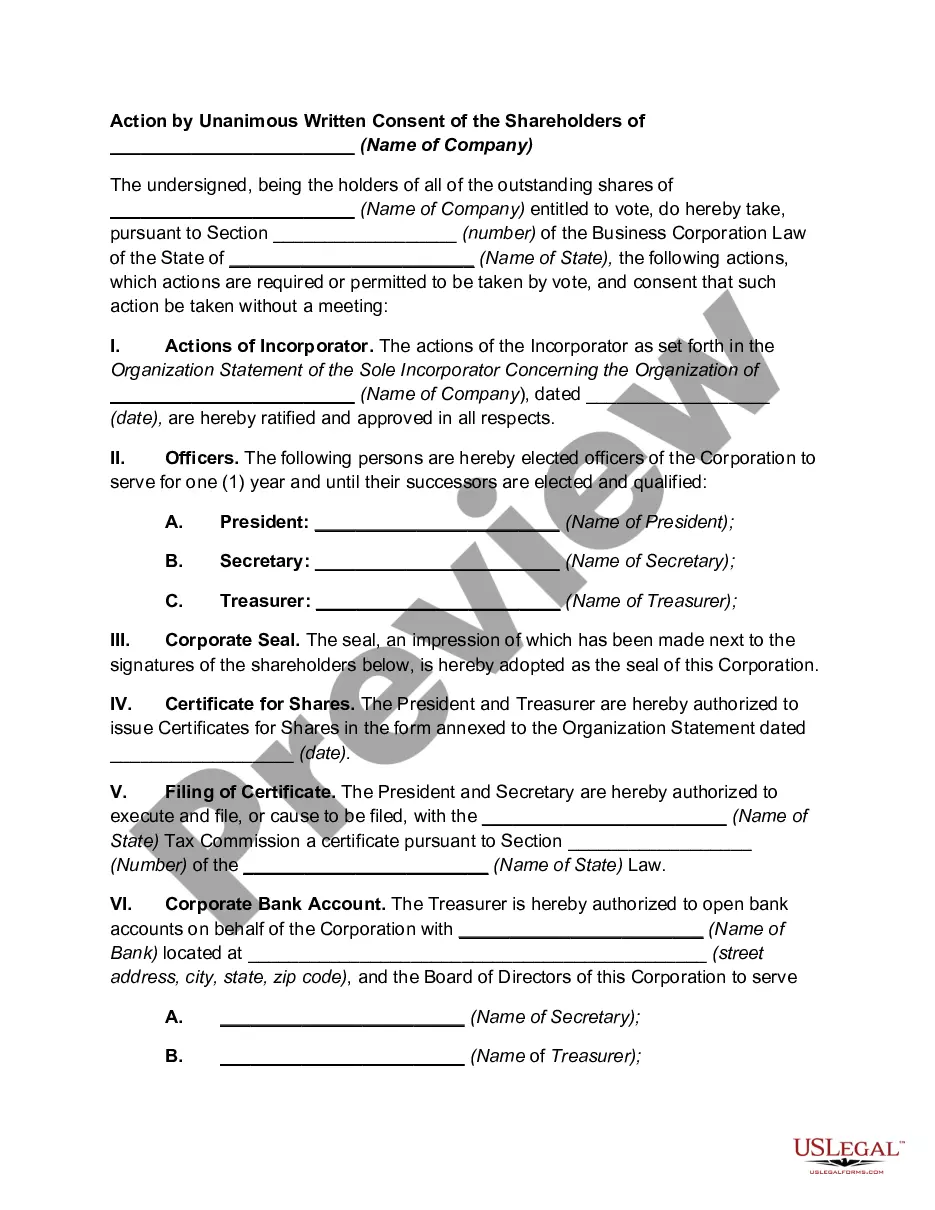

South Carolina Material Return Record

Description

How to fill out Material Return Record?

If you want to finalize, obtain, or print valid document templates, utilize US Legal Forms, the leading selection of legal forms available online.

Take advantage of the site's user-friendly and convenient search feature to find the documents you need. Numerous templates for business and personal purposes are categorized by type and state, or by keywords.

Use US Legal Forms to access the South Carolina Material Return Record with just a few clicks.

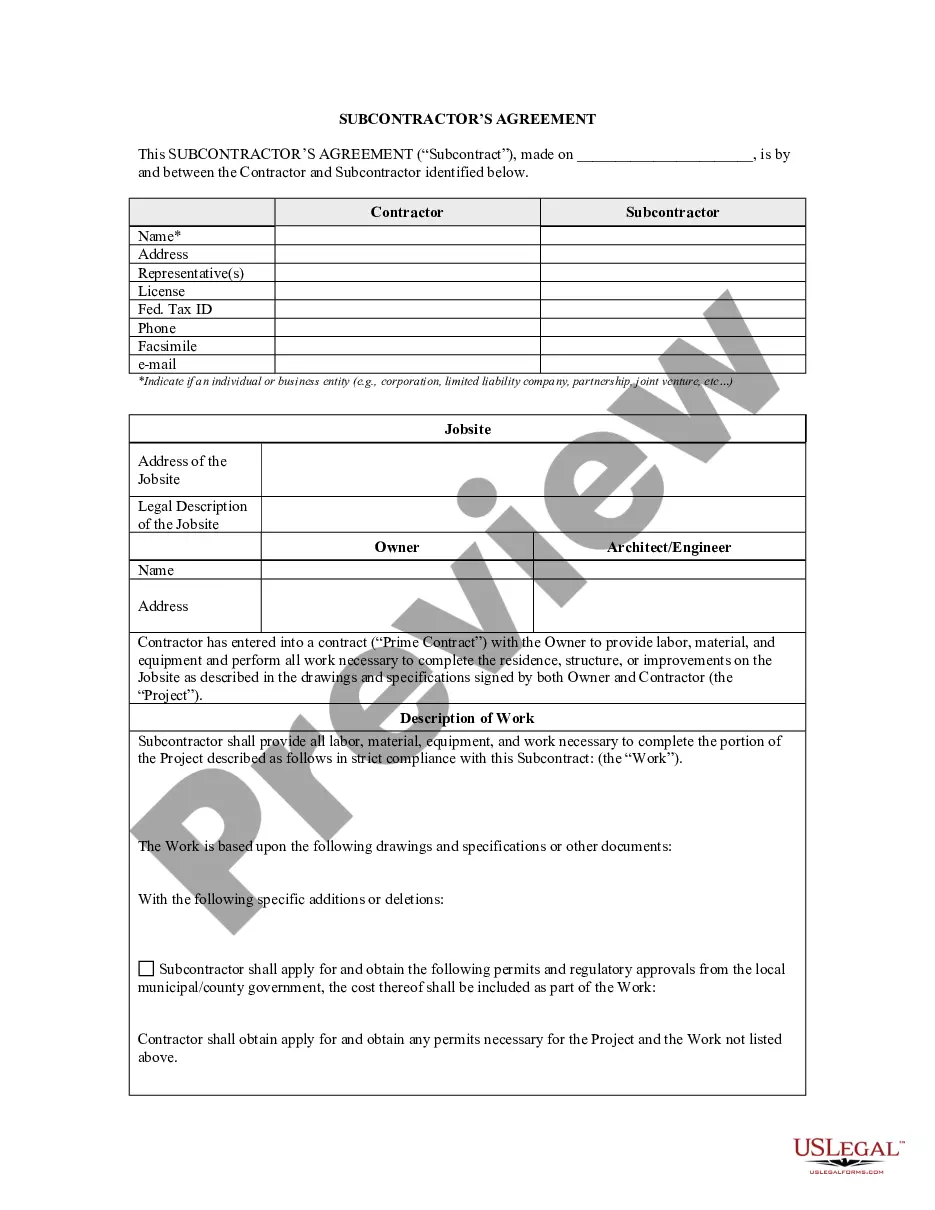

Every legal document template you obtain is yours indefinitely. You have access to every form you saved in your account. Visit the My documents section and select a form to print or download again.

Compete, download, and print the South Carolina Material Return Record with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to acquire the South Carolina Material Return Record.

- You can also access documents you previously saved from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

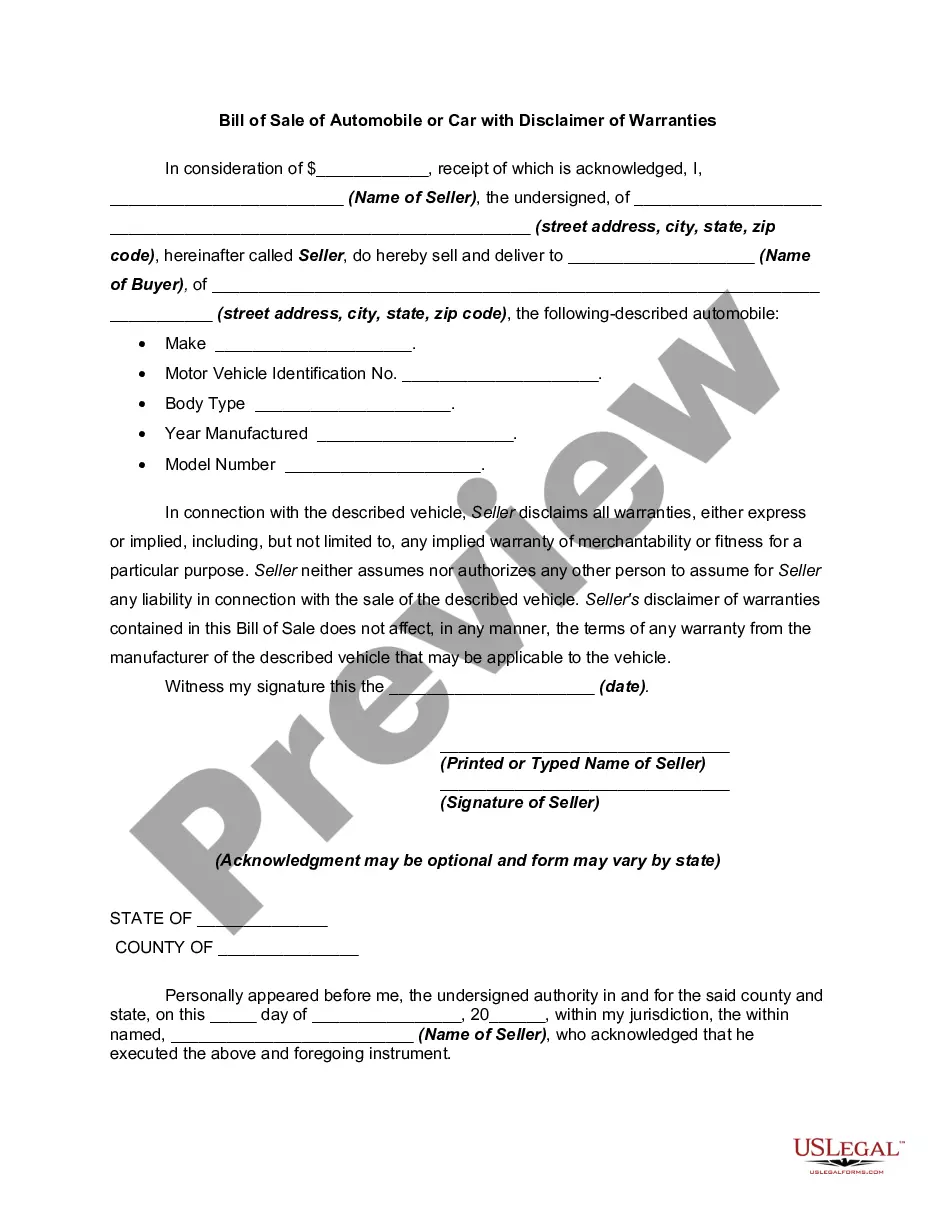

- Step 1. Ensure that you have chosen the form for the correct city/state.

- Step 2. Use the Preview option to review the form's content. Make sure to read the details.

- Step 3. If you are dissatisfied with the form, use the Search box at the top of the screen to locate other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Buy Now button. Choose your pricing plan and enter your information to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Step 6. Select the format of the legal form and download it onto your device.

- Step 7. Fill out, modify, and print or sign the South Carolina Material Return Record.

Form popularity

FAQ

Forms are available at dor.sc.gov/forms. What if I am audited by the IRS? If you receive a refund or owe additional federal tax, you must file an amended SC1040, along with a Schedule AMD, after the federal audit report becomes final.

Generally speaking, you are required to file a South Carolina Income Tax return if you are required to file a federal return, or if you are a non-resident with South Carolina gross income of more than the federal personal exemption amounts.

South Carolina's FOIA starts with the presumption that all public body records and meetings are open and available to the public. A record cannot be withheld and a meeting cannot be closed unless a specific exemption or some other state law applies.

The South Carolina deed recording fee is imposed for the privilege of recording a deed, and is based on the transfer of real property from one person or business entity to another. The fee is generally imposed on the grantor of the real property, although the grantee may be secondarily liable for the fee.

Does a South Carolina Resale Certificate Expire? South Carolina Resale Certificates do not expire as long as the purchaser's business is in operation.

According to South Carolina Instructions for Form SC 1040, you must file a South Carolina income tax return if: You are a RESIDENT and: You filed a federal return with income that was taxable by South Carolina. You had South Carolina income taxes withheld from your wages.

Generally, all documents presented for recording require:An original, wet signed document.Signature of the Party of the First Part.Two witnesses to the signature.A South Carolina Probate or Acknowledgement.A property description to include a recorded plat reference or metes and bounds description.More items...

As the buyer of a property, you are the one responsible for recording the deed. Deeds for real estate need to be filed directly with the municipality or county where the property is located. The documents must be signed, witnessed, and notarized in order to be registered.

South Carolina residents should file an SC1040. A part-year resident or nonresident of South Carolina should file an SC1040 with a completed Schedule NR (Nonresident Schedule) attached. You can file your South Carolina tax return using one of the following methods: Electronic filing using a professional tax preparer.

2022 If you file as a full-year resident, file the SC1040. Report all your income as though you were a resident for the entire year. You will be allowed a credit for taxes paid on income taxed by South Carolina and another state. Complete the SC1040TC and attach a copy of the other state's Income Tax return.