This form of release is used when Lessor releases, relinquishes, and quit claims to the present owners of the Lease all of a Production Payment interest. From and after the Effective Date, the Production Payment interest in the Lease is deemed to have terminated and is no longer a burden on the leasehold estate created by the Lease.

South Carolina Release of Production Payment by Lessor

Description

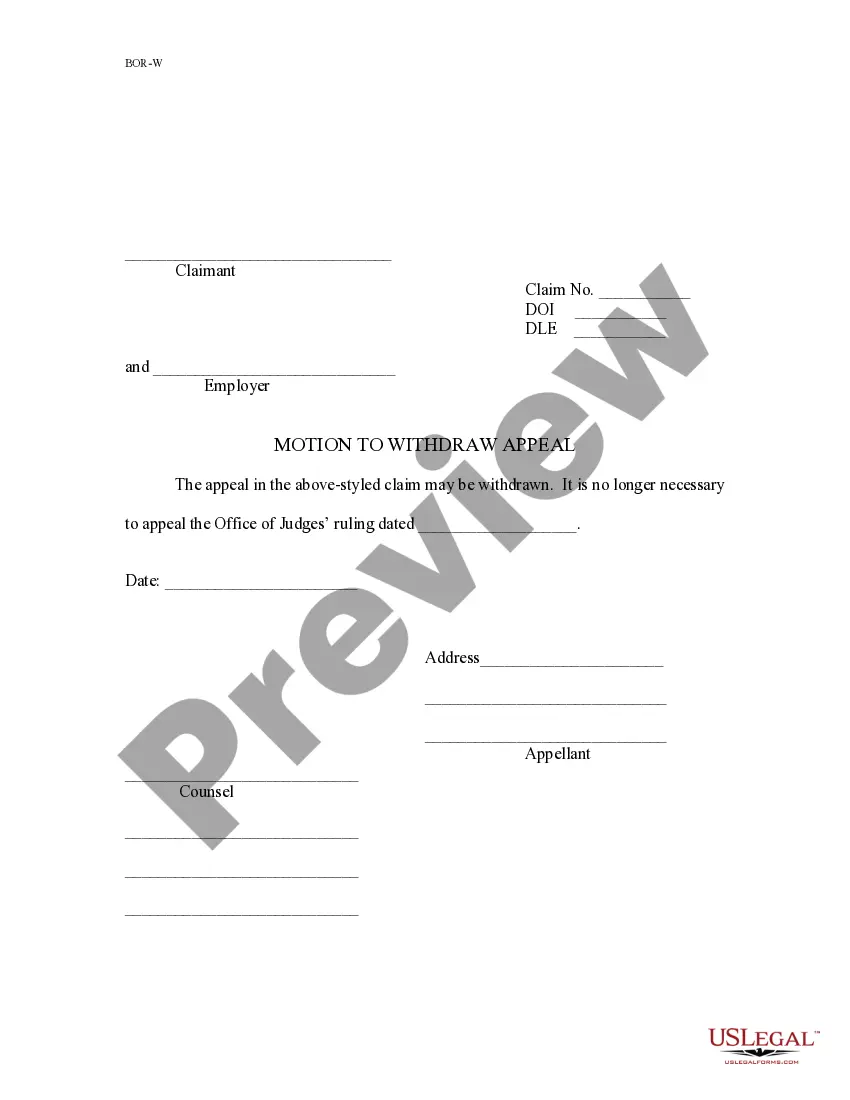

How to fill out Release Of Production Payment By Lessor?

Have you been inside a place in which you will need files for possibly organization or person functions nearly every day? There are a lot of legitimate file web templates available online, but getting versions you can trust isn`t simple. US Legal Forms offers 1000s of type web templates, just like the South Carolina Release of Production Payment by Lessor, that happen to be created in order to meet state and federal demands.

If you are currently acquainted with US Legal Forms website and have a merchant account, just log in. After that, you can obtain the South Carolina Release of Production Payment by Lessor format.

If you do not come with an account and would like to begin to use US Legal Forms, abide by these steps:

- Find the type you require and make sure it is for the proper metropolis/county.

- Use the Preview key to check the form.

- Browse the information to actually have selected the correct type.

- If the type isn`t what you are trying to find, utilize the Look for field to discover the type that meets your requirements and demands.

- When you obtain the proper type, just click Buy now.

- Pick the costs program you want, submit the required information to create your bank account, and buy the transaction using your PayPal or credit card.

- Decide on a convenient document structure and obtain your version.

Get all of the file web templates you may have bought in the My Forms menus. You may get a additional version of South Carolina Release of Production Payment by Lessor at any time, if possible. Just select the required type to obtain or produce the file format.

Use US Legal Forms, by far the most considerable collection of legitimate kinds, to conserve time and avoid faults. The support offers skillfully manufactured legitimate file web templates which you can use for a variety of functions. Generate a merchant account on US Legal Forms and start creating your life a little easier.

Form popularity

FAQ

So you may not have to pay much, if any additional rent, if you break your lease. You need pay only the amount of rent the landlord loses because you moved out early. This is because South Carolina requires landlords to take reasonable steps to keep their losses to a minimum?or to "mitigate damages" in legal terms.

So you may not have to pay much, if any additional rent, if you break your lease. You need pay only the amount of rent the landlord loses because you moved out early. This is because South Carolina requires landlords to take reasonable steps to keep their losses to a minimum?or to "mitigate damages" in legal terms.

Joint Tenants with Rights of Survivorship: Created by SC Code §27-7-40. Upon the death of one owner, the death certificate is filed at the courthouse and that owner's interest automatically passes to the surviving owner(s). In other words, it does not pass through an estate.

Under the Residential Landlord-Tenant Act, a tenant may bring an action against the landlord for recovery of damages or to obtain legal relief for any violations by the Landlord. These remedies will be discussed later. A tenant is responsible for paying rent on time.

A typical early termination clause will require two months' rent. Setting this figure in advance in the lease may be viewed as a liquidated damages clause. For the clause to be enforceable, there must be a reasonable relationship between the landlord's losses and the amount the tenant must pay.

Early Termination Fee: The clause will state how much the tenant must pay to end their lease early. The tenant will usually have to pay the landlord the equivalent of two month's rent if they want to end their lease early, but this amount could be higher or lower based on the lease clause between landlord and tenant.

South Carolina Landlord Tenant Law permits landlords to require tenants to pay a security deposit. The security deposit must be returned to the tenant within thirty days after termination of the tenancy. Past due rent and the cost of damages can be withheld from the security deposit.

Can Tenants Withhold Rent in South Carolina? Under South Carolina law, tenants may withhold rent if the landlord fails to provide essential services such as heating systems, water supply, good sanitary conditions, and maintenance.