This lease rider form may be used when you are involved in a lease transaction, and have made the decision to utilize the form of Oil and Gas Lease presented to you by the Lessee, and you want to include additional provisions to that Lease form to address specific concerns you may have, or place limitations on the rights granted the Lessee in the “standard” lease form.

South Carolina Reservation of Additional Interests in Production

Description

How to fill out Reservation Of Additional Interests In Production?

You can devote several hours online looking for the legitimate record web template that meets the federal and state needs you will need. US Legal Forms provides a huge number of legitimate types which can be evaluated by specialists. You can actually down load or print the South Carolina Reservation of Additional Interests in Production from your service.

If you already have a US Legal Forms accounts, you are able to log in and click on the Download switch. Afterward, you are able to full, edit, print, or indication the South Carolina Reservation of Additional Interests in Production. Every legitimate record web template you get is yours eternally. To have one more copy of any acquired type, proceed to the My Forms tab and click on the related switch.

If you are using the US Legal Forms internet site for the first time, keep to the easy directions beneath:

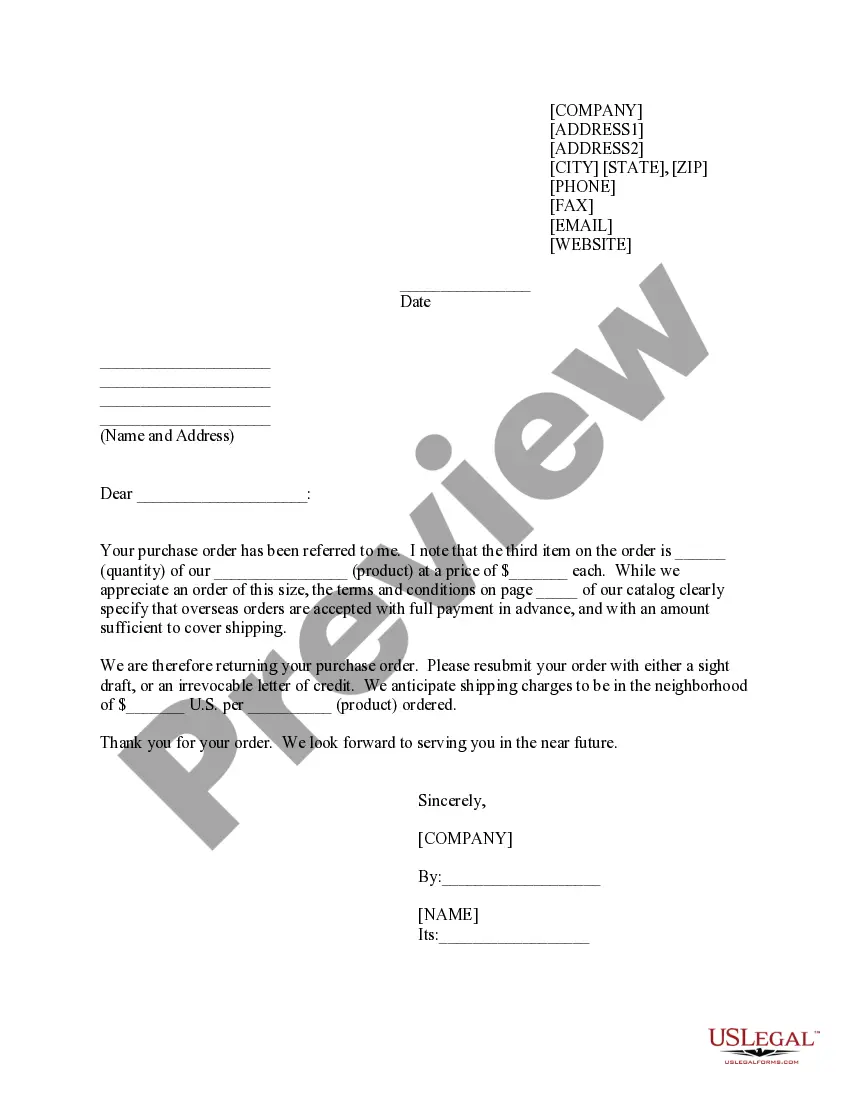

- Initially, ensure that you have chosen the proper record web template for your area/city of your liking. Browse the type information to make sure you have selected the right type. If readily available, utilize the Review switch to look through the record web template at the same time.

- If you would like get one more version of the type, utilize the Look for discipline to discover the web template that suits you and needs.

- Upon having found the web template you desire, click on Acquire now to carry on.

- Find the rates strategy you desire, type in your credentials, and sign up for an account on US Legal Forms.

- Total the transaction. You should use your charge card or PayPal accounts to pay for the legitimate type.

- Find the structure of the record and down load it in your product.

- Make alterations in your record if needed. You can full, edit and indication and print South Carolina Reservation of Additional Interests in Production.

Download and print a huge number of record templates utilizing the US Legal Forms site, that offers the largest selection of legitimate types. Use skilled and condition-distinct templates to tackle your company or specific demands.

Form popularity

FAQ

SECTION 33-44-202. Organization. (a) One or more persons may organize a limited liability company, consisting of one or more members, by delivering articles of organization to the office of the Secretary of State for filing.

In South Carolina, you must have a minimum of three directors. Most nonprofits will have more depending on the size and structure of the organization. South Carolina also requires that board members be naturalized persons. There are no residency or membership requirements in the state.

Notices to the Attorney General. (a) A nonprofit organization shall give the Attorney General written notice that it intends to dissolve at or before the time it delivers articles of dissolution to the Secretary of State. The notice shall include a copy or summary of the plan of dissolution.

SECTION 36-2-318. Third party beneficiaries of warranties express or implied. A seller's warranty whether express or implied extends to any natural person who may be expected to use, consume or be affected by the goods and whose person or property is damaged by breach of the warranty.

SECTION 58-27-265. Identification of regulatory challenges and opportunities associated with electrification of transportation sector.

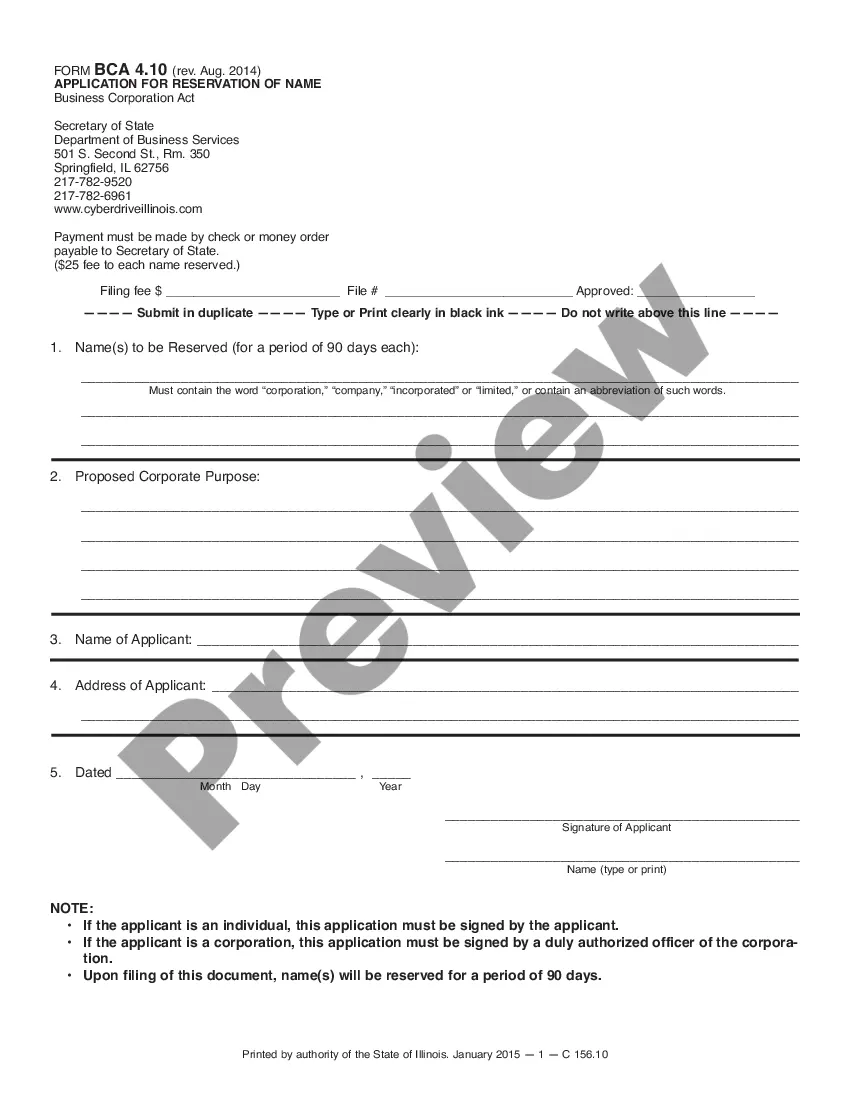

South Carolina Business Corporation Act of 1988 defines a Corporation or Domestic Corporation as a corporation incorporated for profit and not a foreign corporation. Any person may act as the incorporator of a corporation by delivering articles of incorporation to the Secretary of State for filing.

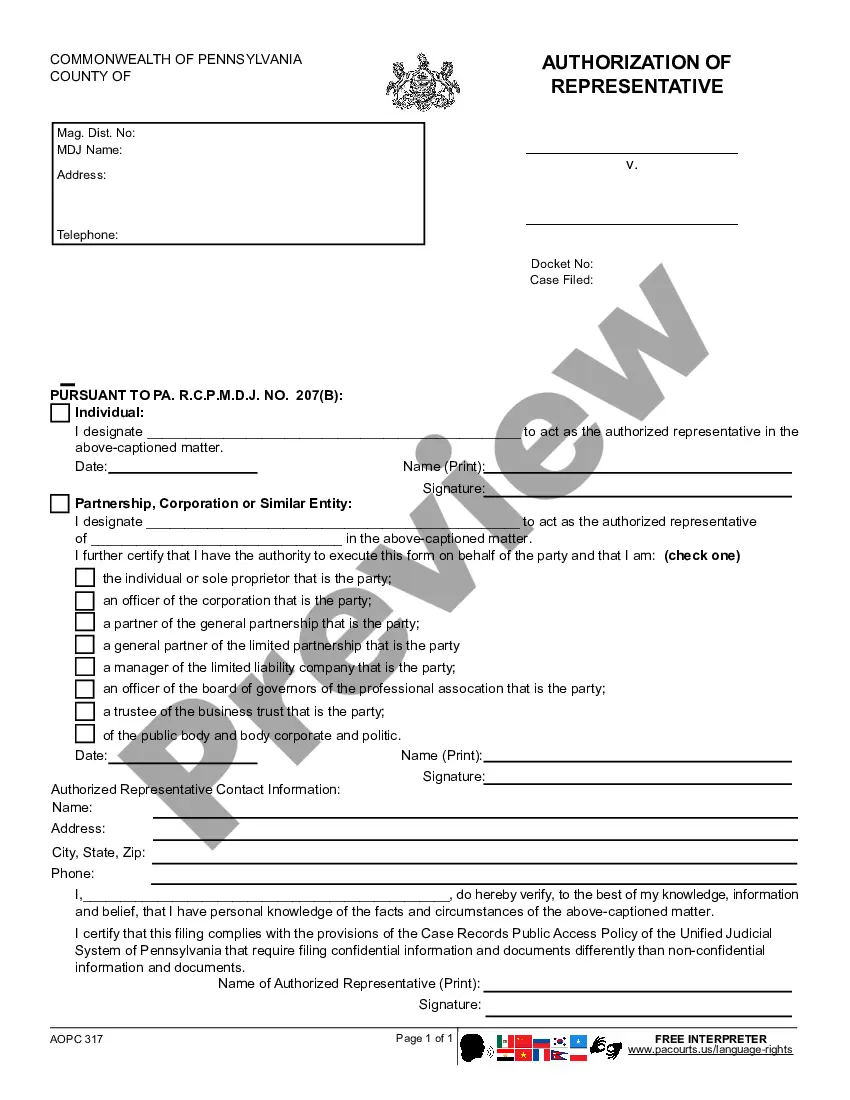

SECTION 33-1-103. Designation of representation in magistrates' court; unauthorized practice of law. A corporation or partnership, as defined in this section, may designate an employee or principal of the corporation or partnership to represent it in magistrates' court.

(a) Unless prohibited or limited by the articles or bylaws, any action that may be taken at any annual, regular, or special meeting of members may be taken without a meeting if the corporation delivers a written or electronic ballot to every member entitled to vote on the matter.