South Dakota Sample Letter to accompany Revised Quitclaim Deed

Description

How to fill out Sample Letter To Accompany Revised Quitclaim Deed?

Are you currently within a place where you will need papers for sometimes organization or personal functions almost every time? There are plenty of legal record themes available on the Internet, but finding types you can depend on is not effortless. US Legal Forms gives thousands of develop themes, such as the South Dakota Sample Letter to accompany Revised Quitclaim Deed, that are published in order to meet state and federal needs.

In case you are presently acquainted with US Legal Forms site and have your account, simply log in. Afterward, you may acquire the South Dakota Sample Letter to accompany Revised Quitclaim Deed format.

Unless you provide an account and wish to begin using US Legal Forms, adopt these measures:

- Get the develop you will need and ensure it is for the proper town/area.

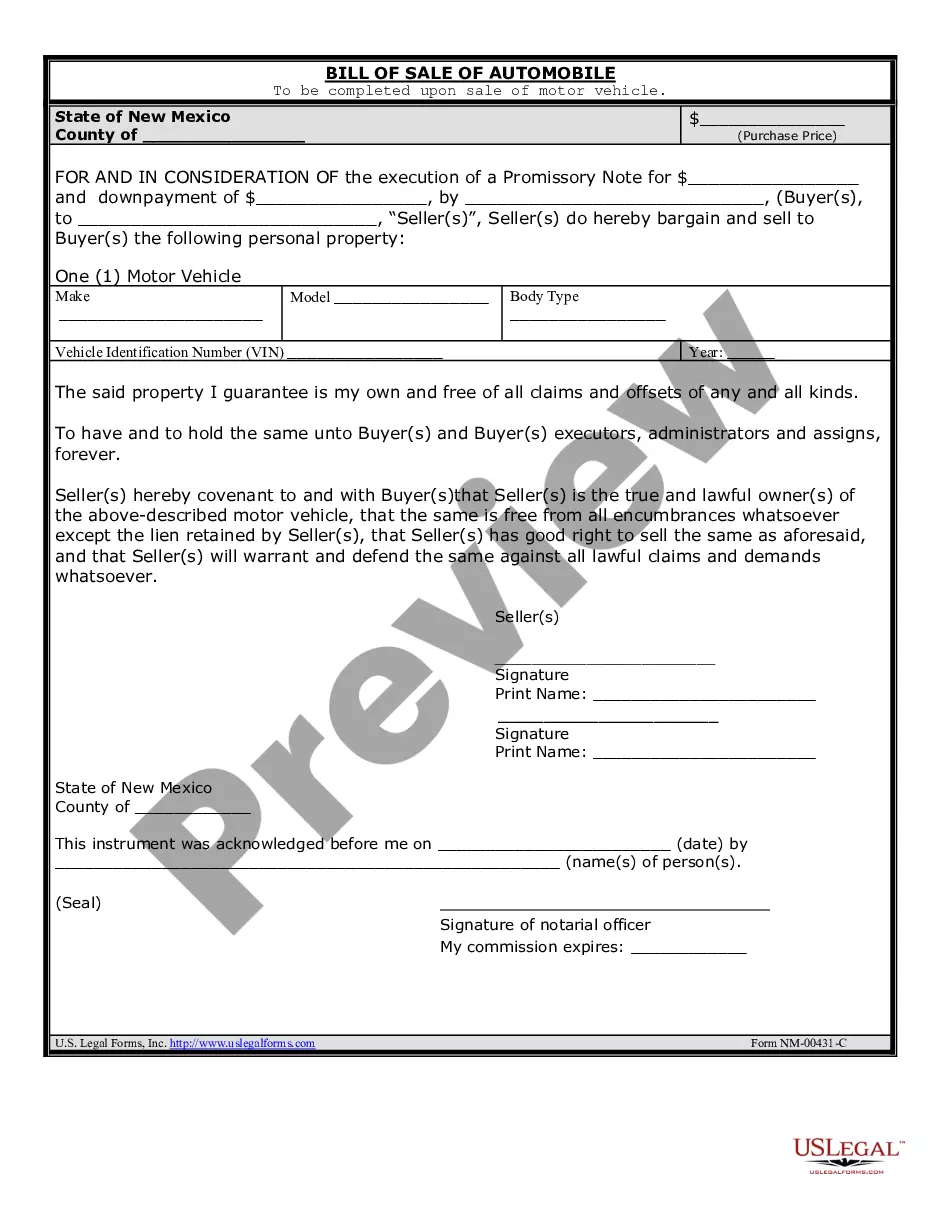

- Utilize the Preview option to analyze the shape.

- Look at the information to ensure that you have chosen the proper develop.

- In the event the develop is not what you`re trying to find, make use of the Research area to get the develop that meets your requirements and needs.

- When you obtain the proper develop, just click Get now.

- Opt for the pricing program you want, fill out the desired information and facts to generate your bank account, and pay money for an order utilizing your PayPal or bank card.

- Decide on a convenient file formatting and acquire your backup.

Locate all of the record themes you possess bought in the My Forms food list. You may get a more backup of South Dakota Sample Letter to accompany Revised Quitclaim Deed anytime, if needed. Just select the required develop to acquire or printing the record format.

Use US Legal Forms, probably the most considerable selection of legal varieties, to conserve some time and stay away from faults. The services gives skillfully made legal record themes which can be used for an array of functions. Generate your account on US Legal Forms and commence creating your way of life easier.

Form popularity

FAQ

A South Dakota deed used in the purchase, exchange, transfer, or assignment of real estate must be accompanied by a certificate of value (Dept. of Revenue Form PT 56) when it is presented for recording. Form PT 56 is not required when recording South Dakota transfer-on-death (TOD) deeds.

A South Dakota quitclaim deed is a conveyance instrument for real property that does not guarantee the title's condition or the grantor as the legal title holder.

A transfer on death (TOD) deed is like a regular deed you might use to transfer your South Dakota real estate, but with a crucial difference: It doesn't take effect until your death.

A South Dakota deed used in the purchase, exchange, transfer, or assignment of real estate must be accompanied by a certificate of value (Dept. of Revenue Form PT 56) when it is presented for recording. Form PT 56 is not required when recording South Dakota transfer-on-death (TOD) deeds.

NounLaw. a transfer of all one's interest, as in a parcel of real estate, especially without a warranty of title.

A South Dakota warranty deed?sometimes called a general warranty deed?provides the most thorough warranty of title. The current owner guarantees a clear title?subject to no undisclosed liens or other encumbrances?and agrees to defend the new owner's title against adverse claims.

The cost of transfer taxes in South Dakota is $0.50/$500 of the home's sale value. Most real estate transfers will be charged this tax, but there are some exceptions. Exceptions include, but are not limited to, transfers between spouses, foreclosure, distribution of estates, divorces, or pure gifts.

Signing Requirements § 43-25-26: The grantor must sign South Dakota quitclaim deeds before a notary public or a subscribing witness. Recording Requirements § 43-28-1: Quitclaim deeds must be recorded with the County Register of Deeds's Office in the county where the real property is located. Transfer Tax § 43-4-21: $.