South Carolina Partnership Agreement for a Real Estate Development

Description

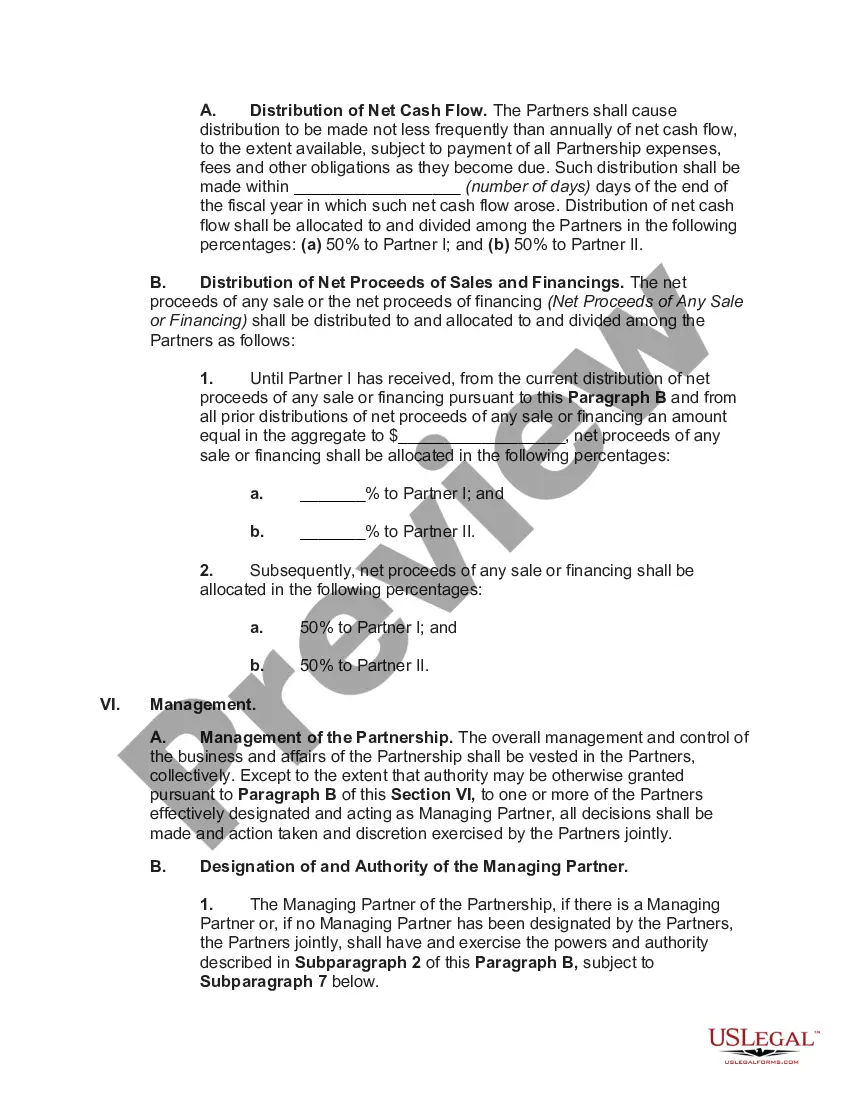

How to fill out Partnership Agreement For A Real Estate Development?

Locating the suitable authorized document template can be a challenge.

Of course, numerous templates are accessible online, but how can you find the legal form you require? Utilize the US Legal Forms website.

The service offers thousands of templates, including the South Carolina Partnership Agreement for a Real Estate Development, suitable for both business and personal needs.

You can preview the form using the Review button and read the form description to confirm it is suitable for you.

- All of the forms are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, sign in to your account and click the Download button to obtain the South Carolina Partnership Agreement for a Real Estate Development.

- Use your account to browse through the legal forms you have purchased previously.

- Access the My documents section of your account and download another copy of the document you need.

- For new users of US Legal Forms, here are some simple steps to follow.

- First, ensure you select the correct form for your area.

Form popularity

FAQ

Individuals or entities with income sourced from South Carolina must file a state tax return. This includes partnerships, as they must report their income and allocate taxable parts to partners. Filing your tax return promptly helps avoid penalties and interest charges. For clarity and compliance, refer to your South Carolina Partnership Agreement for a Real Estate Development when determining your tax obligations.

In South Carolina, any partnership that earns income or has any financial activity must file a state partnership return. This rule applies regardless of whether the partnership owes taxes. Filing accurately ensures that your partnership remains compliant with local laws. When drafting your South Carolina Partnership Agreement for a Real Estate Development, remember that clear financial guidelines can simplify this process.

Generally, partnerships must file a partnership return if they have income and expenses for the tax year. This requirement applies unless the partnership is exempt in South Carolina. Each partnership must comply with state regulations to maintain transparency and proper documentation. To streamline the process, refer to resources on forming a South Carolina Partnership Agreement for a Real Estate Development.

Creating a simple partnership agreement involves several key steps. First, outline the purpose of the partnership, detailing each partner's contributions and responsibilities. Next, agree on profit-sharing and decision-making processes. For the best results, consider using templates available on platforms like US Legal Forms, especially for your South Carolina Partnership Agreement for a Real Estate Development.

Yes, South Carolina mandates that LLCs file an annual report with the Secretary of State. This report ensures the LLC remains in good standing within the state. It is important to keep track of your filing deadlines to avoid penalties. Staying compliant can help you efficiently manage your South Carolina Partnership Agreement for a Real Estate Development.

Yes, South Carolina recognizes federal partnership extensions, allowing partnerships to file their returns later if they have filed for a federal extension. This extension helps partnerships manage their legal and financial obligations more efficiently. To stay organized and informed, consider utilizing the US Legal Forms platform to access necessary documents related to your South Carolina Partnership Agreement for a Real Estate Development.

SC form I 309 is the South Carolina partnership income tax return that partnerships must file to report their income and deductions. It provides a comprehensive overview of the financial activities of the partnership during the tax year. Properly completing this form is vital for partnerships operating under a South Carolina Partnership Agreement for a Real Estate Development to ensure accurate tax compliance.

Structuring a general partnership involves outlining roles, contributions, and profit-sharing terms among partners. A well-drafted South Carolina Partnership Agreement for a Real Estate Development includes essential elements like ownership percentages, management duties, and procedures for resolving conflicts. This structure provides clarity, helping partners collaborate effectively and achieve common goals.

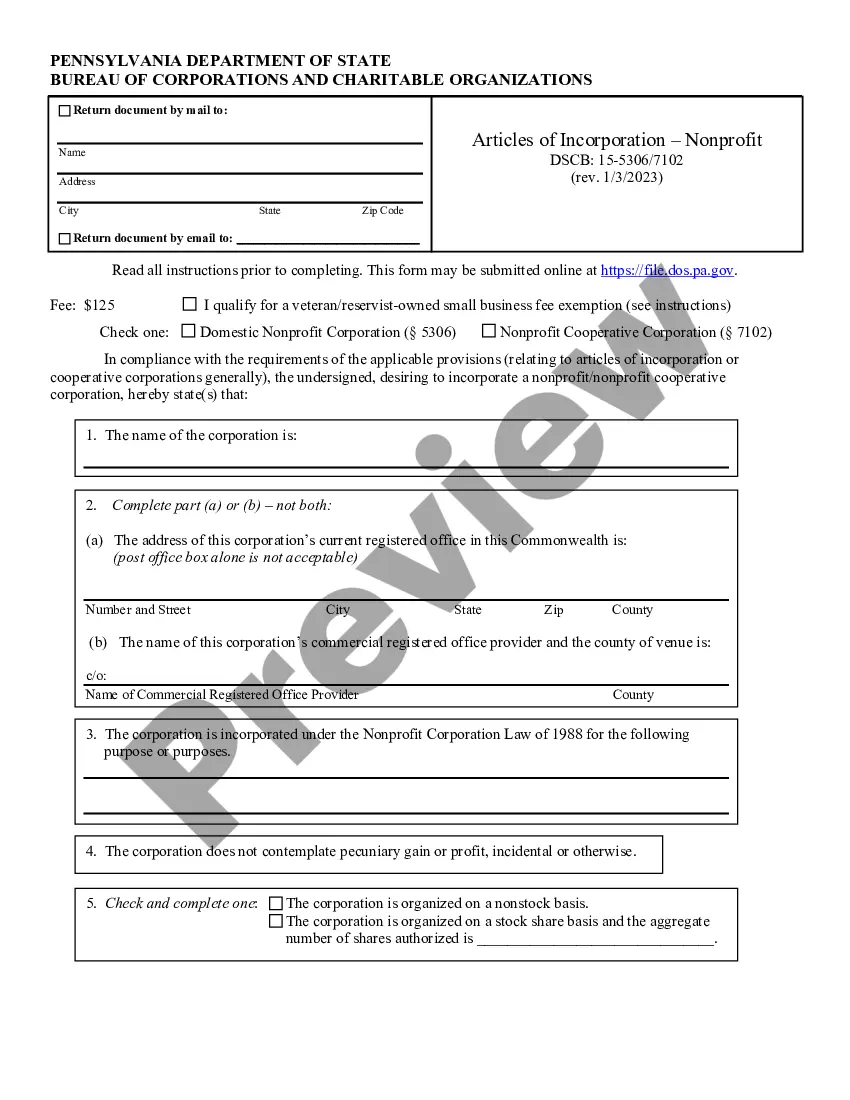

To form a general partnership in South Carolina, at least two individuals or entities must come together to conduct business for profit. A formal written agreement, such as a South Carolina Partnership Agreement for a Real Estate Development, can outline each partner's contributions, responsibilities, and profit-sharing arrangements. While written agreements are not mandatory, having one can prevent misunderstandings and disputes.

In South Carolina, any partnership that earns income must file a partnership return, regardless of whether it is a general or limited partnership. Each partner is individually responsible for reporting their share of partnership income on their personal tax returns. Understanding the requirements for a South Carolina Partnership Agreement for a Real Estate Development can help ensure compliance and smooth operations.