South Carolina Specialty Services Contact - Self-Employed

Description

How to fill out Specialty Services Contact - Self-Employed?

Are you currently in the situation where you require documentation for either business or personal purposes almost every time.

There are numerous legal document templates available on the internet, but finding ones you can rely on is not easy.

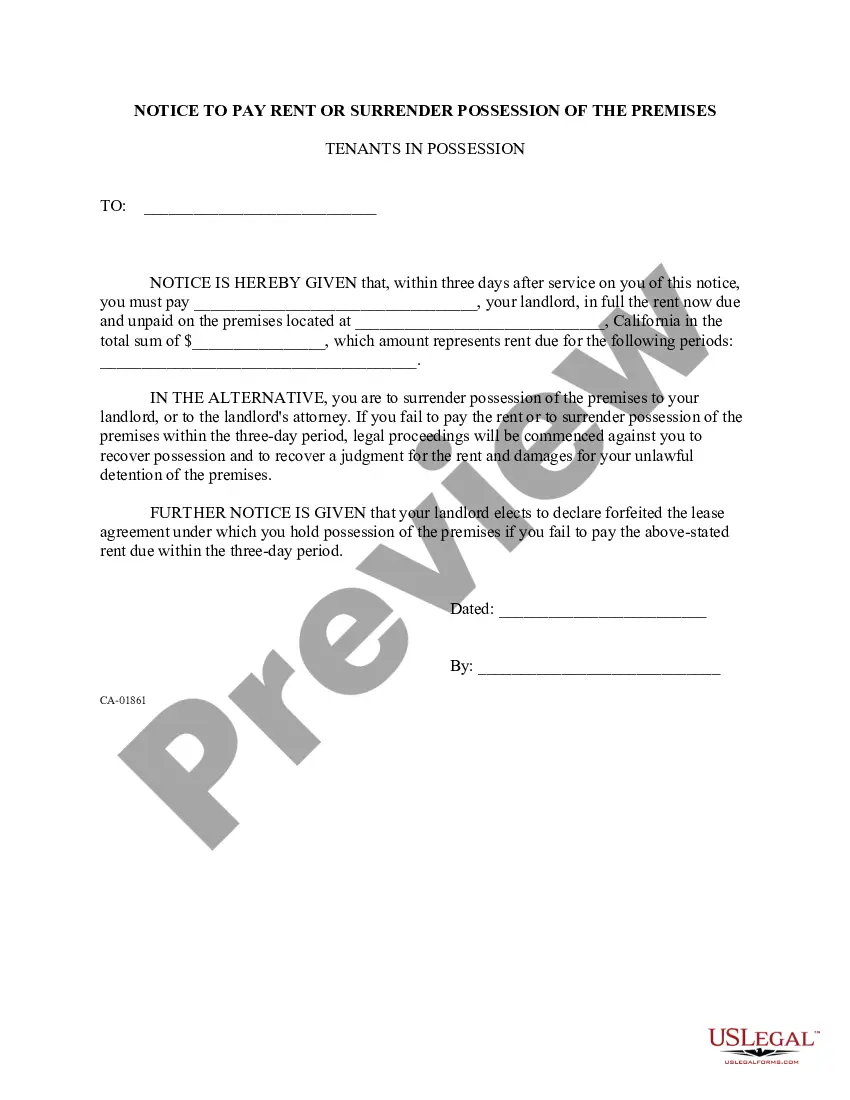

US Legal Forms provides thousands of form templates, such as the South Carolina Specialty Services Contact - Self-Employed, designed to comply with federal and state regulations.

Once you find the appropriate form, click Buy now.

Select the pricing plan you prefer, enter the necessary details to create your account, and purchase your order using your PayPal or credit card. Choose a convenient document format and download your copy. Access all the document templates you have purchased in the My documents list. You can obtain an additional copy of South Carolina Specialty Services Contact - Self-Employed at any time by clicking on the desired form to download or print the document template. Utilize US Legal Forms, one of the largest collections of legal forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the South Carolina Specialty Services Contact - Self-Employed template.

- If you do not have an account and would like to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/area.

- Use the Review button to evaluate the form.

- Check the summary to confirm that you have selected the correct form.

- If the form is not what you are looking for, utilize the Search field to find the form that fits your requirements.

Form popularity

FAQ

Yes, in South Carolina, income from consulting services is considered taxable. If you provide consulting services as a self-employed individual, you are required to report that income on your tax returns. Leveraging the support of South Carolina Specialty Services Contact - Self-Employed can provide you clarity on your tax obligations and help you navigate any nuances specific to your consulting business. Staying informed about tax requirements is essential for your success.

To file self-employment forms, start by gathering all necessary documents, including your income statements and expense records. You will typically use IRS Form 1040 Schedule C to report your earnings and expenses. The South Carolina Specialty Services Contact - Self-Employed offers tools and resources to help streamline this process and ensure you submit your forms accurately. Filing your forms properly can save you time and stress in the long run.

As a self-employed individual, you can prove your income with various documents, including tax returns, bank statements, and invoices. Keeping organized records will make it easier to show your earnings if needed for loans or other applications. The South Carolina Specialty Services Contact - Self-Employed team can guide you in structuring your documentation to present a clear picture of your financial status. Always ensure your paperwork is thorough to enhance credibility.

Receiving a 1099 form means you earned income as an independent contractor or freelancer, which typically indicates you're self-employed. However, not all self-employed individuals receive a 1099; some may generate income from business ownership or other sources. Consulting the South Carolina Specialty Services Contact - Self-Employed can help clarify your specific situation and ensure you manage your income correctly. Understanding this distinction is vital for your tax filings.

Obtaining your specialty contractor license in South Carolina involves several key steps, starting with confirming your qualifications and project requirements. Once you've verified your eligibility, you'll need to complete the relevant application forms and submit them along with any required documentation. If you're looking for support during this journey, consider leveraging the resources provided by South Carolina Specialty Services Contact - Self-Employed to ensure a smooth application process.

The independent contractor law in South Carolina outlines the standards that determine whether a worker qualifies as an independent contractor or an employee. This classification affects tax obligations, liability, and workers' compensation. Understanding these laws can significantly impact your business operations and compliance; resources from South Carolina Specialty Services Contact - Self-Employed can assist you in navigating these regulations.

To obtain a specialty contractor license in South Carolina, you first need to meet specific eligibility requirements, including experience and education in your trade. Next, you can submit an application to the South Carolina Department of Labor, Licensing, and Regulation. Utilizing services from South Carolina Specialty Services Contact - Self-Employed can streamline this process with expert guidance on paperwork and requirements.

Yes, you can issue a 1099 to an individual without a business license as long as they are providing services as an independent contractor. However, it is crucial to ensure that the services they offer qualify under IRS regulations. To maintain compliance, consider consulting with legal or tax professionals knowledgeable in the area, where resources from South Carolina Specialty Services Contact - Self-Employed can guide you.

In South Carolina, the specialty contractor license limit depends on the specific classification and the nature of the work you intend to perform. Generally, the state allows you to manage projects up to a certain financial threshold without requiring additional bonding or full licensure. For a more detailed understanding of your limits, it's beneficial to consult with professionals or resources available through the South Carolina Specialty Services Contact - Self-Employed platform.

To qualify as an independent contractor, you must have the freedom to control how you complete your work, without being stricted by an employer. You typically provide your own tools and set your own hours. Moreover, independent contractors often work for multiple clients simultaneously, allowing for more autonomy. If you need help navigating these qualifications, the US Legal platform is a great resource for South Carolina Specialty Services Contact - Self-Employed solutions.