South Carolina How to Request a Home Affordable Modification Guide

Description

How to fill out How To Request A Home Affordable Modification Guide?

Are you presently in a situation where you frequently require documents for either business or personal purposes? There is an assortment of legal document templates accessible online, but locating reliable versions is challenging.

US Legal Forms offers a vast collection of form templates, including the South Carolina How to Request a Home Affordable Modification Guide, which can be downloaded to satisfy federal and state requirements.

If you are familiar with the US Legal Forms website and possess an account, simply Log In. After this, you can download the South Carolina How to Request a Home Affordable Modification Guide template.

Access all the document templates you have purchased in the My documents menu. You can acquire an additional copy of the South Carolina How to Request a Home Affordable Modification Guide at any time if needed. Simply select the desired form to download or print the document template.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service provides expertly crafted legal document templates suitable for a variety of purposes. Create your account on US Legal Forms and start simplifying your life.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Identify the form you require and confirm it is for the correct city/state.

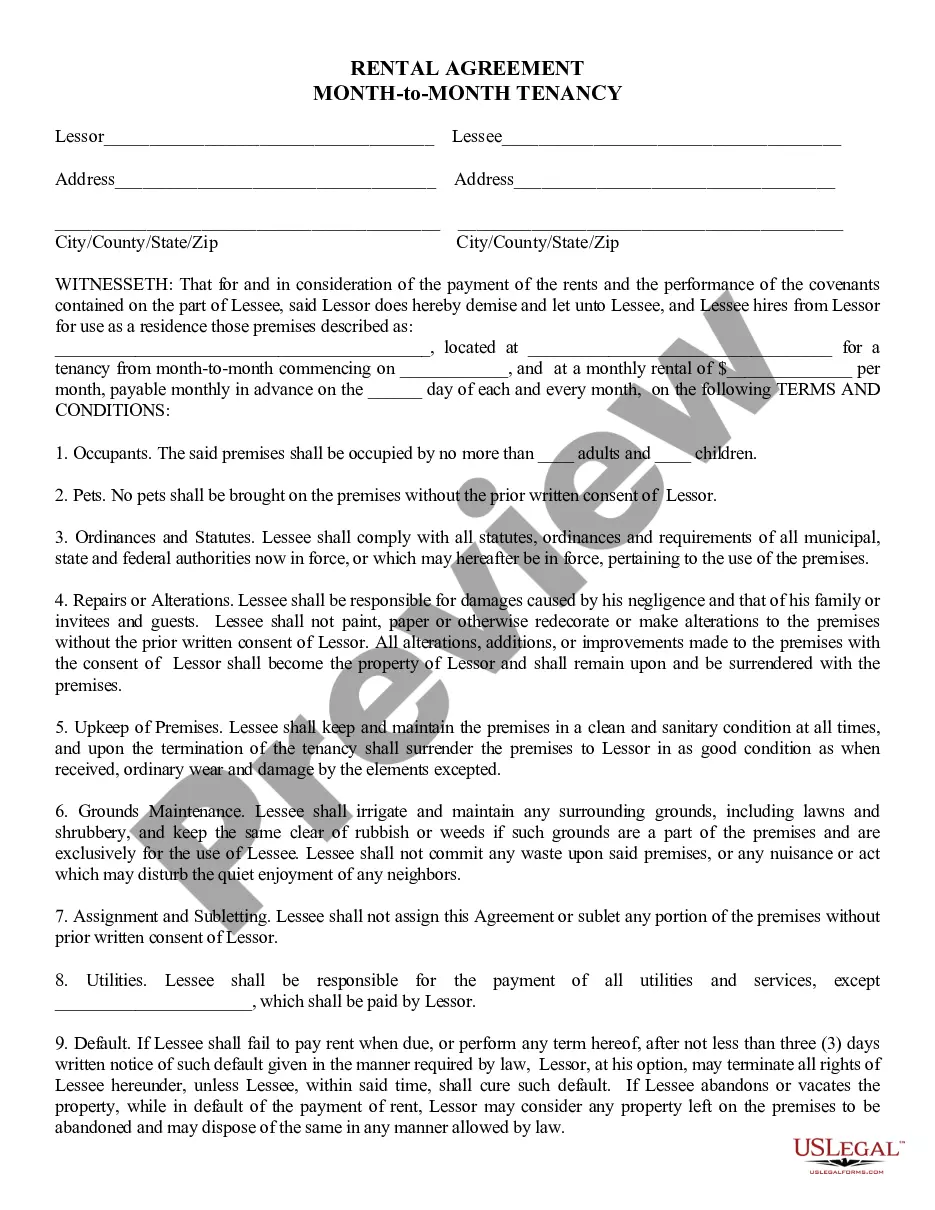

- Utilize the Preview button to review the form.

- Read the description to ensure you have selected the right form.

- If the form does not match your needs, use the Search area to find a form that fits your requirements.

- Once you find the correct form, click on Get now.

- Select the pricing plan you prefer, provide the necessary information to create your account, and process the payment using your PayPal or credit card.

- Choose a suitable file format and download your copy.

Form popularity

FAQ

The South Carolina home repair program aims to assist homeowners facing financial difficulties with necessary home repairs. This program provides various forms of support, which may include grants or low-interest loans to ensure that your home remains safe and livable. If you need more information, referring to the South Carolina How to Request a Home Affordable Modification Guide can provide insights on how these resources may complement your mortgage modification efforts.

Applying for a mortgage modification involves submitting a formal request to your lender, along with supporting documentation regarding your financial condition. You will need to fill out specific forms and provide evidence of income and expenses. The South Carolina How to Request a Home Affordable Modification Guide can serve as an invaluable resource, guiding you through each step to ensure you meet all requirements.

The process of obtaining a mortgage modification can vary based on your financial situation and the responsiveness of your lender. While some borrowers find the application straightforward, others may encounter challenges due to paperwork or eligibility requirements. Utilizing the South Carolina How to Request a Home Affordable Modification Guide can greatly simplify your experience and help you navigate the process effectively.

To qualify for a mortgage modification in South Carolina, borrowers typically need to demonstrate financial hardship. This condition could arise from job loss, medical expenses, or other significant life changes. It is essential to provide required documents, including income statements and any proof of hardship, as outlined in the South Carolina How to Request a Home Affordable Modification Guide.

HAMP stands for the Home Affordable Modification Program, which is a federal initiative designed to help homeowners facing financial difficulties modify their mortgage loans. Through this program, eligible homeowners can receive a reduction in their monthly payments, making housing more affordable. Understanding HAMP is essential, especially when navigating the South Carolina How to Request a Home Affordable Modification Guide for personal financial solutions.

The SC Housing Trust Fund Home Repair Program assists low-income homeowners who need essential repairs to ensure their homes are safe and livable. The program often covers critical repairs like plumbing, electrical work, and roofing. For those in need of home modifications, referring to the South Carolina How to Request a Home Affordable Modification Guide can provide further insights into financial assistance options.

To qualify for the Virginia Mortgage Relief Program, applicants must demonstrate financial hardship related to the COVID-19 pandemic and need assistance with their mortgage payments. The program is designed to help homeowners avoid foreclosure and stabilize their housing situation. By learning about the South Carolina How to Request a Home Affordable Modification Guide, you can explore additional options that may benefit your situation.