South Carolina Angel Fund Promissory Note Term Sheet

Description

Term sheet is a non-binding agreement setting forth the basic terms and conditions under which an investment will be made."

How to fill out Angel Fund Promissory Note Term Sheet?

Finding the right lawful papers web template might be a struggle. Needless to say, there are plenty of themes accessible on the Internet, but how will you discover the lawful kind you will need? Utilize the US Legal Forms web site. The support delivers a huge number of themes, for example the South Carolina Angel Fund Promissory Note Term Sheet, that you can use for business and personal requirements. Every one of the varieties are checked by professionals and satisfy federal and state demands.

When you are currently authorized, log in in your accounts and click on the Acquire button to obtain the South Carolina Angel Fund Promissory Note Term Sheet. Make use of your accounts to appear throughout the lawful varieties you might have purchased formerly. Visit the My Forms tab of your accounts and get yet another copy in the papers you will need.

When you are a fresh consumer of US Legal Forms, listed here are simple instructions so that you can follow:

- Initial, make sure you have chosen the correct kind for your personal town/state. You may examine the form using the Review button and read the form information to ensure this is the right one for you.

- In the event the kind will not satisfy your requirements, utilize the Seach field to get the right kind.

- When you are positive that the form would work, click the Purchase now button to obtain the kind.

- Opt for the costs prepare you would like and type in the necessary info. Build your accounts and pay money for the transaction using your PayPal accounts or bank card.

- Opt for the submit structure and acquire the lawful papers web template in your gadget.

- Full, revise and print and indicator the acquired South Carolina Angel Fund Promissory Note Term Sheet.

US Legal Forms is definitely the greatest collection of lawful varieties for which you can discover various papers themes. Utilize the company to acquire professionally-made files that follow state demands.

Form popularity

FAQ

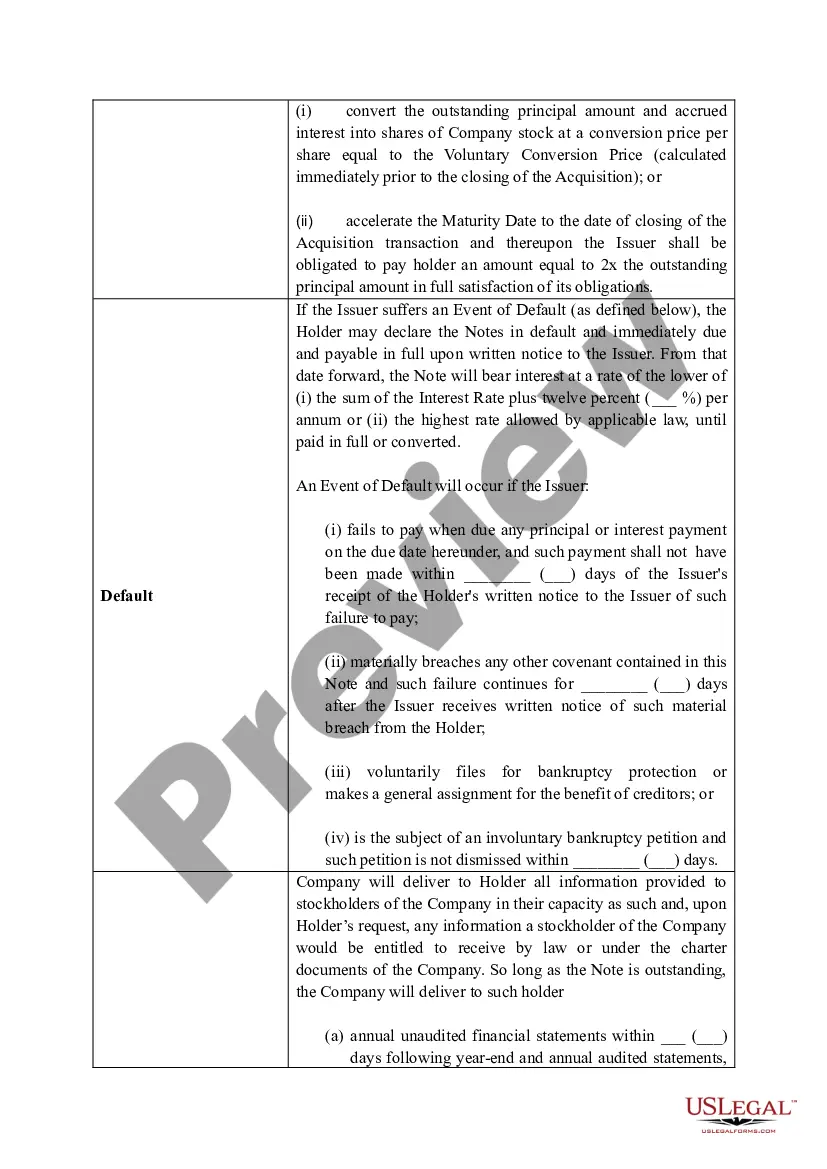

Founders who receive a term sheet need to understand, from a legal perspective, how to manage the process. Key provisions of a VC term sheet include: investment structure, key economic terms, shareholder agreements, due diligence, exclusivity and closing.

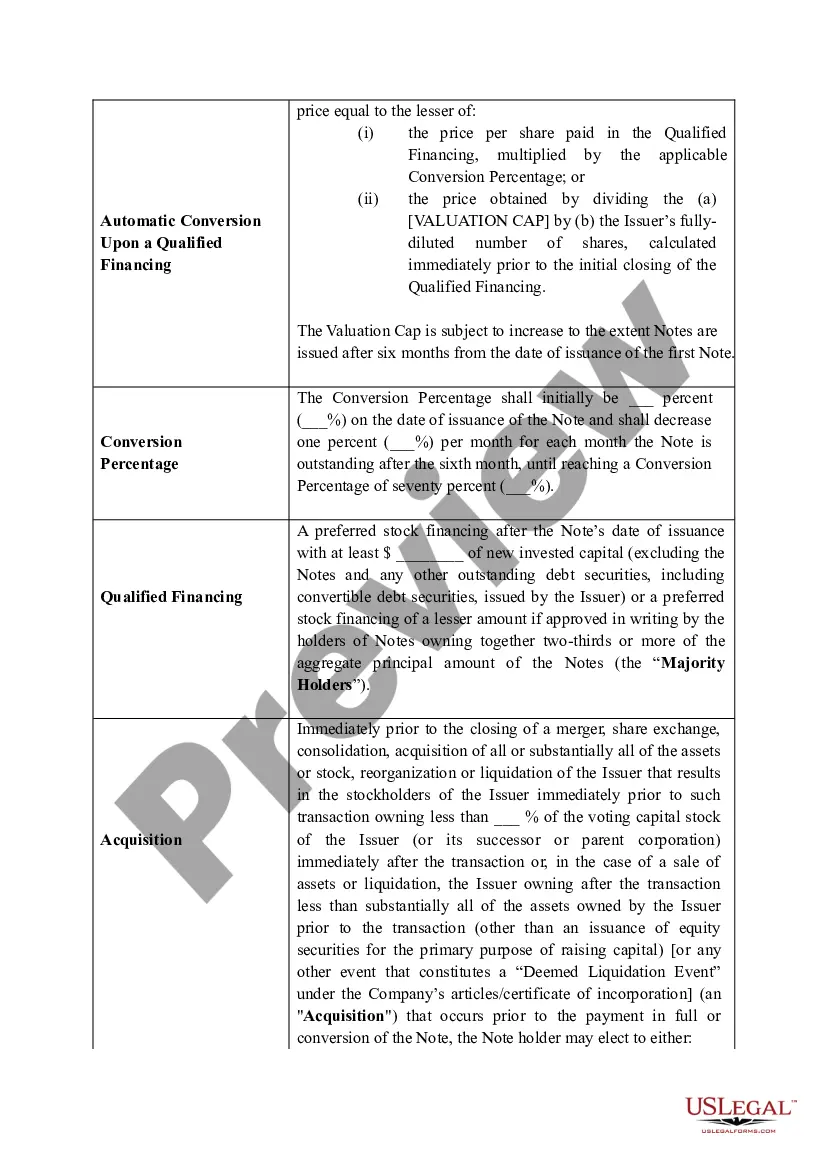

A term sheet is usually a non-binding agreement outlining the basic terms and conditions of the investment. It serves as a template for the convertible note for both parties.

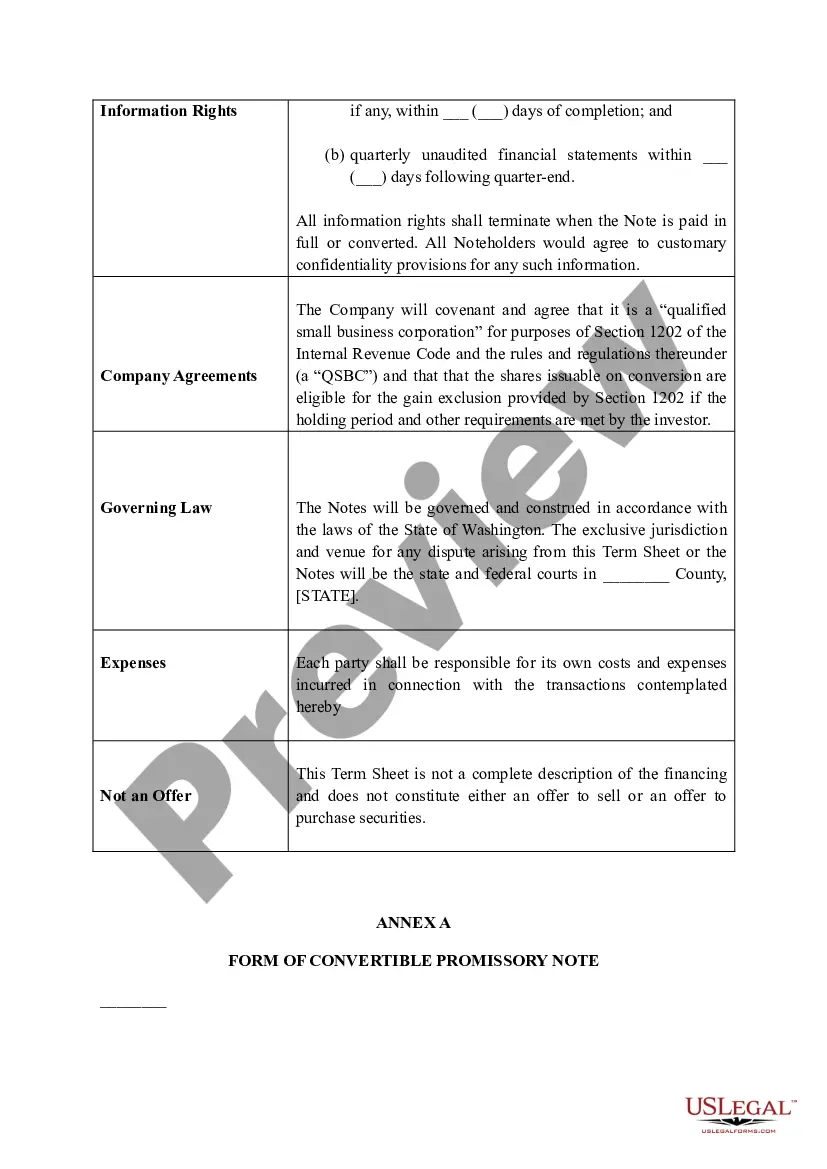

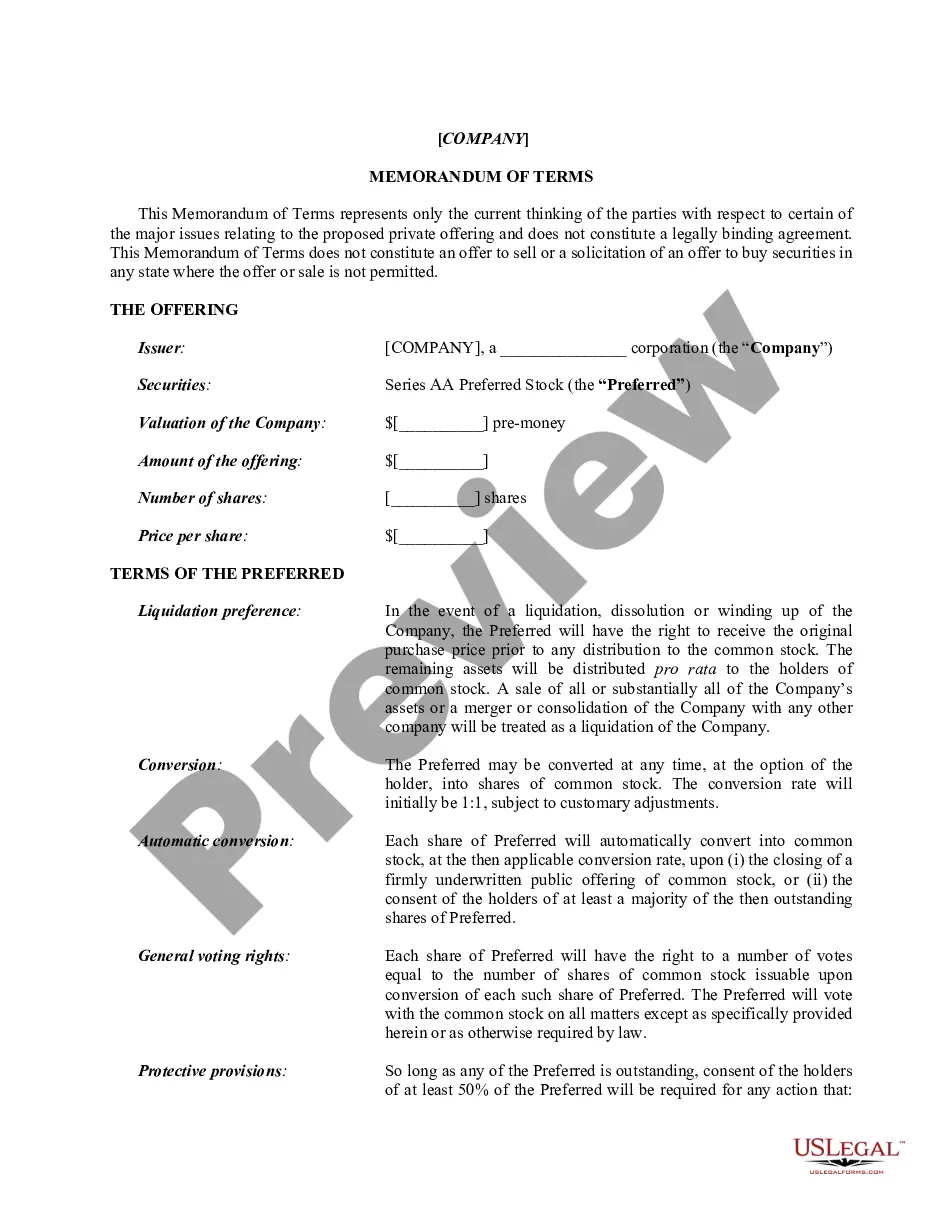

The company valuation, investment amount, percentage stake, voting rights, liquidation preference, anti-dilutive provisions, and investor commitment are some items that should be spelled out in the term sheet.

Once you're certain the investors offering you a term sheet are a good match, go beyond the obvious. Investment dollars and valuation are critical, of course, but don't overlook important details like option pools, liquidation preferences and the composition of your board.

But no matter who the investor is, a term sheet will always contain six key components, including: A valuation. An estimate of what a company is worth as an investment opportunity. ... Securities being issued. ... Board rights. ... Investor protections. ... Dealing with shares. ... Miscellaneous provisions.

How to Prepare a Term Sheet Identify the Purpose of the Term Sheet Agreements. Briefly Summarize the Terms and Conditions. List the Offering Terms. Include Dividends, Liquidation Preference, and Provisions. Identify the Participation Rights. Create a Board of Directors. End with the Voting Agreement and Other Matters.

VC Term Sheet Definition Although short-lived, the VC term sheet's main purpose is to lay out the initial specifics of a VC investment such as the valuation, dollar amount raised, class of shares, investor rights and investor protection clauses.