This form is a Quitclaim Deed where the grantor is an unmarried individual and the grantee is a corporation. Upon ordering, you may download the form in Word, Rich Text or Wordperfect formats.

South Dakota Quitclaim Deed from Individual to Corporation

Description

Key Concepts & Definitions

Quitclaim Deed: A legal instrument by which the owner of a property transfers any interest, ownership, or rights they have in the property to another party without guaranteeing the title. In the context of 'quitclaim deed from individual to corporation', it refers to an individual transferring their stake in a property to a corporate entity.

Step-by-Step Guide to Transferring a Quitclaim Deed from an Individual to a Corporation

- Preparation: Verify that a quitclaim deed is the appropriate document for the transfer. It's important to consult with a real estate attorney to ensure this method suits your situation.

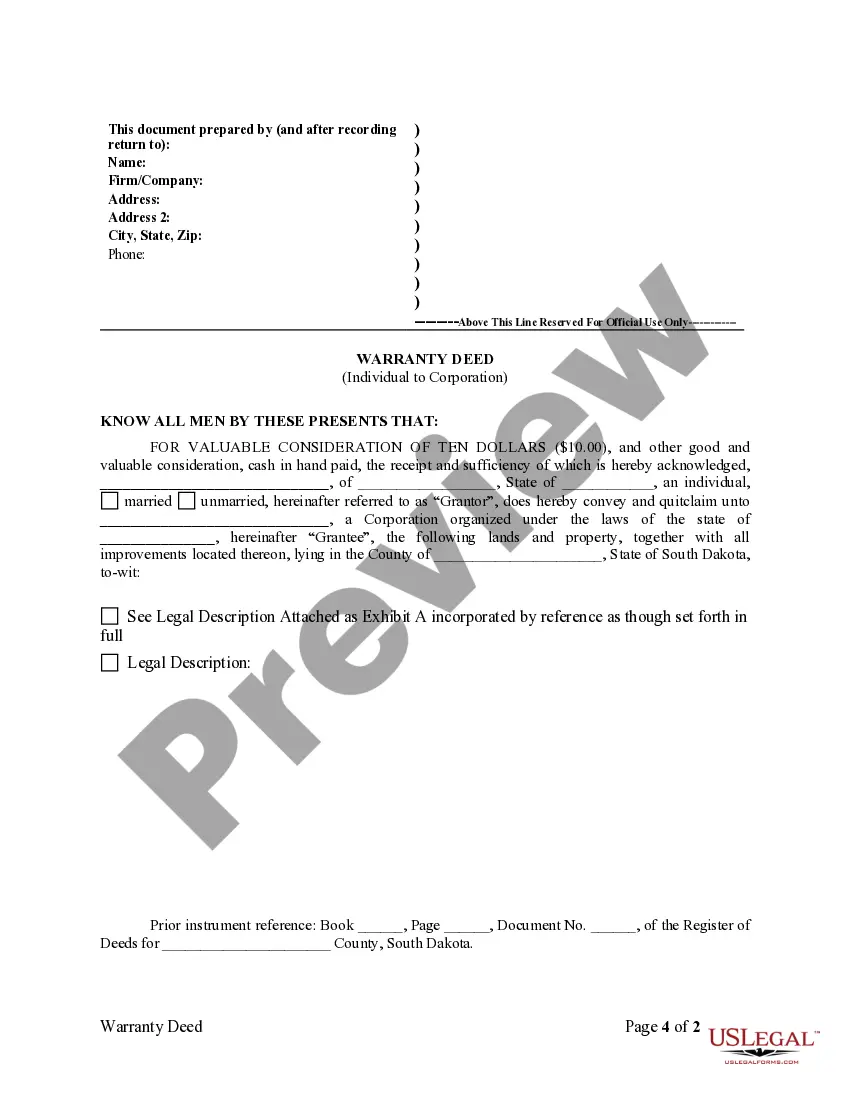

- Gather Information: Collect necessary details like the legal description of the property, corporate entity details, and any encumbrances on the property.

- Fill Out the Quitclaim Deed Form: Accurately complete the form, ensuring all names and legal terms are correct. The individual should be listed as the 'grantor' and the corporation as the 'grantee'.

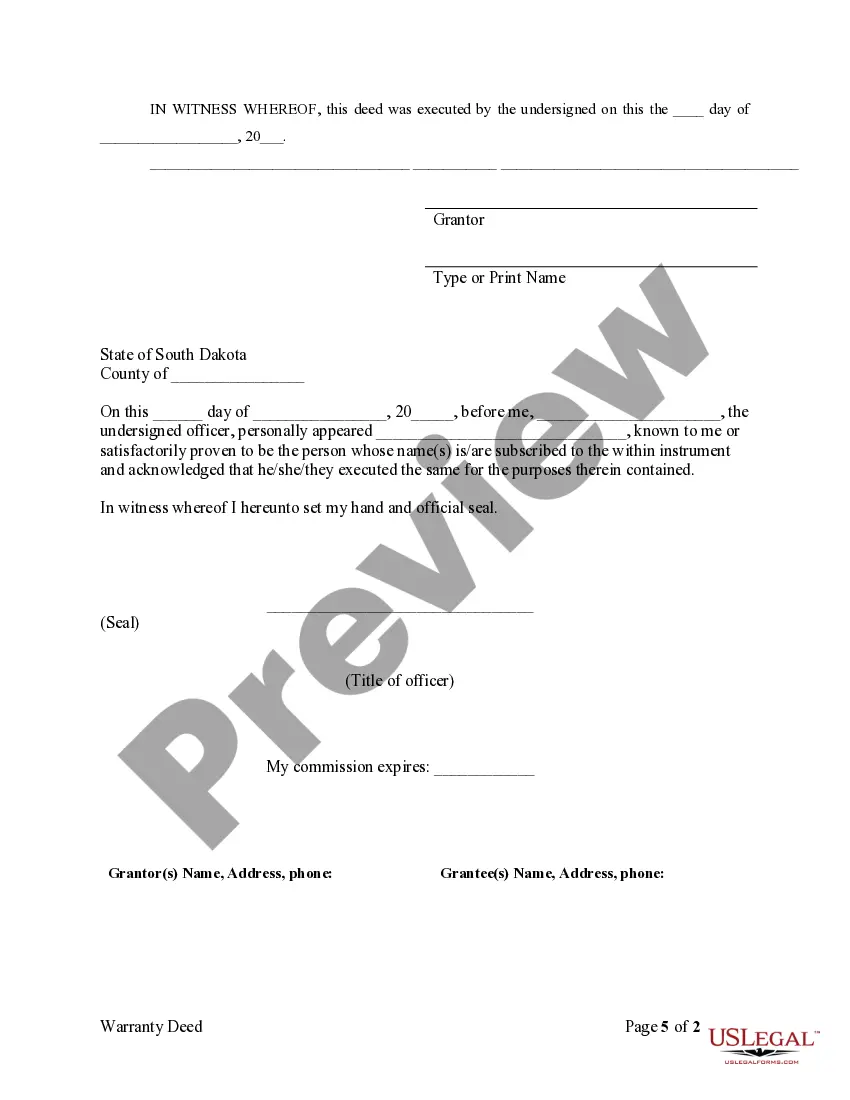

- Signature: The grantor must sign the deed. Depending on state laws, a witness or notarization may be required.

- File the Deed: Record the deed with the local county clerk's office or other appropriate local government entity to make the transfer official.

Risk Analysis

- Lack of Warranty: Quitclaim deeds do not guarantee a clear title; the corporation receives only the interests that the individual actually had, which may be none.

- Future Disputes: If title issues arise, the corporation has limited legal recourse against the grantor compared to other types of property deeds.

- Impact on Corporate Liability: Accepting property via a quitclaim deed might expose the corporation to unknown liens or legal claims.

Best Practices

- Legal Consultation: Always involve a lawyer who specializes in real estate to navigate the complexities of property transfer via quitclaim deeds.

- Title Search: Conduct a thorough title search before the transfer to uncover any potential issues with the propertys title.

- Clerical Accuracy: Ensure all documentation is filled out correctly to avoid delays or legal issues with the transfer.

Common Mistakes & How to Avoid Them

- Ignoring Legal Advice: Skipping consultation with a real estate attorney can lead to serious ramifications if the deed is not appropriate for your scenario.

- Inaccurate Documentation: Failing to correctly detail the property or corporation in the deed can invalidate the entire document.

- Neglecting to Record the Deed: Not filing the deed with the appropriate authorities might result in the corporation not being recognized as the new owner.

How to fill out South Dakota Quitclaim Deed From Individual To Corporation?

The work with papers isn't the most simple job, especially for people who almost never deal with legal paperwork. That's why we advise using accurate South Dakota Quitclaim Deed from Individual to Corporation templates made by professional lawyers. It gives you the ability to eliminate difficulties when in court or dealing with official organizations. Find the samples you require on our site for high-quality forms and exact descriptions.

If you’re a user having a US Legal Forms subscription, just log in your account. As soon as you’re in, the Download button will automatically appear on the file page. After downloading the sample, it’ll be saved in the My Forms menu.

Users without an activated subscription can easily create an account. Use this brief step-by-step guide to get the South Dakota Quitclaim Deed from Individual to Corporation:

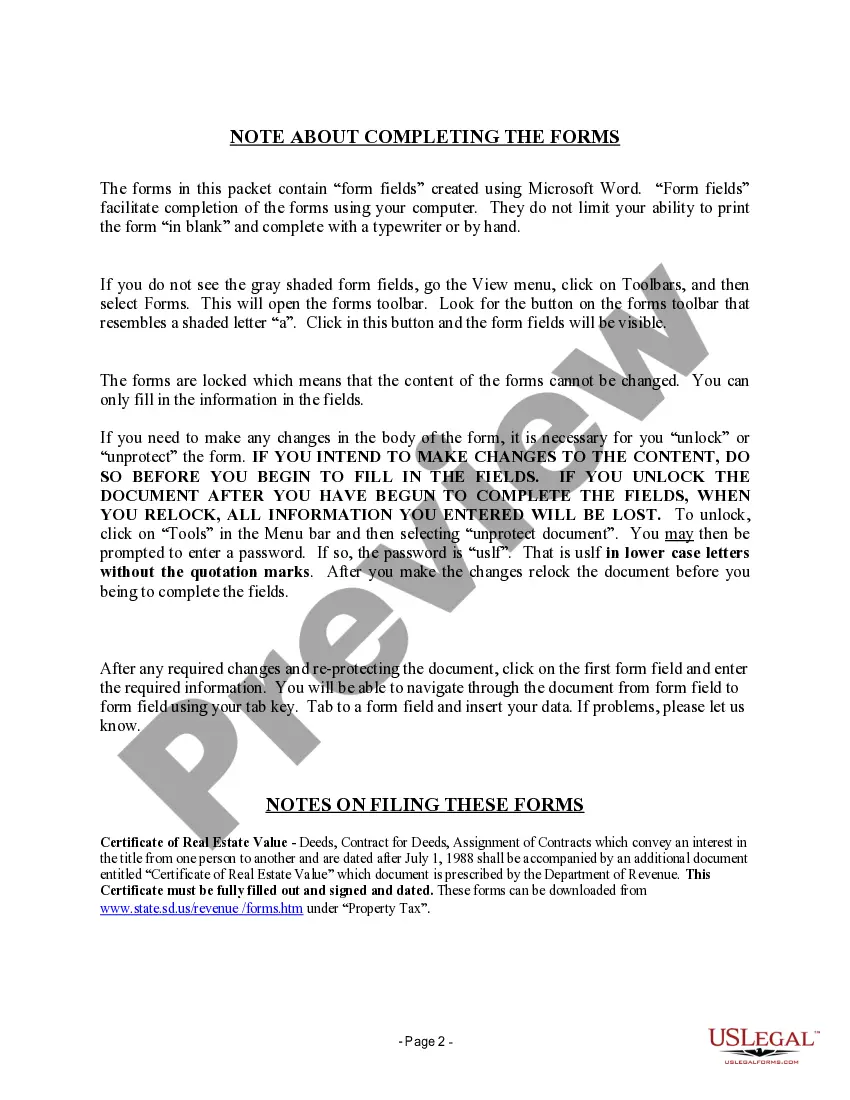

- Ensure that the document you found is eligible for use in the state it is necessary in.

- Verify the file. Use the Preview feature or read its description (if readily available).

- Click Buy Now if this file is the thing you need or use the Search field to find another one.

- Select a convenient subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your document in a wanted format.

Right after finishing these straightforward steps, you can fill out the form in your favorite editor. Double-check filled in details and consider requesting a legal representative to examine your South Dakota Quitclaim Deed from Individual to Corporation for correctness. With US Legal Forms, everything gets much simpler. Try it now!

Form popularity

FAQ

A quitclaim deed is a legal instrument that is used to transfer interest in real property.The owner/grantor terminates (quits) any right and claim to the property, thereby allowing the right or claim to transfer to the recipient/grantee.

Step 1: Download the SD quitclaim deed form. Step 2: List information about the grantor, who is the person selling or giving away the property. Step 3: List information about the grantee, the person receiving the property.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

How to Quitclaim Deed to LLC. A quitclaim deed to LLC is actually a very simple process. You will need a deed form and a copy of the existing deed to make sure you identify titles properly and get the legal description of the property.

When done properly, a deed is recorded anywhere from two weeks to three months after closing. However, there are many instances where deeds are not properly recorded. Title agents commit errors, lose deeds, and even go out of business. Even county offices sometimes fail to record deeds that were properly submitted.

A Quitclaim Deed must be notarized by a notary public or attorney in order to be valid.Consideration in a Quitclaim Deed is what the Grantee will pay to the Grantor for the interest in the property.

Quitclaim deeds are most often used to transfer property between family members. Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners get divorced and one spouse's name is removed from the title or deed.