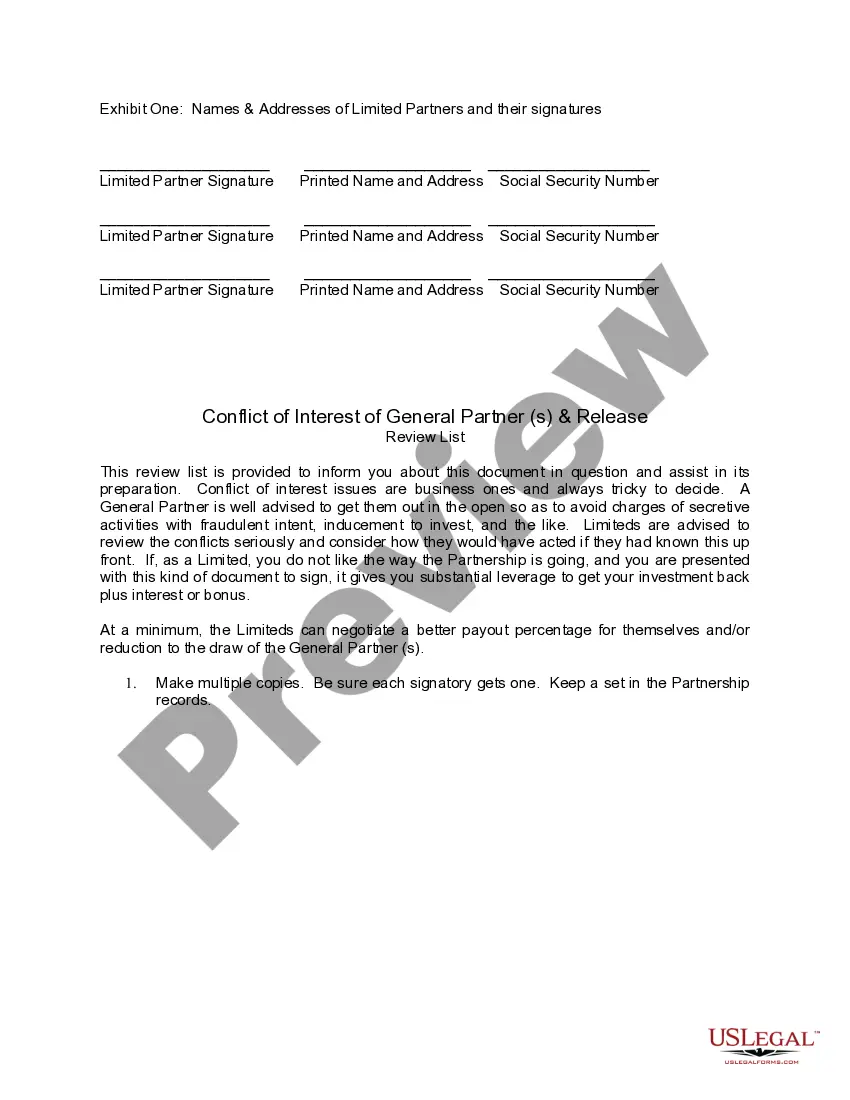

South Carolina Conflict of Interest of General Partner and Release

Description

How to fill out Conflict Of Interest Of General Partner And Release?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a diverse array of legal document templates that you can download or print.

By using the site, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most recent versions of forms such as the South Carolina Conflict of Interest of General Partner and Release in moments.

If you have a subscription, Log In and download the South Carolina Conflict of Interest of General Partner and Release from the US Legal Forms library. The Download button will be available on every document you view.

When you are satisfied with the form, confirm your selection by clicking the Get now button. Then, choose the payment plan you prefer and provide your information to register for your account.

Gain access to the South Carolina Conflict of Interest of General Partner and Release with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- You can access all previously saved forms from the My documents section of your account.

- If you're using US Legal Forms for the first time, here are some simple tips to get started.

- Make sure you have chosen the correct form for your city/state.

- Click the Review button to examine the contents of the form.

- Check the form summary to confirm that you have selected the appropriate document.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find the one that fits.

Form popularity

FAQ

The difference between a general partner vs. limited partner is a general partner is an owner of the partnership, and a limited partner is a silent partner in the business. A general partner is an owner of a partnership.

Any General Partner may be removed by the vote or written consent of Partners holding not less than 80% of the total number of votes eligible to be cast by all Partners.

Limited Partners (LP) are the ones who have arranged and invested the capital for venture capital fund but are not really concerned about the daily maintenance of a venture capital fund whereas General Partners (GP) are investment professionals who are vested with the responsibility of making decisions with respect to

A general partnership is an unincorporated business with two or more owners who share business responsibilities. Each general partner has unlimited personal liability for the debts and obligations of the business.

One party (the general partner) has control over the assets and management responsibilities, but also are personally liable. The other party (limited partners) are generally investors whose personal liability is limited to their investment.

A. The person engaged in wrongful conduct that adversely and materially affected the. limited partnership activities. b. The person willfully or persistently committed a material breach of the partnership.

While it's never the ideal solution, the answer is yes. Sometimes the only way to resolve an issue with a business partner is through a lawsuit. If your business partner is engaging in conduct that is harmful to the company, or that violates their obligation to the company, a lawsuit may be the only option.

Ordinarily, partners cannot sue each other for damages based on partnership business, at least not until there has been an action for dissolution and accounting.

In a general partnership: all partners (called general partners) are personally liable for all business debts, including court judgments. each individual partner can be sued for the full amount of any business debt (though that partner can in turn sue the other partners for their share of the debt), and.

General partner is an owner who has unlimited liability and is active in managing the firm. Limited partner is an owner who invests money in the business, but enjoys limited liability.