South Carolina Disability Services Contract - Self-Employed

Description

How to fill out Disability Services Contract - Self-Employed?

If you need to compile, acquire, or print authorized document templates, utilize US Legal Forms, the largest collection of legal forms, available online. Take advantage of the site’s user-friendly and efficient search to find the documents you need. Various templates for commercial and personal purposes are categorized by types and states, or keywords.

Use US Legal Forms to obtain the South Carolina Disability Services Contract - Self-Employed with just a few clicks.

If you are already a US Legal Forms user, Log In to your account and then click the Download button to get the South Carolina Disability Services Contract - Self-Employed. You can also access forms you previously downloaded in the My documents section of your account.

Every legal document template you purchase is yours permanently. You will have access to every form you downloaded in your account. Go to the My documents section and select a form to print or download again.

Stay competitive and obtain, and print the South Carolina Disability Services Contract - Self-Employed with US Legal Forms. There are thousands of professional and state-specific templates you can use for your business or personal needs.

- Step 1. Ensure you have selected the form for the correct city/state.

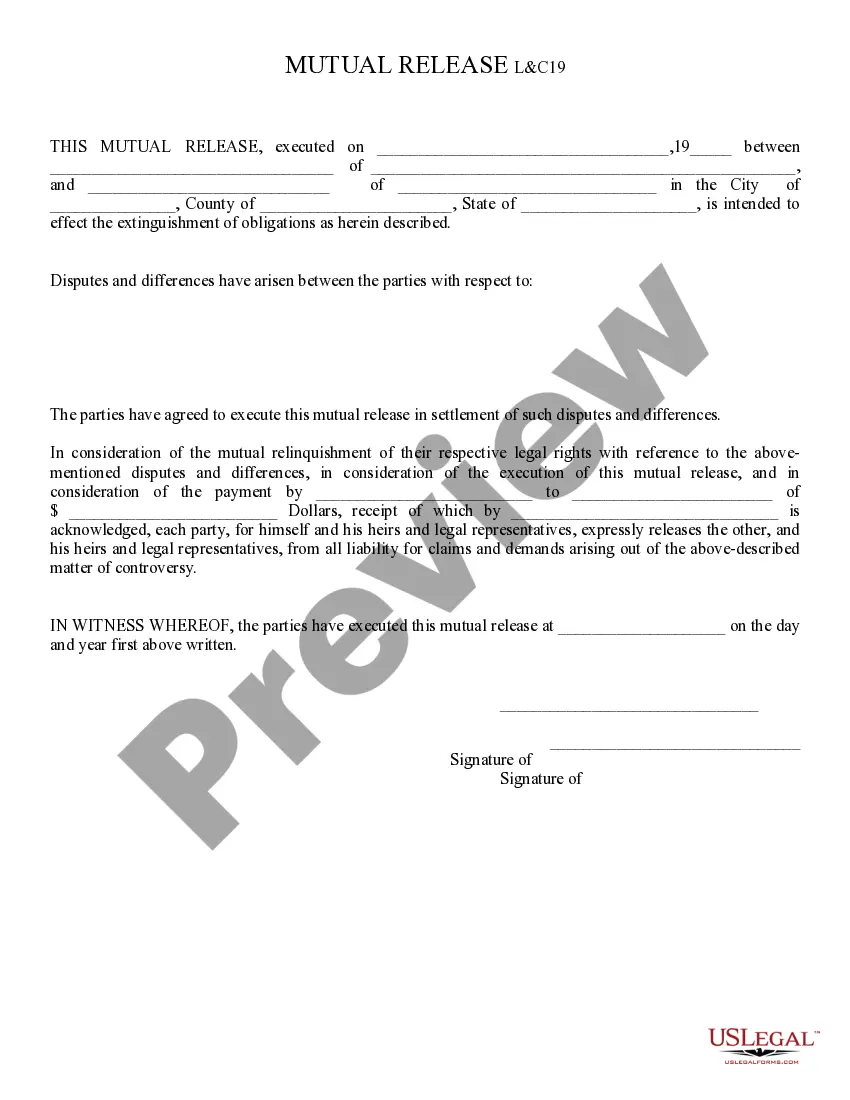

- Step 2. Use the Preview option to review the form’s content. Remember to check the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your information to create an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the South Carolina Disability Services Contract - Self-Employed.

Form popularity

FAQ

Self-employed individuals can indeed claim disability benefits if they meet the necessary requirements. They must provide evidence of their disability and how it impacts their ability to work. For those under a South Carolina Disability Services Contract - Self-Employed, understanding how to present their case effectively can improve their chances of approval. Utilizing platforms like uslegalforms can assist in navigating the claims process.

Yes, self-employed individuals can file for disability benefits under certain conditions. To qualify, they must demonstrate that their disability prevents them from working. Those operating under a South Carolina Disability Services Contract - Self-Employed should keep thorough records of their income and work history. This documentation is vital when filing for benefits.

Independent contractors in South Carolina are subject to self-employment taxes, which currently stand at 15.3%. This rate includes Social Security and Medicare taxes. Additionally, self-employed individuals must also consider state income tax, which varies based on income levels. Being aware of these tax obligations is key for those operating under a South Carolina Disability Services Contract - Self-Employed.

The independent contractor law in South Carolina defines the relationship between workers and businesses. It ensures that independent contractors, including those involved in South Carolina Disability Services Contract - Self-Employed, are classified correctly. This classification affects taxation, benefits, and legal responsibilities. Understanding this law is crucial for self-employed individuals to ensure compliance and maximize their benefits.

Self-employment can provide flexibility and independence for people with disabilities. Through the South Carolina Disability Services Contract - Self-Employed, you can create a work environment that suits your needs and skills. Additionally, being your own boss allows you to set your own hours and work at your own pace. This option can lead to personal fulfillment and financial stability.

Absolutely, you can be on disability and own a business. The South Carolina Disability Services Contract - Self-Employed allows individuals to pursue self-employment while still receiving disability benefits. It’s crucial to understand the income limitations and reporting requirements associated with your benefits. With the right resources, you can successfully balance your business and disability needs.

Yes, owning an LLC while on disability is possible. The South Carolina Disability Services Contract - Self-Employed offers guidance on how to manage your business and disability benefits simultaneously. Make sure to report your income accurately to avoid any complications with your benefits. This way, you can enjoy the flexibility of being self-employed while receiving support.

Yes, you can run a business while on disability. However, it's important to understand how your earnings may impact your benefits. With the South Carolina Disability Services Contract - Self-Employed, you can explore options that allow you to maintain your business without losing your disability benefits. Consulting with a professional can help you navigate the rules effectively.

The average disability payment in South Carolina varies depending on several factors, including your work history and the specific program you qualify for under the South Carolina Disability Services Contract - Self-Employed. Generally, payments can range widely, so it's crucial to assess your situation individually. To get detailed information tailored to your needs, visit the US Legal Forms platform for helpful resources and guidance.

Yes, self-employment can count towards disability benefits under the South Carolina Disability Services Contract - Self-Employed. If you are self-employed and meet the necessary criteria, you can still qualify for benefits. It is essential to report your income accurately, as it will affect your eligibility. For personalized assistance, consider exploring resources on the US Legal Forms platform.