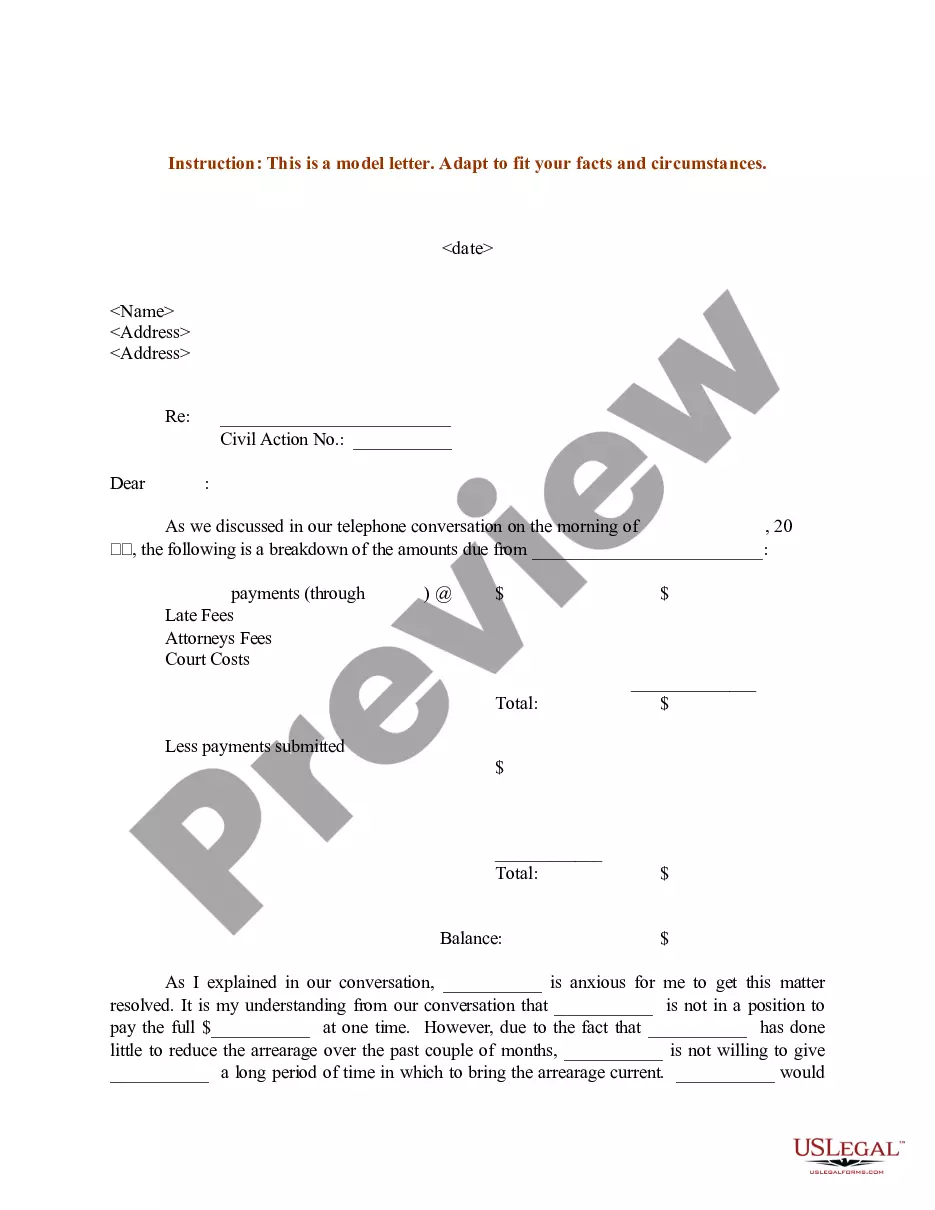

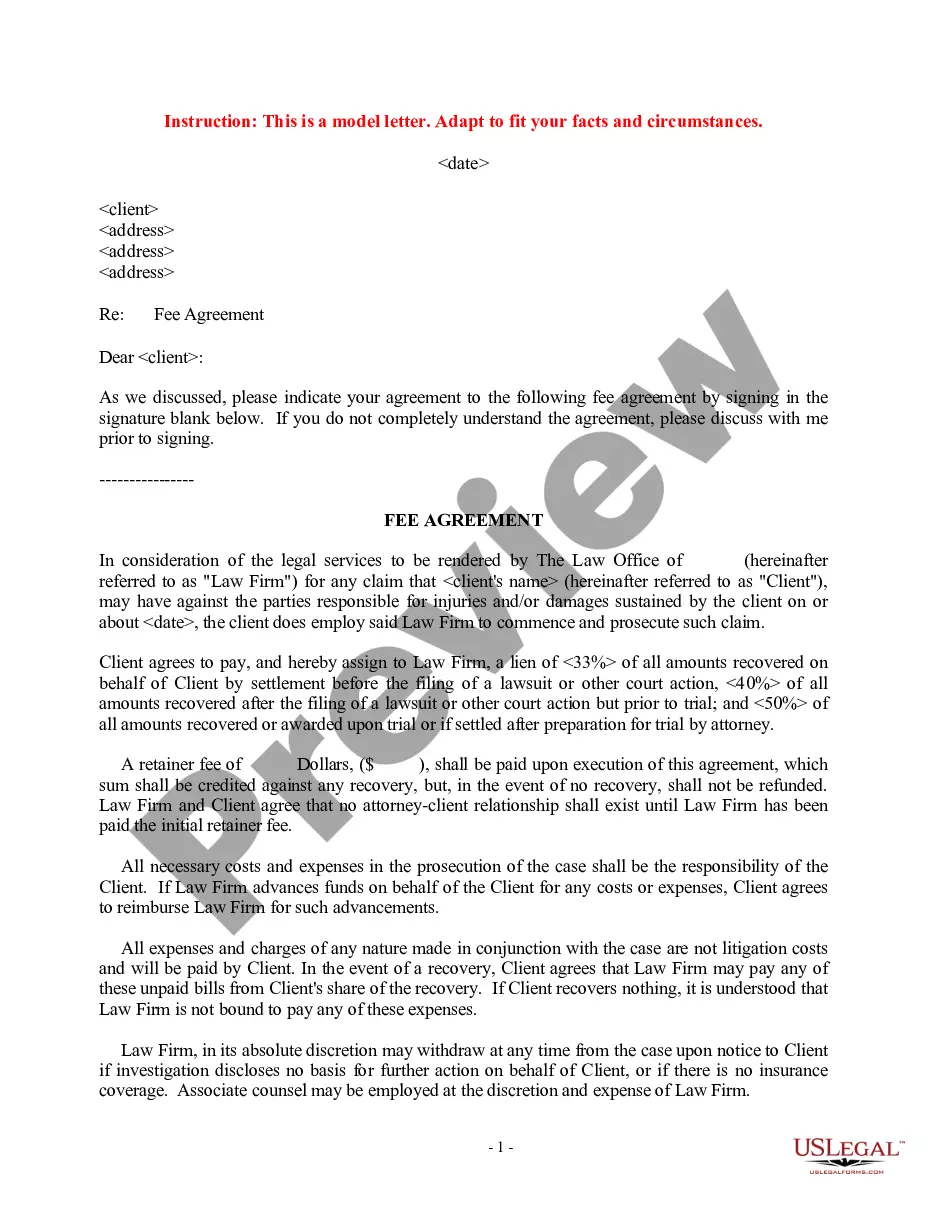

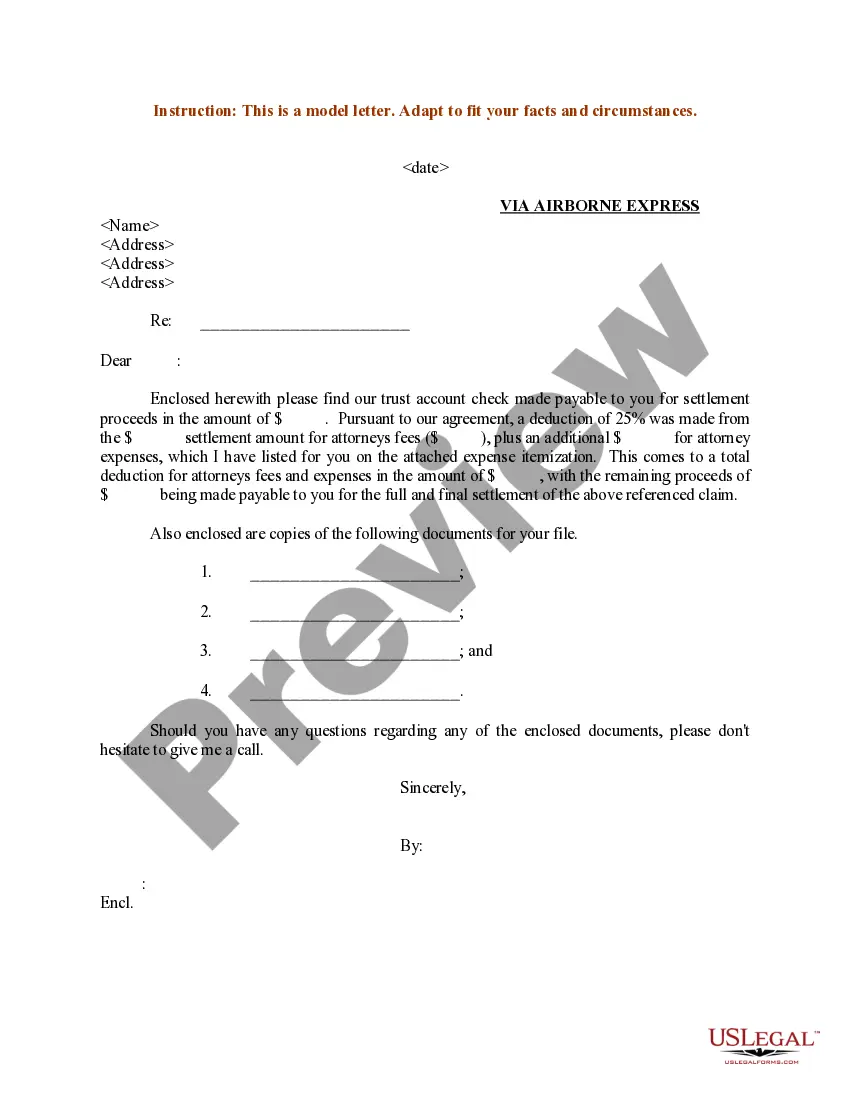

South Dakota Sample Letter for Explanation of Attorneys Fees and Settlement Payment

Description

How to fill out Sample Letter For Explanation Of Attorneys Fees And Settlement Payment?

Are you in a situation where you require documents for both business or personal reasons almost every day? There are numerous legal document templates available online, but finding ones you can trust isn’t easy.

US Legal Forms offers thousands of template options, including the South Dakota Sample Letter for Explanation of Attorneys Fees and Settlement Payment, which can be crafted to meet state and federal standards.

If you are already acquainted with the US Legal Forms website and possess an account, simply Log In. After that, you can download the South Dakota Sample Letter for Explanation of Attorneys Fees and Settlement Payment template.

Choose a convenient document format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain another copy of the South Dakota Sample Letter for Explanation of Attorneys Fees and Settlement Payment at any time, if necessary. Just select the desired document to download or print the template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service provides professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Find the document you need and ensure it is for the correct area/county.

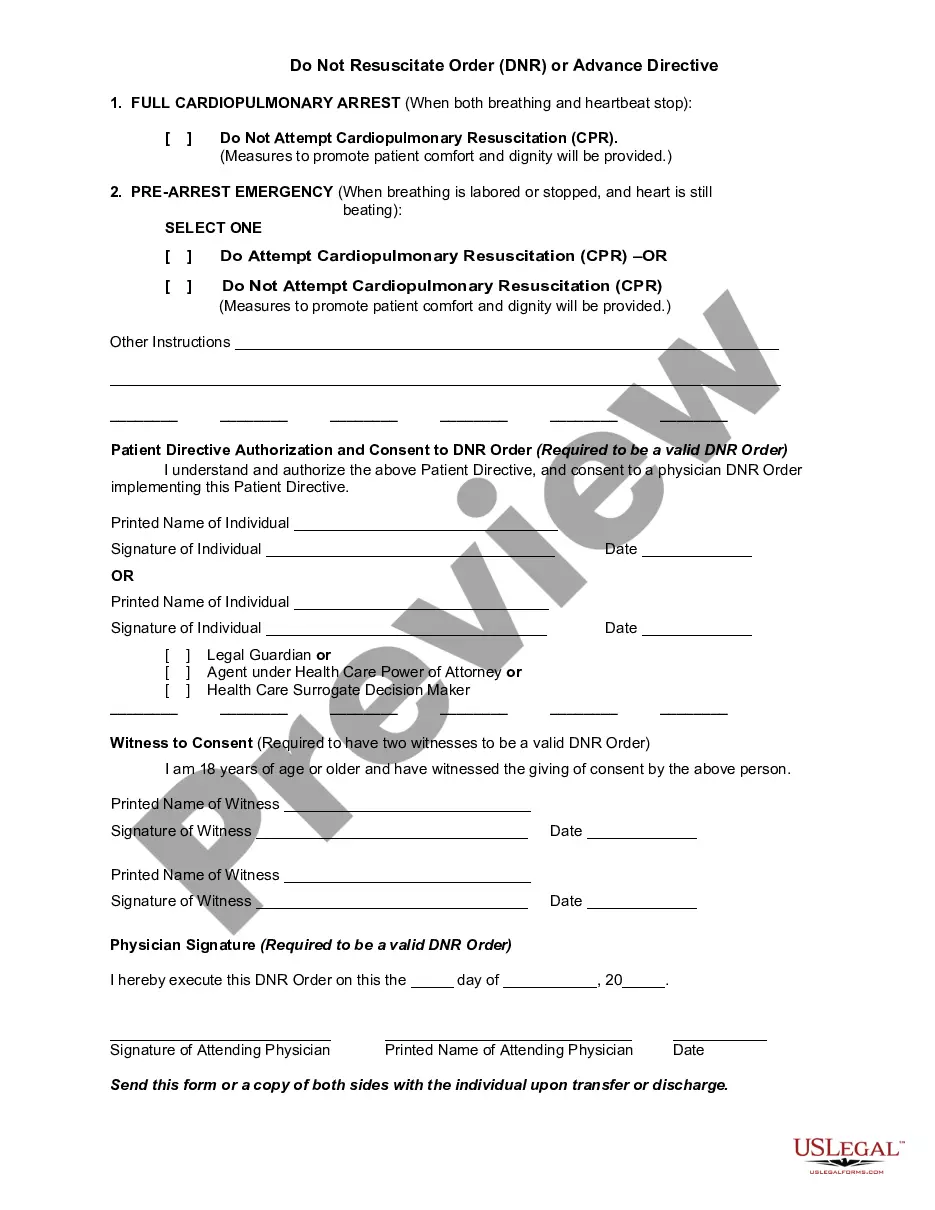

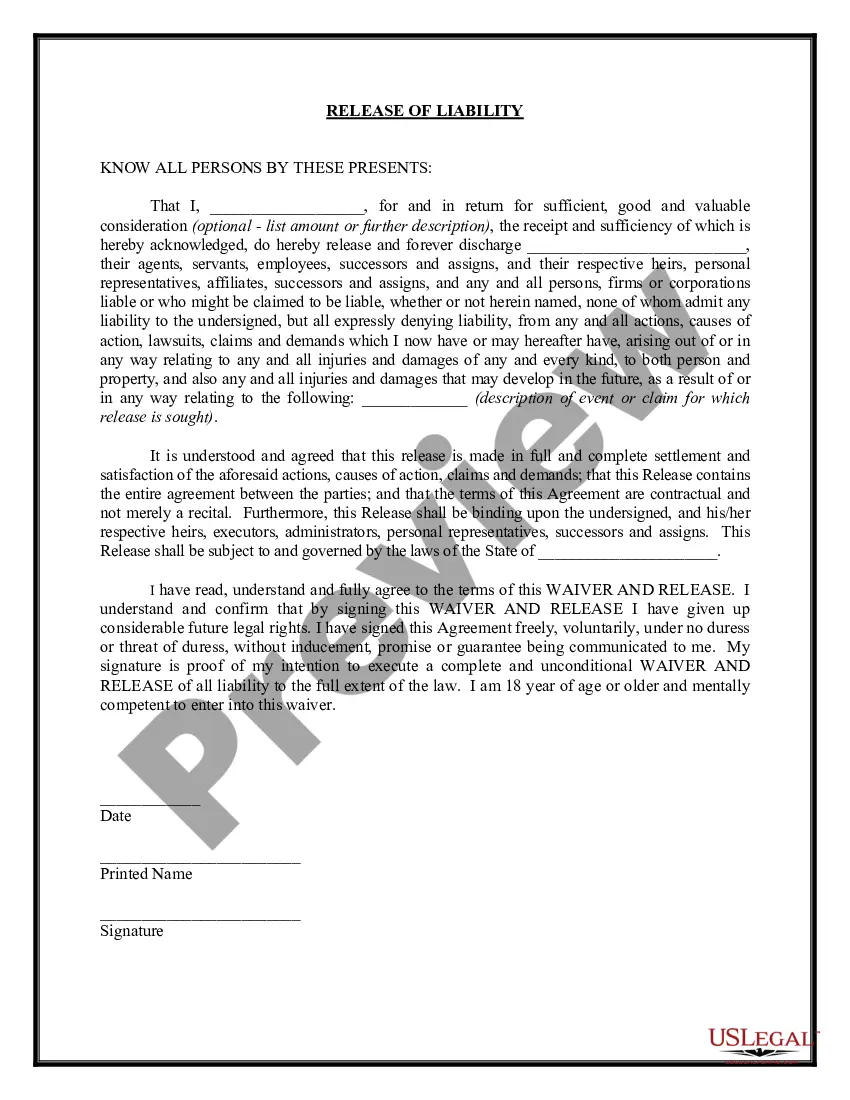

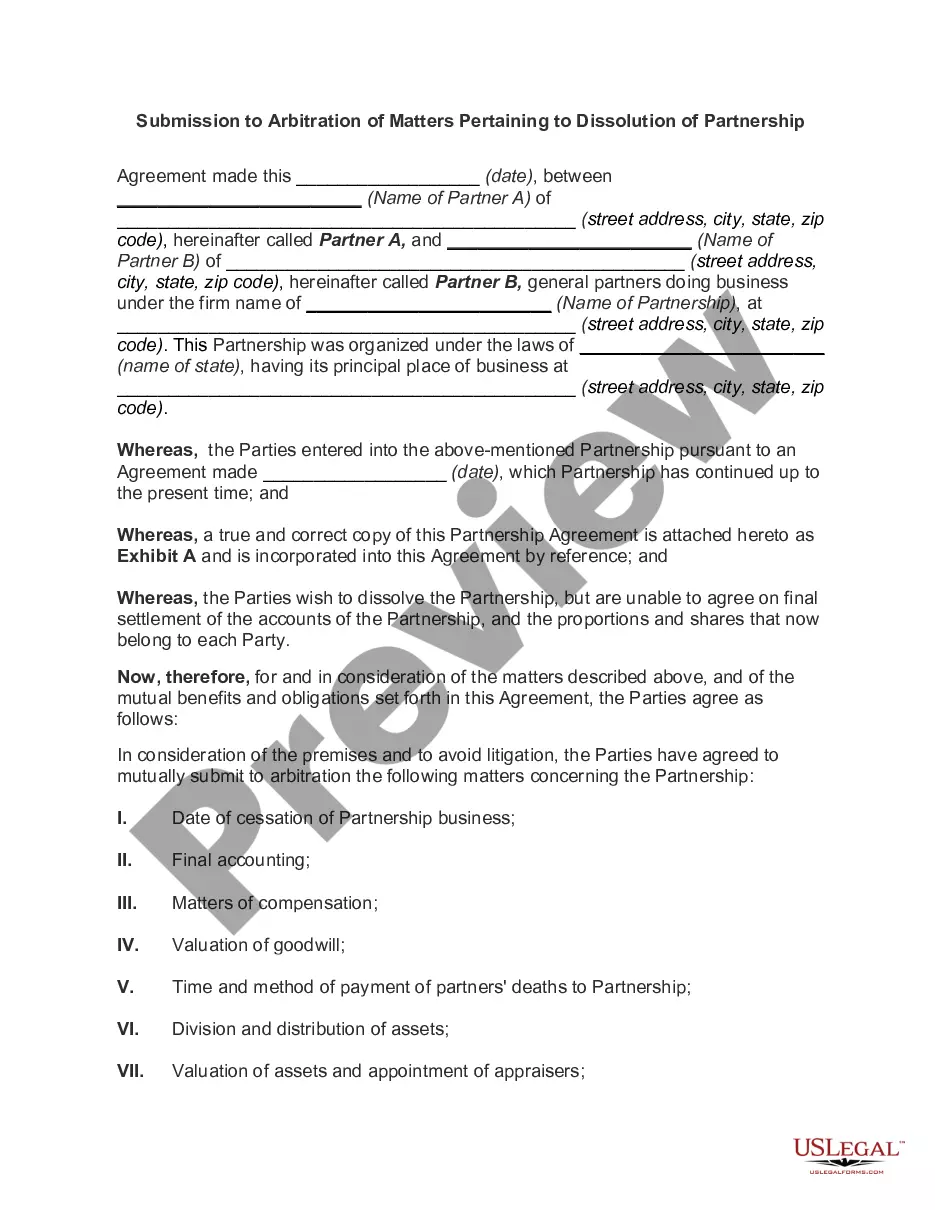

- Use the Preview button to review the form.

- Read the description to confirm you have selected the right document.

- If the form isn’t what you’re looking for, use the Search field to locate the form that fits your needs.

- Once you find the correct document, click on Buy now.

- Select the payment plan you prefer, fill out the required details to create your account, and complete your purchase using your PayPal or Visa or Mastercard.

Form popularity

FAQ

Attorney services are subject to South Dakota state sales or use tax, plus applicable municipal sales or use tax. Sales or use tax applies to the attorney?s total receipts after deducting allowable expenses.

South Dakota does not have an individual income tax. South Dakota also does not have a corporate income tax. South Dakota has a 4.50 percent state sales tax rate, a max local sales tax rate of 4.50 percent, and an average combined state and local sales tax rate of 6.40 percent.

Membership organizations such as the YMCA, YWCA, Boy Scouts, Lions Club, or Jaycees are exempt from sales tax on gross receipts from sales of services made by them and from the sale of their membership fees.

Some customers are exempt from paying sales tax under South Dakota law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.

This is because it has state-level regulations that allow trusts to continue in perpetuity, devoid of state income tax as well as capital gains taxes, and helped by court-sealed records. Compared to its competitors, South Dakota's key businesses are banking as well as health care.