South Carolina Self-Employed Independent Contractor Employment Agreement - General

Description

How to fill out Self-Employed Independent Contractor Employment Agreement - General?

Selecting the ideal authorized document template can be a challenge. Of course, there are numerous templates available online, but how do you find the legal form you need.

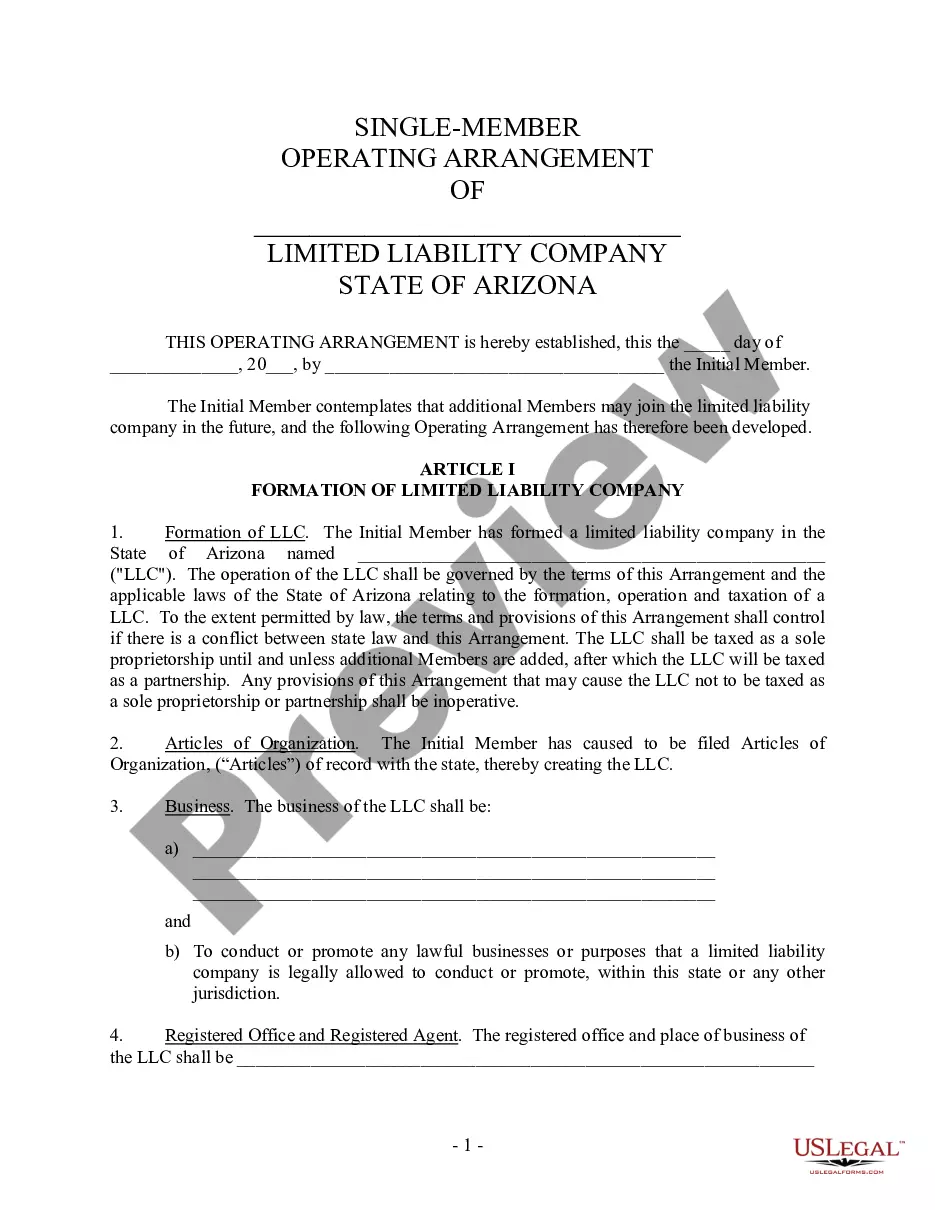

Utilize the US Legal Forms website. The service offers thousands of templates, including the South Carolina Self-Employed Independent Contractor Employment Agreement - General, which you can use for both business and personal purposes.

All forms are reviewed by experts and comply with state and federal regulations.

If the form does not meet your requirements, use the Search field to find the appropriate form. Once you are certain it fits your needs, click the Buy now button to acquire the form. Choose your payment plan and provide the necessary information. Create your account and pay for the order using your PayPal account or Visa or Mastercard. Select the file format and download the legal document template to your device. Complete, revise, and print the received South Carolina Self-Employed Independent Contractor Employment Agreement - General. US Legal Forms is the largest collection of legal forms where you can find numerous document templates. Use the service to obtain professionally crafted documents that comply with state regulations.

- If you are already registered, Log In to your account and click on the Acquire button to access the South Carolina Self-Employed Independent Contractor Employment Agreement - General.

- Use your account to browse the legal forms you have previously purchased.

- Visit the My documents tab of your account to download another copy of the document you desire.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- First, ensure you have selected the correct form for your specific city/county.

- You can preview the form using the Preview button and review the form description to confirm it's the right one for you.

Form popularity

FAQ

Simply put, being an independent contractor is a way of being self-employed. Is an independent contractor self-employed? Yes. Independent contractors are self-employed who earn an income but do not work as employees.

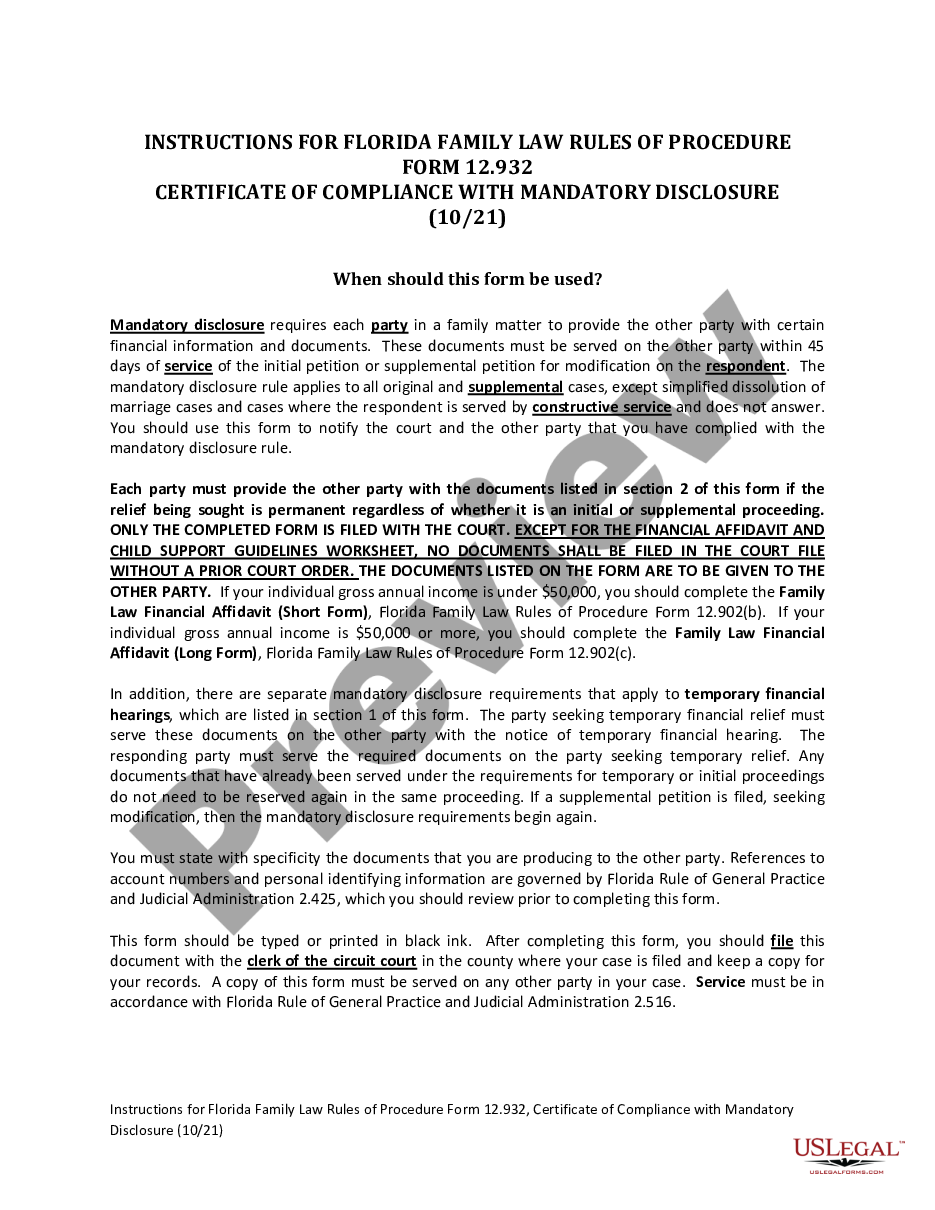

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

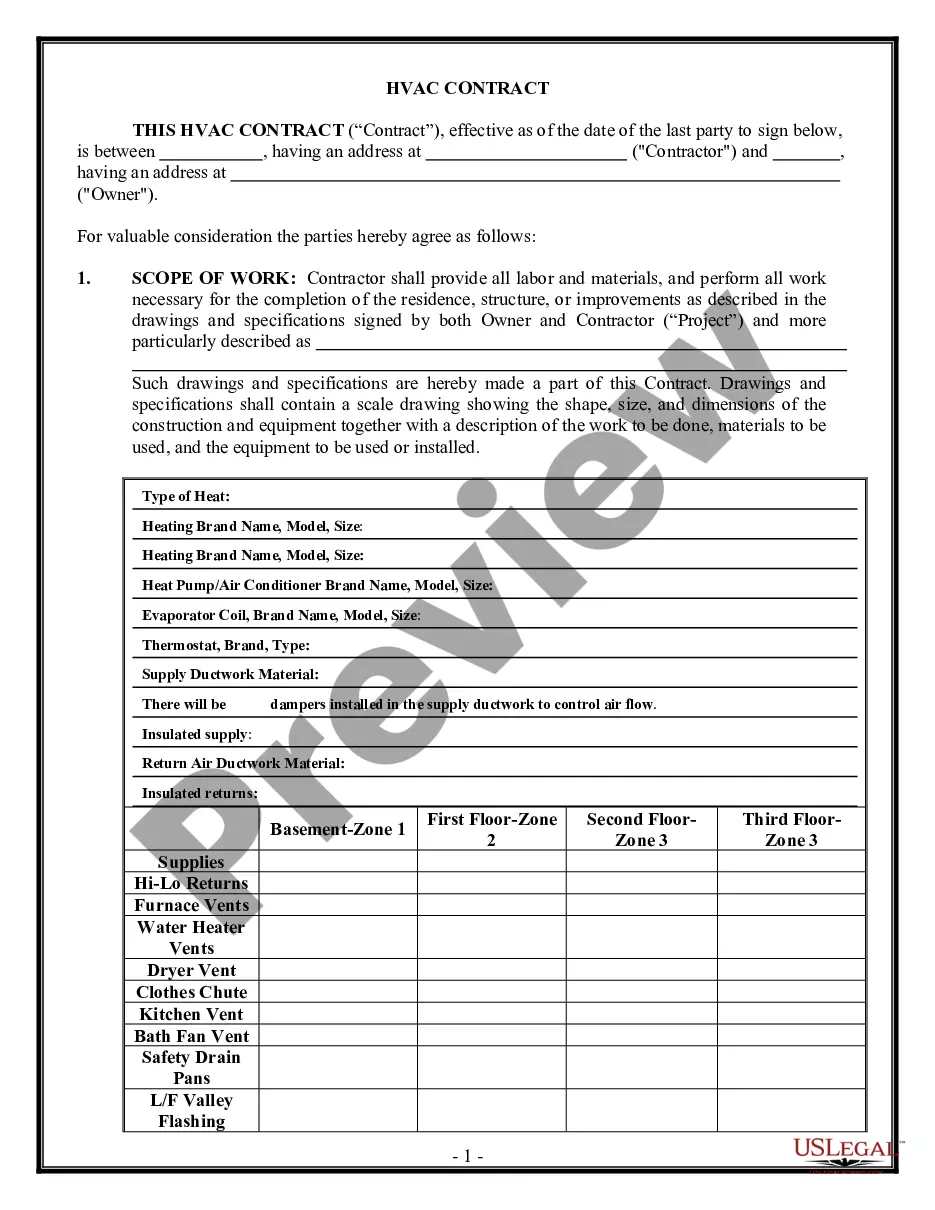

What Should an Independent Contractor Agreement Contain?Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved.Responsibilities & Deliverables.Payment-Related Details.Confidentiality Clause.Contract Termination.Choice of Law.

An Independent Contractor Agreement is a written contract that outlines the terms and conditions of the working arrangement between an independent contractor and client, including: A description of the services provided. Terms and length of the project or service.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

Independent contractors use 1099 forms. In California, workers who report their income on a Form 1099 are independent contractors, while those who report it on a W-2 form are employees. Payroll taxes from W-2 employees are automatically withheld, while independent contracts are responsible for paying them.