South Carolina Exemption Statement

Description

How to fill out Exemption Statement?

It is possible to invest time on the Internet trying to find the authorized file template that suits the federal and state demands you want. US Legal Forms supplies a large number of authorized kinds which are analyzed by pros. It is simple to obtain or produce the South Carolina Exemption Statement - Texas from your assistance.

If you currently have a US Legal Forms account, you are able to log in and click on the Download switch. Afterward, you are able to total, edit, produce, or indication the South Carolina Exemption Statement - Texas. Every single authorized file template you get is your own forever. To have one more version of the obtained form, check out the My Forms tab and click on the corresponding switch.

If you are using the US Legal Forms internet site the very first time, follow the straightforward recommendations listed below:

- Very first, make certain you have chosen the proper file template for the region/city of your liking. See the form explanation to make sure you have picked the appropriate form. If offered, use the Preview switch to search with the file template also.

- If you would like get one more version of the form, use the Look for industry to obtain the template that fits your needs and demands.

- Once you have located the template you need, just click Purchase now to proceed.

- Find the pricing program you need, type in your references, and register for your account on US Legal Forms.

- Total the purchase. You can use your Visa or Mastercard or PayPal account to fund the authorized form.

- Find the structure of the file and obtain it in your gadget.

- Make alterations in your file if required. It is possible to total, edit and indication and produce South Carolina Exemption Statement - Texas.

Download and produce a large number of file web templates using the US Legal Forms web site, which provides the most important collection of authorized kinds. Use expert and express-specific web templates to tackle your organization or specific needs.

Form popularity

FAQ

Summary. The income tax withholding for the State of South Carolina includes the following changes: The maximum standard deduction in the case of any exemptions has changed from $4,200 to $4,580. The exemption allowance has changed from $2,670 to $2,750.

How to Fill Out an Exempt W4 Form | 2023 | Money Instructor - YouTube YouTube Start of suggested clip End of suggested clip This is an essential step the form is invalid without your signature. Now remember to leave the restMoreThis is an essential step the form is invalid without your signature. Now remember to leave the rest of the form blank. You're claiming that you won't have any federal income tax liability.

An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately. Usually, those who are married and have either one child or more claim three allowances.

An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately. Usually, those who are married and have either one child or more claim three allowances.

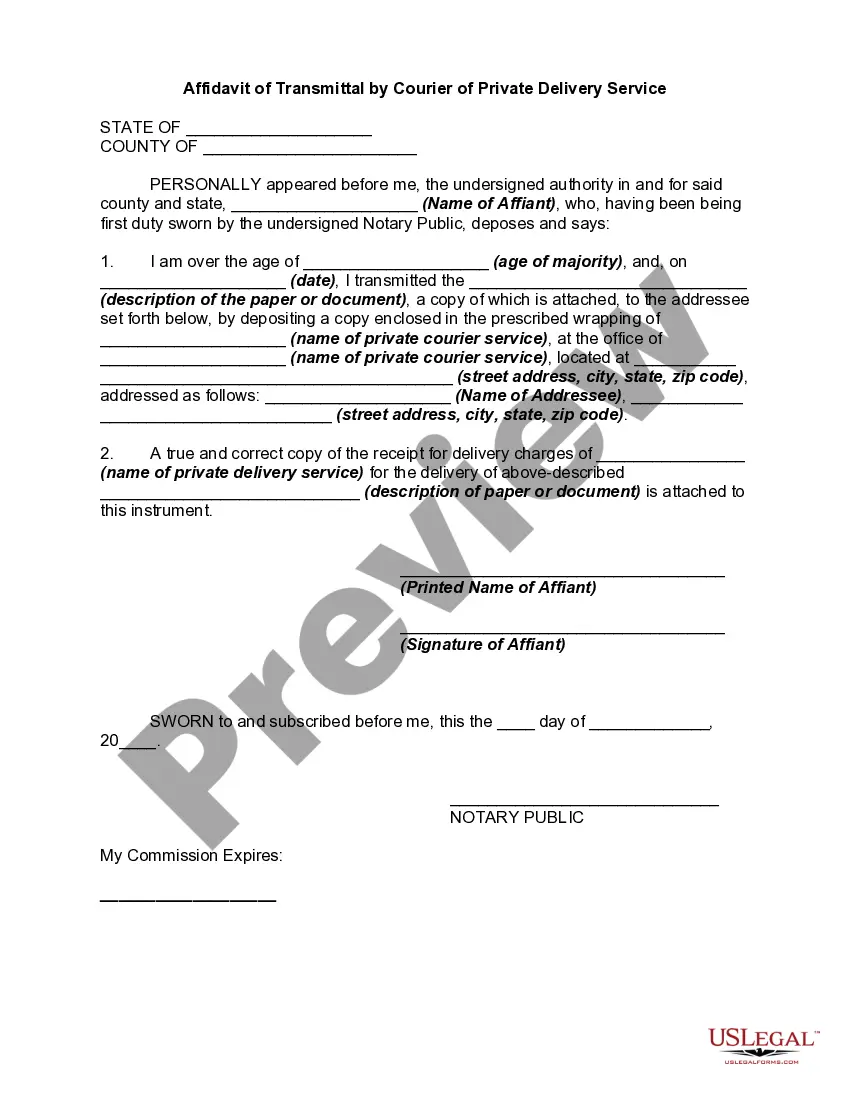

All Application for Exemption Certificate requests must be submitted on our free online tax portal, MyDORWAY, at MyDORWAY.dor.sc.gov. a MyDORWAY account to request Sales and Use Tax exemptions. If you do not have a Sales and Use Tax account, complete the Business Tax Application at dor.sc.gov/register.

Claiming more allowances will lower the amount of income tax that's taken out of your check. Conversely, if the total number of allowances you're claiming is zero, that means you'll have the most income tax withheld from your take-home pay.

The total number of allowances claimed is important?the more tax allowances claimed, the less income tax will be withheld from a paycheck; the fewer allowances claimed, the more tax will be withheld.

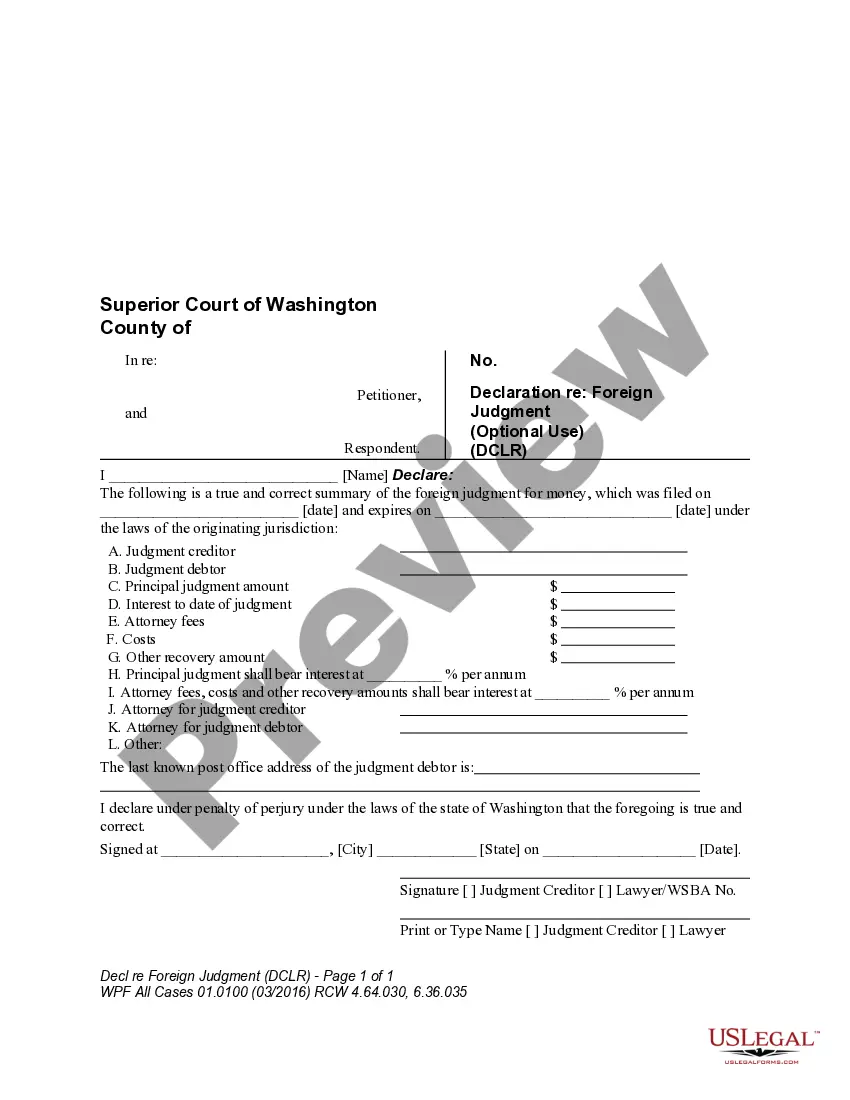

An exemption certificate must show: (1) the name and address of the purchaser; (2) a description of the item to be purchased; (3) the reason the purchase is exempt from tax; (4) the signature of the purchaser and the date; and. (5) the name and address of the seller.