South Carolina Software License Subscription Agreement

Description

How to fill out Software License Subscription Agreement?

If you need to acquire comprehensive, download, or print authorized document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's straightforward and convenient search to find the documents you require.

Many templates for commercial and personal purposes are organized by categories and states, or keywords.

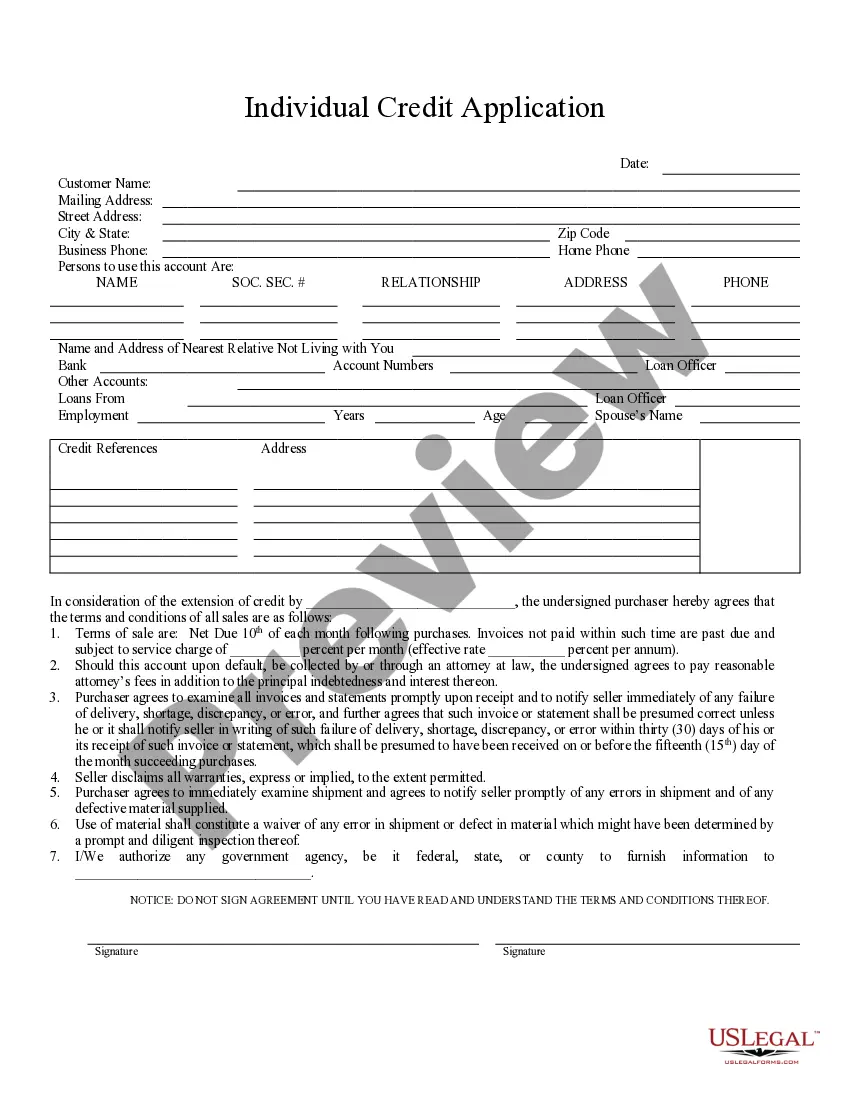

Step 4. Once you have found the form you need, click the Purchase now button. Choose the payment plan you prefer and provide your details to register for the account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to obtain the South Carolina Software License Subscription Agreement in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Acquire button to get the South Carolina Software License Subscription Agreement.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Make sure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form's content. Don't forget to read the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

Generally, a subscription agreement does not need to be notarized to be legally binding. However, in certain cases, having a South Carolina Software License Subscription Agreement notarized can add an extra layer of authenticity. Notarization might be beneficial for larger transactions or specific legal requirements. Always consult a legal professional to determine the best course of action for your situation.

A subscription agreement is legally binding if it includes essential elements such as offer, acceptance, and consideration. In the context of a South Carolina Software License Subscription Agreement, both parties must agree to the terms outlined. This creates a contractual obligation that is enforceable in court. Therefore, ensure that you fully understand the terms before signing.

Subscription agreements are indeed legally binding in South Carolina, as long as they comply with state laws. A South Carolina Software License Subscription Agreement requires both parties to adhere to the terms specified. This ensures that the rights and responsibilities are clear, promoting a smooth business relationship. For tailored agreements, consider using a platform like US Legal Forms.

Yes, subscriptions can be legally binding, provided they meet certain criteria. When you enter into a South Carolina Software License Subscription Agreement, you are agreeing to the terms laid out in the document. This means both parties must fulfill their obligations under the agreement. To ensure clarity, it is advisable to consult with a legal expert.

Examples of licensing agreements include software licenses, music licensing agreements, and franchise agreements. Each type serves a specific purpose, allowing users to access resources legally. A South Carolina Software License Subscription Agreement is a specific form of software licensing agreement tailored to meet the needs of users in South Carolina.

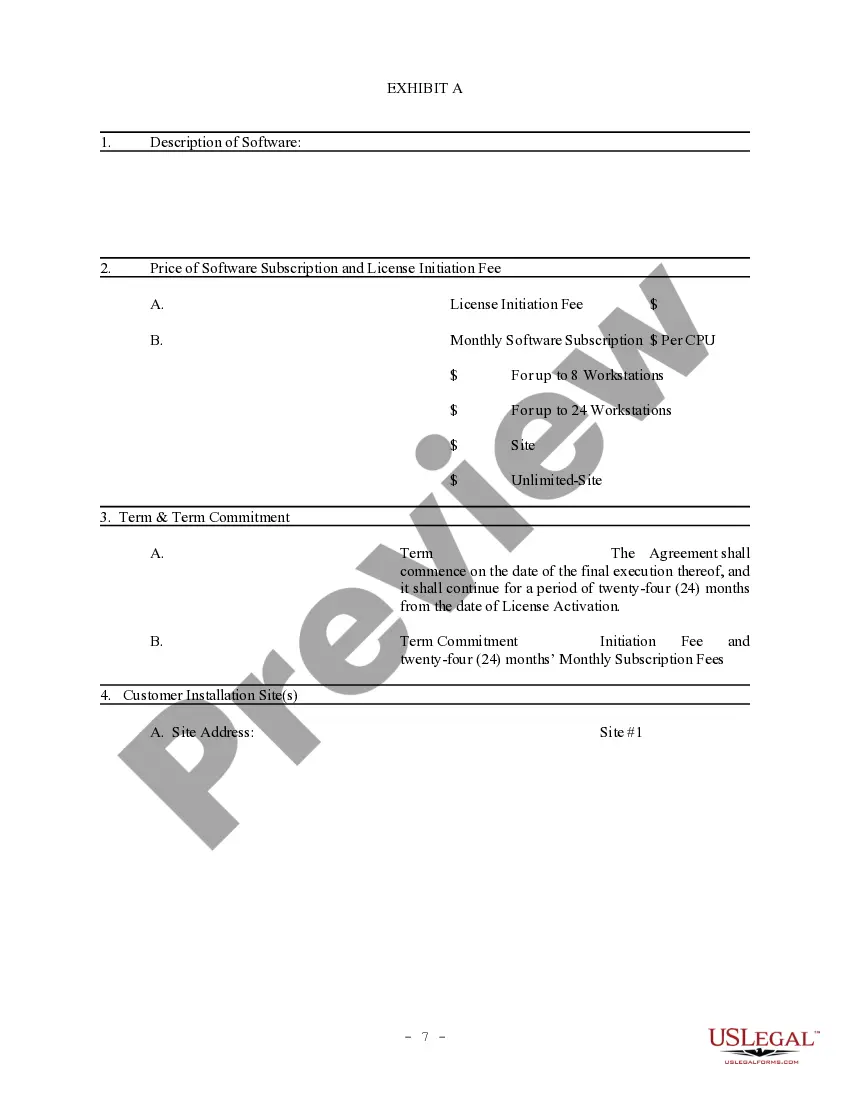

Common clauses in a software license agreement include grant of license, payment terms, restrictions on use, and termination conditions. These clauses define how the software can be used and what rights the user has. When drafting a South Carolina Software License Subscription Agreement, including these clauses is essential to ensure clarity and protect both parties.

The three main types of licensing are proprietary, open-source, and subscription-based licensing. Proprietary licenses restrict users from modifying or distributing the software. Open-source licenses allow users to access and modify the software freely, while subscription-based licensing provides access for a limited time, as seen in a South Carolina Software License Subscription Agreement.

Subscription licenses are agreements that allow users to access software for a specified period in exchange for payment. These licenses provide flexibility, as users can often adjust their subscription based on their needs. In the context of a South Carolina Software License Subscription Agreement, subscription licenses can help businesses manage costs while getting the latest software updates.

A software subscription agreement is a legal document outlining the terms under which a user can access and use software. This agreement specifies the duration of the subscription, payment terms, and any restrictions on usage. When considering a South Carolina Software License Subscription Agreement, it is crucial to understand these terms to ensure compliance and protect your interests.

Most states do not require LLCs to have an operating agreement, including South Carolina. However, some states, like Delaware and New York, urge LLCs to adopt one to improve business clarity and reduce disputes. Even in states where it is not required, having an operating agreement is beneficial for establishing internal policies. You can find relevant templates on US Legal Forms to help you create your operating agreement.