South Carolina Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation

Description

How to fill out Shareholders' Agreement With Special Allocation Of Dividends Among Shareholders In A Close Corporation?

Have you ever found yourself in a situation where you require documents for either business or personal purposes almost every day? There are numerous legitimate document templates available online, but finding versions you can rely on isn't straightforward.

US Legal Forms offers thousands of customizable templates, such as the South Carolina Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation, designed to meet state and federal standards.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. After that, you can download the South Carolina Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation template.

- Acquire the document you need and confirm it is for your specific city/region.

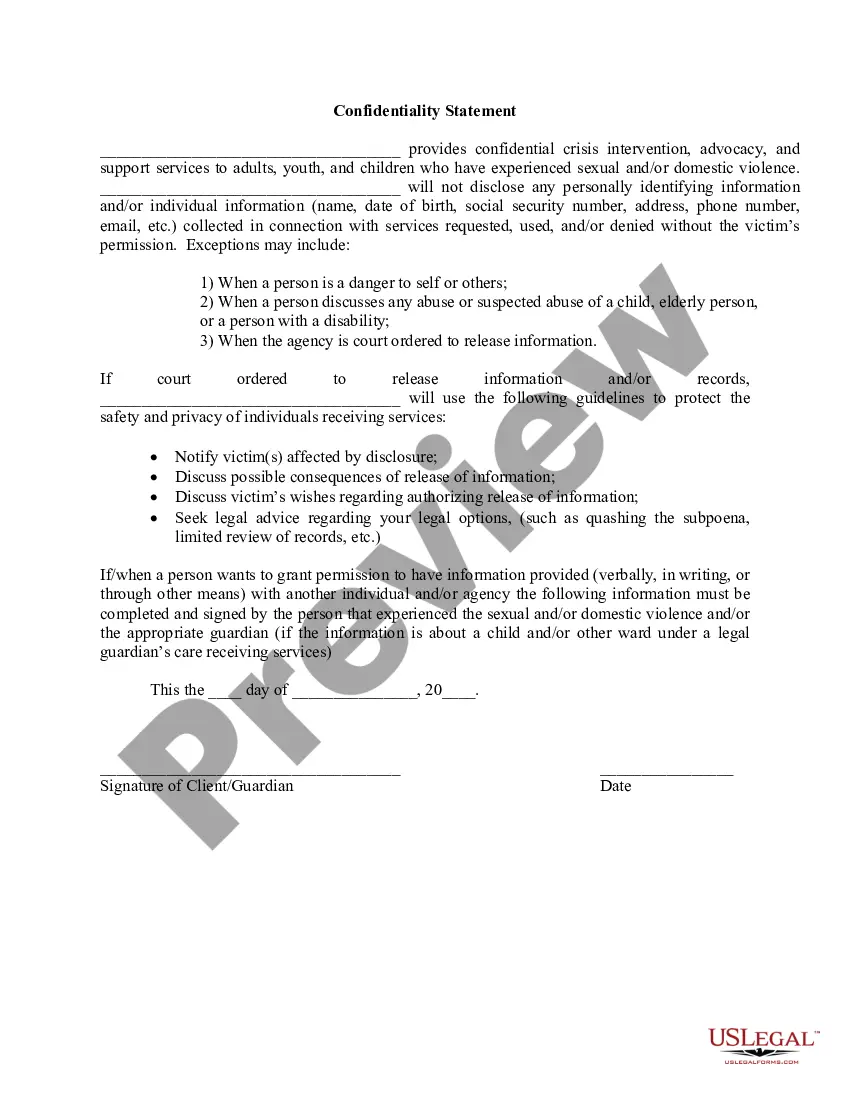

- Utilize the Preview button to review the document.

- Read the description to ensure you have selected the correct document.

- If the document isn't what you're searching for, employ the Search field to locate the document that suits your needs and specifications.

- Once you find the appropriate document, click on Purchase now.

- Choose your desired pricing plan, complete the necessary information to create your account, and process the payment using PayPal or your credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

What is a statutory close corporation? Basically, a statutory close corporation is an election that corporations can choose in their Articles of Incorporation. These corporations will have 50 shareholders or less and must meet several other requirements.

Restrictions on the right to transfer shares must appear in the: (a) articles of incorporation; (b) bylaws; and (c) certificate of stock. Restrictions must appear in all three documents; otherwise, the same shall not be binding on any purchaser in good faith.

Closed corporations are companies with a small number of shareholders that are held by managers, owners, and even families. These companies are not publicly traded and the general public cannot readily invest in them.

What is a close corporation? A close corporation is a legal entity much like a company. A CC is run and administered by its members, who must be natural persons (i.e. not other legal entities). A close corporation's members are like a company's shareholders.

A statutory close corporation is a special election that corporations with fewer than 50 shareholders may select. The designation allows for more flexibility than typically allowed with a 200bregular corporation.

Ernst & Young, PricewaterhouseCoopers, SC Johnson, Hearst Corporation, and Publix Super Markets, Inc. are other well-known U.S. closed corporations. Some examples of a non-U.S. closed corporation are Sweden's IKEA, Germany's ALDI and Bosch, and Denmark's LEGO.

HISTORY: 1988 Act No. 444, Section 2. SECTION 33-18-103. Definition and election of statutory close corporation status. (a) A statutory close corporation is a corporation whose articles of incorporation contain a statement that the corporation is a statutory close corporation.

But an entitlement contained in the bylaws or a shareholders' agreement does not result in automatic forfeiture of a board seat upon termination of employment. 2. A shareholders' agreement cannot deprive the board of its statutory authority to manage corporate affairs and appoint officers.

A close corporation is a corporation which does not exceed a statutorily defined number of shareholders and is not a public corporation. This number depends on the state's business laws, but the number is usually 35 shareholders.

An S corporation is responsible for most of the same reporting and corporate governance requirements, such as shareholder and director meetings, as standard C corporations. Shareholders of a close corporation enjoy relaxed requirements regarding corporate governance and reporting.