This lease rider form may be used when you are involved in a lease transaction, and have made the decision to utilize the form of Oil and Gas Lease presented to you by the Lessee, and you want to include additional provisions to that Lease form to address specific concerns you may have, or place limitations on the rights granted the Lessee in the standard lease form.

South Carolina Shut-In Oil Royalty

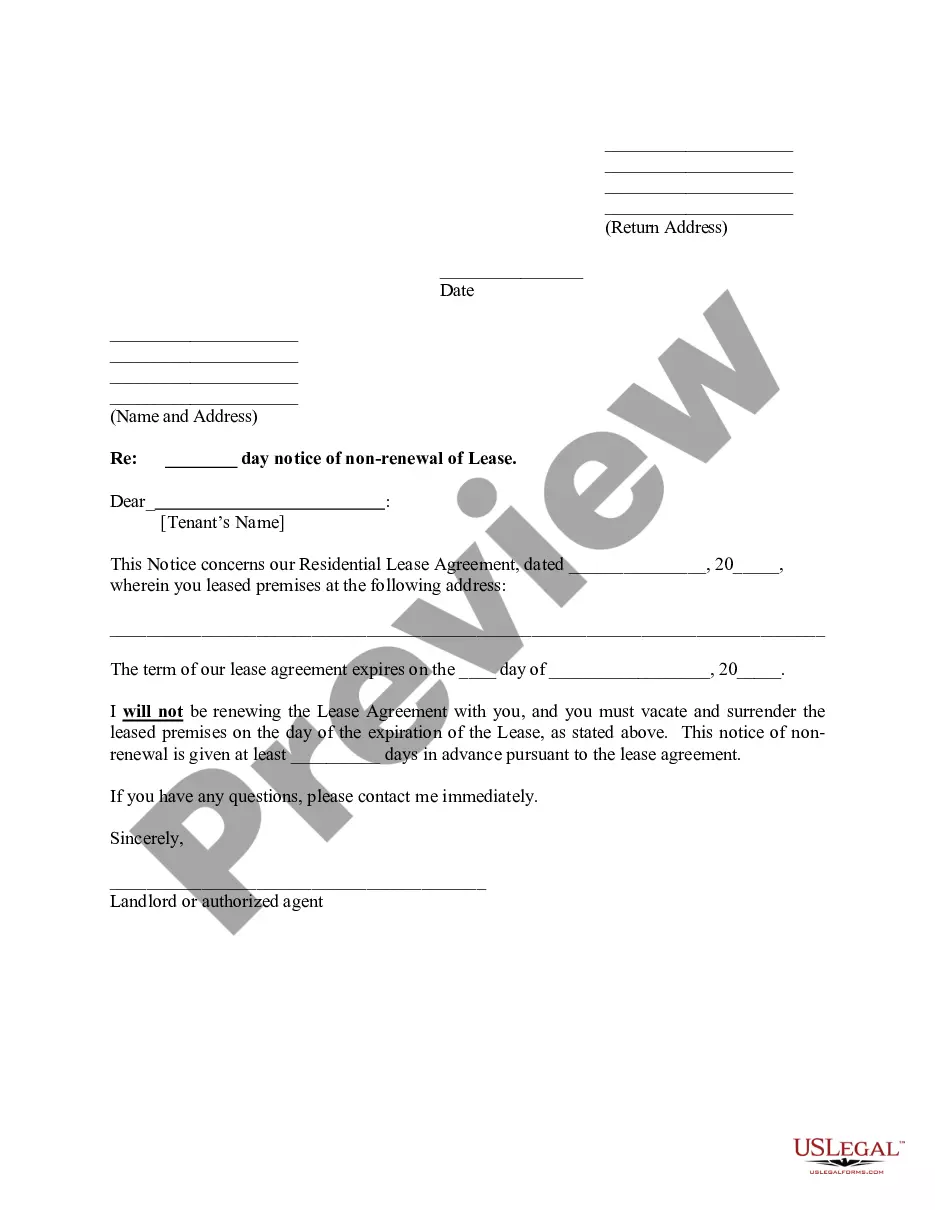

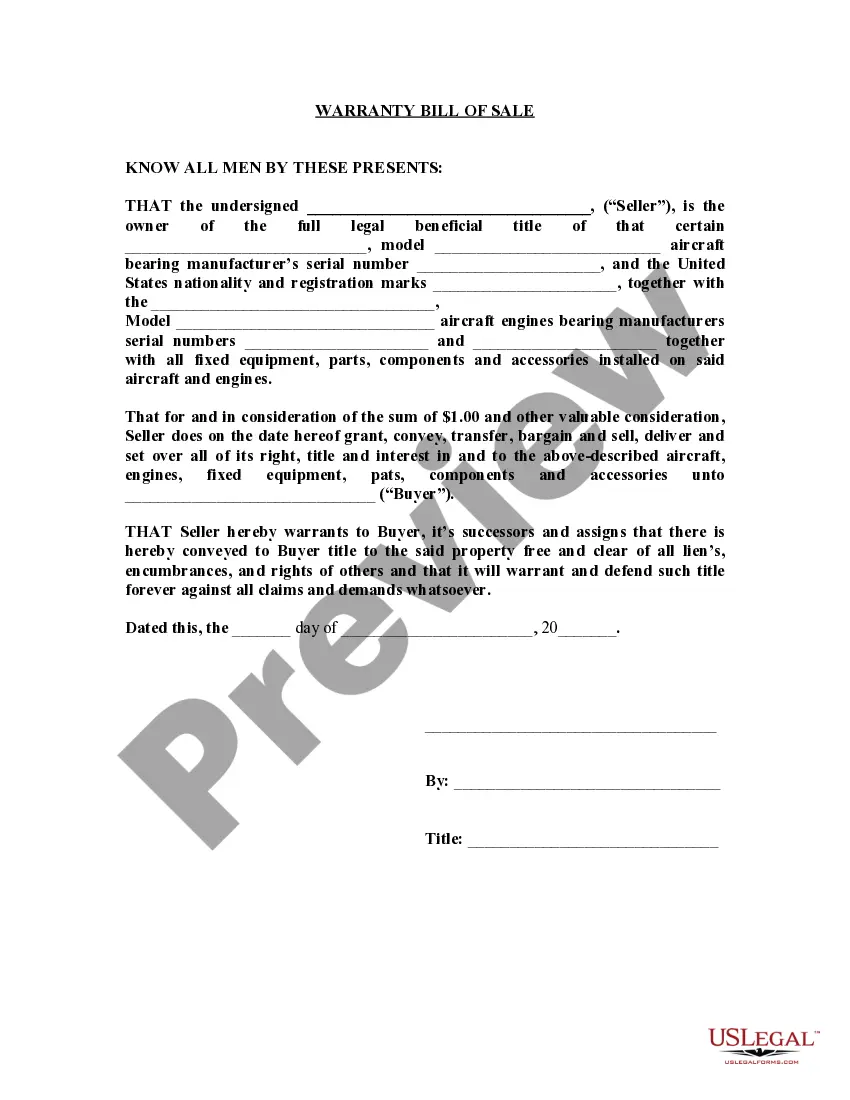

Description

How to fill out Shut-In Oil Royalty?

If you need to complete, acquire, or produce authorized file web templates, use US Legal Forms, the biggest variety of authorized kinds, that can be found on the web. Use the site`s basic and hassle-free research to obtain the documents you will need. Different web templates for organization and individual reasons are categorized by categories and suggests, or key phrases. Use US Legal Forms to obtain the South Carolina Shut-In Oil Royalty in just a number of clicks.

If you are previously a US Legal Forms customer, log in in your bank account and click on the Acquire key to find the South Carolina Shut-In Oil Royalty. You can also access kinds you previously acquired inside the My Forms tab of your bank account.

If you work with US Legal Forms the first time, follow the instructions listed below:

- Step 1. Be sure you have chosen the shape for the appropriate city/land.

- Step 2. Make use of the Preview solution to look over the form`s articles. Never neglect to read through the explanation.

- Step 3. If you are not satisfied with the kind, take advantage of the Lookup discipline near the top of the screen to discover other variations in the authorized kind design.

- Step 4. Once you have identified the shape you will need, select the Get now key. Opt for the pricing plan you prefer and include your references to register for the bank account.

- Step 5. Procedure the purchase. You can use your Мisa or Ьastercard or PayPal bank account to perform the purchase.

- Step 6. Choose the structure in the authorized kind and acquire it on your own product.

- Step 7. Full, change and produce or signal the South Carolina Shut-In Oil Royalty.

Each and every authorized file design you purchase is your own property forever. You may have acces to each and every kind you acquired in your acccount. Click the My Forms section and decide on a kind to produce or acquire again.

Be competitive and acquire, and produce the South Carolina Shut-In Oil Royalty with US Legal Forms. There are many professional and state-distinct kinds you can use for your personal organization or individual requires.

Form popularity

FAQ

Generally, the standard royalty rates for authors is under 10% for traditional publishing and up to 70% with self-publishing.

Most states and many private landowners require companies to pay royalty rates higher than 12.5%, with some states charging 20% or more, ing to federal officials. The royalty rate for oil produced from federal reserves in deep waters in the Gulf of Mexico is 18.75%.

If a successful well is drilled and completed, the lease/royalties last until there is no more (economic) production and the well or wells are all plugged and abandoned. If a slowly drying up well or field production stream is sold to a smaller, lower-cost producer, the royalties continue.

Oil & Gas Production Date or Month Your royalty checks will arrive 2-3 months after production begins, as there is a tremendous amount of accounting and production sales information that require delayed payments. After you receive your first payment, you will then receive them monthly.

The value of a royalty interest is derived from expected future revenues generated by leasing and/or production, which are largely determined by oil and gas market prices and the current drilling environment.

A clause in an oil & gas lease that allows a lessee to keep the lease in effect past the primary term by substituting payment of shut-in royalty for actual production.

A royalty interest is a non-possessory real property interest in oil and gas production free of production and operating expenses, which may be created by grant or by reservation or exception.

Royalty Rate: This rate is the percentage stated on the lease agreement as revenue allocation. It represents the amount the resource owner is expected to receive from the sale of the oil and gas. Royalty rates are between 12.5% to 15%.