South Dakota Receipt as Payment in Full

Description

How to fill out Receipt As Payment In Full?

Have you ever found yourself in a situation where you require documents for either professional or personal purposes almost daily.

There is a multitude of legal document templates accessible online, but locating reliable ones can be challenging.

US Legal Forms offers thousands of document templates, including the South Dakota Receipt as Payment in Full, designed to meet federal and state requirements.

Once you find the correct document, click Buy now.

Select your preferred pricing plan, fill in the necessary information to create your account, and complete your purchase using PayPal or credit card. Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain another copy of the South Dakota Receipt as Payment in Full whenever needed; just select the desired document to download or print the template. Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates for various uses. Set up an account on US Legal Forms and start making your life a bit simpler.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the South Dakota Receipt as Payment in Full template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the document you need and make sure it corresponds to your specific city/state.

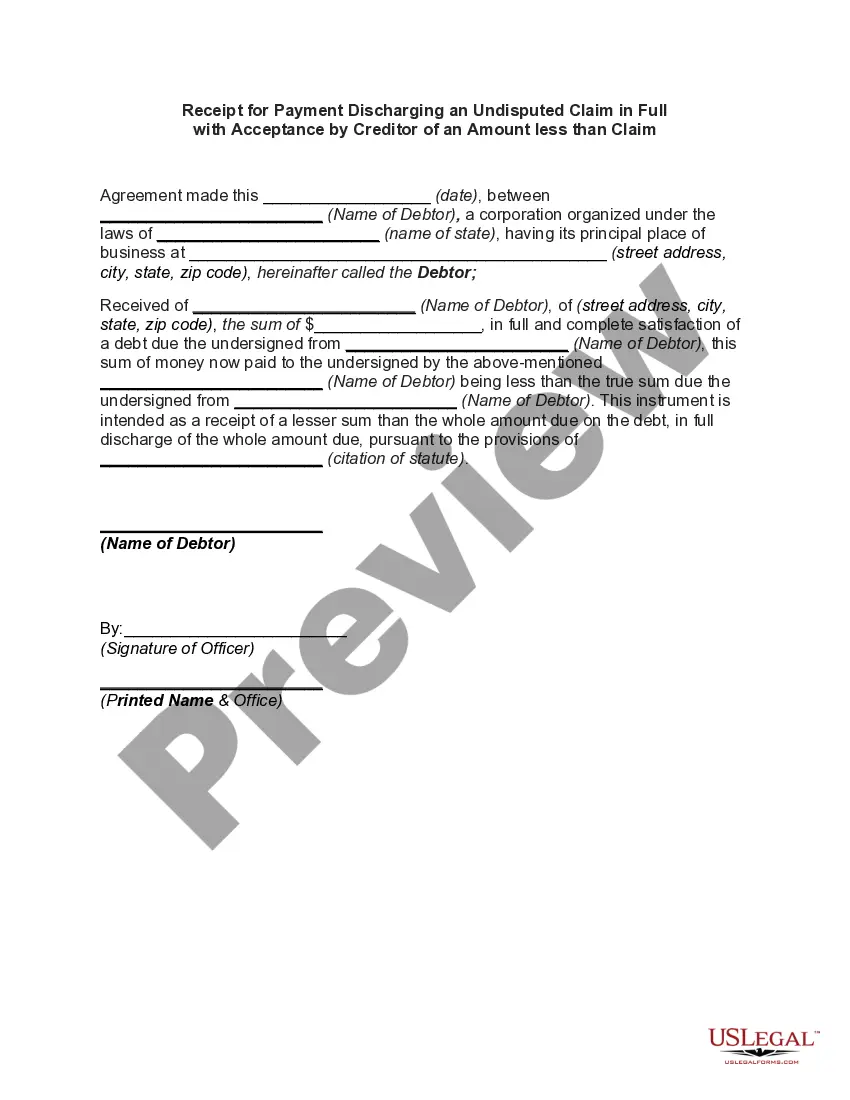

- Utilize the Preview feature to examine the document.

- Review the summary to ensure you have selected the correct document.

- If the document isn't what you are seeking, use the Search field to find the document that meets your needs and standards.

Form popularity

FAQ

South Dakota offers several tax advantages, including no state income tax and low business taxes. This creates a welcoming environment for both individuals and businesses. Additionally, South Dakota boasts relatively low property taxes, making it appealing for homeowners as well. For anyone navigating these financial waters, the South Dakota Receipt as Payment in Full provides a practical solution to ensure smooth transactions.

While many claim South Dakota as one of the most tax-friendly states, other contenders include Wyoming and Florida. Each of these states has unique tax structures that benefit residents in various ways, including the absence of state income tax and low sales tax rates. Ultimately, the best choice depends on individual circumstances. If you focus on transactions in South Dakota, consider using the South Dakota Receipt as Payment in Full for your fiscal activities.

Yes, South Dakota is considered tax-friendly for retirees. The absence of a state income tax allows retirees to enjoy their pensions and retirement accounts more fully. Additionally, property taxes are relatively low compared to other states, which is a significant advantage for retirees looking to make the most of their income. Incorporating the South Dakota Receipt as Payment in Full may also aid in managing retirement funds effectively.

South Dakota is often viewed as a favorable tax state due to its lack of a state income tax. This means residents can keep more of their earnings. Moreover, businesses benefit from lower overall tax rates, fostering a thriving economic environment. When considering financial decisions, the South Dakota Receipt as Payment in Full can enhance your transactions.

North Dakota imposes a gross receipts tax on certain businesses, which applies to total sales instead of just taxable sales. This tax structure can create confusion for businesses operating in both North and South Dakota. Knowing the differences, especially when utilizing tools like the South Dakota Receipt as Payment in Full, helps ensure compliance. For those who need clarification on tax obligations, US Legal Forms provides valuable resources to assist in understanding these matters.

South Dakota does not impose a personal income tax, which can benefit residents significantly. This absence of income tax encourages economic growth and attracts businesses to the state. Consequently, residents can manage their finances and make payments more effectively, especially when using the South Dakota Receipt as Payment in Full. Several resources are available to help you understand how this impacts your financial planning.

In South Dakota, certain items are exempt from sales tax. These include food for home consumption, prescription drugs, and some medical equipment. Understanding these exemptions can help you manage finances better as you navigate the South Dakota Receipt as Payment in Full approach. For those engaged in business, it's essential to stay informed about any changes to these exemptions to maximize savings.

Wage garnishment in South Dakota involves legal procedures where a portion of an employee's earnings goes directly to creditors. South Dakota law imposes limits on the amount that can be garnished, typically not exceeding 25% of disposable earnings. Knowing your rights regarding wage garnishments can help you manage your finances. For additional support, the South Dakota Receipt as Payment in Full can serve as a critical document when addressing garnishments.

Yes, South Dakota does not have a state income tax, which means there is no state withholding on wages. Employers in South Dakota are required to handle federal tax withholding, social security, and Medicare contributions. This structure can simplify payroll processing. If your business handles payments accurately, consider how the South Dakota Receipt as Payment in Full could streamline your documentation.

South Dakota has no state income tax due to a combination of factors, including a robust economy and strategic tax policies. The state generates revenue from alternative sources like sales tax and business taxes. This structure attracts new residents and businesses, fostering growth and stability. By being aware of elements such as the South Dakota Receipt as Payment in Full, you can leverage the state's advantages while managing your financial obligations effectively.