South Carolina Mileage Reimbursement Form

Description

How to fill out Mileage Reimbursement Form?

Are you currently in a location where you occasionally need to have documents for business or specific purposes almost every day.

There are numerous legitimate document templates available online, but finding reliable forms can be challenging.

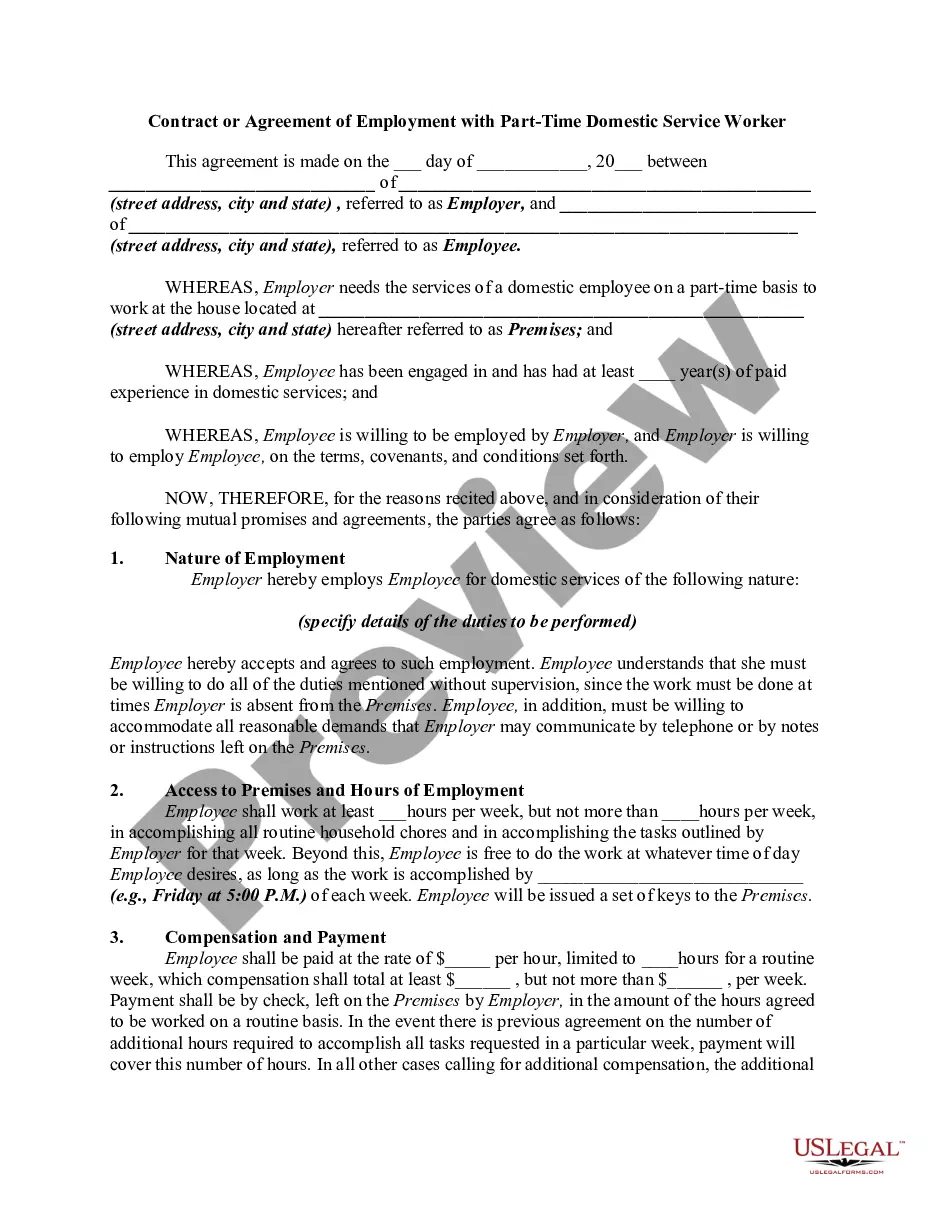

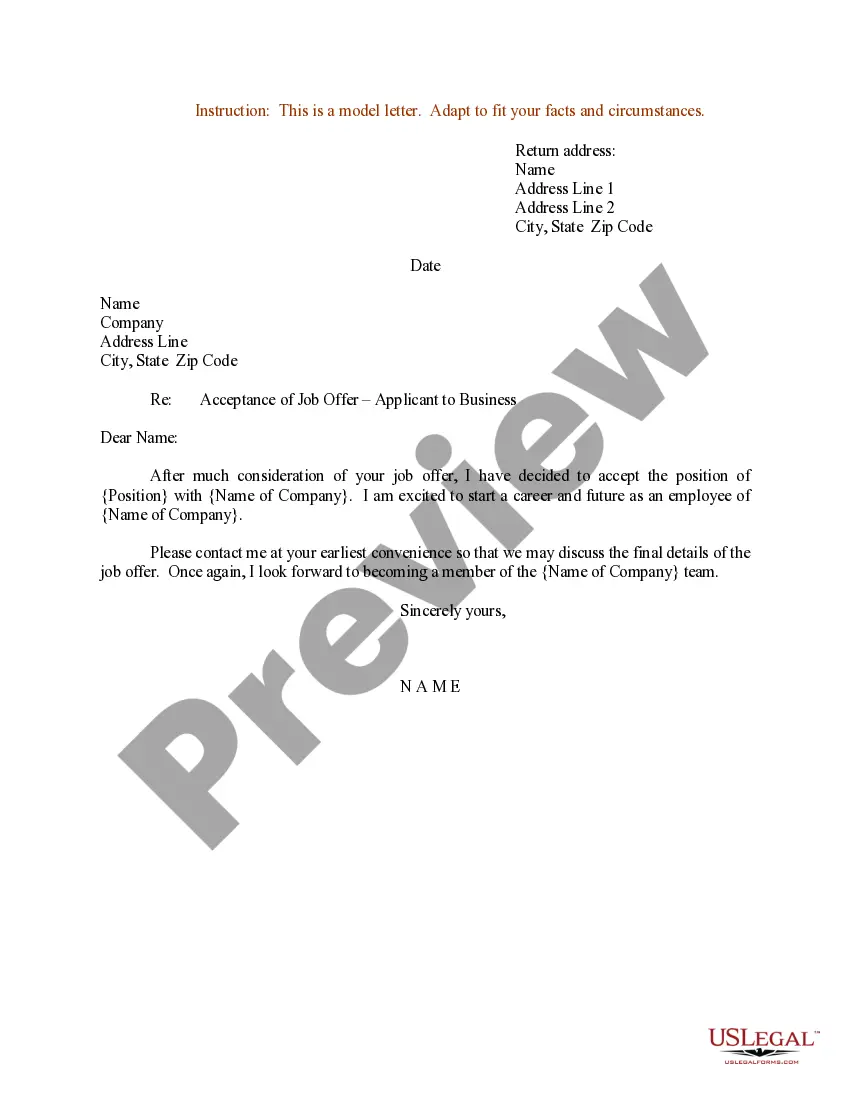

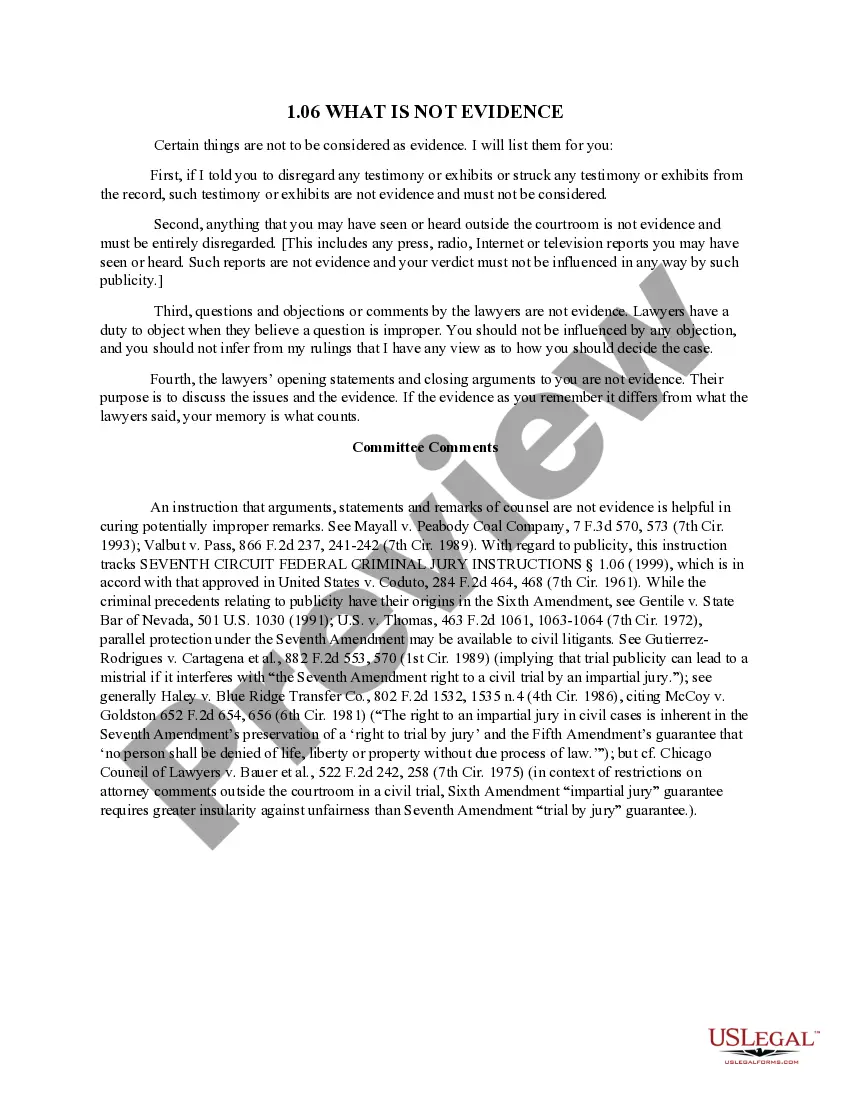

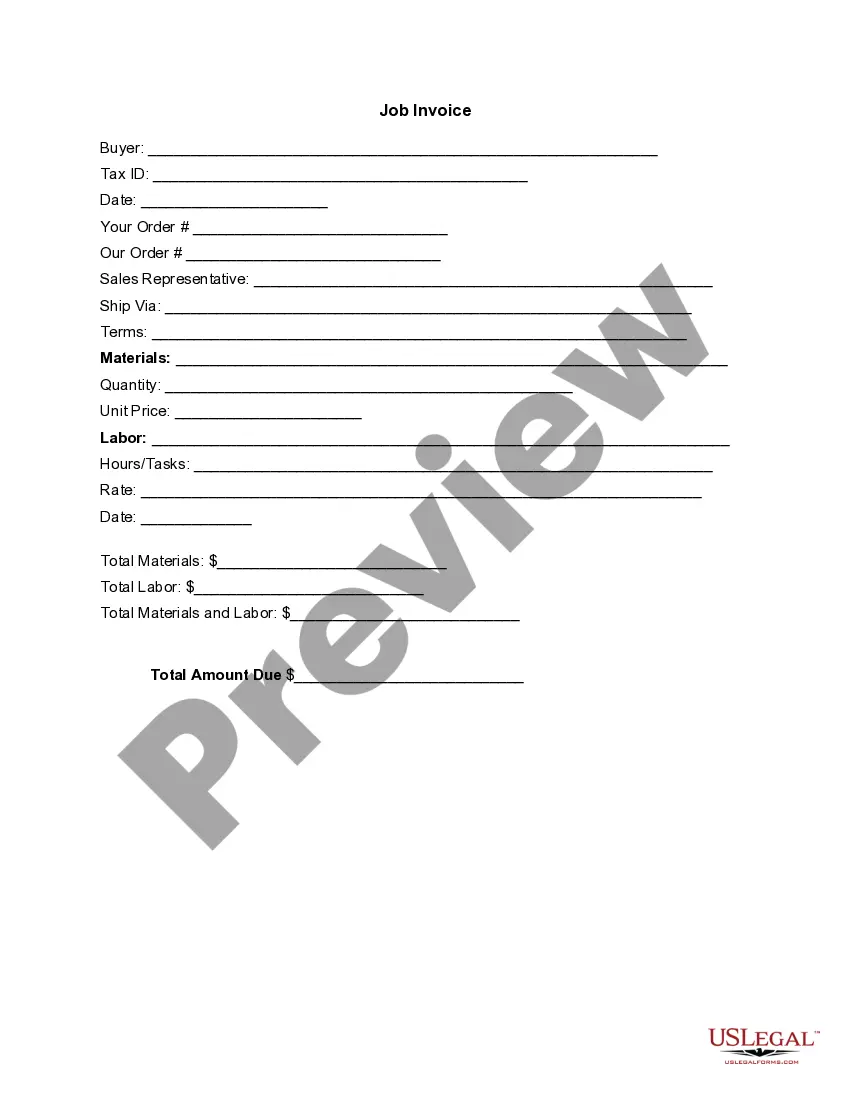

US Legal Forms provides thousands of template documents, including the South Carolina Mileage Reimbursement Form, that are crafted to meet federal and state regulations.

Once you find the correct form, click Acquire now.

Select the pricing plan you want, complete the required information to create your account, and pay for your order using your PayPal or credit card. Choose a convenient file format and download your copy.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the South Carolina Mileage Reimbursement Form template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct area/county.

- Utilize the Review option to examine the document.

- Check the description to confirm that you have selected the right form.

- If the form is not what you’re looking for, use the Search section to find the document that matches your needs and specifications.

Form popularity

FAQ

Advantages of mileage reimbursements over car allowances Again, it's simple: Mileage rates are easy to administer, and any rate under the IRS rate is non-taxable. The tax-free payments are the main advantage over car allowances.

A Mileage Reimbursement Form is a document that is given to the accounting department for reimbursement of the traveling costs. Mileage reimbursements are usually done on a bi-monthly or a monthly basis.

New Mileage Reimbursement Rate Effective January 1, 2021 Beginning on January 1, 2021, the Internal Revenue Service rate will be 56 cents per mile (IRS Revenue IR 2020-279). Effective January 1, 2021, the new mileage reimbursement rate to claimants to and from a place of medical attention is 56 cents per mile.

Mileage Reimbursement a. General Rules - Employees shall be reimbursed for use of a personal vehicle on official business per mile at the rate provided by current IRS rulings as directed by the State Comptroller General's Office when such reimbursement is the most economical, available method.

Many businesses structure their reimbursement policies around the IRS standard mileage reimbursement rate of 56 cents per mile.

A mileage reimbursement is not taxable as long as it does not exceed the IRS mileage rate (the 2022 rate is 58.5 cents per business mile). If the mileage rate exceeds the IRS rate, the difference is considered taxable income. This approach requires employees to record and report mileage.

New Mileage Reimbursement Rate Effective January 1, 2021 Effective January 1, 2021, the new mileage reimbursement rate to claimants to and from a place of medical attention is 56 cents per mile.

Mileage reimbursements are worth more to you than deducting a mileage allowance on your tax return. A reimbursement for mileage pays you 100 percent of the mileage allowance. A reimbursement of 55.5 cents per mile for 2,000 miles of work-related driving thus means you get $1,100, all of which is tax free.

In 2021, the standard IRS mileage rate is 56 cents per mile for business miles driven, 16 cents per mile for moving or medical purposes and 14 cents per mile for charity miles driven.