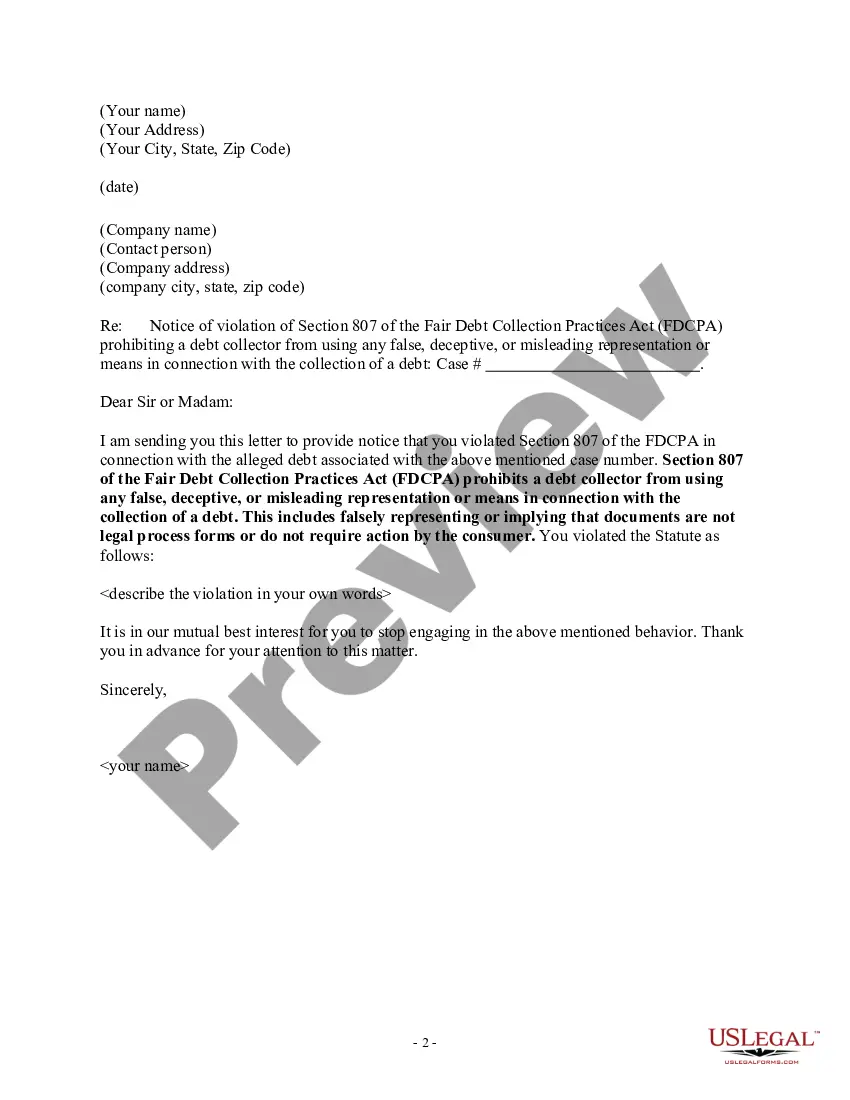

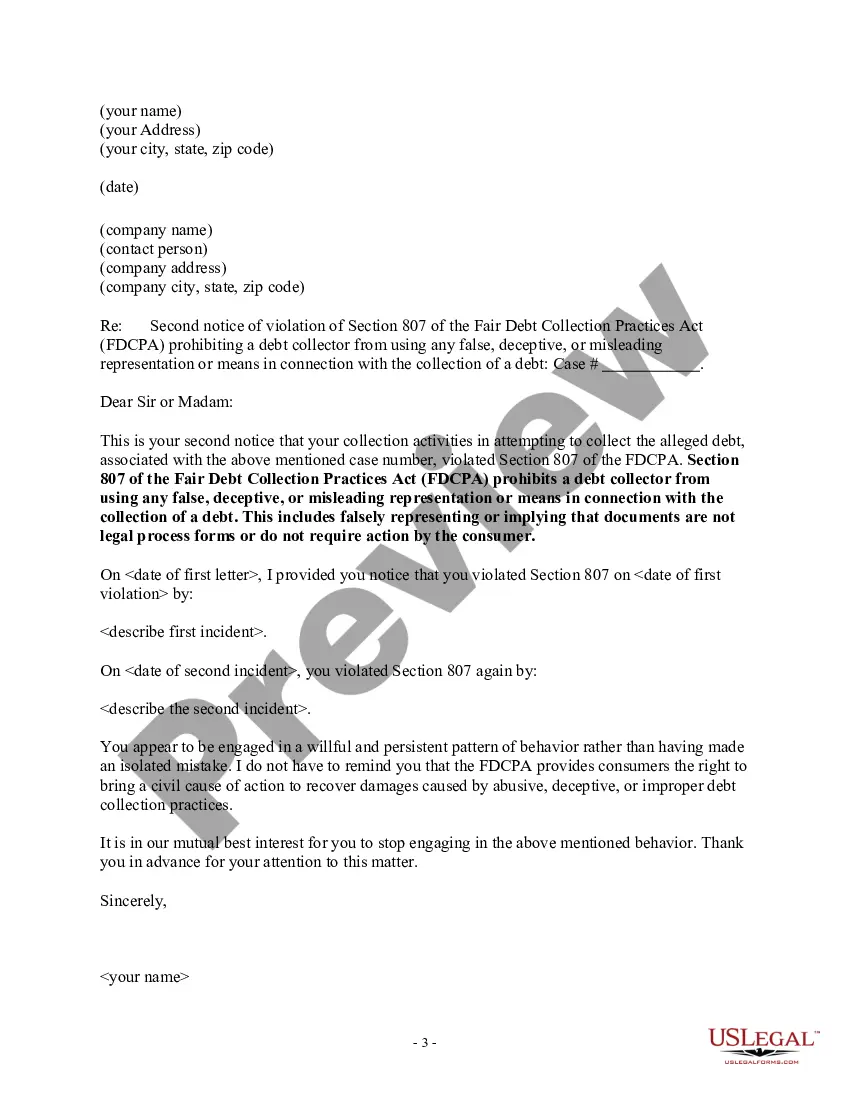

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes falsely representing or implying that documents are not legal process forms or do not require action by the consumer.

South Carolina Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action

Description

How to fill out Notice To Debt Collector - Falsely Representing Documents Are Not Legal Process Or Do Not Require Action?

If you want to fulfill, download, or print official document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Take advantage of the site`s straightforward and user-friendly search to locate the documents you require.

Various templates for business and personal needs are categorized by groups and states, or keywords.

Step 4. Once you have found the form you need, click the Purchase now button. Select the payment plan you prefer and enter your details to register for an account.

Step 5. Complete the payment. You may use your credit card or PayPal account to finish the transaction.

- Employ US Legal Forms to find the South Carolina Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to receive the South Carolina Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions provided below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to examine the form`s content. Don`t forget to read the overview.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the screen to find additional versions of the legal form template.

Form popularity

FAQ

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

Repeated calls. Threats of violence. Publishing information about you. Abusive or obscene language.

Unfair practices are prohibitedDeposit or threaten to deposit a postdated check before your intended payment date. Take or threaten to take property if it's not allowed. Collect more than you owe on a debt, which may include fees and interest.

You are not obliged let a debt collector into your home and they don't have the right to take goods away. It's very important to understand that a debt collector is not the same as an enforcement agent or bailiff. Debt collectors have no special legal powers.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.16 Sept 2020

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

There are 3 ways to remove collections without paying: 1) Write and mail a Goodwill letter asking for forgiveness, 2) study the FCRA and FDCPA and craft dispute letters to challenge the collection, and 3) Have a collections removal expert delete it for you.

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.