South Carolina Underwriter Agreement - Self-Employed Independent Contractor

Description

How to fill out Underwriter Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a broad selection of legal form templates that you can download or print.

Through the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can find the latest forms such as the South Carolina Underwriter Agreement - Self-Employed Independent Contractor in just a few minutes.

If you already have an account, Log In and retrieve the South Carolina Underwriter Agreement - Self-Employed Independent Contractor from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously saved forms from the My documents tab of your account.

Make modifications. Fill out, edit, print, and sign the saved South Carolina Underwriter Agreement - Self-Employed Independent Contractor.

Every document you save to your account does not have an expiration date and is yours indefinitely. So, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the South Carolina Underwriter Agreement - Self-Employed Independent Contractor with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple guidelines to help you get started.

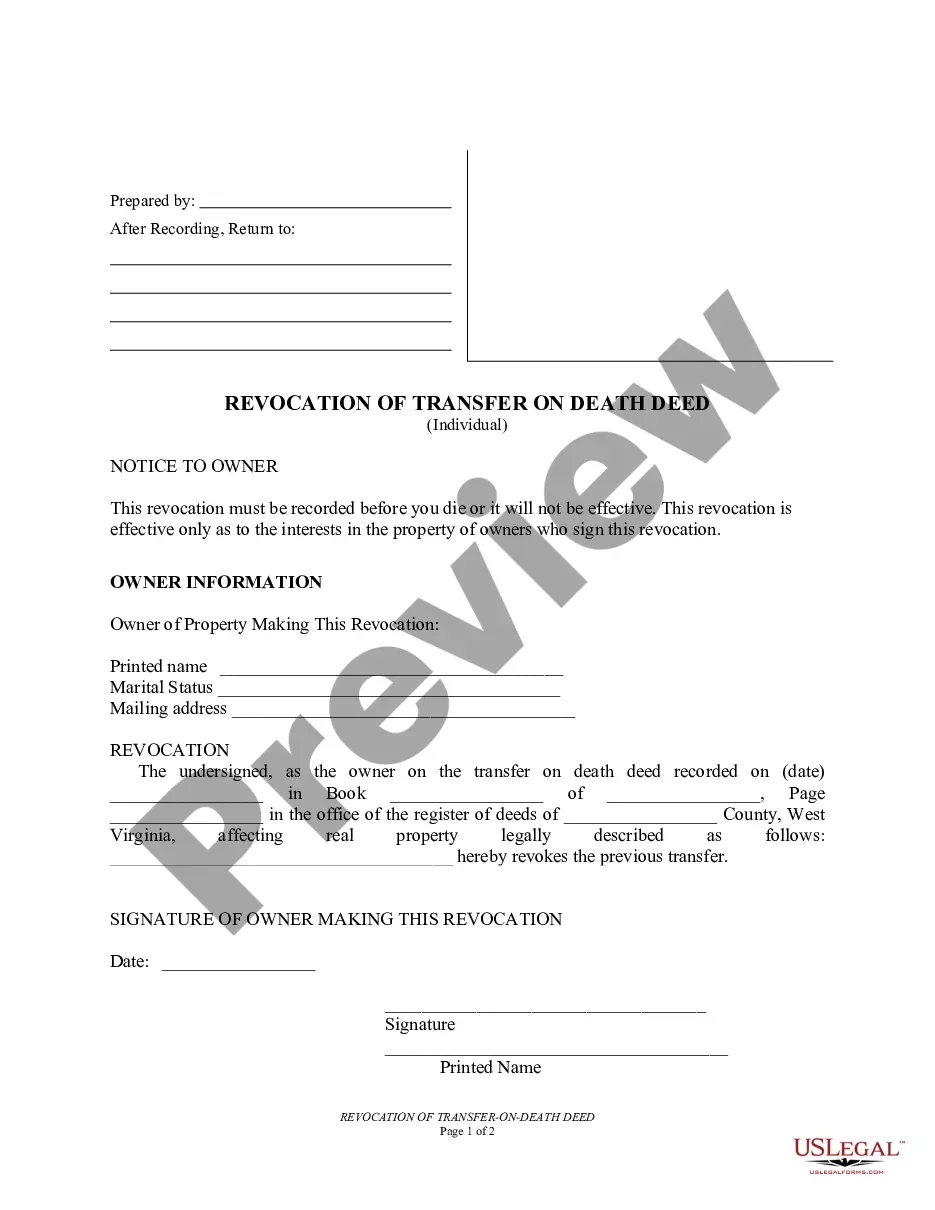

- Ensure you have selected the correct form for your area/state. Click on the Review button to check the form's content. Refer to the form description to confirm you have chosen the right document.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

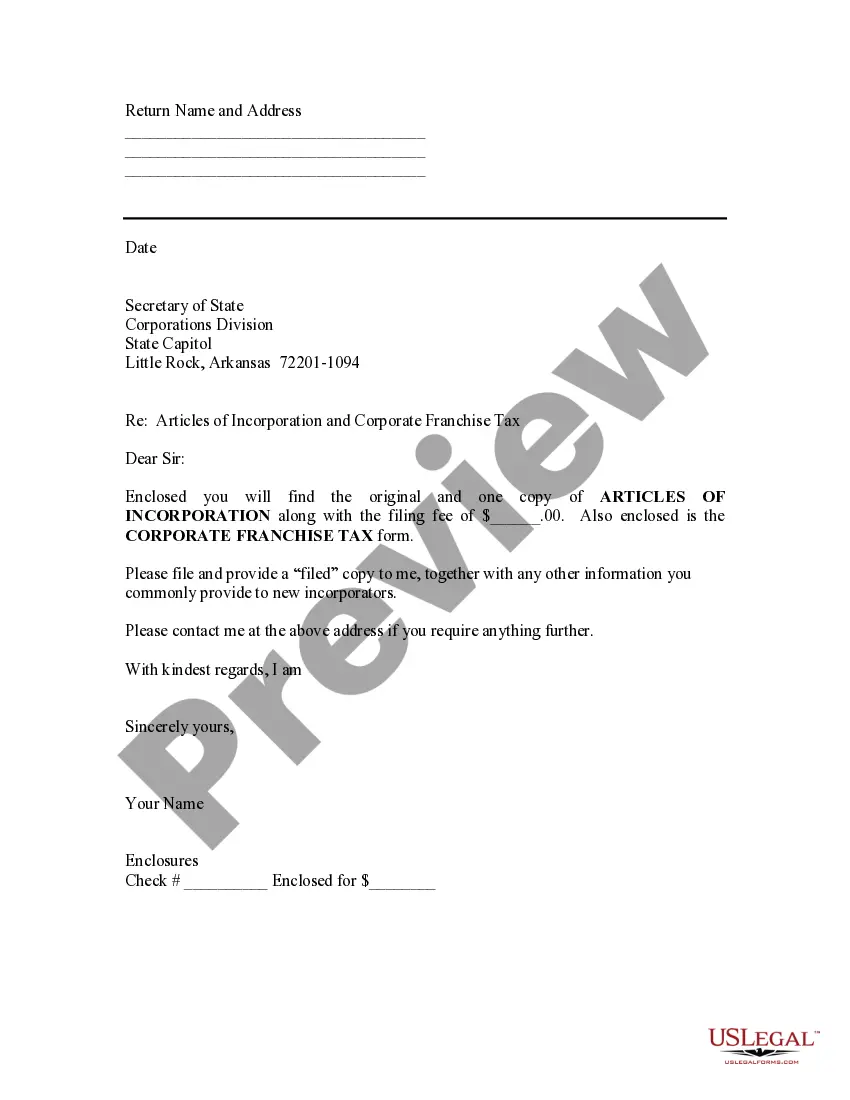

- If you are satisfied with the form, confirm your selection by clicking on the Purchase now button. Then, select your preferred pricing plan and provide your details to create an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the payment.

- Choose the format and download the form to your device.

Form popularity

FAQ

A basic independent contractor agreement typically includes the contractor's services, payment details, and termination clauses. It acts as a legal foundation that clarifies expectations and minimizes risks for both the contractor and the client. This agreement is crucial for establishing an understanding of the working relationship. For those seeking a straightforward solution, uslegalforms offers customizable templates for a South Carolina Underwriter Agreement - Self-Employed Independent Contractor.

An independent contractor agreement in South Carolina outlines the terms and conditions under which a contractor operates. This document serves to protect both parties by specifying responsibilities, payment structures, and legal rights. It is essential for formalizing the working relationship and ensuring compliance with local laws. An effective South Carolina Underwriter Agreement - Self-Employed Independent Contractor guides you through these contractual obligations.

The new federal rule on independent contractors focuses on clarifying the classification of workers. The Department of Labor proposes guidelines that may affect how independent contractors are defined, particularly around the nature of control and independence. Understanding these changes is vital for compliance. If you are drafting a South Carolina Underwriter Agreement - Self-Employed Independent Contractor, staying informed on these regulations will benefit your business.

Filling out an independent contractor agreement involves several key components, such as defining the scope of work, payment terms, and the duration of the agreement. Make sure to include specific details about the services provided and any deadlines. This clarity helps prevent misunderstandings. For those new to the process, uslegalforms offers templates to assist in crafting a comprehensive South Carolina Underwriter Agreement - Self-Employed Independent Contractor.

Yes, independent contractors file taxes as self-employed individuals. Since they do not receive a regular paycheck, they must report their earnings as income from self-employment. This requires specific tax forms, including Schedule C, to accurately report income and expenses. Utilizing a service like uslegalforms can streamline the tax filing process for your South Carolina Underwriter Agreement - Self-Employed Independent Contractor.

The independent contractor law in South Carolina defines the relationship between employers and independent contractors. It's important to understand that independent contractors work independently, not under the direct supervision of an employer. This distinction affects tax obligations and eligibility for benefits. For those looking to establish their own business as a South Carolina Underwriter Agreement - Self-Employed Independent Contractor, familiarity with these laws is crucial.

Writing an independent contractor agreement starts with defining the scope of work and the specific services you will provide. It's essential to include payment terms, deadlines, and both parties' obligations. Make sure to address termination conditions and confidentiality clauses if applicable. For a solid template, explore the South Carolina Underwriter Agreement - Self-Employed Independent Contractor on US Legal Forms to ensure you cover all necessary elements.

Filling out a declaration of independent contractor status form requires you to clearly state your status as a self-employed independent contractor. You should include details about your business structure, the services rendered, and how payments are processed. Make sure to confirm that you operate independently without direct control from your clients. Using the South Carolina Underwriter Agreement - Self-Employed Independent Contractor can help guide you through this process on US Legal Forms.

To fill out an independent contractor form, begin by providing your personal information, including your name and contact details. Next, specify the services you provide as a self-employed independent contractor. Then, review the payment terms, including rates and invoicing methods. For a comprehensive process, consider using the South Carolina Underwriter Agreement - Self-Employed Independent Contractor available on US Legal Forms.

Creating an independent contractor agreement requires clear communication about the terms of engagement. Begin by outlining the scope of work, payment terms, and deadlines. You can simplify this process by utilizing resources like the USLegalForms platform, which offers templates that ensure compliance with the South Carolina Underwriter Agreement - Self-Employed Independent Contractor guidelines. This way, you can establish a solid foundation for your working relationship.