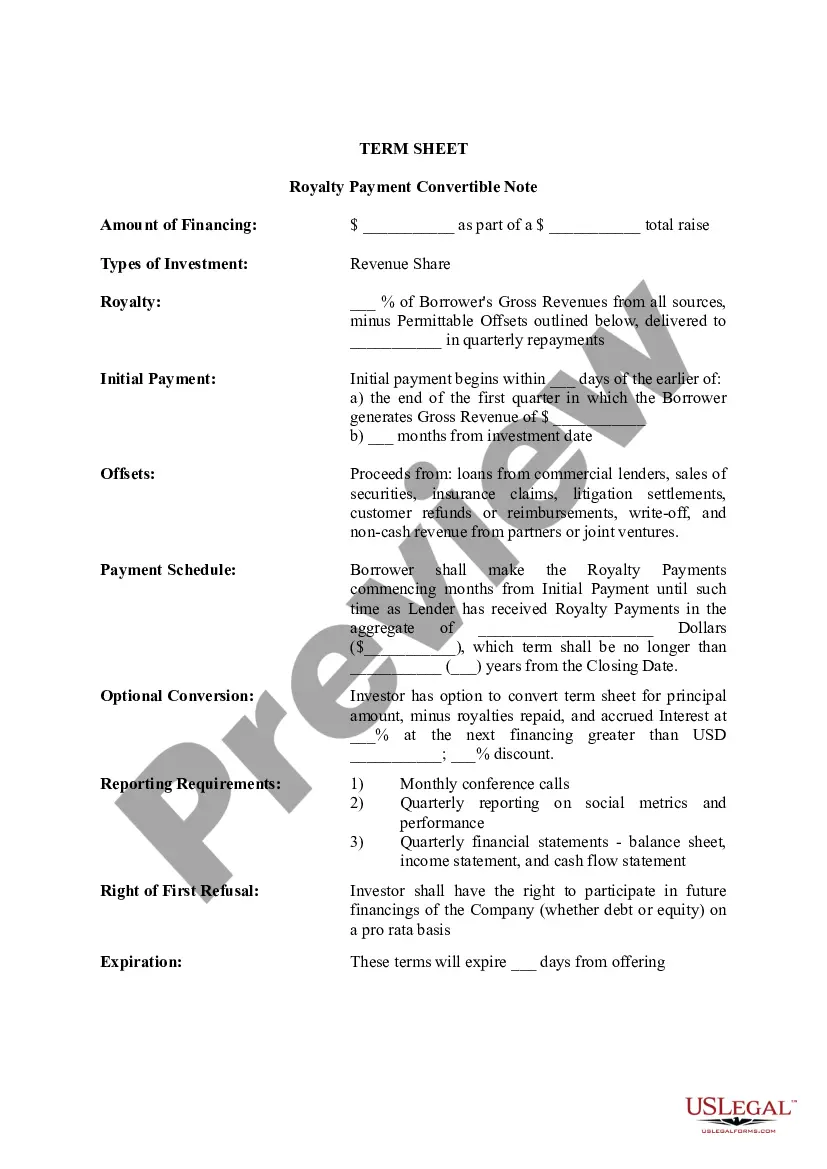

South Carolina Term Sheet - Royalty Payment Convertible Note

Description

How to fill out Term Sheet - Royalty Payment Convertible Note?

US Legal Forms - one of several biggest libraries of legal forms in the United States - gives a variety of legal file web templates you can download or print. Using the internet site, you can get a large number of forms for enterprise and personal functions, categorized by categories, claims, or keywords.You will find the most up-to-date types of forms much like the South Carolina Term Sheet - Royalty Payment Convertible Note within minutes.

If you already have a registration, log in and download South Carolina Term Sheet - Royalty Payment Convertible Note in the US Legal Forms local library. The Download switch can look on each type you perspective. You have access to all formerly acquired forms in the My Forms tab of your respective bank account.

If you want to use US Legal Forms for the first time, allow me to share simple guidelines to help you get started:

- Be sure you have selected the proper type for your personal town/county. Click on the Preview switch to check the form`s content material. Look at the type description to ensure that you have selected the appropriate type.

- In case the type doesn`t fit your specifications, use the Lookup field towards the top of the screen to find the one which does.

- If you are pleased with the shape, verify your option by simply clicking the Purchase now switch. Then, select the rates program you favor and give your references to register to have an bank account.

- Procedure the purchase. Use your credit card or PayPal bank account to complete the purchase.

- Pick the structure and download the shape on your own gadget.

- Make modifications. Load, change and print and indicator the acquired South Carolina Term Sheet - Royalty Payment Convertible Note.

Each and every format you added to your bank account lacks an expiration time and is also the one you have for a long time. So, in order to download or print yet another backup, just check out the My Forms segment and then click around the type you will need.

Gain access to the South Carolina Term Sheet - Royalty Payment Convertible Note with US Legal Forms, probably the most considerable local library of legal file web templates. Use a large number of specialist and express-particular web templates that meet your small business or personal requires and specifications.

Form popularity

FAQ

Common provisions of a convertible debt financing include: The interest rate. Usually somewhere between 4% and 8%. The maturity date. Usually 12?24 months. A mandatory conversion paragraph. ... An optional conversion paragraph. ... A change of control provision. ... A conversion discount. ... A valuation cap. ... An amendment provision.

SAFE notes are technically equity, not debt, and we account for them as equity on the balance sheet. This has important ramifications for investors who are trying to take advantage of the Qualified Small Business Stock (QSBS) exclusion.

So the cash coming in from your convertible note will generally equate to the liability that you add to the balance sheet. And, if your accounting is doing a good job, the accrued interest is a non-cash expense that flows through your income statement and impacts your accumulated net income in the equity section.

Although it is customary to forego a term sheet, in some cases it may be required if the parties need to negotiate certain terms. It can be advantageous to use a term sheet for the company to easily summarize the terms of the notes for potential other investors purchasing a convertible note.

Copyright PURE Asset Management 2022. A convertible note, also called a hybrid security or hybrid, refers to a debt instrument that can be converted into equity (ownership in a company) at some point in time in the future.

Calculating post-money valuation Post-money valuation = Pre-money valuation + Size of investment. ... Share price = New investment amount / # of new shares received. ... Post-money valuation / total # of shares post-investment = New investment amount / # of new shares received.

Convertible Notes are loans ? so they are recorded on the Balance Sheet of a company as a liability when they are made. Depending on the debt's maturity date, they can either be shown as a current liability (loans maturing within 12 months) or as a Long-term liability (loans maturing over 12 months).

Convertible bonds can affect all three sections of a balance sheet. Asset accounts ?cash? and ?debt issue costs? reflect proceeds and expenses from issuing a bond. You also update the cash account when you repay the face value of a maturing bond.