifiable. If necessary, legal platforms such as uslegalforms can help you explore options and draft the needed documentation for this process.

Yes, it is possible to get out of being a guarantor for a South Dakota Conditional Guaranty of Payment of Obligation. You can negotiate with the lender to release you from your obligations, especially if the primary borrower has improved their creditworthiness or has fulfilled certain requirements. Additionally, reviewing the terms of the guarantee can reveal options for release. Legal advice can help clarify your rights and responsibilities.

To terminate a South Dakota Conditional Guaranty of Payment of Obligation, you generally need to follow the specific terms outlined in the guarantee agreement. This often involves notifying the lender or creditor in writing, confirming mutually agreed conditions for cancellation, or reaching a settlement. It's essential to review the contract to ensure compliance with termination procedures. Consulting a legal professional can provide guidance tailored to your situation.

Exiting a guaranty typically involves reviewing the terms of the agreement for any clauses that allow termination. In the context of a South Dakota Conditional Guaranty of Payment of Obligation, it is essential to understand the specific conditions and legal requirements that apply. Seeking legal advice can clarify your options and protect your interests. Moreover, USLegalForms can provide the necessary resources to help you navigate this process seamlessly.

An unconditional guaranty of payment is a legal commitment where one party ensures the payment of a debt or obligation if the primary borrower fails to do so. This is crucial in South Dakota, where a Conditional Guaranty of Payment of Obligation may allow certain terms and conditions to be attached. Understanding these guarantees can help you navigate your financial responsibilities, especially under South Dakota law. Utilizing platforms like USLegalForms can help you draft these agreements effectively.

An unconditional guaranty of payment and performance commits the guarantor to fulfill the obligation without any conditions. This means that if the primary borrower defaults, the lender can directly approach the guarantor for payment. This concept aligns closely with the South Dakota Conditional Guaranty of Payment of Obligation, providing security to lenders and peace of mind for all parties involved.

The statute of limitations on debt collection in South Dakota is generally six years. This law sets the maximum time that creditors can file a lawsuit to collect an outstanding debt. Knowing this limitation is key when dealing with the South Dakota Conditional Guaranty of Payment of Obligation, as it defines your rights and responsibilities.

In South Dakota, a debt typically becomes uncollectible after a period of six years. This timeframe applies to most common debts such as personal loans and credit card debts. Understanding this statute can be crucial for managing your obligations, especially concerning the South Dakota Conditional Guaranty of Payment of Obligation.