South Dakota Agreement to Repay Cash Advance on Credit Card

Description

How to fill out Agreement To Repay Cash Advance On Credit Card?

If you wish to thoroughly explore legal document templates, download, or print legal paperwork formats, utilize US Legal Forms, the largest collection of legal documents available online.

Take advantage of the site’s user-friendly and straightforward search to access the documents you need.

Different templates for businesses and personal purposes are organized by categories and states, or by keywords.

All legal document formats you acquire are yours permanently. You will have access to every document you purchased in your account.

Check the My documents section and select a document to print or download again. Remain competitive and download, and print the South Dakota Agreement to Repay Cash Advance on Credit Card with US Legal Forms. There are countless professional and state-specific forms available for your business or personal needs.

- Employ US Legal Forms to obtain the South Dakota Agreement to Repay Cash Advance on Credit Card with just a few clicks.

- If you are already a US Legal Forms member, sign in to your account and click the Acquire button to download the South Dakota Agreement to Repay Cash Advance on Credit Card.

- You can also access forms you previously downloaded within the My documents section of your account.

- If this is your first time using US Legal Forms, follow these steps.

- Step 1. Make sure you have selected the form for the appropriate city/state.

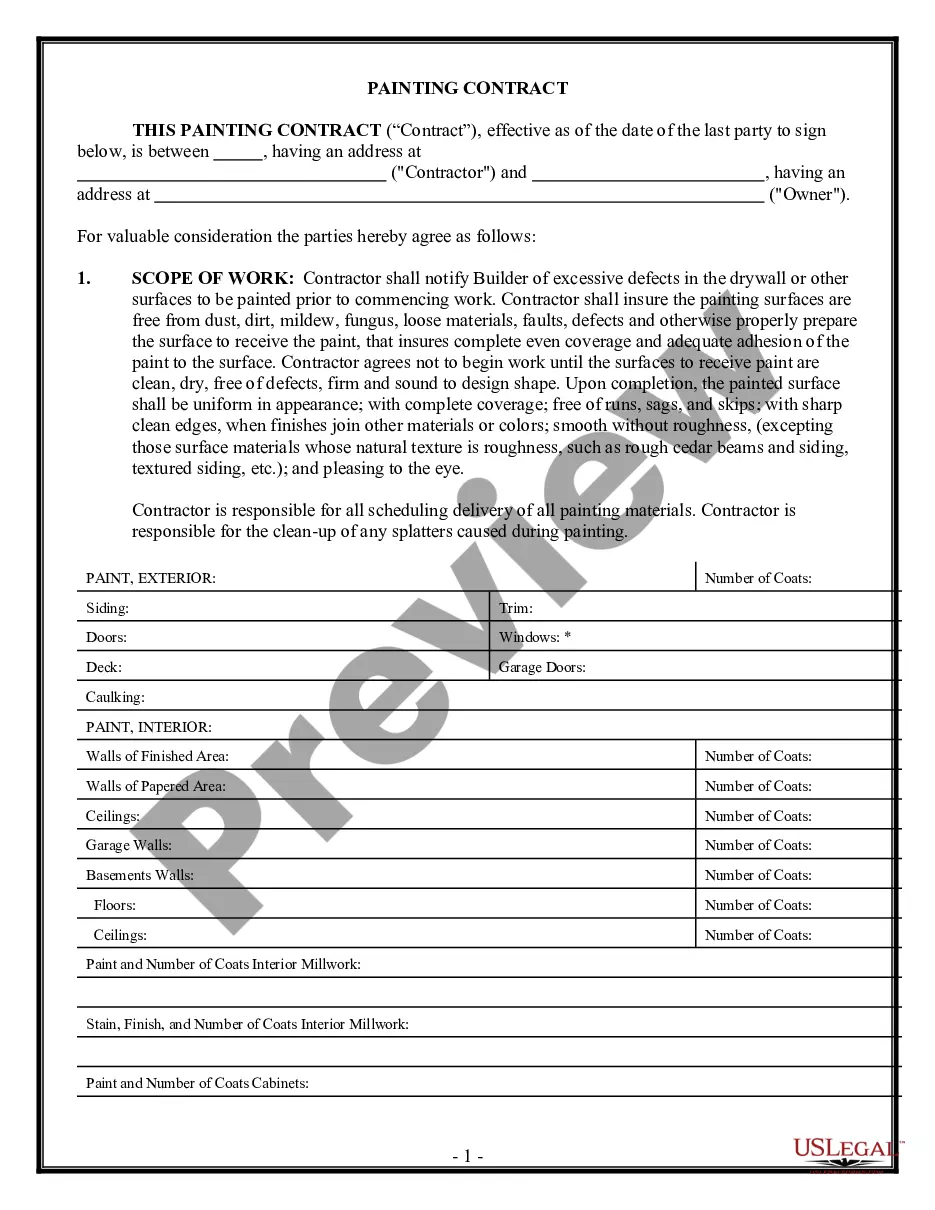

- Step 2. Use the Preview option to review the content of the form. Don’t forget to check the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other models in the legal form format.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose your preferred pricing plan and enter your details to create an account.

- Step 5. Complete the transaction. You can use your Visa, MasterCard, or PayPal account to finalize the payment.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Fill in, modify, and print or sign the South Dakota Agreement to Repay Cash Advance on Credit Card.

Form popularity

FAQ

The only way to avoid a cash advance fee is by avoiding cash advances and cash equivalent transactions on your credit card. If you can't avoid the transaction completely, you can minimize the cash advance fee you pay by reducing the amount of cash you withdraw on your credit card.

Cash advances can be made at ATM's as well as at bank branches and through online banking. Cash advances also carry a limit and banks will mention the amount of money you can withdraw as a cash advance in your credit card statement. This amount is usually your credit limit or an amount lower than your credit limit.

Advance payments are generally made in two situations. They can be applied to a sum of money provided before a contractually agreed-upon due date, or they may be required before the receipt of the requested goods or services.

Since your advance begins accruing interest the same day you get your cash, start repaying the amount you borrow as soon as possible. If you take out a $200 cash advance, aim to pay that amount in fullor as much as possibleon top of your minimum payment. Make it a goal to repay the amount in days instead of weeks.

From getting cash out of an ATM to buying foreign currency or gift cards, discover all the transactions that are considered cash advances. Most credit cards give you the ability to get cash or a cash equivalent using your account, and this action is defined as a cash advance.

Paying a bill using a credit card or line of credit is treated the same as getting a cash advance. You'll be charged interest from the time you make the payment, just like you would for a cash advance.

PayPal doesn't charge a fee on credit card payments for goods and services, but it charges a 2.9% fee on money sent to friends or family members. PayPal payments aren't cash advances. They're treated like retail transactions and shouldn't incur additional bank fees.

What Does 'Cash Advance' Mean? A cash advance lets you borrow a certain amount of money against your credit card's line of credit. You usually pay a fee for the service.

Here's how many of the major credit card companies treat Venmo transactions: American Express: Venmo transactions using Amex credit cards typically code as purchases, not cash advances. They shouldn't incur a cash advance fee, though this may be subject to change.

Pay off cash advances immediately In other words, there is no grace or interest-free period when it comes to cash advances. To avoid paying a hefty fee in terms of interest on this transaction, consider paying off the cash advance as soon as possible if you have no other transactions on your credit card.