South Dakota Quitclaim Deed from Individual to Corporation

Overview of this form

The Quitclaim Deed from Individual to Corporation is a legal document that facilitates the transfer of property ownership. This form designates an unmarried individual as the grantor (the person transferring the property) and a corporation as the grantee (the entity receiving the property). Unlike other property deeds, this quitclaim deed conveys any interest the grantor has in the property without guaranteeing that the title is clear or marketable.

What’s included in this form

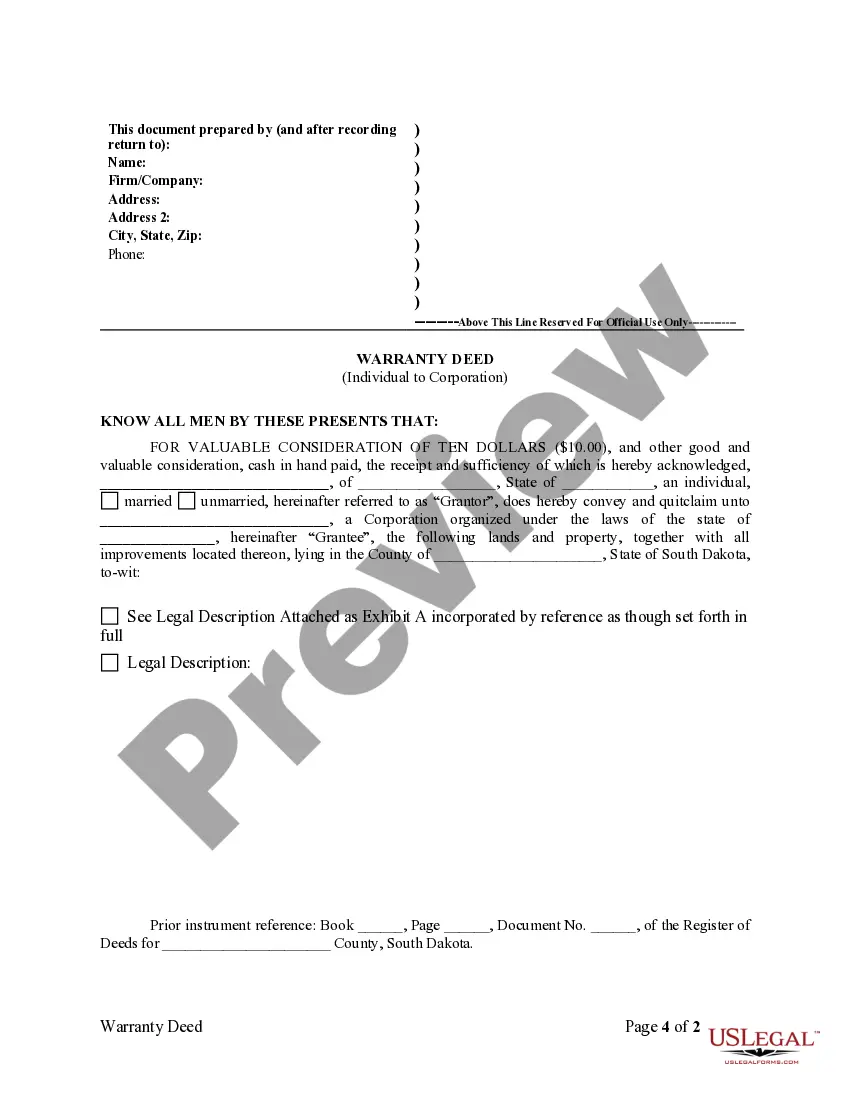

- Grantor and grantee information: Names and addresses of the individual transferring the property and the corporation receiving it.

- Legal description of the property: Detailed information about the property being transferred.

- Date of transfer: The date the deed is executed to finalize the transfer.

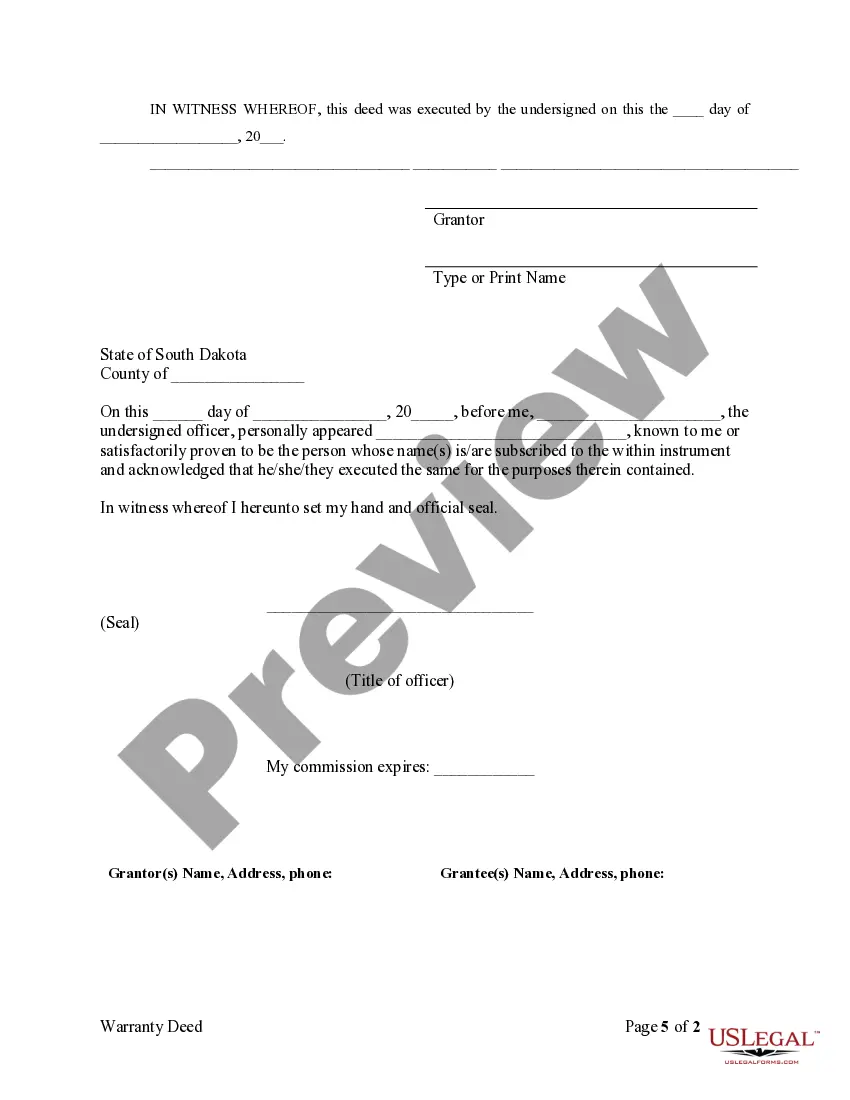

- Notary acknowledgment: A section for notarization to verify the identity of the grantor when signing the deed.

- Certificate of Real Estate Value: An additional document that may need to be included if specified by local law.

Jurisdiction-specific notes

This Quitclaim Deed from Individual to Corporation is specific to South Dakota and follows state laws regarding property transfer. Users should also be aware that a Certificate of Real Estate Value may need to be included with this form when applicable.

When to use this document

This quitclaim deed is typically used when an individual wishes to transfer property ownership to a corporation, such as in the case of business entities acquiring real estate. It may also be used in property settlements or in transactions where the granter does not require guarantees about the title.

Who can use this document

- Individuals who own property and want to transfer it to a corporation.

- Business owners looking to formalize the ownership of company real estate.

- Legal representatives facilitating property transfers on behalf of individuals.

Instructions for completing this form

- Identify the parties: Enter the name and address of the grantor and the corporation.

- Specify the property: Include a detailed legal description of the property being transferred.

- Enter the date of transfer: Fill in the date on which the deed is executed.

- Sign the document: The grantor must sign the form in front of a notary public.

- Complete notary acknowledgment: The notary public will fill out the required acknowledgment section.

Does this form need to be notarized?

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Avoid these common issues

- Failing to provide a complete legal description of the property.

- Not signing the document in front of a notary public.

- Omitting the date of transfer.

- Incorrectly filling out the notary acknowledgment section.

Why complete this form online

- Convenience of immediate download and access from anywhere.

- Editability allows you to customize the document before printing.

- Reliability from using a template drafted by licensed attorneys, ensuring legal compliance.

Form popularity

FAQ

A quitclaim deed is a legal instrument that is used to transfer interest in real property.The owner/grantor terminates (quits) any right and claim to the property, thereby allowing the right or claim to transfer to the recipient/grantee.

Step 1: Download the SD quitclaim deed form. Step 2: List information about the grantor, who is the person selling or giving away the property. Step 3: List information about the grantee, the person receiving the property.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

How to Quitclaim Deed to LLC. A quitclaim deed to LLC is actually a very simple process. You will need a deed form and a copy of the existing deed to make sure you identify titles properly and get the legal description of the property.

When done properly, a deed is recorded anywhere from two weeks to three months after closing. However, there are many instances where deeds are not properly recorded. Title agents commit errors, lose deeds, and even go out of business. Even county offices sometimes fail to record deeds that were properly submitted.

A Quitclaim Deed must be notarized by a notary public or attorney in order to be valid.Consideration in a Quitclaim Deed is what the Grantee will pay to the Grantor for the interest in the property.

Quitclaim deeds are most often used to transfer property between family members. Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners get divorced and one spouse's name is removed from the title or deed.