This Plan of Dissolution of a Law Firm covers covers all necessary topics for the dissolution of the firm. Included are: Plan of dissolution, liquidation objectives, surrender of leasehold estates, estimated balance sheet items, termination of personnel, accounts receivable billing and collecting, cash management, professional liability, and indemnity issues.

South Carolina Dissolving a Law Firm

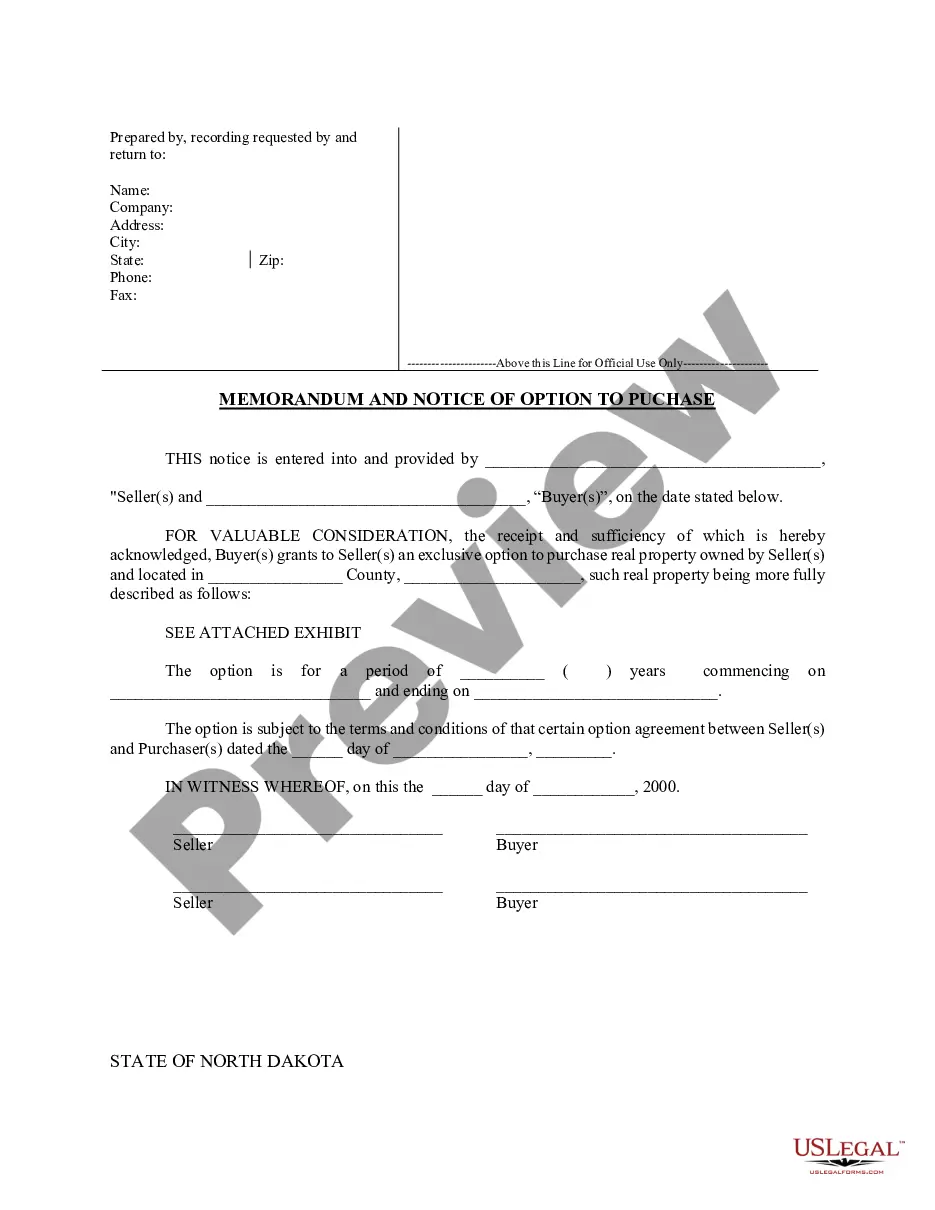

Description

How to fill out Dissolving A Law Firm?

If you want to complete, obtain, or produce lawful record web templates, use US Legal Forms, the greatest selection of lawful forms, that can be found on-line. Make use of the site`s basic and hassle-free look for to find the documents you require. A variety of web templates for company and personal purposes are categorized by categories and suggests, or search phrases. Use US Legal Forms to find the South Carolina Dissolving a Law Firm in just a few click throughs.

When you are already a US Legal Forms customer, log in in your accounts and click on the Down load key to find the South Carolina Dissolving a Law Firm. You can also access forms you previously saved within the My Forms tab of the accounts.

Should you use US Legal Forms initially, follow the instructions under:

- Step 1. Ensure you have selected the shape for that proper town/nation.

- Step 2. Use the Review option to check out the form`s content. Don`t neglect to learn the description.

- Step 3. When you are unhappy with the kind, use the Look for field near the top of the display to get other types in the lawful kind format.

- Step 4. After you have found the shape you require, click the Get now key. Choose the prices plan you choose and put your references to sign up for an accounts.

- Step 5. Method the deal. You can utilize your bank card or PayPal accounts to accomplish the deal.

- Step 6. Pick the formatting in the lawful kind and obtain it on the device.

- Step 7. Total, change and produce or signal the South Carolina Dissolving a Law Firm.

Each and every lawful record format you purchase is your own property permanently. You might have acces to each and every kind you saved in your acccount. Click the My Forms segment and choose a kind to produce or obtain yet again.

Contend and obtain, and produce the South Carolina Dissolving a Law Firm with US Legal Forms. There are millions of expert and status-specific forms you can use for your personal company or personal needs.

Form popularity

FAQ

Steps to Take to Close Your Business File a Final Return and Related Forms. Take Care of Your Employees. Pay the Tax You Owe. Report Payments to Contract Workers. Cancel Your EIN and Close Your IRS Business Account. Keep Your Records.

Confirm that the company can, or has, paid any outstanding debts. Closing the company bank accounts. Informing all interested parties and HMRC of your decision to dissolve the company. This must be done within 7 days of lodging your strike off application with Companies House.

How do you dissolve a South Carolina Limited Liability Company? To dissolve a South Carolina LLC, file Articles of Termination, in duplicate, with the South Carolina Secretary of State, Division of Business Filings (SOS). The form is available on the SOS website (see link below).

How do you dissolve a South Carolina Corporation? To dissolve a South Carolina corporation, file Articles of Dissolution with the South Carolina Secretary of State, Division of Business Filings (SOS). Submit the form in duplicate, with a self-addressed stamped envelope, so the SOS can return a copy to you.

Dissolution terminates the existence of a company, but you must still: Wind up the operations. Liquidate the assets. Take other steps to end its existence.

Close your business Decide to close. Sole proprietors can decide on their own, but any type of partnership requires the co-owners to agree. ... File dissolution documents. ... Cancel registrations, permits, licenses, and business names. ... Comply with employment and labor laws. ... Resolve financial obligations. ... Maintain records.

Filing accounts and a company tax return with HMRC. You must state that these are the final accounts due to the planned dissolution of the company. Asking HMRC to close down the company's payroll scheme and deregister for VAT. Confirm that the company can, or has, paid any outstanding debts.

Final Guidance on Dissolving Your Califonia Corporation The process to dissolve your corporation in California is relatively straightforward. However, if you qualify for one of the special dissolution procedures, you might need additional help navigating the process.