South Carolina Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes

Description

How to fill out Affidavit That All The Estate Assets Have Been Distributed To Devisees By Executor Or Estate Representative With Statement Concerning Debts And Taxes?

Have you been within a placement that you will need documents for both company or individual uses almost every time? There are a variety of lawful papers layouts available online, but discovering ones you can trust isn`t straightforward. US Legal Forms offers 1000s of form layouts, just like the South Carolina Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes, which are created to fulfill state and federal needs.

Should you be presently familiar with US Legal Forms site and also have a merchant account, basically log in. Afterward, it is possible to download the South Carolina Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes design.

Should you not have an bank account and need to start using US Legal Forms, abide by these steps:

- Find the form you want and ensure it is for the appropriate metropolis/region.

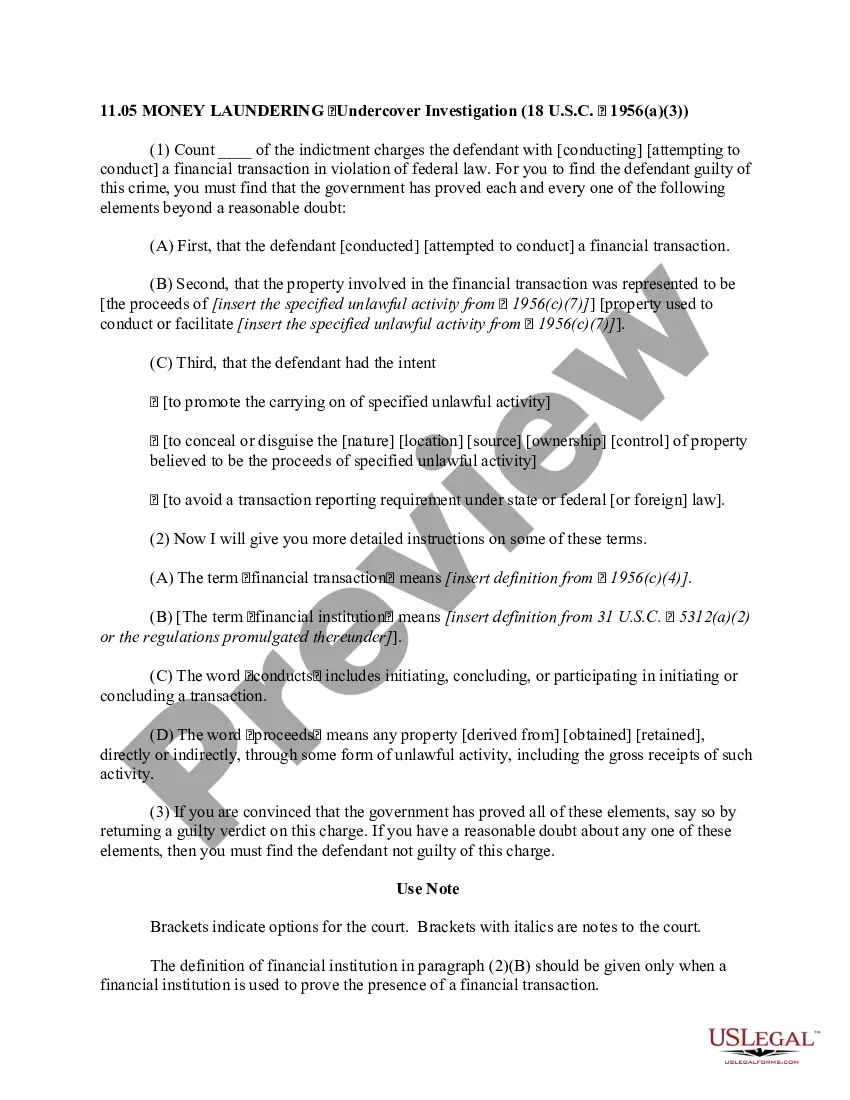

- Utilize the Review key to examine the shape.

- Read the outline to ensure that you have selected the appropriate form.

- In case the form isn`t what you`re searching for, make use of the Look for field to get the form that fits your needs and needs.

- If you discover the appropriate form, click on Acquire now.

- Choose the rates plan you want, fill in the required information and facts to create your account, and pay money for your order making use of your PayPal or charge card.

- Choose a practical data file format and download your copy.

Discover all the papers layouts you may have purchased in the My Forms food list. You can aquire a more copy of South Carolina Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes at any time, if necessary. Just click the needed form to download or print the papers design.

Use US Legal Forms, one of the most substantial variety of lawful varieties, to save lots of time as well as avoid mistakes. The services offers professionally created lawful papers layouts which you can use for a variety of uses. Create a merchant account on US Legal Forms and begin producing your life a little easier.

Form popularity

FAQ

A distribution is the delivery of cash or an asset to a given heir. After resolving debts and paying any taxes due, the executor should distribute the remaining estate to the heirs in ance with the instructions in the will (or as dictated by the court).

Probate court is a specialized type of court that deals with the property and debts of a person who has died. The basic role of the probate court judge is to assure that the deceased person's creditors are paid, and that any remaining assets are distributed to the proper beneficiaries.

An heir is someone who is set to inherit the property of the deceased when no will or testament has been made. A beneficiary is someone who was chosen by the deceased to inherit their property as laid out in a will or testament.

One of the easiest ways to think of the key differences between an executor and a power of attorney is that an executor helps someone to carry out their wishes after they die, while a power of attorney enables the chosen person to make decisions on their behalf while they're still alive.

Finding Assets Typical Sources. Common sources of information about asset existence include: ... Probate Court. ... Life Insurance Search. ... Retirement Benefits Search. ... Digital Assets. ... Refunds. ... Abandoned Assets. ... Paid Asset Search.

A will, or a last will and testament, is a legal document that describes how you would like your property and other assets to be distributed after your death.

Any asset that is in a trust. Assets in a pension plan. Any asset that already has a beneficiary attached to it. Insurance policy with a beneficiary. Retirement funds with a named beneficiary. Real estate with joint tenancy with right of survivorship.