South Carolina Employee Evaluation Form for Accountant

Description

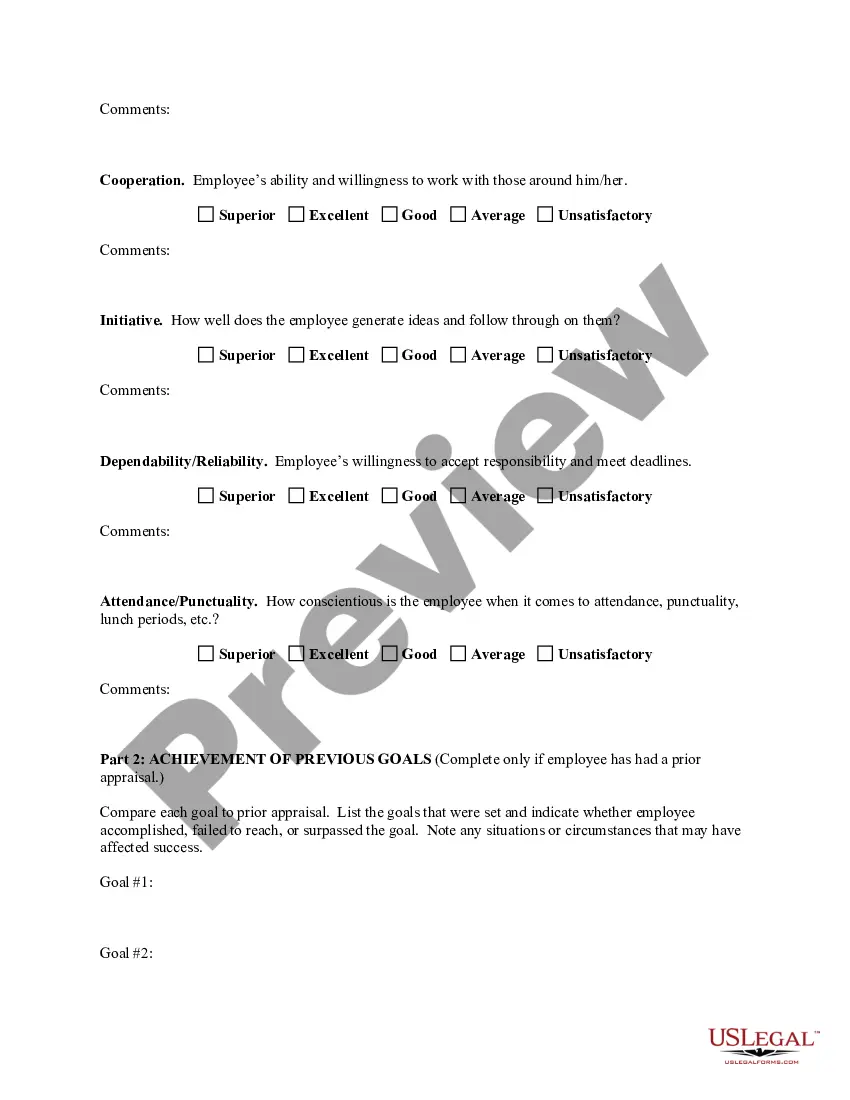

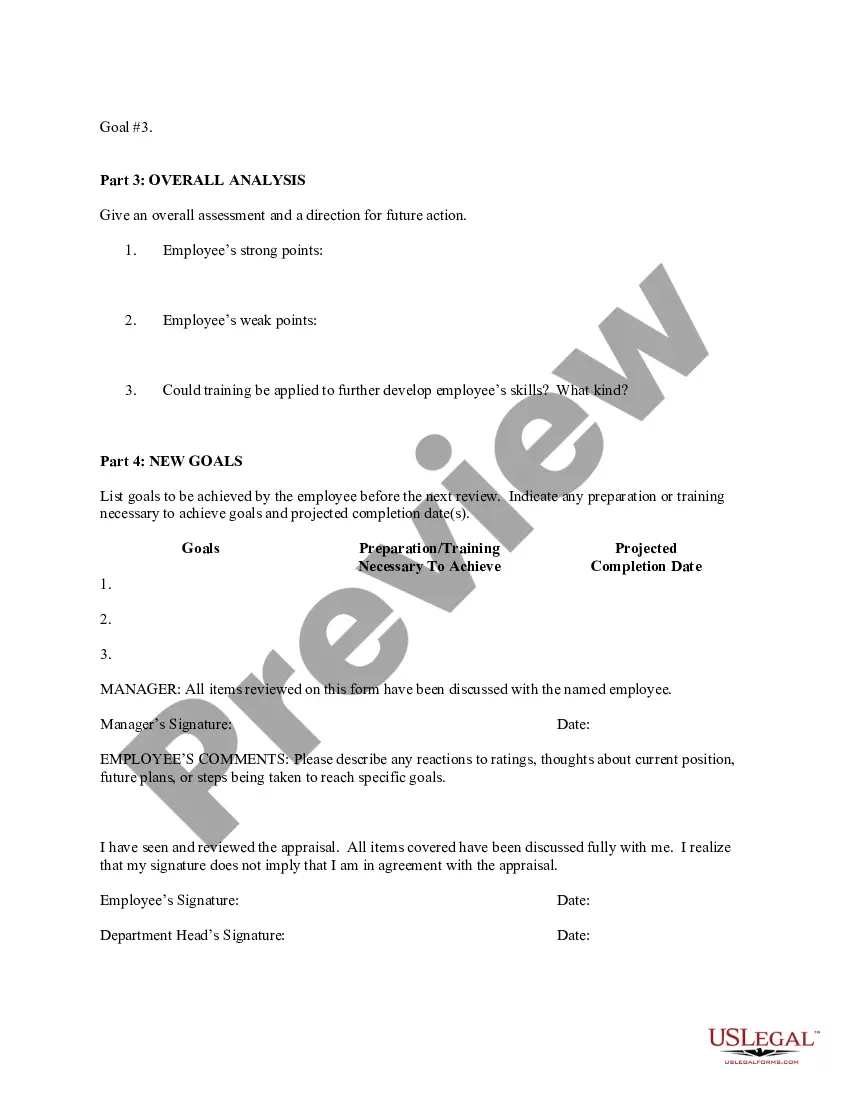

How to fill out Employee Evaluation Form For Accountant?

Finding the appropriate legal document format can be challenging.

Certainly, there are numerous templates available online, but how do you acquire the legal form you need.

Use the US Legal Forms website. The platform provides thousands of templates, including the South Carolina Employee Evaluation Form for Accountant, suitable for both business and personal purposes.

You can preview the form using the Preview option and read the form description to verify that it is suitable for your needs.

- All of the forms are vetted by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Obtain button to access the South Carolina Employee Evaluation Form for Accountant.

- Use your account to browse through the legal documents you've previously ordered.

- Navigate to the My documents section of your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

- First, ensure that you have chosen the correct form for your city/county.

Form popularity

FAQ

To get your CPA in South Carolina, you must satisfy the educational requirements, pass the National CPA Exam, and gain the necessary work experience. Once you have met these standards, submit your application to the South Carolina Board of Accountancy for licensure. Utilizing resources such as the South Carolina Employee Evaluation Form for Accountant can guide you through the stages and ensure you meet all requirements effectively.

For a 3-year B.COM degree, you get 90 credit hours. In the past, a CA certificate gave you an additional around 40 credit hours. With 90+40=130 credit hours, you can get qualified for a few states.

Steps to Become a CPA in South CarolinaComplete 150 semester hours of acceptable college-level coursework in accounting.Accumulate the required hours of experience.Complete the AICPA ethics course and exam.Pass the Uniform CPA Examination.Apply for a license.Receive a license.

The South Carolina Leadership, Effectiveness, Advancement ,and Development (SCLead.org) data management system facilitates special area educator, teacher, and principal professional growth and development in schools and districts across the state.

In general, it takes four years of study to earn a degree in accounting.

New Jersey, Pennsylvania, Connecticut, Massachusettsevery state in the Union except for New York and Hawaiiallow non-CPAs to hold a minority ownership stake in a CPA firm. The sky hasn't fallen. CPA firms are still CPA firms, even with non-CPAs contributing to their growth.

Yes. Your firm can have non-CPA owners, but the majority of the firm's ownership (at least 51%) must be held by CPAs who are currently licensed in some state. All owners must be active individual participants in the firm. Investors, LLPs, LLCs, and commercial interests are not permitted to be firm owners.

Most agencies have a turnaround time of 2 weeks but can also vary from 5 business days to 8+ weeks.

The Foreign Academic Credentials Service assists people educated outside the United States in determining the equivalency of their international credentials in terms of an education in the U.S. FACS was established in 1982 at the request of the American Institute of Certified Public Accountants (AICPA) and the National

Students often report that Financial Accounting and Reporting (FAR) is the most difficult part of the CPA Exam to pass, because it is the most comprehensive section.