South Carolina Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner

Description

How to fill out Agreement To Dissolve And Wind Up Partnership Between Surviving Partners And Estate Of Deceased Partner?

Have you ever found yourself in a situation where you need to have documents for either business or particular purposes almost all the time.

There is an assortment of legal document templates accessible online, but finding reliable ones is not easy.

US Legal Forms provides a vast array of form templates, including the South Carolina Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner, designed to comply with federal and state regulations.

Select the subscription plan you prefer, provide the necessary information to create your account, and finalize your purchase using your PayPal or credit card.

Choose a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you will be able to download the South Carolina Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Locate the form you require and confirm it is for the correct city/state.

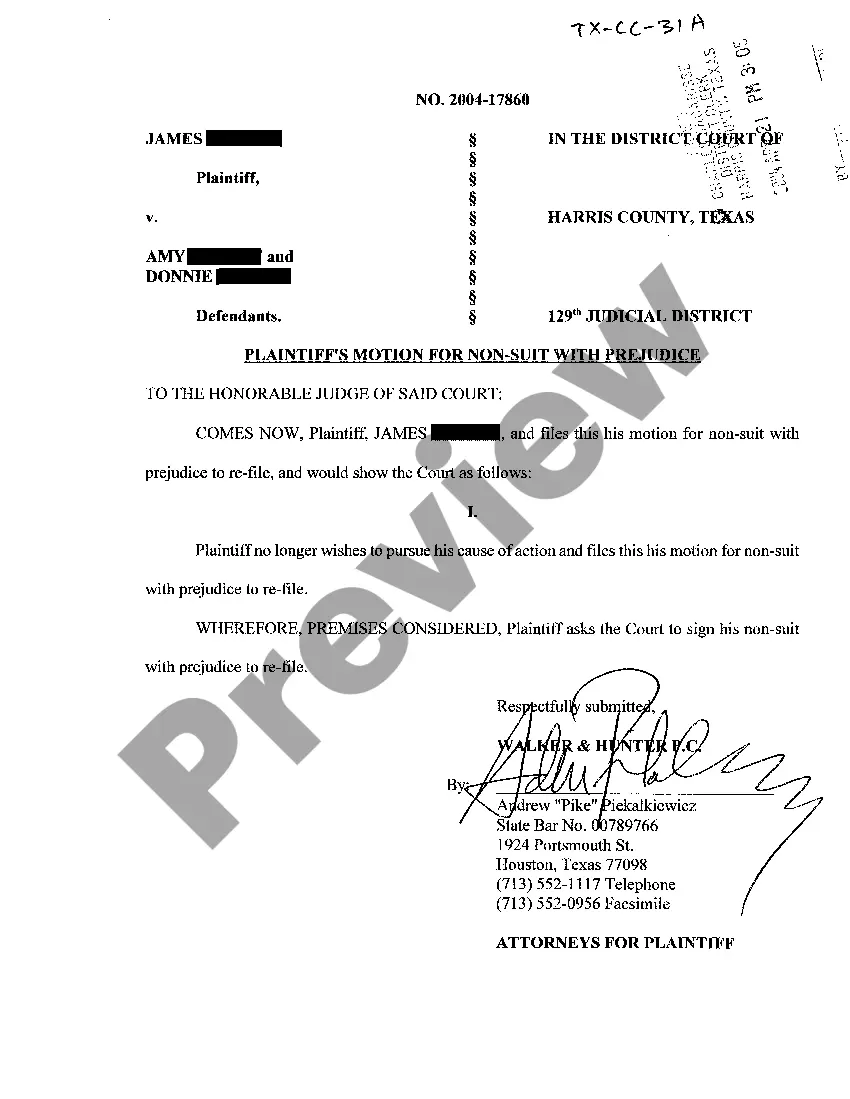

- Utilize the Preview feature to review the form.

- Check the description to ensure you have selected the correct form.

- If the form isn’t what you need, use the Search field to find a form that suits your needs and specifications.

- When you find the appropriate form, click Purchase now.

Form popularity

FAQ

The four criteria of a general partnership include mutual agreement, sharing of profits and losses, joint management, and unlimited liability for partners. Each partner must agree to participate in the business and share its financial outcomes. In the event that a partnership dissolves, partners may need to draft a South Carolina Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner to outline the process for dissolution. Understanding these criteria helps partners manage risks and responsibilities effectively.

In a General Partnership, all partners are financially obligated to any debts incurred by the partnership. When a partner leaves, the partnership dissolves and the partners equally split debts and assets.

How to Dissolve a Nonprofit Corporation in South CarolinaAuthorizing Dissolution.Initial Notice to Attorney General.Articles of Dissolution."Winding Up"Notice to Creditors and Other Claimants.Final Notice to Attorney General.Federal Tax Note.Additional Information.

In a general partnership: all partners (called general partners) are personally liable for all business debts, including court judgments. each individual partner can be sued for the full amount of any business debt (though that partner can in turn sue the other partners for their share of the debt), and.

A partnership is a formal arrangement by two or more parties to manage and operate a business and share its profits. There are several types of partnership arrangements. In particular, in a partnership business, all partners share liabilities and profits equally, while in others, partners may have limited liability.

In a general partnership, each partner has unlimited personal liability. Partnership rules usually dictate that whatever debts are incurred by the business, it is the legal responsibility of all partners to pay them off.

Partners are personally liable for the business obligations of the partnership. This means that if the partnership can't afford to pay creditors or the business fails, the partners are individually responsible to pay for the debts and creditors can go after personal assets such as bank accounts, cars, and even homes.

South Carolina requires business owners to submit their Articles of Termination by mail. You can also have a professional service provider file your Articles of Dissolution for you. Incfile prepares the Articles of Dissolution for you, and files them to the state for $149 + State Fees.

Closing a business or accountTo close SC Dept. of Revenue accounts online, go to MyDORWAY.dor.sc.gov.To close SC Dept. of Revenue accounts by paper use the form C-278 Account Closing Form.To close your Alcohol and Tobacco account use the L-1278 Form.

Steps to Take to Close Your BusinessFile a Final Return and Related Forms.Take Care of Your Employees.Pay the Tax You Owe.Report Payments to Contract Workers.Cancel Your EIN and Close Your IRS Business Account.Keep Your Records.