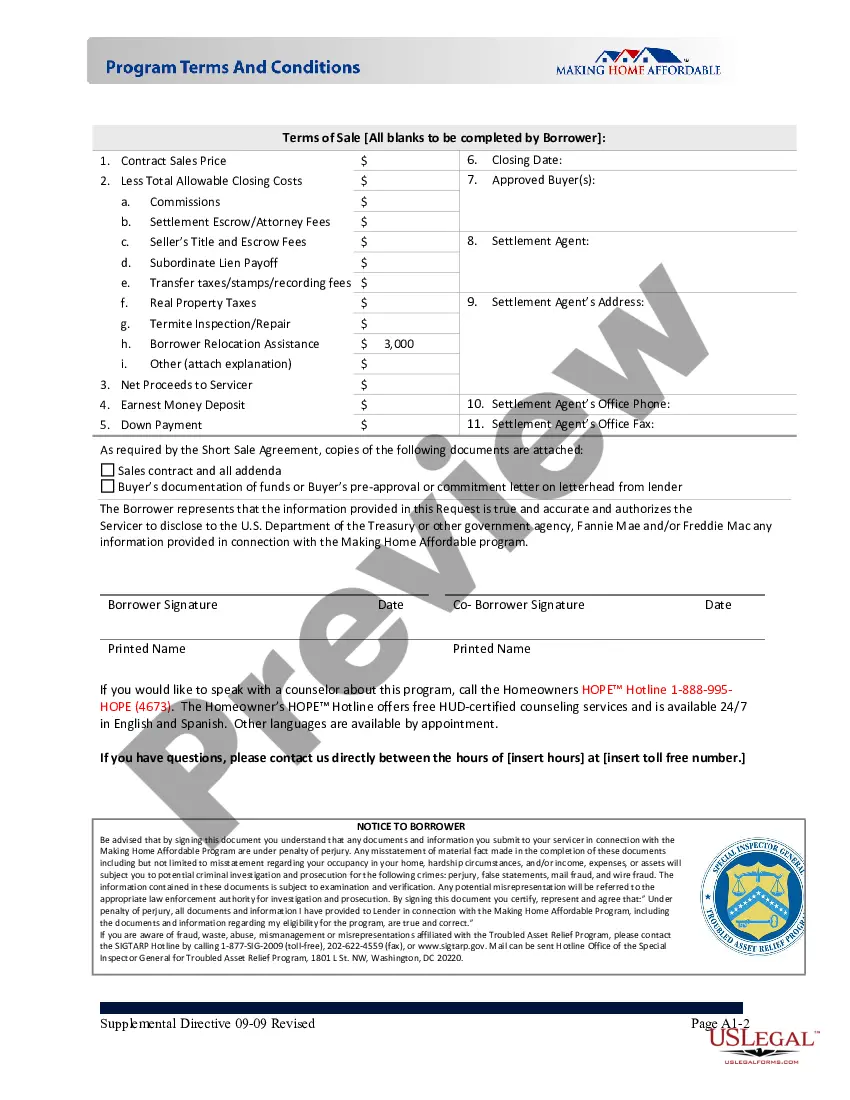

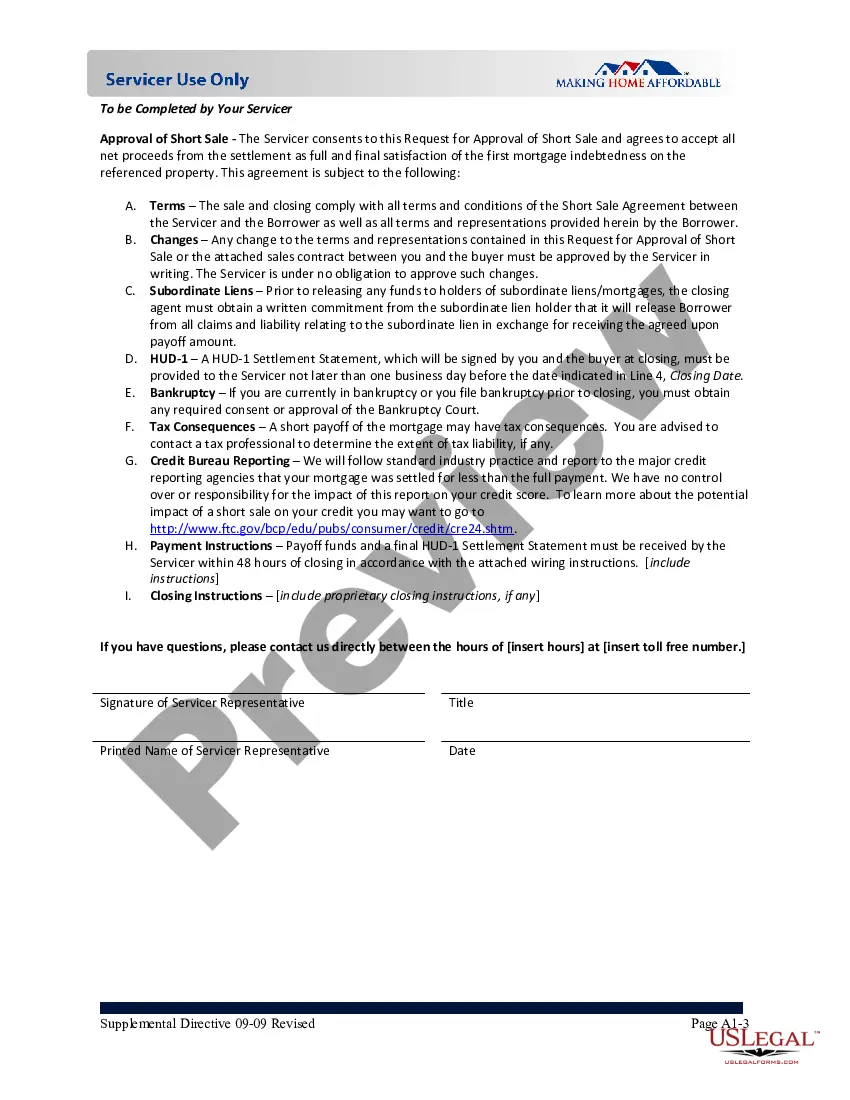

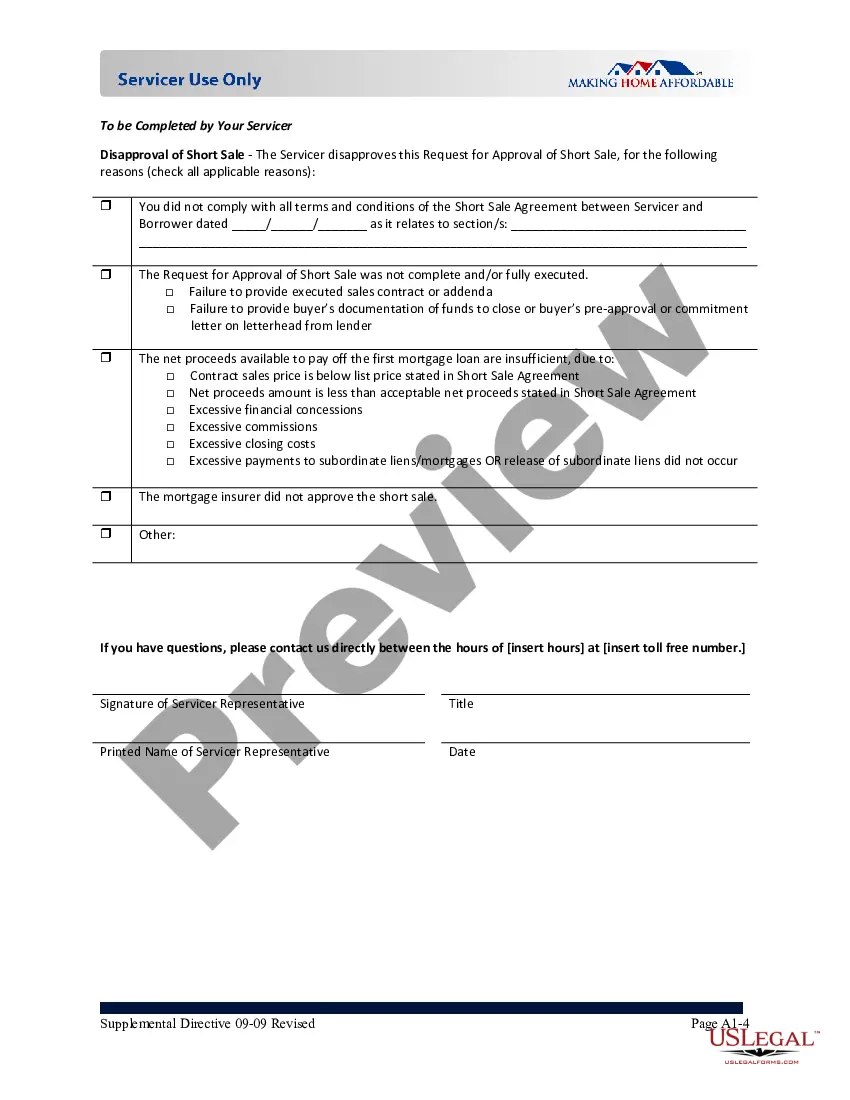

South Carolina MHA Request for Short Sale

Description

How to fill out MHA Request For Short Sale?

Are you presently in a situation where you require documents for various business or personal reasons frequently.

There are numerous legitimate document templates available online, but finding ones you can rely on is challenging.

US Legal Forms offers a vast selection of form templates, including the South Carolina MHA Request for Short Sale, tailored to meet state and federal regulations.

Once you locate the correct form, click on Acquire now.

Select the pricing plan you prefer, complete the required information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the South Carolina MHA Request for Short Sale template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your specific location/state.

- Utilize the Review button to verify the form.

- Check the details to confirm that you have chosen the correct form.

- If the form does not match your needs, use the Search field to locate the form that suits your requirements.

Form popularity

FAQ

Section 29 3 330 in South Carolina outlines the legal framework for specific mortgage transactions and foreclosures. This section ensures that borrowers are treated fairly under the law, providing them certain rights during foreclosure proceedings. If you are considering a South Carolina MHA Request for Short Sale, being knowledgeable about this section can be beneficial. It equips you with information that can be crucial in negotiations and legal considerations.

Foreclosing on an owner-financed property in South Carolina involves a specific legal process that may require court intervention. Generally, the lender must notify the borrower and provide them with the opportunity to remedy any defaults. If you are navigating this path and considering a South Carolina MHA Request for Short Sale, it’s advisable to consult with an experienced attorney. They can help you understand your rights and the steps to take for a successful resolution.

Section 29 3 330 of the South Carolina Code pertains to the rights of the lender and borrower in foreclosure proceedings. It specifically addresses procedures related to the foreclosure of loans secured by residential properties. Understanding this section is important when considering a South Carolina MHA Request for Short Sale, as it can impact your ability to negotiate or resolve foreclosure issues favorably. Familiarizing yourself with these laws can empower you in financial discussions.

The choice between a deed of trust and a mortgage often depends on individual circumstances. A deed of trust involves three parties: the borrower, the lender, and a trustee, while a mortgage involves two parties. If you are exploring options to manage your property through a South Carolina MHA Request for Short Sale, it’s vital to weigh the benefits of each type of agreement. Consulting with a legal professional can guide you to the best option for your situation.

Yes, due diligence is an essential aspect of real estate transactions in South Carolina. Buyers are encouraged to conduct thorough inspections and reviews of property titles and conditions before finalizing any agreements. When you are considering a South Carolina MHA Request for Short Sale, due diligence can protect your interests and ensure a smoother process. It helps identify potential issues, allowing you to make informed decisions.

In South Carolina, a debt can become uncollectible after a period of three years. This timeframe is established by the statute of limitations, which varies by the type of debt. If you are dealing with a financial struggle and considering a South Carolina MHA Request for Short Sale, understanding these timelines can be crucial. A proactive approach may help you address your financial obligations more effectively.

In South Carolina, the foreclosure process typically begins after a homeowner has missed several mortgage payments, usually around three to six months. However, the exact time can vary depending on the lender's policies and practices. If you’re struggling with payments, consider looking into a South Carolina MHA Request for Short Sale to find a viable option before foreclosure becomes inevitable.

In South Carolina, there is a redemption period after foreclosure where homeowners can reclaim their property. This period typically lasts for one year from the date of the foreclosure sale. If you find yourself facing a foreclosure, you might explore a South Carolina MHA Request for Short Sale to alleviate some pressure and preserve your credit.

Yes, South Carolina is a due diligence state. This means that buyers and sellers must conduct thorough research and assessments before closing a deal. If you are considering a South Carolina MHA Request for Short Sale, it's crucial to understand your responsibilities during this period and ensure that you have all necessary documentation ready.

Yes, a seller can back out of a real estate contract in South Carolina, but it may result in legal repercussions. Sellers must have valid reasons linked to contract contingencies or mutual agreement for termination. It’s wise to consult legal resources when dealing with a South Carolina MHA Request for Short Sale, as the situation can be complex.