Texas Qualifying Event Notice Information for Employer to Plan Administrator

Description

How to fill out Qualifying Event Notice Information For Employer To Plan Administrator?

If you require to complete, obtain, or print sanctioned document templates, utilize US Legal Forms, the foremost collection of legal forms accessible online.

Take advantage of the site's straightforward and convenient search to locate the documents you need.

A range of templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have located the form you need, click the Get now button. Choose your preferred pricing plan and enter your credentials to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Utilize US Legal Forms to retrieve the Texas Qualifying Event Notice Information for Employer to Plan Administrator with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Texas Qualifying Event Notice Information for Employer to Plan Administrator.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct area/state.

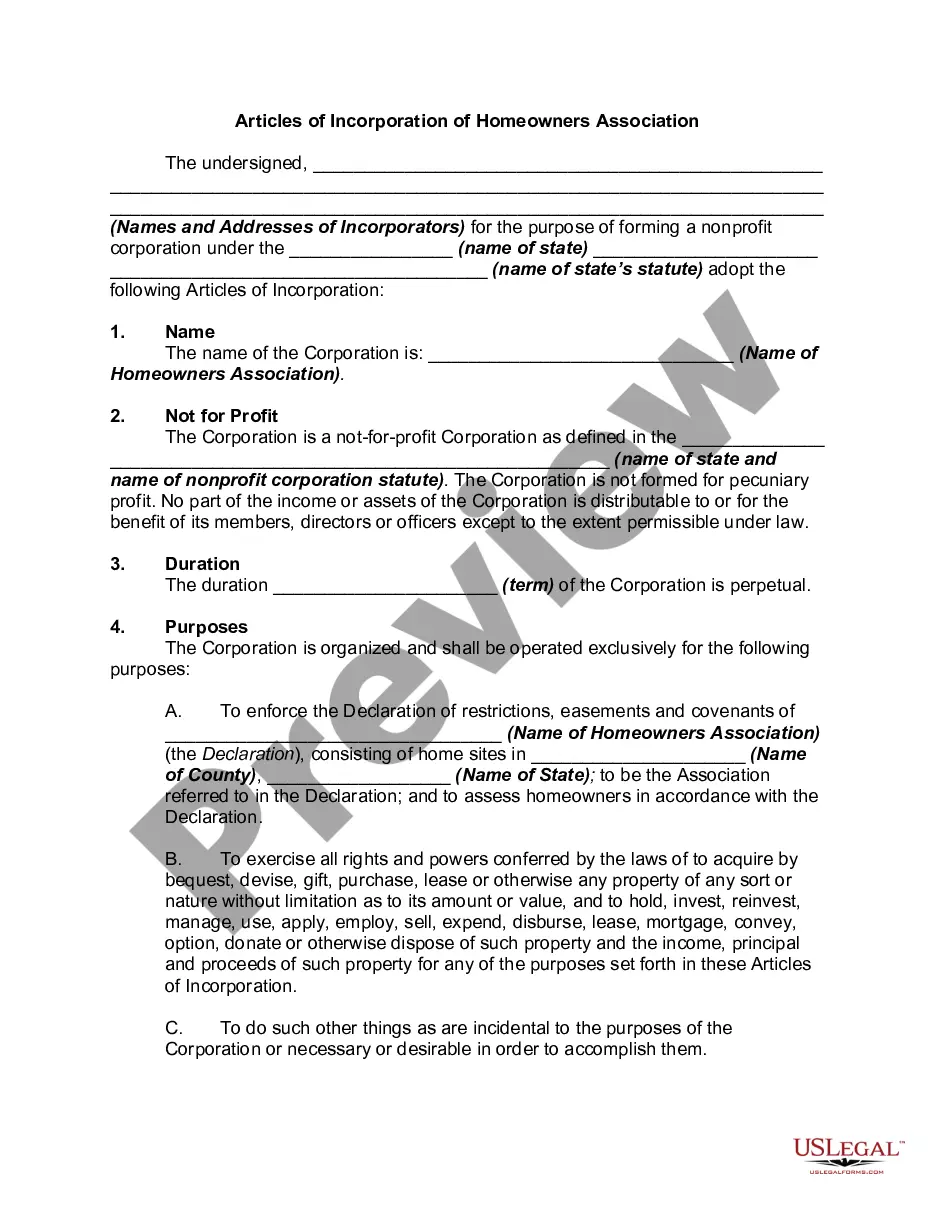

- Step 2. Use the Review option to review the form's details. Be sure to read through the information.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

In Texas, COBRA coverage typically lasts for up to 18 months after your qualifying event, such as job loss or reduced hours. In some cases, your coverage may extend to 36 months for additional qualifying events like divorce or death. Understanding the Texas Qualifying Event Notice Information for Employer to Plan Administrator is crucial, as it lays out the specific timelines and requirements for your COBRA coverage. Being proactive ensures that you do not miss any important deadlines.

Losing COBRA Benefits Here's the good news: Rolling off of COBRA coverage is a qualifying event that opens a special enrollment period for you to purchase your own health coverage. And you'll have more options, flexibility and control of your health plan outside of COBRA with an individual health insurance plan.

Under COBRA, you and your family have the right to remain on whatever health plan your former employer has for up to 18 months. You must continue paying the full premium, which includes both your former employer's share and your share plus a 2 percent administrative fee.

From a legal standpoint, there is no federal law that says companies must offer health insurance to their employees. However, employers' health insurance requirements do apply for some businesses depending on their size.

When the qualifying event is the covered employee's termination of employment or reduction in hours of employment, qualified beneficiaries are entitled to 18 months of continuation coverage.

Are All Employers Required To Offer Health Insurance? Absolutely, yes. As a part of the Consolidated Revised Guidelines for resuming workplace operations by the Ministry of Home Affairs, on 15th April 2020, the Insurance Regulatory and Development Authority of India (IRDAI) released an order (No.

The following are qualifying events: the death of the covered employee; a covered employee's termination of employment or reduction of the hours of employment; the covered employee becoming entitled to Medicare; divorce or legal separation from the covered employee; or a dependent child ceasing to be a dependent under

The Consolidated Omnibus Budget Reconciliation Act (COBRA) gives workers and their families who lose their health benefits the right to choose to continue group health benefits provided by their group health plan for limited periods of time under certain circumstances such as voluntary or involuntary job loss,

COBRA Qualifying Event Notice The employer must notify the plan if the qualifying event is: Termination or reduction in hours of employment of the covered employee, 2022 Death of the covered employee, 2022 Covered employee becoming entitled to Medicare, or 2022 Employer bankruptcy.

Second qualifying events may include the death of the covered employee, divorce or legal separation from the covered employee, the covered employee becoming entitled to Medicare benefits (under Part A, Part B or both), or a dependent child ceasing to be eligible for coverage as a dependent under the group health plan.