South Carolina Simple Agreement for Future Equity

Description

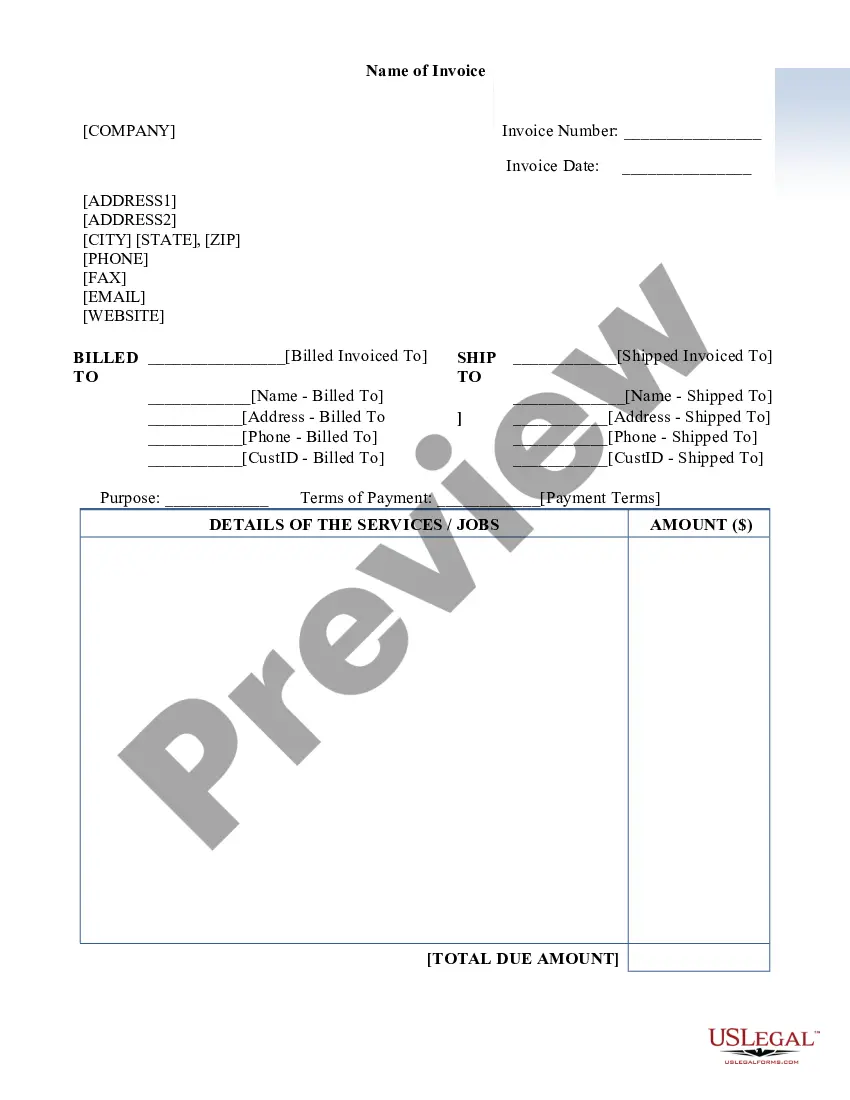

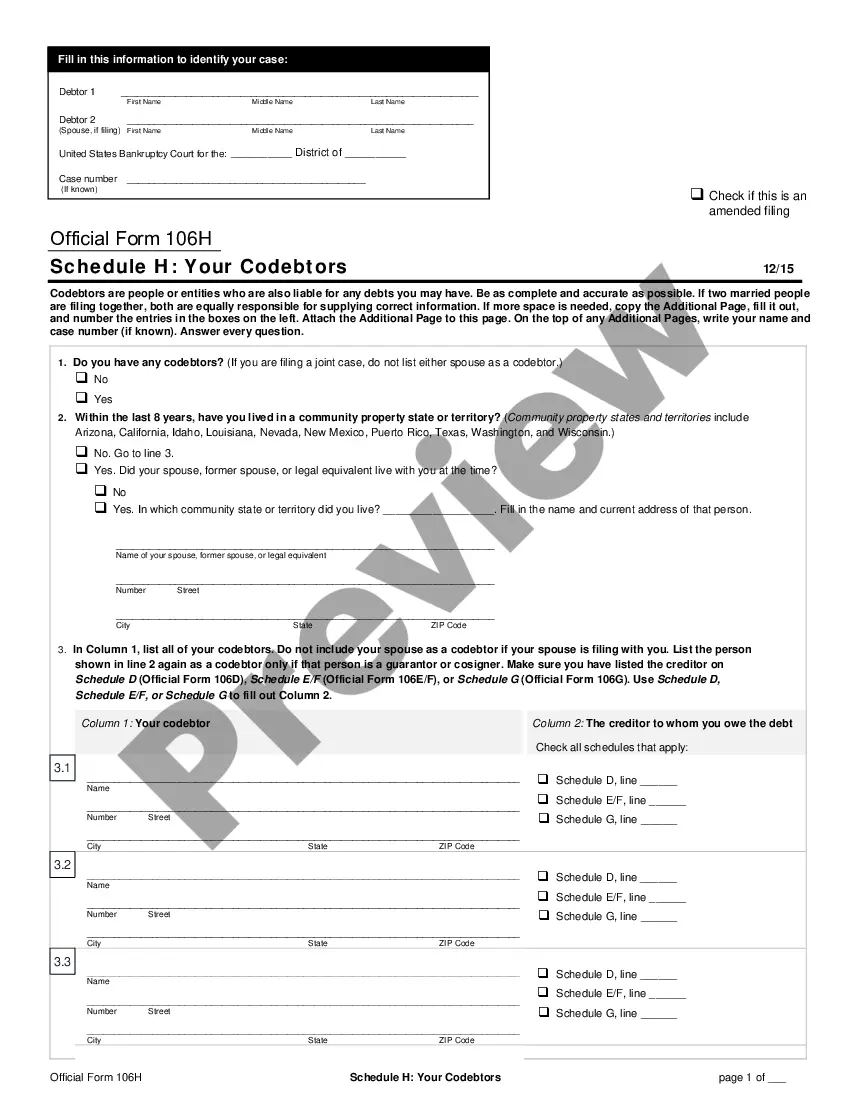

How to fill out Simple Agreement For Future Equity?

US Legal Forms - one of many biggest libraries of legitimate forms in the United States - provides an array of legitimate document layouts you may download or print out. While using internet site, you will get a large number of forms for business and specific reasons, categorized by categories, states, or keywords.You can find the most up-to-date types of forms just like the South Carolina Simple Agreement for Future Equity within minutes.

If you have a monthly subscription, log in and download South Carolina Simple Agreement for Future Equity through the US Legal Forms library. The Download switch can look on each form you view. You have accessibility to all in the past acquired forms inside the My Forms tab of your own account.

If you would like use US Legal Forms the very first time, listed below are simple directions to get you started:

- Be sure you have picked out the proper form for your metropolis/state. Click on the Preview switch to analyze the form`s content. Look at the form description to actually have selected the proper form.

- In case the form does not match your demands, take advantage of the Search field on top of the screen to get the one which does.

- In case you are satisfied with the form, affirm your selection by clicking on the Get now switch. Then, choose the pricing program you favor and give your accreditations to register to have an account.

- Procedure the deal. Utilize your bank card or PayPal account to finish the deal.

- Select the structure and download the form on the device.

- Make adjustments. Fill up, edit and print out and sign the acquired South Carolina Simple Agreement for Future Equity.

Every single design you added to your money does not have an expiry particular date and it is yours forever. So, in order to download or print out one more version, just proceed to the My Forms section and then click about the form you require.

Gain access to the South Carolina Simple Agreement for Future Equity with US Legal Forms, probably the most considerable library of legitimate document layouts. Use a large number of skilled and status-certain layouts that meet your small business or specific requirements and demands.

Form popularity

FAQ

SAFEs are generally considered taxable at the time of the triggering event, when the SAFE converts into equity (i.e. stock in the company).

Cons: SAFE investors assume most, if not all, of the risk, in that there is no guarantee of any equity ownership in the company. ... A SAFE holder is not entitled to any company assets in the event of a liquidation.

What's Included in a Simple Agreement for Future Equity? The key terms of a SAFE include the investment amount, the valuation cap, and the conversion discount.

Determine valuation cap for SAFE. The SAFE discount is derived by dividing the valuation cap by the typical equity financing valuation and then removing that value from one (representing no discount). In this case, $2 million / $4 million = 0.5 and 1 ? 0.5 = 0.5 would be the mathematical representations.

A simple agreement for future equity (SAFE) is a financing contract that may be used by a start-up company to raise capital in its seed financing rounds. The instrument is viewed by some as a more founder-friendly alternative to convertible notes because a SAFE is quicker and easier to negotiate and has fewer terms.

A simple agreement for future equity (SAFE) is an agreement between an investor and a company that provides rights to the investor for future equity in the company similar to a warrant, except without determining a specific price per share at the time of the initial investment.

Calculation ing to the Discount Rate The total shares are calculated ing to the SAFE money invested divided by the share price in the next round, multiplied by the discount rate. If we take our example above, if during the next financing round, the company raises money ing to a share price of $10.

A simple agreement for future equity delays valuation of a company until it has more performance data on which to base a valuation. At the same time, it promises an investor the right to buy future equity when a valuation is made. A SAFE can be converted into preferred stock in the future.