South Carolina Clauses Relating to Dividends, Distributions

Description

How to fill out Clauses Relating To Dividends, Distributions?

Have you been within a placement in which you will need paperwork for possibly organization or specific purposes virtually every working day? There are tons of legal document layouts accessible on the Internet, but getting versions you can trust isn`t easy. US Legal Forms delivers a large number of type layouts, such as the South Carolina Clauses Relating to Dividends, Distributions, that are composed in order to meet federal and state specifications.

When you are presently informed about US Legal Forms internet site and possess your account, basically log in. After that, you may download the South Carolina Clauses Relating to Dividends, Distributions web template.

If you do not come with an bank account and wish to begin to use US Legal Forms, follow these steps:

- Discover the type you require and make sure it is for your right town/area.

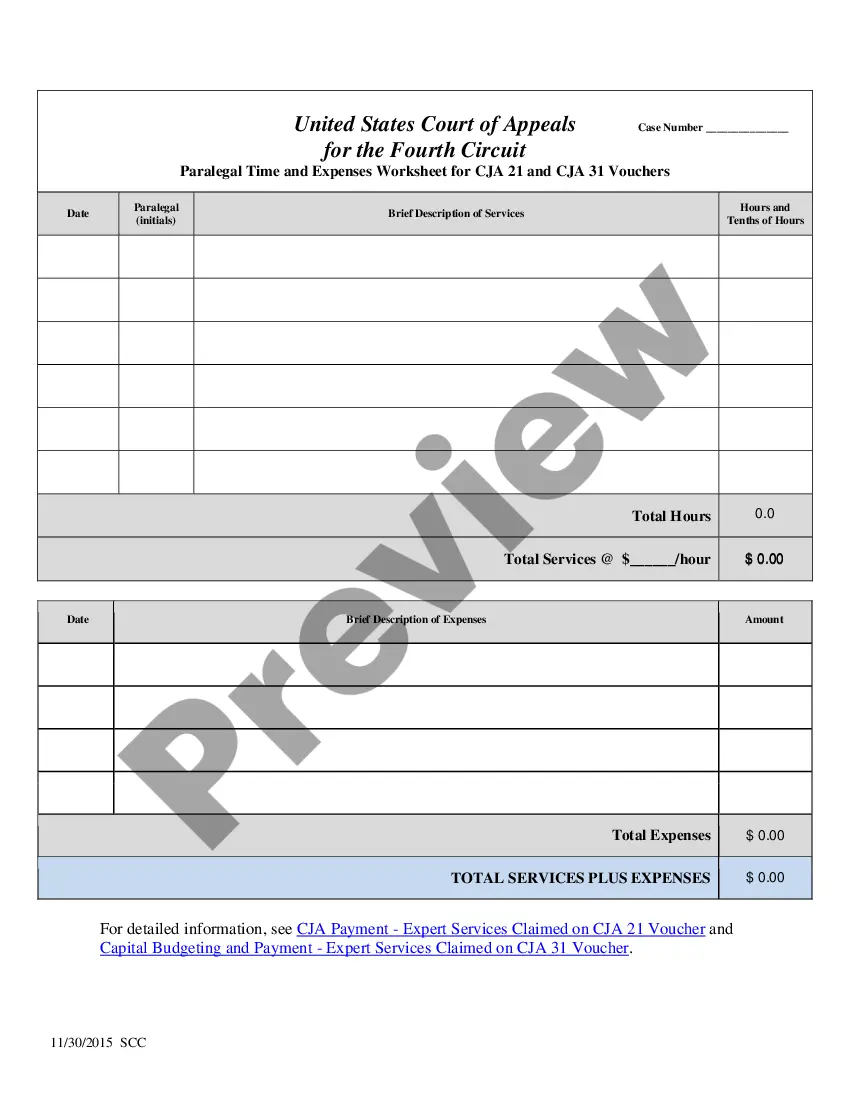

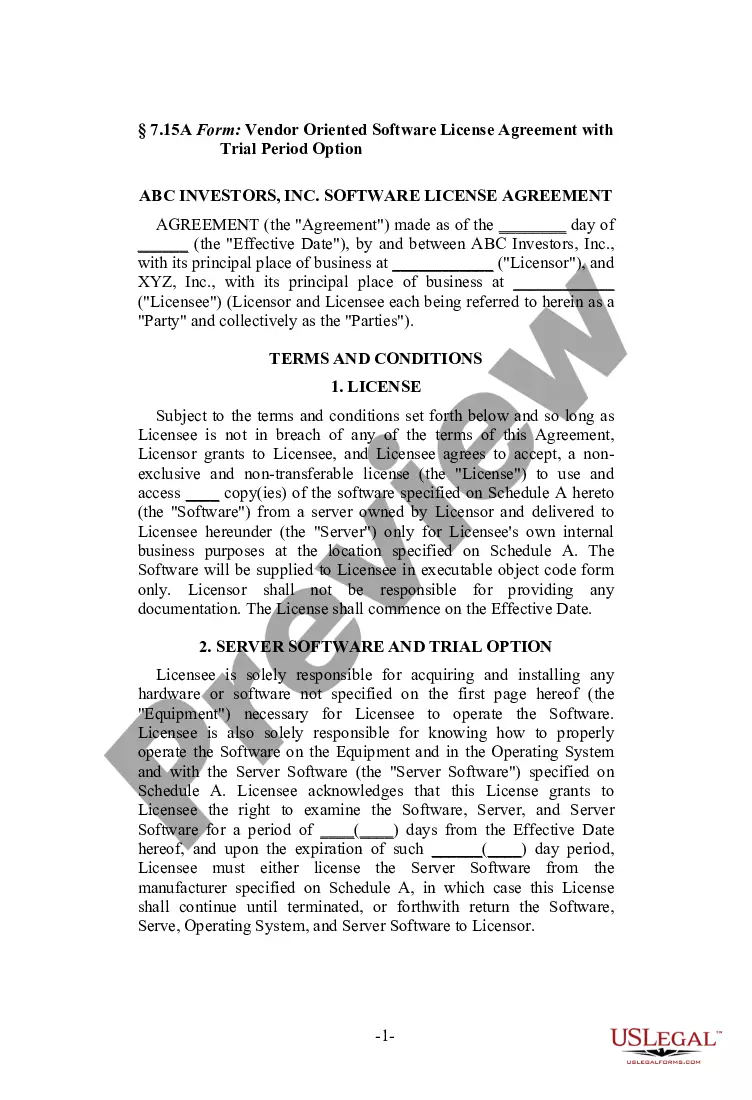

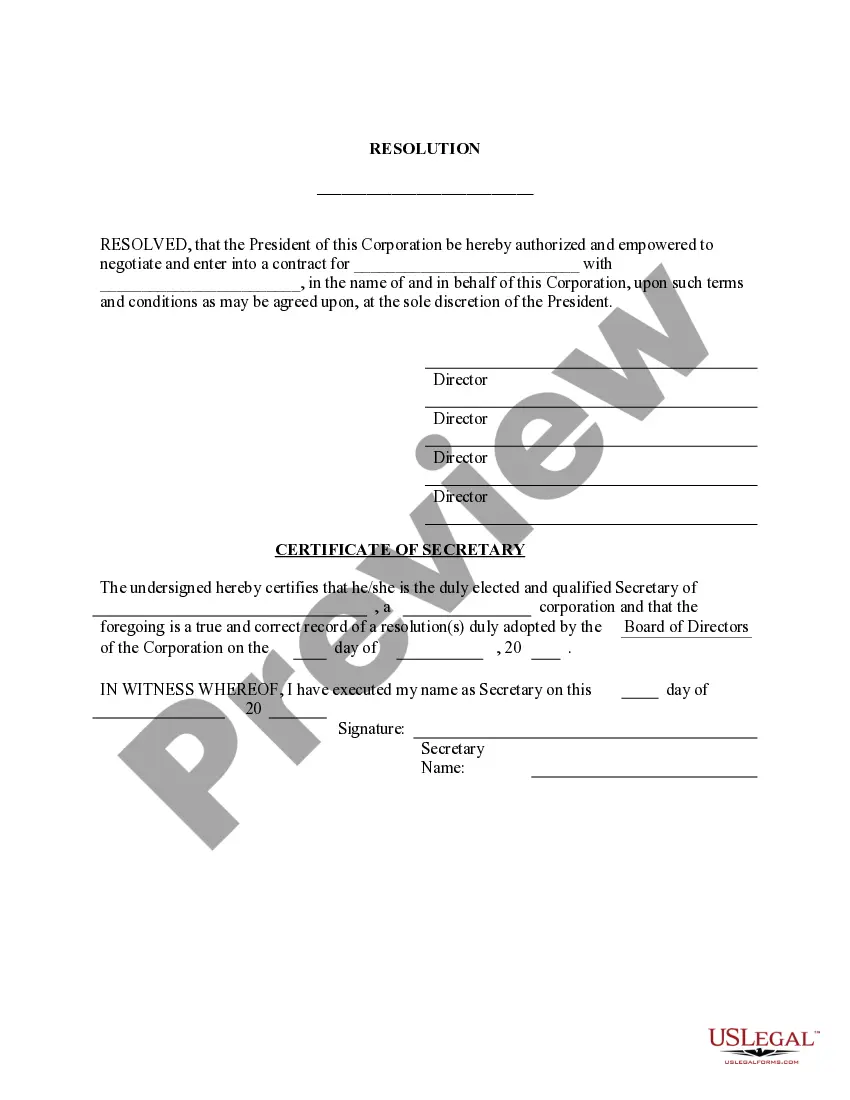

- Utilize the Review option to check the shape.

- Browse the explanation to actually have chosen the appropriate type.

- In the event the type isn`t what you`re looking for, make use of the Research discipline to find the type that suits you and specifications.

- Once you obtain the right type, click on Acquire now.

- Choose the costs prepare you want, complete the desired information to create your account, and purchase an order making use of your PayPal or charge card.

- Select a practical data file structure and download your duplicate.

Discover all of the document layouts you have purchased in the My Forms menus. You can obtain a more duplicate of South Carolina Clauses Relating to Dividends, Distributions anytime, if possible. Just select the necessary type to download or print the document web template.

Use US Legal Forms, by far the most extensive selection of legal types, to conserve time and prevent faults. The services delivers appropriately made legal document layouts that you can use for an array of purposes. Create your account on US Legal Forms and commence creating your lifestyle a little easier.

Form popularity

FAQ

South Carolina Code §12-6-3360(C)(1) provides a tax credit against South Carolina income tax, bank tax, or insurance premium tax for a qualifying business creating new jobs in this State.

South Carolina Code §12-6-2210 provides for the determination of whether taxable income of a business will be apportioned. A taxpayer whose entire business is transacted or conducted in South Carolina is subject to income tax based on the entire taxable income of the business for the taxable year.

Under Code Section 12-6-30(1) the definition of ?'Taxpayer' includes an individual, trust, estate, partnership, association, company, corporation, or any other entity subject to the tax imposed by this chapter or required to file a return.? [emphasis added] While ABC, a limited liability company taxed as a partnership, ...

S.C. Code, Section 12-6-545(G) (1) "Active trade or business income or loss" means income or loss of an individual, estate, trust, or any other entity except those taxed or exempted from tax pursuant to Sections 12-6-530 through 12-6-550 resulting from the ownership of an interest in a pass-through business.

South Carolina Code §12-6-3515 allows a taxpayer, who is entitled to and claims a federal charitable deduction for a gift of land for conservation or for a qualified conservation contribution on a qualified real property interest located in South Carolina, to claim a South Carolina income tax credit equal to 25% of the ...

South Carolina Code §12-6-3535(B) allows a taxpayer an income tax credit equal to 25% of the rehabilitation expenses for a certified historic residential structure located in South Carolina. The rehabilitation expenses must, within a 36-month period, exceed $15,000 to qualify for the credit.

INDIVIDUAL INCOME TAX RATES South Carolina Code §12-6-510 imposes an income tax upon the South Carolina taxable income of individuals, estates, and trusts at rates ranging from 3% to a maximum rate of 7%. There are six income brackets adjusted annually for inflation.

South Carolina Code §12-6-2252 (i.e., the single sales factor apportionment method) provides that a taxpayer whose principal business in South Carolina is manufacturing or any form of collecting, buying, assembling, or processing goods and materials in this state or whose principal business in South Carolina is selling ...