South Carolina Return Authorization Form

Description

How to fill out Return Authorization Form?

Are you currently in the location where you require documents for potentially business or personal purposes nearly every working day.

There are numerous legitimate document templates available online, but locating ones you can rely on is not easy.

US Legal Forms offers a vast array of form templates, such as the South Carolina Return Authorization Form, specifically designed to meet state and federal requirements.

If you locate the correct form, click Acquire now.

Choose a convenient file format and download your copy. View all the document templates you have purchased in the My documents menu. You can obtain an extra copy of the South Carolina Return Authorization Form anytime, if necessary. Just access the required form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legitimate types, to save time and avoid errors. The service provides professionally crafted legal document templates that can be employed for various purposes. Create your account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can obtain the South Carolina Return Authorization Form template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

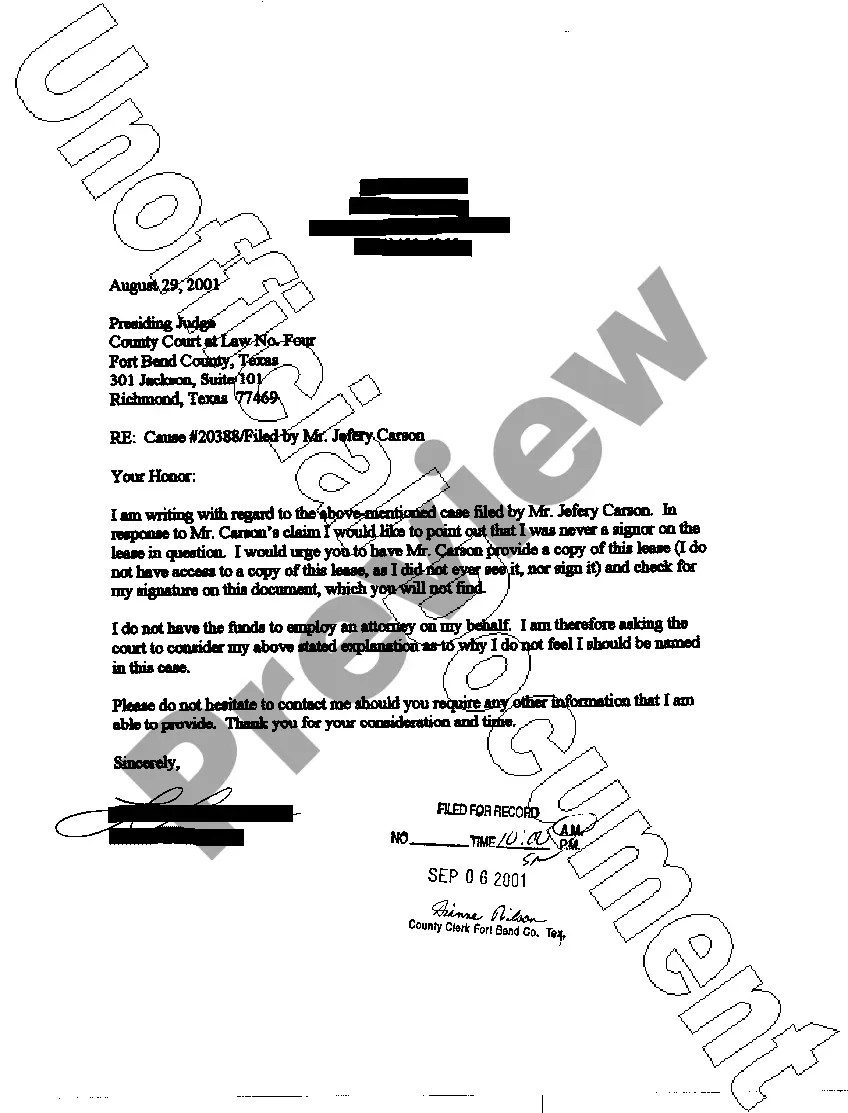

- Use the Preview button to examine the form.

- Review the details to ensure you have selected the correct form.

- If the form is not what you are looking for, use the Search area to find the form that satisfies your needs.

Form popularity

FAQ

Any resident of South Carolina who earns enough income to meet the minimum filing requirements must submit an SC income tax return. This includes individuals with wages, business income, or additional sources that exceed the thresholds set by the state. Using the South Carolina Return Authorization Form can help ensure that your return is submitted appropriately and on time to avoid any penalties.

No, the 1040 form and W-2 are not the same; they serve different purposes in the tax process. The W-2 form summarizes an employee's annual earnings and taxes withheld by their employer, while the 1040 form is the individual's income tax return used to report total income and tax liability. It's important to understand these differences when preparing your taxes and utilizing the South Carolina Return Authorization Form for state submissions.

The 1040 form is primarily used for filing individual income tax returns at the federal level in the United States. Taxpayers utilize this form to report their income, calculate taxes owed, and claim refunds. When filing your federal return, remember that the South Carolina Return Authorization Form aids in facilitating smooth processing with state tax authorities too.

The St. 9 form is the South Carolina Sales and Use Tax Return, necessary for businesses engaged in selling goods and providing services subject to sales tax. Filing this form correctly ensures compliance with state tax regulations and helps avoid any legal complications. For businesses, managing these forms alongside the South Carolina Return Authorization Form can simplify the tax filing experience.

The SC1040 form is the South Carolina individual income tax return form, which taxpayers must file annually. This form allows individuals to report their income, claim deductions, and calculate their tax liability. If you are using the South Carolina Return Authorization Form, it can assist in confirming that your submitted SC1040 is processed correctly and on time.

Yes, South Carolina enforces a state withholding tax on income. This tax is deducted directly from employee wages in accordance with the state regulations. Understanding how withholding works helps both employers and employees fulfill their tax obligations. Utilizing the South Carolina Return Authorization Form can enhance your understanding of how to manage these tax responsibilities effectively.

Yes, South Carolina provides a state withholding form similar to the federal W-4. This form allows employees to declare their tax withholding preferences for state income tax. Filling out this form accurately can help prevent under-withholding or over-withholding throughout the year. The South Carolina Return Authorization Form can help clarify any necessary documentation.

Many states require tax withholding forms to ensure proper withholding from employee wages. States like California, New York, and, of course, South Carolina mandate specific forms for this purpose. Employers and employees need to understand their responsibilities to comply with state laws. Engaging with resources such as the South Carolina Return Authorization Form can simplify this process.

Typically, the post office does not carry state tax forms, including those for South Carolina. Most taxpayers obtain their forms from the state’s revenue department or online resources. You can easily access forms like the SC1040 or other specific returns from the South Carolina Department of Revenue's website. The South Carolina Return Authorization Form can also be beneficial during this process.

Yes, South Carolina has its own state income tax form, primarily the SC1040. This form is essential for reporting your income and tax situation in the state. Additionally, it ensures you meet the requirements set by the South Carolina Department of Revenue. Using the South Carolina Return Authorization Form can assist you in managing related documentation efficiently.