South Carolina Oil, Gas and Mineral Royalty Transfer

Description

How to fill out Oil, Gas And Mineral Royalty Transfer?

You are able to spend several hours on-line trying to find the legal document template that suits the federal and state requirements you need. US Legal Forms provides 1000s of legal types which are reviewed by professionals. You can actually download or produce the South Carolina Oil, Gas and Mineral Royalty Transfer from the support.

If you already have a US Legal Forms accounts, you are able to log in and click the Down load switch. Next, you are able to full, edit, produce, or indication the South Carolina Oil, Gas and Mineral Royalty Transfer. Each and every legal document template you acquire is the one you have permanently. To acquire yet another copy of the acquired form, check out the My Forms tab and click the related switch.

If you work with the US Legal Forms internet site for the first time, follow the simple guidelines under:

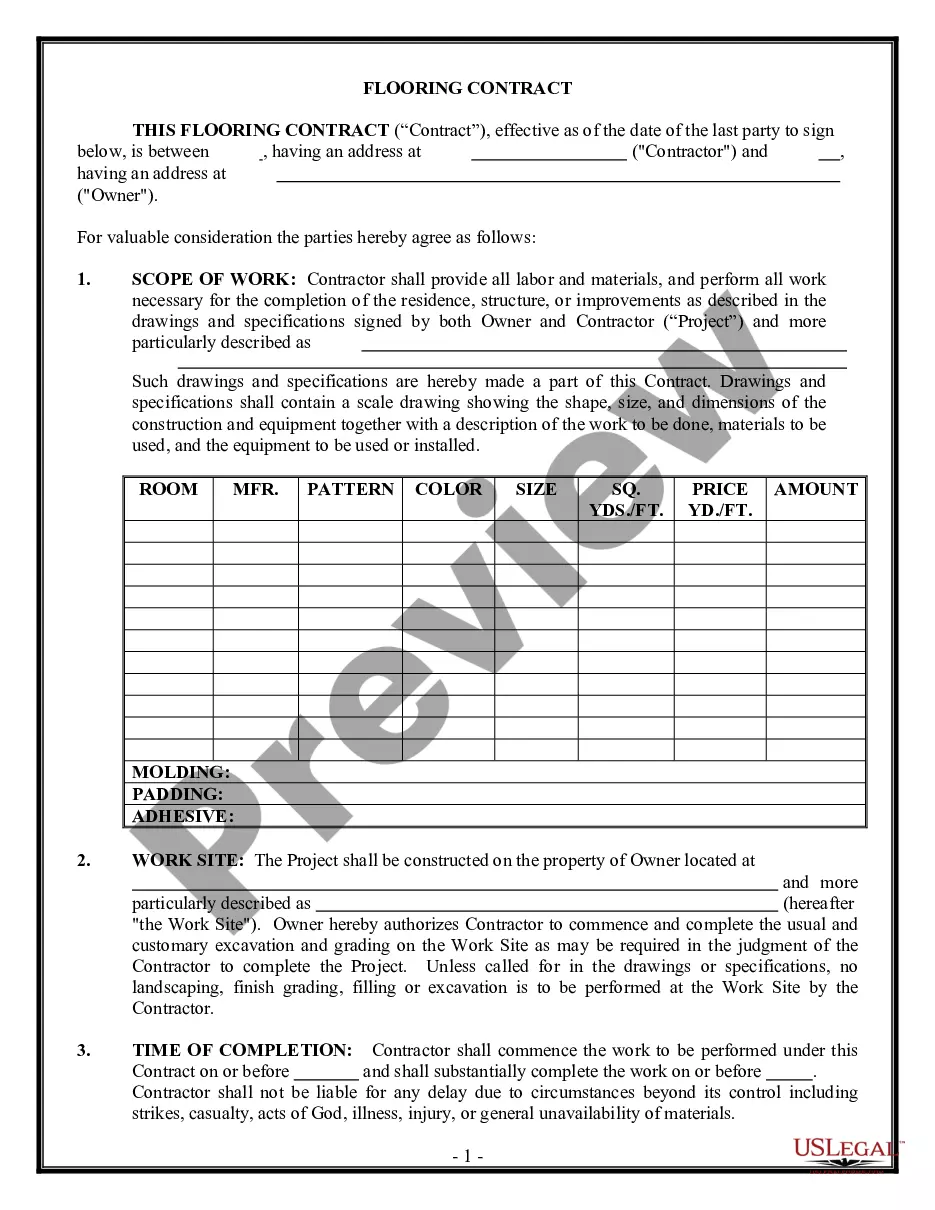

- First, make sure that you have chosen the proper document template for that region/town that you pick. Browse the form explanation to make sure you have selected the appropriate form. If accessible, make use of the Review switch to appear from the document template at the same time.

- If you wish to discover yet another version of the form, make use of the Look for industry to get the template that suits you and requirements.

- After you have found the template you desire, click Purchase now to carry on.

- Pick the pricing strategy you desire, enter your accreditations, and sign up for a free account on US Legal Forms.

- Full the transaction. You can utilize your credit card or PayPal accounts to purchase the legal form.

- Pick the format of the document and download it in your product.

- Make modifications in your document if needed. You are able to full, edit and indication and produce South Carolina Oil, Gas and Mineral Royalty Transfer.

Down load and produce 1000s of document themes making use of the US Legal Forms website, which provides the most important variety of legal types. Use specialist and condition-certain themes to tackle your small business or specific requires.

Form popularity

FAQ

It really comes down to your personal decision. Figuring out whether to sell oil and gas royalties can be challenging for some. Here are some of the most common reasons for selling an oil and gas royalty: Taxes: You will save substantial money if you inherited mineral rights by selling your oil royalties.

The right of governments to levy royalties from oil and gas companies derives from their ownership of natural resources. Through royalty payments, governments are compensated by oil and gas companies for the extraction of public natural resources.

The legal process for inheriting royalties involves obtaining a deed from the deceased's estate and transferring ownership.

If you sign a mineral rights lease, then you are on your way to earning oil and gas royalties. As a mineral rights owner, you can receive royalty compensation. This is from the sale of crude oil, natural gas, and other valuable resources found on your property.

The value of a royalty interest is derived from expected future revenues generated by leasing and/or production, which are largely determined by oil and gas market prices and the current drilling environment.

Natural gas royalty rates are determined every month for each well event or tract in a Production Entity (PE). The royalty rate can be up to 27% of the value of the natural gas and is based on: Whether the gas is produced from Crown Land or freehold land.

The royalty percentage is usually 12.5% to 15% but can change based on regional regulations or negotiations. Types of Leases: There are different types of oil and gas leases, and they affect royalty calculations differently.

Royalty rate is shown as either a gross royalty rate between 1-9% of gross revenues, or a net royalty rate between 25% to 40% of net revenues, depending on if the project is pre- or post-payout and the current WTI price in Canadian dollars. For pre-payout projects, a gross royalty rate is used.