South Carolina Term Sheet - Series A Preferred Stock Financing of a Company

Description

The Term Sheet is not a commitment to invest, and is conditioned on the completion of the conditions to closing set forth.

How to fill out Term Sheet - Series A Preferred Stock Financing Of A Company?

You can devote several hours on-line searching for the lawful file web template which fits the federal and state needs you need. US Legal Forms offers a huge number of lawful kinds which are reviewed by specialists. It is possible to download or print the South Carolina Term Sheet - Series A Preferred Stock Financing of a Company from your service.

If you already possess a US Legal Forms accounts, you may log in and click on the Download option. Next, you may full, change, print, or indication the South Carolina Term Sheet - Series A Preferred Stock Financing of a Company. Each lawful file web template you get is your own for a long time. To get another duplicate of any purchased develop, visit the My Forms tab and click on the related option.

If you are using the US Legal Forms website the first time, follow the simple recommendations beneath:

- First, ensure that you have chosen the best file web template for that area/metropolis of your choice. Look at the develop outline to ensure you have selected the appropriate develop. If accessible, use the Review option to check with the file web template too.

- In order to locate another version in the develop, use the Research industry to find the web template that meets your requirements and needs.

- Once you have located the web template you want, just click Purchase now to proceed.

- Choose the pricing plan you want, key in your accreditations, and register for a free account on US Legal Forms.

- Complete the transaction. You should use your Visa or Mastercard or PayPal accounts to cover the lawful develop.

- Choose the formatting in the file and download it in your gadget.

- Make adjustments in your file if possible. You can full, change and indication and print South Carolina Term Sheet - Series A Preferred Stock Financing of a Company.

Download and print a huge number of file templates using the US Legal Forms Internet site, that offers the biggest selection of lawful kinds. Use professional and state-certain templates to take on your small business or individual needs.

Form popularity

FAQ

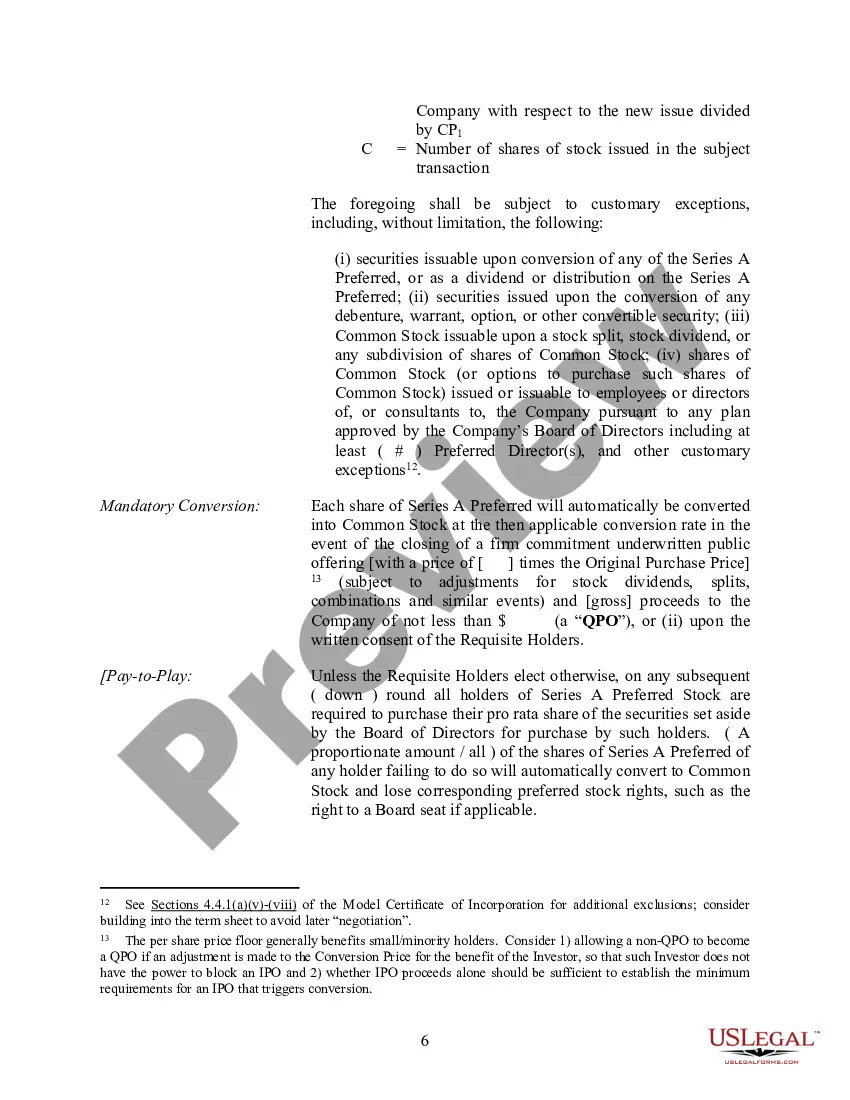

Term sheet examples: What's included? Along with setting the valuation for the company, a term sheet details the amount of the investment and detailed terms around the calculations of pricing for the preferred shares the investor will receive for their money. A term sheet also establishes the investor's rights.

Preference shares, more commonly referred to as preferred stock, are shares of a company's stock with dividends that are paid out to shareholders before common stock dividends are issued. If the company enters bankruptcy, preferred stockholders are entitled to be paid from company assets before common stockholders.

Term sheets for venture capital financings include detailed provisions describing the terms of the preferred stock being issued to investors. Some terms are more important than others. The following brief description of certain material terms divides them into two categories: economic terms and control rights.

How to Prepare a Term Sheet Identify the Purpose of the Term Sheet Agreements. Briefly Summarize the Terms and Conditions. List the Offering Terms. Include Dividends, Liquidation Preference, and Provisions. Identify the Participation Rights. Create a Board of Directors. End with the Voting Agreement and Other Matters.

A term sheet outlines the basic terms and conditions of an investment opportunity and is a non-binding agreement that serves as a starting point for more detailed agreements ? like a commitment letter, definitive agreement (share purchase agreement), or subscription agreement.

The first round of stock made available to the public by a startup is referred to as Series A preferred stock. This type of stock is generally offered for purchase during the seed stage of a new startup and can be converted into common stock in the event of an initial public offering or sale of the company.

The first round of stock offered during the seed or early stage round by a portfolio company to the venture investor or fund. This stock is convertible into common stock in certain cases such as an IPO or the sale of the company.

Key Takeaways. Preferred stock is a different type of equity that represents ownership of a company and the right to claim income from the company's operations. Preferred stockholders have a higher claim on distributions (e.g. dividends) than common stockholders.