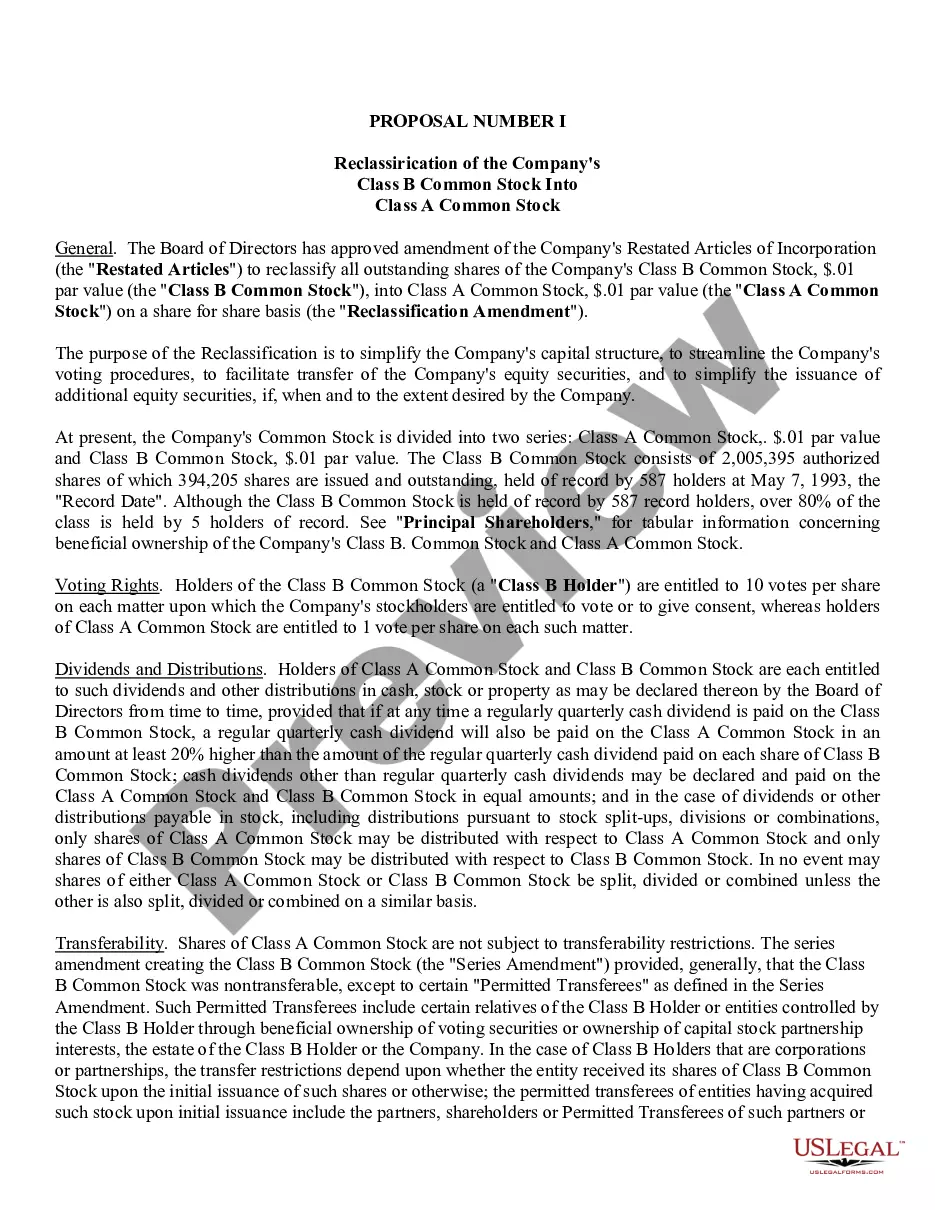

South Carolina Reclassification of Class B common stock into Class A common stock

Description

How to fill out Reclassification Of Class B Common Stock Into Class A Common Stock?

If you wish to full, acquire, or printing lawful file templates, use US Legal Forms, the largest variety of lawful forms, which can be found on the Internet. Take advantage of the site`s easy and hassle-free look for to discover the documents you need. Various templates for organization and personal reasons are sorted by categories and claims, or search phrases. Use US Legal Forms to discover the South Carolina Reclassification of Class B common stock into Class A common stock in just a handful of mouse clicks.

When you are presently a US Legal Forms buyer, log in for your account and click on the Acquire key to obtain the South Carolina Reclassification of Class B common stock into Class A common stock. You may also gain access to forms you previously acquired inside the My Forms tab of your account.

If you work with US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Be sure you have selected the form for the correct metropolis/region.

- Step 2. Use the Preview choice to examine the form`s articles. Don`t neglect to see the explanation.

- Step 3. When you are unsatisfied with all the form, make use of the Lookup industry near the top of the screen to discover other types of the lawful form design.

- Step 4. After you have found the form you need, select the Get now key. Pick the rates plan you like and put your references to sign up on an account.

- Step 5. Procedure the deal. You can use your credit card or PayPal account to finish the deal.

- Step 6. Select the format of the lawful form and acquire it on your gadget.

- Step 7. Total, change and printing or indicator the South Carolina Reclassification of Class B common stock into Class A common stock.

Every lawful file design you buy is the one you have eternally. You may have acces to every single form you acquired inside your acccount. Select the My Forms portion and decide on a form to printing or acquire yet again.

Remain competitive and acquire, and printing the South Carolina Reclassification of Class B common stock into Class A common stock with US Legal Forms. There are many specialist and condition-certain forms you may use for your personal organization or personal requires.

Form popularity

FAQ

Class A shares often have more voting power and a higher priority for dividends and profit in the event of liquidation. However, the exact characteristics vary depending on the firm. It's possible that Class A shares are more expensive than Class B shares or aren't offered to the general public.

Reclassification occurs when a mutual fund company changes the share class of certain issues. This may be done to add or remove a sales load from fund shares, or to require larger minimum investments for purchase.

And while Class A stockholders might be able to convert their shares into Class B shares, a Class B shareholder may not be able to convert their shares into Class A shares.

Class A, common stock: Each share confers one vote and ordinary access to dividends and assets. Class B, preferred stock: Each share confers one vote, but shareholders receive $2 in dividends for every $1 distributed to Class A shareholders. This class of stock has priority distribution for dividends and assets.

Class A shares can be converted into class B, but not the other way around. If you own class A shares, then you can convert them into class B at any time. Each class A share you convert then becomes 1500 class B shares. However, this only goes in one direction.

Class B shares typically have lower dividend priority than Class A shares and fewer voting rights. However, different classes do not usually affect an average investor's share of the profits or benefits from the company's overall success.

It involves converting issued shares from their existing class, i.e. 'type' or 'classification', to a different one. Since most companies are set up with only 'ordinary' shares, it is often necessary to convert some or all of these shares to different classes as the business develops.

Class A shares will typically grant more voting rights than other classes. This difference is often only pertinent for shareholders who take an active role in the company. Nevertheless, because of the voting rights, A-shares are often more valuable than B shares.