South Dakota Oil, Gas and Mineral Deed - Individual to Two Individuals

Description

How to fill out Oil, Gas And Mineral Deed - Individual To Two Individuals?

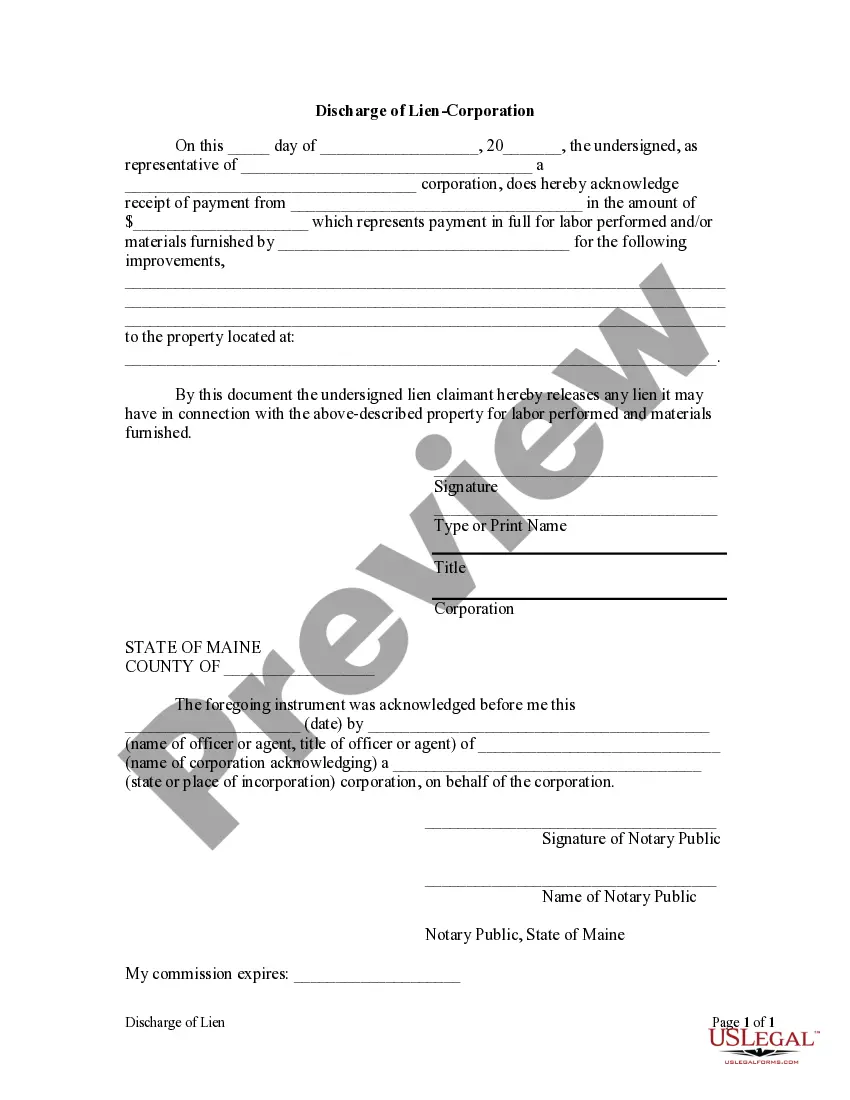

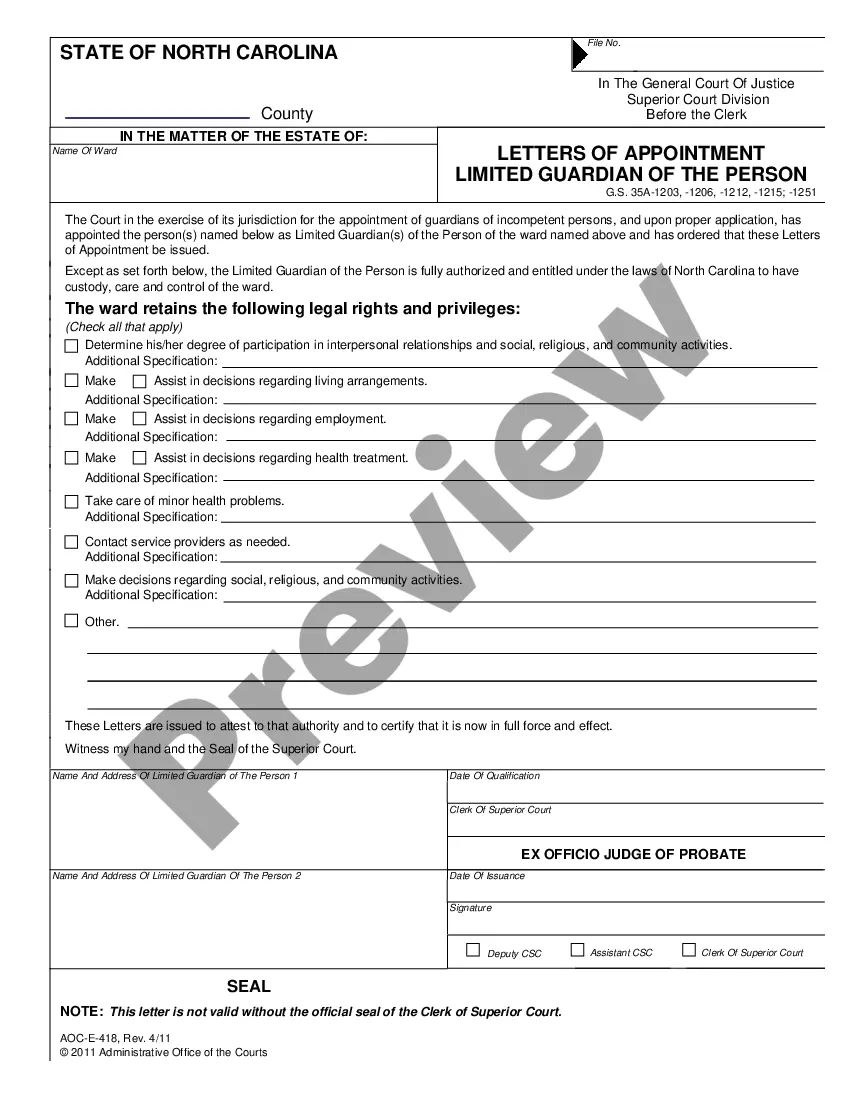

You may spend several hours on the web attempting to find the lawful document web template which fits the federal and state needs you need. US Legal Forms supplies a large number of lawful kinds which are examined by specialists. You can easily obtain or produce the South Dakota Oil, Gas and Mineral Deed - Individual to Two Individuals from our support.

If you already possess a US Legal Forms bank account, you may log in and click the Download button. After that, you may total, change, produce, or indication the South Dakota Oil, Gas and Mineral Deed - Individual to Two Individuals. Every single lawful document web template you acquire is your own eternally. To have yet another version associated with a acquired form, go to the My Forms tab and click the corresponding button.

Should you use the US Legal Forms web site the first time, adhere to the basic guidelines below:

- Initially, make sure that you have selected the proper document web template for your state/city of your liking. Read the form outline to ensure you have chosen the right form. If accessible, utilize the Preview button to search through the document web template at the same time.

- If you would like find yet another model from the form, utilize the Lookup area to discover the web template that suits you and needs.

- After you have discovered the web template you would like, click on Get now to continue.

- Find the prices strategy you would like, type in your credentials, and register for your account on US Legal Forms.

- Complete the transaction. You may use your credit card or PayPal bank account to purchase the lawful form.

- Find the structure from the document and obtain it for your gadget.

- Make changes for your document if required. You may total, change and indication and produce South Dakota Oil, Gas and Mineral Deed - Individual to Two Individuals.

Download and produce a large number of document layouts using the US Legal Forms web site, that offers the biggest assortment of lawful kinds. Use expert and status-specific layouts to handle your business or specific requires.

Form popularity

FAQ

Mineral interests are defined by the Texas Property Tax Code as real property and are subject to taxes the same as all other real property. When do mineral interests become taxable? Mineral interests become taxable on January 1 of the year following the first production of the unit.

Transfer by deed: You can sell your mineral rights to another person or company by deed. Transfer by will: You can specify who you want to inherit your mineral rights in your will. Transfer by lease: You can lease mineral rights to a third party through a lease agreement.

To transfer any rights to minerals successfully, follow these steps: The new owner has to acquire a copy of the deed for the site at a local courthouse in New Mexico. Review the deed to ensure it matches the description and to ensure that the so-called rights to any minerals are included in the property deed.

After a death, assets like mineral rights often go through probate, which is a legal process to authenticate a will and distribute assets ing to it. If no will exists, probate helps determine how assets should be divided.

Transfer By Will If no specific beneficiaries to the mineral rights are designated, ownership passes to the property and real estate heir. It is also possible and often easier to create a family holding company and assign mineral rights to this company, creating a limited liability company (LLC) or partnership.

The following are methods for establishing mineral rights ownership: Deed. A deed is used to transfer mineral rights ownership from one party to another. Lease. ... Severance. ... Adverse Possession. ... Surface Use Agreement. ... Royalties. ... Mineral Estate. ... Texas Railroad Commission.

An attorney can create a deed or assignment that conveys the mineral rights to the new owners. The original deed will need to be recorded in the county where the minerals are located. If there are producing wells on the property, each operator will need to be notified of the change in ownership.